- Market Definition and Research Methodology

- Market Definition and Segmentation

- Assumptions and Acronyms

- Research Objective

- Research Methodology

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Trends

- Opportunities

- Regulatory & Standards Landscape

- Industry Risk Analysis

- Recent Trends and Future Prospect

- Analysis on 4Ps for Livestock and Aquaculture LED Lighting Market

- Analysis on LED Grow Lights

- Pricing Analysis

- Investment Analysis

- Value Chain Analysis

- Industry Growth Outlook

- Impact of COVID-19 on Livestock and Aquaculture LED Lighting Market

- Competitive Structure

- Market Share Analysis, 2021

- Competitive Benchmarking

- Competitive Positioning

- Company Profiles

- DeLaval

- Big Dutchman

- Les éclairs CBM inc.

- Aruna Lighting Holding B.V.

- HATO Agricultural Lighting

- Sunbird Lighting Pty Ltd

- Greengage Agritech Ltd.

- LED Livestock ApS

- Fienhage Poultry-Solutions GmbH

- Uni-light LED

- J&D Manufacturing

- Erilon

- Agrilux (Thies Electrical Distributing Co. Inc.)

- Agri-Light Energy Systems Ltd.

- Once Inc.

- Shenzhen Hontech-Wins Electronics Co., Ltd.

- Lely International N.V.

- Adolf Schuch GmbH

- Gasolec B.V.

- Global Livestock and Aquaculture LED Lighting Market

- By Value (USD Million)

- Market Segmentation Analysis 2023-2036

- By Product Type

- LED Bulb

- Led Tube Light

- Led Fixtures

- By Watt

- Below 100W

- 100W-200W

- 200W-300W

- 300W-400W

- Above 400W

- By Installation

- Retrofit

- New Installation

- By Distribution Channel

- Online

- Distributors & Dealers/Retailers

- Direct Sales

- By Application

- Livestock Lighting

- Poultry

- Cattle

- Pig/Swine

- Others

- Aquaculture Lighting

- Fish

- Shellfish

- Algae

- Livestock Lighting

- By Region

- North America

- Europe

- Asia Pacific

- Rest of World

- By Product Type

- North America Livestock and Aquaculture LED Lighting Market

- By Value (USD Million)

- Market Segmentation Analysis 2023-2036

- By Product Type

- LED Bulb

- Led Tube Light

- Led Fixtures

- By Watt

- Below 100W

- 100W-200W

- 200W-300W

- 300W-400W

- Above 400W

- By Installation

- Retrofit

- New Installation

- By Distribution Channel

- Online

- Distributors & Dealers/Retailers

- Direct Sales

- By Application

- Livestock Lighting

- Poultry

- Cattle

- Pig/Swine

- Others

- Aquaculture Lighting

- Fish

- Shellfish

- Livestock Lighting

- By Country

- United States

- Canada

- By Product Type

- Europe Livestock and Aquaculture LED Lighting Market

- By Value (USD Million)

- Market Segmentation Analysis 2023-2036

- By Product Type

- By Watt

- By Installation

- By Distribution Channel

- By Application

- By Country

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific Livestock and Aquaculture LED Lighting Market

- By Value (USD Million)

- Market Segmentation Analysis 2023-2036

- By Product Type

- By Watt

- By Installation

- By Distribution Channel

- By Application

- By Country

- China

- Japan

- India

- South Korea

- Singapore

- Australia

- Rest of Asia Pacific

- Rest of World Livestock and Aquaculture LED Lighting Market

- By Value (USD Million)

- Market Segmentation Analysis 2023-2036

- By Product Type

- By Watt

- By Installation

- By Distribution Channel

- By Application

- By Country

- Latin America

- Middle East & Africa

Livestock and Aquaculture LED Lighting Market Outlook:

