- Introduction

- Study Objective

- Scope of the Report

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- Data Triangulation

- Client-specific Requirements and Tailored Solutions

- Executive Summary

- Executive Summary

- Strategic Imperative

- Outcome: Actionable Insights

- Global Economic Outlook

- World Economic and Risk Outlook for 2024

- World Debt 2023

- World Trade: Imports and Exports

- Regional Outlook

- Developed Economies

- Economies in Transition

- Developing Economies

- Global Industry Overview

- Global Overview

- Industry Supply Chain Analysis

- DROT

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Use Case Analysis

- Industry Risk Assessment

- GROWTH OUTLOOK

- Industry Supply Chain Analysis

- Competitive Landscape

- Competitive Landscape

- Company Profile

- Burford Capital LLC

- Omni Bridgeway

- Therium Group Holdings Limited

- GLS Capital

- Validity Finance, LLC

- Parabellum Capital LLC

- Others

- Outlook and Projections

- Market Outlook and Projections

- Global Segmentation (USD Million), 2024-2037, By

- Type

- Organization Size

- End-User

- Region

- Cross Analysis

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Type

- Organization Size

- End-User

- Country Level Analysis

- US

- Canada

- Overview

- US Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment USD Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Type

- Organization Size

- End-User

- Overview

- About Research Nester

Litigation Funding Investment Market Outlook:

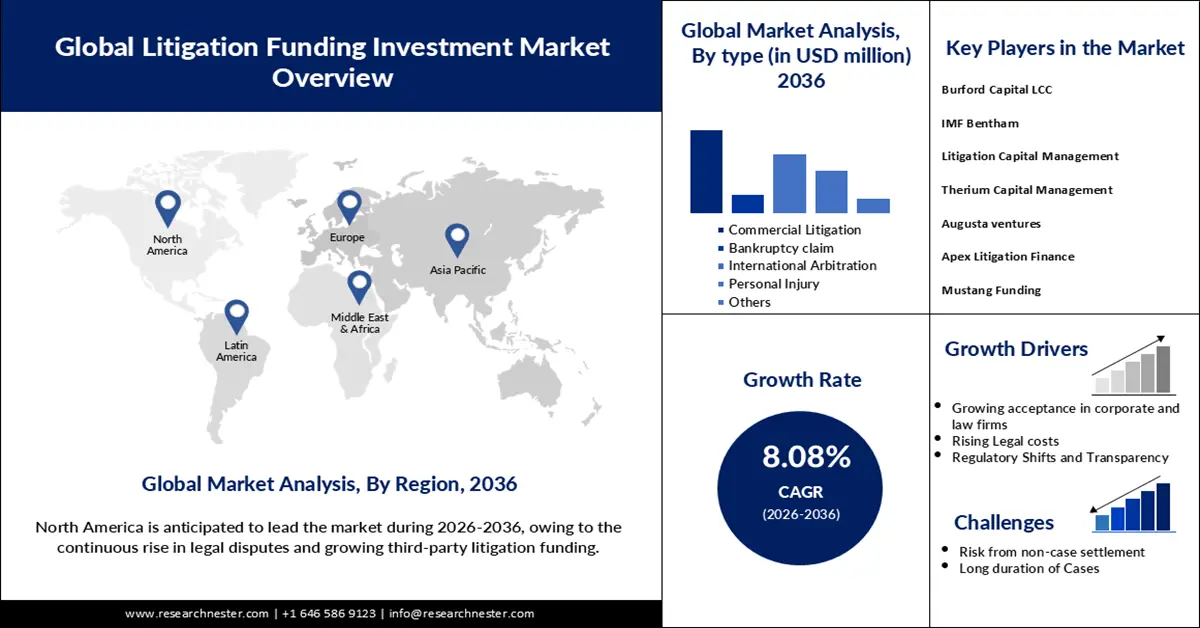

Litigation Funding Investment Market size was valued at USD 20.64 billion in 2025 and is projected to reach USD 51.09 billion by the end of 2036, rising at a CAGR of 8.08% during the forecast period i.e., between 2026 and 2036. In 2026, the industry size of litigation funding investment is estimated at USD 23.48 billion.

