Livestock and Aquaculture LED Lighting Market - Regional Analysis

APAC Market Insights

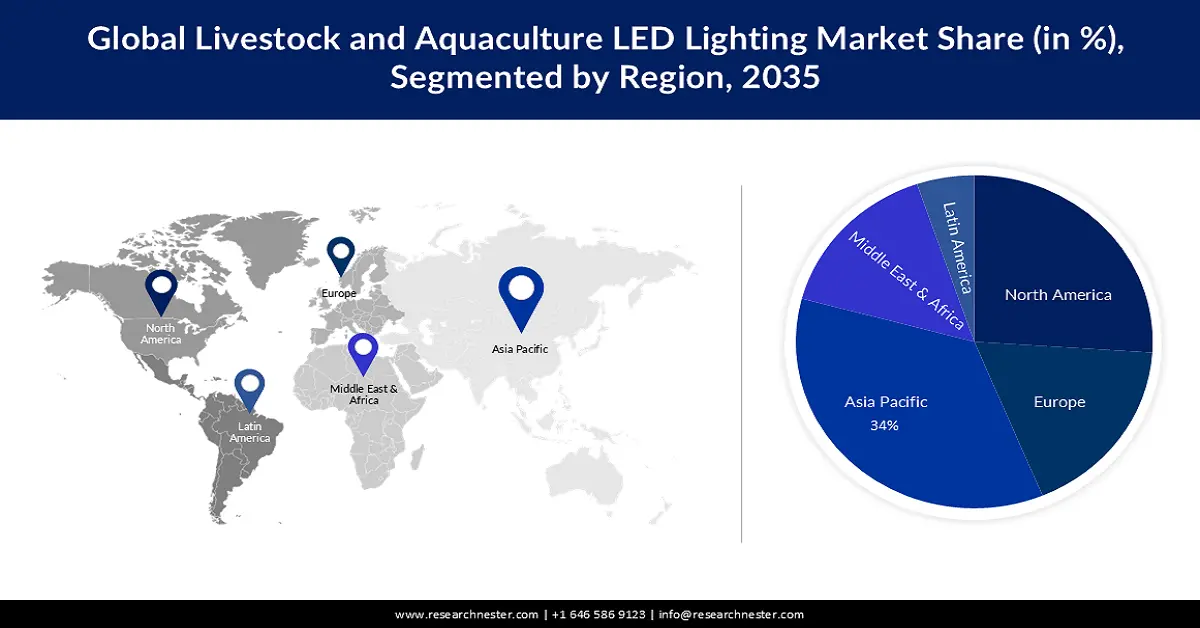

North America industry is predicted to hold largest revenue share of 34% by 2035, impelled by increasing use of meat consumption in the region. The growth of the market in the region can primarily be attributed to the increasing production of different types of fish in the region, along with the fact that the region is the world’s largest producer of fish. According to the statistics by FAO, the world capture production of different types of fish in the inland waters in the Asia Pacific increased from 7127712 in the year 2013 to 7866687 in the year 2019. Besides this, the increasing focus of the government of nations in the region to promote sustainable aquaculture practices is also projected to add to the market growth during the forecast period. The market in the region is further segmented by country into China, Japan, India, South Korea, Singapore, Australia, and the Rest of Asia Pacific. The market in China is projected to garner the largest revenue of USD 2514.5 Million by the end of 2031, up from a revenue of USD 1291.2 Million in the year 2021.

Europe Market Insights

The European livestock and aquaculture LED lighting market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the increasing use of meat consumption in the region. The rising number of slaughterhouses in the region with varied types of animal meat with growing meat eaters are driving the market growth. The increasing population of cows, sheep, and goats for milk and dairy products in the region. In 2021, the population of pigs was more than 140 million, bovine animals were 75 million, and the population of sheep and goats was 70 million in Europe. The production of pig meat in 2021 reached a peak of 23 million tons. Also, the production of poultry meat in Europe during 2021 was estimated to be more than 13 million tons as per the estimations. The growing agriculture production in Europe that need cattle for farming and other works is estimated to hike the market growth.

North American Market Insights

Further, the market in North America, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing population and changes in diet patterns are driving the market growth. The rising focus on animal health to increase livestock and animal product production as many people depend on it for their living is driving the market segment growth. The growing demand for organic food among people with rising disposable income and growing awareness of diet habits is estimated to propel the market segment growth. Rising meat usage in dishes and many events as a special meal plan is estimated to hike the market growth.