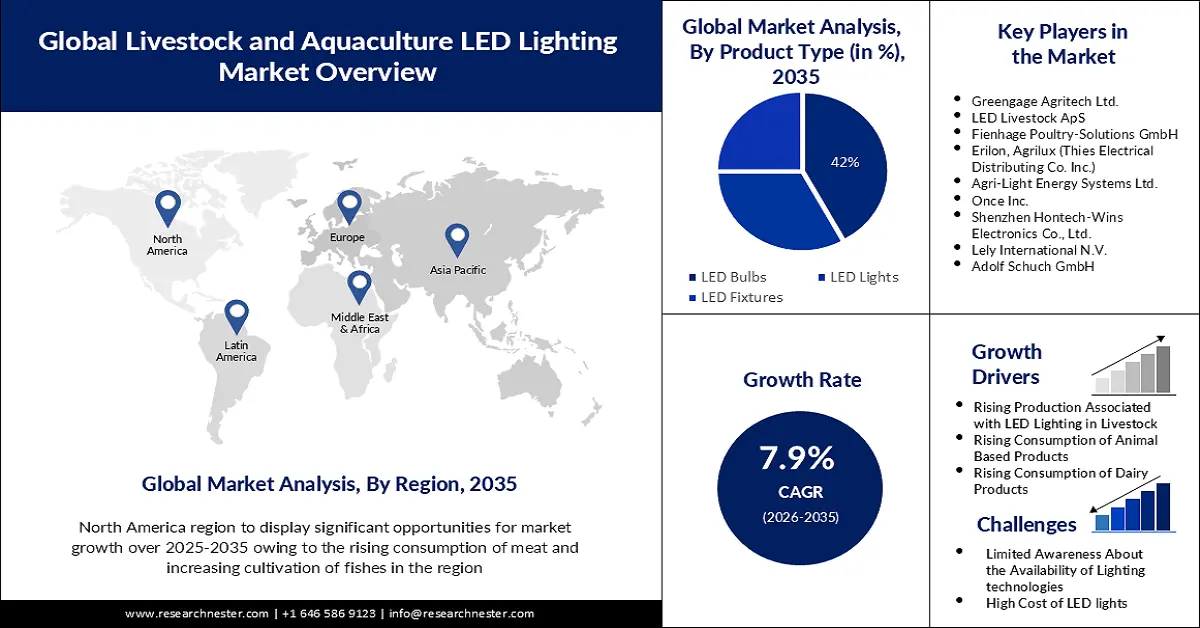

Livestock and Aquaculture LED Lighting Market size was over USD 5.93 billion in 2025 and is anticipated to cross USD 12.68 billion by 2035, growing at more than 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of livestock and aquaculture LED lighting is estimated at USD 6.35 billion.

The growth of the market can be attributed to the increasing agricultural activities and rising population. The growing demand for animal products such as wool, animal skin, and fiber is estimated to hike market growth. As per the estimations, the amount of raw wool produced in 2021 across the world was estimated to be more than 1950 million kilograms and the population of sheep increased by more than 4 billion from the year 2020.

In addition, the rising use of animals for transport by farmers and other people, for fertilizer preparation is estimated to propel the market growth. The increasing use of by-products such as cow dung for the production of biogas owing to a rising preference for renewable fuels is driving the market growth in the coming years. The amount of biogas produced from the installed biogas plants across the globe as of 2021 was over 20 gigawatts which raised by 5% from the year 2020. Approximately 15L to 30L of biogas was produced from just one kilogram of cow dung per day worldwide as of 2021.

Key Livestock and Aquaculture LED Lighting Market Insights Summary:

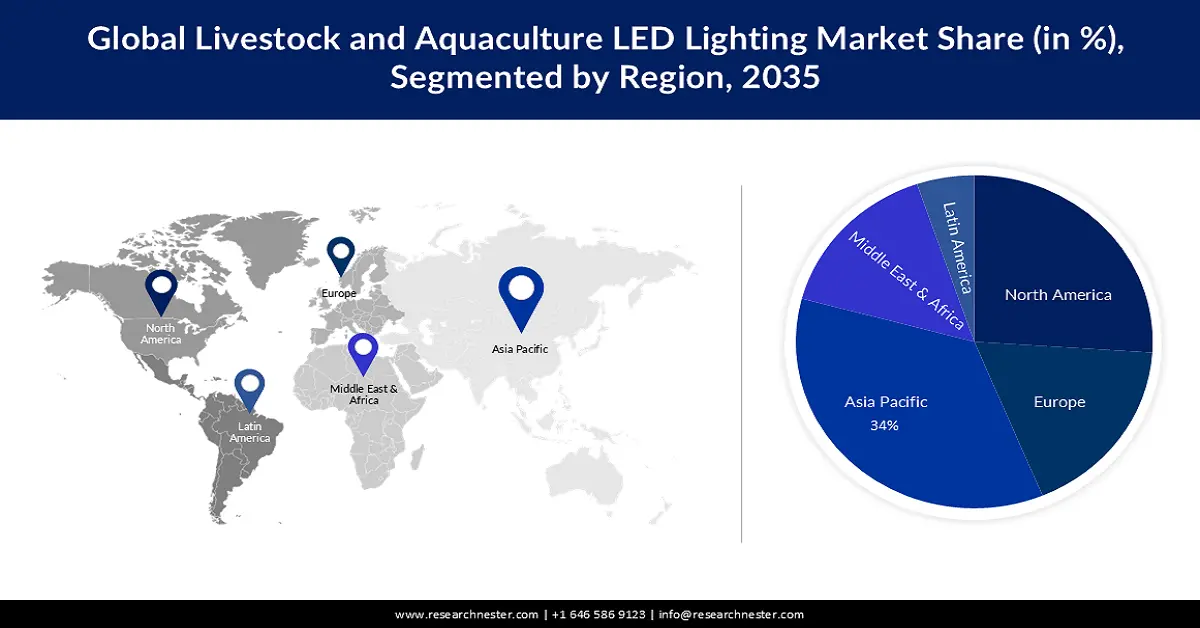

Regional Insights:

- North America is predicted to hold 34% share by 2035, impelled by increasing meat consumption and focus on livestock health.

- Asia Pacific is anticipated to garner the largest revenue of USD 3922.7 Million by 2031, owing to rising fish production and government support for sustainable aquaculture practices.

Segment Insights:

- LED Bulbs segment is projected to account for 42% share by 2035, propelled by increasing use in chicken farms owing to energy efficiency and long-lasting performance.

- Livestock segment is anticipated to hold 56% share by 2035, owing to rising consumption of animal products and adoption of LED lighting for livestock health and production enhancement.

Key Growth Trends:

- Increasing Adoption of Smart Livestock Farming and Aquaculture Practices

- Rising Production Associated with LED Lighting in Livestock and Agriculture

Major Challenges:

- Limited Awareness About the Availability of Smart Lighting Technologies

- High Cost of LED Lights

Key Players: Signify Holding, Greengage Agritech Ltd., LED Livestock ApS, Fienhage Poultry-Solutions GmbH, Erilon, Agrilux (Thies Electrical Distributing Co. Inc.), Agri-Light Energy Systems Ltd., Once Inc., Shenzhen Hontech-Wins Electronics Co., Ltd., Lely International N.V., Adolf Schuch GmbH, Gasolec B.V.

Global Livestock and Aquaculture LED Lighting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.93 billion

- 2026 Market Size: USD 6.35 billion

- Projected Market Size: USD 12.68 billion by 2035

- Growth Forecasts: 7.9%

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, India, Germany

- Emerging Countries: South Korea, Singapore, Australia, Brazil, Mexico

Last updated on : 21 November, 2025

Livestock and Aquaculture LED Lighting Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Adoption of Smart Livestock Farming and Aquaculture Practices –Smart farming, smart livestock, and aquaculture are estimated to increase the production, quality, and usage of maximum resources and reduce the environmental effect. The use of automatic lighting systems to control the temperature and brightness of the light prevents excessive coldness and heat in cattle sheds. The value of smart farming in India was projected to reach a worth of USD 890 million by the end of 2028.

- Rising Production Associated with LED Lighting in Livestock and Agriculture – The growth of the aquaculture production of all fishes was estimated to reach USD 240 billion out of USD 400 billion of the global economy.

- Rising Consumption of Animal Based Products Across the World – As of 2021 Americans consume more than 270 pounds of meat every year on average.

- Growing Aquariums in Homes and Malls to Enhance the Appearance – As of 2022 statistics, more than 1.8 million households across the globe have saltwater aquariums with over 780,000 in the U.S.

- Rising Consumption of Dairy Products for Various Food Items and Dishes – In the United States alone, more than 130 pounds of milk products are consumed by every person as of 2021 reports.

Challenges

- Limited Awareness About the Availability of Smart Lighting Technologies

- High Cost of LED Lights – The manufacturing of LEDs is complex compared to regular halogen bulbs which makes them inexpensive. Also, many parts are used in the production of LED, and these components are costly that increase the investment price. All these factors hamper the market growth.