The market growth is owing to rising awareness about the advantages of litigation funding, catering to business contract disputes, intellectual property cases, and fraud-related lawsuits. Thus, small and medium enterprises and large corporations are investing in deploying litigation funding solutions. Several industry giants are steadily recognizing the potential of litigation funding as an alternative investment source. For instance, LexShares introduced LexShares Marketplace Fund II in 2020. This is a dedicated litigation finance fund with a target size of around USD 100 million. Another example is FightRight Technologies, an Indian startup with launched a Rs.100 crore fund targeting high-net-worth individuals interested in investing commercial legal cases.

Governments have also engaged in litigation funding, particularly in cases involving significant public interest or substantial financial implications. For instance, in the UK, this funding has supported significant cases such as the sub-postmaster’s fight against the Post Office or various equal pay and consumer right claims. This is also expected to fuel the demand for litigation funding investments.

Key Litigation Funding Investment Market Insights Summary:

Regional Highlights:

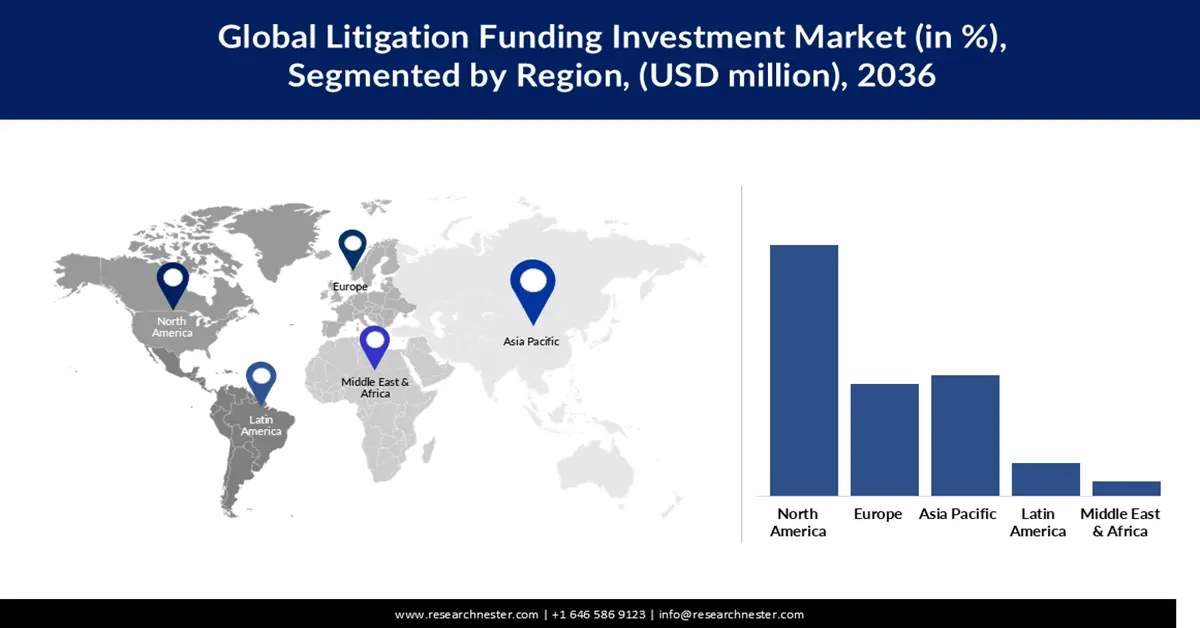

- North America is projected to secure 47.24% share by 2036 in the litigation funding investment market, supported by mature legal systems, abundant institutional capital, and widespread adoption of portfolio-based funding models

- Asia Pacific is set to emerge as the fastest-expanding region by 2036, benefitting from rising cross-border disputes, arbitration-friendly reforms, and increasing acceptance of third-party litigation finance

Segment Insights:

- Commercial Litigation is expected to command 59.31% share by 2036 in the litigation funding investment market, strengthened by high-value corporate disputes and growing preference for capital-efficient risk transfer mechanisms

- MSMEs (Enterprise Size Segment) are forecast to grow at a CAGR of 8.81% by 2036, encouraged by wider access to third-party funding for managing contractual and intellectual property disputes

Key Growth Trends:

- Acceptance by corporate and legal firms

- Rising legal costs and complexity

Major Challenges:

- Risk from non-settlement of case

- Lengthy case duration

Key Players: Burford Capital LCC, IMF Bentham, Litigation Capital Management, Therium Capital Management, Augusta Ventures, Apex Litigation Finance, Bench walk Advisors, Clyde and Co LLP, Mustang Funding

Global Litigation Funding Investment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.64 billion

- 2026 Market Size: USD 23.48 billion

- Projected Market Size: USD 51.09 billion by 2036

- Growth Forecasts: 8.08% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: North America (47.24% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Australia, Canada

- Emerging Countries: India, Singapore, China, Japan, South Korea

Last updated on : 5 January, 2026

Litigation Funding Investment Market - Growth Drivers and Challenges

Growth drivers

- Acceptance by corporate and legal firms: Growing acceptance of third-party litigation financing (TPLF) by both law firms and corporate legal departments is a key driver boosting the global litigation funding investment market. According to a U.S. Government Accountability Office report, litigation funders themselves report increased use by new parties, including major law firms and corporations, with a noticeable shift toward portfolio financing by 2021. About 51% of total capital went into portfolio agreements, up from 28% in 2017. Large law firms are increasingly using external funding to manage the steep upfront costs of complex cases without straining partner capital. Corporate in-house legal teams are also embracing litigation funding as a way to de-risk litigation spend and monetize legal claims, rather than bearing the full financial risks internally. This cultural and financial shift has improved investor confidence in litigation assets, helping institutional capital flow into the litigation funding investment market. Moreover, standardized funding agreement structures and increasing regulatory clarity in several key jurisdictions are further legitimizing TPLF, making it more palatable and strategically useful for legal practices and corporate entities alike.

- Rising legal costs and complexity: Rising legal costs and increasing complexity of litigation are compelling more plaintiffs and law firms to turn to third-party funding, significantly fueling the litigation funding investment market. For example, tort litigation costs in the U.S. surged to US$529 billion in 2022, growing at an annual rate of 7.1% since 2016, indicating that litigation is becoming more expensive. The complexity of modern disputes, especially in commercial and patent litigation, makes funding even more attractive, as cases often require extensive discovery, expert witnesses, and multi-year commitments. In patent litigation alone, the median cost to go through trial can exceed US$3 million, according to a 2023 survey by the American Intellectual Property Law Association.

- Regulatory shifts and transparency: Growing clarity and oversight in litigation-funding frameworks across major jurisdictions is accelerating litigation funding investment market adoption. A U.S. Government Accountability Office (GAO) review notes that while no federal disclosure mandate exists, an increasing number of courts and states are introducing rules requiring parties to reveal third-party funding agreements, strengthening confidence in funded cases. In the U.K., the Civil Justice Council’s 2025 report recommends light-touch regulation and clearer disclosure practices in collective proceedings to improve fairness and reduce information asymmetry. The European Law Institute (ELI) has issued principles urging disclosure of funders’ identity, funding terms, and conflict-of-interest safeguards, supporting transparent and ethically managed funding structures. Together, these shifts create a more predictable legal environment, reduce risks for investors, and promote litigation funding as a trusted financial mechanism worldwide.

Challenges

- Risk from non-settlement of case: The funding is entirely dependent on the successful outcomes of legal cases; however, delays in hearings, unexpected procedural hurdles, and case dismissals heighten the possibility of no returns. Such uncertainties can result in complete capital loss for funders, making the market inherently vulnerable. Variations in legal systems across jurisdictions further complicate risk assessment, discouraging investors from pursuing complex or cross-border cases. These conditions often dampen investor confidence and reduce overall risk appetite, slowing market expansion as funders become more selective. Emerging businesses are particularly exposed, as limited experience and weaker legal evaluation capabilities can lead them to underestimate risks and suffer greater financial setbacks.

