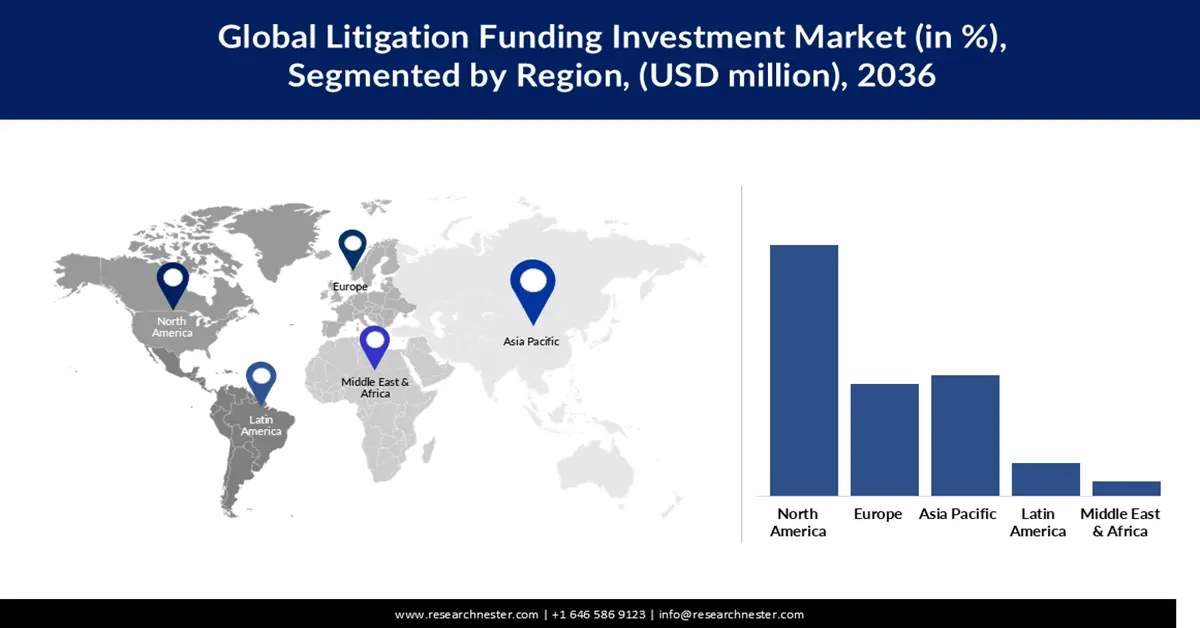

Litigation Funding Investment Market - Regional Analysis

North America Market Insights

North America litigation funding investment market is expected to grow at a revenue share of 47.24% by 2036. The region is a dominant force in the global market, due to its mature legal systems, deep pools of institutional capital, and a high volume of complex commercial litigation. The region’s growth is further supported by favorable regulatory conditions and rising legal costs, making third-party funding an attractive asset class for investors. Key players are actively deploying portfolio models, combining multiple cases to diversify risk, which further accelerates capital flow into the region. According to market research, North America accounts for a significant portion of global funding activity.

In the U.S., third-party litigation financing is well-established, particularly for commercial cases. According to a U.S. Government Accountability Office (GAO) report, funders stated that much of their capital is concentrated in North America, with typical single-case investments averaging around US$2.3 million and portfolio deals at about US$4.5 million.

In Canada, litigation funding is gaining traction amid rising litigation trends, particularly in commercial litigation. The Insurance Bureau of Canada (IBC) report, based on research by Dentons LLP, highlighted that law firms are increasingly using third-party capital to pursue lawsuits that might otherwise be too risky. The report also warns that the largely unregulated nature of the industry in Canada could potentially driveup commercial insurance costs if unchecked.

Asia Pacific Market Insights

Asia Pacific is the fastest-growing region for the litigation funding investment market, driven by rising complexity in commercial disputes, increasing cross-border activity, and growing awareness of third-party funding as a strategic tool. Regulatory reform and arbitration-friendly frameworks in key jurisdictions further support growth. The region’s increasing integration into global supply chains and more frequent intellectual-property and commercial litigation also contribute to demand for funding. As institutional investors seek diversification, the region is viewed as a growth frontier within the litigation funding ecosystem.

In China, third-party litigation funding (TPF) is increasingly gaining traction despite the absence of explicit legislation. Courts have recognized funding agreements in both litigation and arbitration, for example, in Winhc Information Technology vs. Changzhou Ainuo Textile and other cases, showing that Chinese funders like Omni Bridgeway and Deminor are active locally. In 2024, CIETAC (China International Economic and Trade Arbitration Commission) implemented new rules explicitly governing third-party funding, requiring parties to disclose funding arrangements, including the funder’s identity. Despite the lack of a dedicated regulatory framework, the practice is being cautiously tolerated. Further, the Beijing Fourth Intermediate Court affirmed that third-party funding in arbitration is legal if it does not undermine fairness. Meanwhile, a growing number of domestic Chinese funders have emerged. Global Arbitration Review reported that local funders founded by ex-lawyers are now actively investing in commercial disputes. Yet, the overall number of publicly disclosed funded cases remains modest compared to Western markets, which suggests the market is still in an early growth phase. At the same time, the Chinese legal infrastructure is adapting: funded parties must now notify both arbitrators and opponents of funding agreements, and tribunals can account for such funding in cost awards under the new CIETAC rules.

India’s litigation funding investment market is rapidly evolving, driven by a severe backlog in its court system. There are over 44.6 million pending cases in lower courts as of January 2024. Emerging Indian funders, like LegalPay, FightRight, and LegalFund, have launched operations since 2019 to support commercial arbitration and insolvency litigation. Despite no centralized national legislation, third-party funding is recognized in several states via legal provisions and has been validated by Indian courts. Legal-tech startups are playing a big role: they use AI and predictive analytics to underwrite cases more precisely and manage risk.

Europe Market Insights

Europe is becoming a major growth region in the litigation funding investment market, supported by its increasing cross-border commercial disputes, evolving regulatory frameworks, and strong institutional investor interest. The European Parliament’s 2022 resolution has sparked discussion of a common EU directive on third-party funding, pushing for greater standardisation. Moreover, the Representative Actions Directive (RAD) continues to shape collective redress mechanisms, fueling demand for funding in group litigation. Funders are increasingly active across various jurisdictions, especially in commercial and arbitration disputes, positioning Europe as a competitive and maturing region for litigation finance.

In Germany, third-party litigation funding is legal and well-established, particularly for civil and commercial disputes. Since 2021, statutory rules have been clarified, and there are around twenty active funders in the country. Although litigation funding does not require a banking license, some funders still face regulatory burdens under German financial law. Demand is driven by corporate claimants seeking to commercialise or de-risk high-value disputes, and funders are increasingly seen as alternative financiers in complex litigation.

France’s litigation funding investment market is nascent compared to other European markets, with limited regulation for domestic disputes. Third-party funding has grown significantly in international arbitration, especially in Paris, where funders like Deminor and Ivo Capital are actively supporting claimant-arbitration. While there is no dedicated law on litigation funding, common law principles and French Bar ethics govern contractual relationships between funders, clients, and lawyers. The Paris Bar Council has formally endorsed third-party funding, particularly for arbitration, noting its role in enhancing access to justice. Market research suggests a growing interest in antitrust and collective-damage disputes as suitable areas for funding.