- Lack of Awareness of the Benefits of LED lights

Livestock and Aquaculture LED Lighting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 5.93 billion |

|

Forecast Year Market Size (2035) |

USD 12.68 billion |

|

Regional Scope |

|

Livestock and Aquaculture LED Lighting Market Segmentation:

Product Type Segment Analysis

The global livestock and aquaculture LED lighting market is segmented and analyzed for demand and supply by product type into LED bulbs, LED Tube lights, and LED fixtures. Out of the three types of livestock and aquaculture LED lighting market the LED bulbs segment is estimated to gain the largest market share of about 42% in the year 2035. The growth of the segment can be attributed to the increasing use of LED bulbs in chicken farms owing to benefits such as less power consumption. The high quality and energy saving with 25 times long-lasting compared to LED tube lights. The percentage of households that used LED light bulbs during 2015-2020 increased from 4% to 45% in the U.S. The rising use of aquaculture is driving market segment growth with increasing consumption of fish and other sea foods. Also, the percentage of people consuming meat around the world is growing day by day is propelling the market segment growth.

Application Segment Analysis

The global livestock and aquaculture LED lighting market is also segmented and analyzed for demand and supply by application into aquaculture and livestock. Amongst these segments, the livestock segment is expected to garner a significant share of around 56% in the year 2035. The amount of people consuming animal products for weight loss and keto diets is rising across the globe which is driving the market segment growth. The growing consumption of dairy products, use of animal fur, and animal parts in various industries are driving the market segment growth in the coming years. The increasing use of LED in livestock for enhancement of production, and maintenance of livestock health. Even, LEDs are used in storage barns for energy saving, better light control, and longevity is driving the market segment growth.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Watt |

|

|

By Installation |

|

|

By Distribution Channel |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Livestock and Aquaculture LED Lighting Market - Regional Analysis

APAC Market Insights

North America industry is predicted to hold largest revenue share of 34% by 2035, impelled by increasing use of meat consumption in the region. The growth of the market in the region can primarily be attributed to the increasing production of different types of fish in the region, along with the fact that the region is the world’s largest producer of fish. According to the statistics by FAO, the world capture production of different types of fish in the inland waters in the Asia Pacific increased from 7127712 in the year 2013 to 7866687 in the year 2019. Besides this, the increasing focus of the government of nations in the region to promote sustainable aquaculture practices is also projected to add to the market growth during the forecast period. The market in the region is further segmented by country into China, Japan, India, South Korea, Singapore, Australia, and the Rest of Asia Pacific. The market in China is projected to garner the largest revenue of USD 2514.5 Million by the end of 2031, up from a revenue of USD 1291.2 Million in the year 2021.

Europe Market Insights

The European livestock and aquaculture LED lighting market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the increasing use of meat consumption in the region. The rising number of slaughterhouses in the region with varied types of animal meat with growing meat eaters are driving the market growth. The increasing population of cows, sheep, and goats for milk and dairy products in the region. In 2021, the population of pigs was more than 140 million, bovine animals were 75 million, and the population of sheep and goats was 70 million in Europe. The production of pig meat in 2021 reached a peak of 23 million tons. Also, the production of poultry meat in Europe during 2021 was estimated to be more than 13 million tons as per the estimations. The growing agriculture production in Europe that need cattle for farming and other works is estimated to hike the market growth.

North American Market Insights

Further, the market in North America, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing population and changes in diet patterns are driving the market growth. The rising focus on animal health to increase livestock and animal product production as many people depend on it for their living is driving the market segment growth. The growing demand for organic food among people with rising disposable income and growing awareness of diet habits is estimated to propel the market segment growth. Rising meat usage in dishes and many events as a special meal plan is estimated to hike the market growth.

Livestock and Aquaculture LED Lighting Market Players:

- Signify Holding

- Greengage Agritech Ltd.

- LED Livestock ApS

- Fienhage Poultry-Solutions GmbH

- Erilon, Agrilux (Thies Electrical Distributing Co. Inc.)

- Agri-Light Energy Systems Ltd.

- Once Inc.

- Shenzhen Hontech-Wins Electronics Co., Ltd.

- Lely International N.V.

- Adolf Schuch GmbH

- Gasolec B.V.

Recent Developments

- Svaberget Smolt located in Norway equipped its lighting systems with Signify Holding. The aquaculture lighting solutions are patented to control the growth and life cycle of land-based farming salmon.

- Signify Holding supplied the Kingfish Company with Philips Aquaculture photoperiodic LED lighting products which optimize the growth of fish and feed conversion at the world’s first sustainable land-grown aquaculture for Yellowtail-fishes.

- Report ID: 4068

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Livestock and Aquaculture LED Lighting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.