- Lengthy case duration: Legal systems vary significantly across countries, creating substantial challenges for law firms handling cross-border disputes and adding complexity to litigation-funding decisions. Prolonged case durations often erode investor confidence and reduce capital efficiency, prompting many funders to withdraw when timelines become uncertain. Smaller and emerging market players are especially affected, as extended proceedings can strain their resources and limit future investment capacity. According to the International Chamber of Commerce, international legal proceedings typically last around 27 months, with most cases falling within the 22–25-month range, underscoring the time-intensive nature of litigation. As investors reassess risks and encounter limited assurance of profitability, overall litigation funding investment market growth can slow, particularly for complex or multi-jurisdictional cases.

Litigation Funding Investment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

8.08% |

|

Base Year Market Size (2025) |

USD 20.64 billion |

|

Forecast Year Market Size (2036) |

USD 51.09 billion |

|

Regional Scope |

|

Litigation Funding Investment Market Segmentation:

Form Type Segment Analysis

Commercial litigation is projected to hold 59.31% of the global litigation funding investment market by 2036, making it the dominant segment due to its high-value claims and strong demand from corporations seeking capital-efficient dispute resolution. Businesses increasingly prefer external funding to manage cash flow, avoid litigation-related financial strain, and shift legal risk to third-party funders. Complex disputes involving antitrust, intellectual property, contract breaches, and cross-border commercial conflicts attract significant investor interest because of their large settlement potential. Moreover, global corporates are adopting litigation finance as a strategic tool to pursue meritorious claims without burdening balance sheets. As corporate awareness grows and funders expand their due diligence and risk assessment capabilities, the commercial litigation segment continues to accelerate the market’s overall expansion.

Enterprise Size Segment Analysis

Micro, Small, and Medium Enterprises (MSMEs) are becoming a major force behind the expansion of the enterprise-size segment in the litigation funding investment market, supported by an expected CAGR of 8.81% by 2036. Limited liquidity and restricted access to traditional financing often prevent MSMEs from pursuing meritorious legal claims, making third-party funding an essential tool for managing legal risk. As disputes related to contracts, intellectual property, and commercial transactions rise, funded litigation enables MSMEs to protect business interests without diverting operational capital. The growing formalization of MSMEs worldwide, supported by government programs that encourage dispute resolution, further increases the pool of eligible claimants. Additionally, funders increasingly view MSME disputes as attractive due to manageable claim sizes, faster case cycles, and high settlement rates, collectively strengthening the segment’s long-term growth.

Funding Structure Segment Analysis

Portfolio funding is strengthening the growth of the funding-structure segment as investors increasingly prioritize diversified, risk-balanced legal finance models. By spreading capital across multiple cases rather than relying on the outcome of a single dispute, funders significantly lower their exposure to loss and improve the likelihood of stable returns. This risk-mitigation advantage has made portfolio arrangements especially appealing to law firms handling high-value commercial, antitrust, or IP cases, where bundled financing supports broader litigation strategies rather than one-off claims. At the same time, portfolio funding enables firms to pursue meritorious but capital-intensive cases without cash-flow restraints, increasing overall demand for litigation finance. As investors seek more predictable yield profiles in an otherwise volatile legal environment, portfolio funding continues to emerge as one of the most scalable and attractive models in the litigation funding investment market.

Our in-depth analysis of the global litigation funding investment market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Enterprise |

|

|

Funding |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Litigation Funding Investment Market - Regional Analysis

North America Market Insights

North America litigation funding investment market is expected to grow at a revenue share of 47.24% by 2036. The region is a dominant force in the global market, due to its mature legal systems, deep pools of institutional capital, and a high volume of complex commercial litigation. The region’s growth is further supported by favorable regulatory conditions and rising legal costs, making third-party funding an attractive asset class for investors. Key players are actively deploying portfolio models, combining multiple cases to diversify risk, which further accelerates capital flow into the region. According to market research, North America accounts for a significant portion of global funding activity.

In the U.S., third-party litigation financing is well-established, particularly for commercial cases. According to a U.S. Government Accountability Office (GAO) report, funders stated that much of their capital is concentrated in North America, with typical single-case investments averaging around US$2.3 million and portfolio deals at about US$4.5 million.

In Canada, litigation funding is gaining traction amid rising litigation trends, particularly in commercial litigation. The Insurance Bureau of Canada (IBC) report, based on research by Dentons LLP, highlighted that law firms are increasingly using third-party capital to pursue lawsuits that might otherwise be too risky. The report also warns that the largely unregulated nature of the industry in Canada could potentially driveup commercial insurance costs if unchecked.

Asia Pacific Market Insights

Asia Pacific is the fastest-growing region for the litigation funding investment market, driven by rising complexity in commercial disputes, increasing cross-border activity, and growing awareness of third-party funding as a strategic tool. Regulatory reform and arbitration-friendly frameworks in key jurisdictions further support growth. The region’s increasing integration into global supply chains and more frequent intellectual-property and commercial litigation also contribute to demand for funding. As institutional investors seek diversification, the region is viewed as a growth frontier within the litigation funding ecosystem.

In China, third-party litigation funding (TPF) is increasingly gaining traction despite the absence of explicit legislation. Courts have recognized funding agreements in both litigation and arbitration, for example, in Winhc Information Technology vs. Changzhou Ainuo Textile and other cases, showing that Chinese funders like Omni Bridgeway and Deminor are active locally. In 2024, CIETAC (China International Economic and Trade Arbitration Commission) implemented new rules explicitly governing third-party funding, requiring parties to disclose funding arrangements, including the funder’s identity. Despite the lack of a dedicated regulatory framework, the practice is being cautiously tolerated. Further, the Beijing Fourth Intermediate Court affirmed that third-party funding in arbitration is legal if it does not undermine fairness. Meanwhile, a growing number of domestic Chinese funders have emerged. Global Arbitration Review reported that local funders founded by ex-lawyers are now actively investing in commercial disputes. Yet, the overall number of publicly disclosed funded cases remains modest compared to Western markets, which suggests the market is still in an early growth phase. At the same time, the Chinese legal infrastructure is adapting: funded parties must now notify both arbitrators and opponents of funding agreements, and tribunals can account for such funding in cost awards under the new CIETAC rules.

India’s litigation funding investment market is rapidly evolving, driven by a severe backlog in its court system. There are over 44.6 million pending cases in lower courts as of January 2024. Emerging Indian funders, like LegalPay, FightRight, and LegalFund, have launched operations since 2019 to support commercial arbitration and insolvency litigation. Despite no centralized national legislation, third-party funding is recognized in several states via legal provisions and has been validated by Indian courts. Legal-tech startups are playing a big role: they use AI and predictive analytics to underwrite cases more precisely and manage risk.

Europe Market Insights

Europe is becoming a major growth region in the litigation funding investment market, supported by its increasing cross-border commercial disputes, evolving regulatory frameworks, and strong institutional investor interest. The European Parliament’s 2022 resolution has sparked discussion of a common EU directive on third-party funding, pushing for greater standardisation. Moreover, the Representative Actions Directive (RAD) continues to shape collective redress mechanisms, fueling demand for funding in group litigation. Funders are increasingly active across various jurisdictions, especially in commercial and arbitration disputes, positioning Europe as a competitive and maturing region for litigation finance.

In Germany, third-party litigation funding is legal and well-established, particularly for civil and commercial disputes. Since 2021, statutory rules have been clarified, and there are around twenty active funders in the country. Although litigation funding does not require a banking license, some funders still face regulatory burdens under German financial law. Demand is driven by corporate claimants seeking to commercialise or de-risk high-value disputes, and funders are increasingly seen as alternative financiers in complex litigation.

France’s litigation funding investment market is nascent compared to other European markets, with limited regulation for domestic disputes. Third-party funding has grown significantly in international arbitration, especially in Paris, where funders like Deminor and Ivo Capital are actively supporting claimant-arbitration. While there is no dedicated law on litigation funding, common law principles and French Bar ethics govern contractual relationships between funders, clients, and lawyers. The Paris Bar Council has formally endorsed third-party funding, particularly for arbitration, noting its role in enhancing access to justice. Market research suggests a growing interest in antitrust and collective-damage disputes as suitable areas for funding.

Key Litigation Funding Investment Market Players:

- Burford Capital LCC (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IMF Bentham (Australia)

- Litigation Capital Management (Australia)

- Therium Capital Management (UK)

- Augusta Ventures (UK)

- Apex Litigation Finance

- Bench walk Advisors

- Clyde and Co LLP

- Mustang Funding (UK)

- Burford Capital LCC: Established in 2009, Burford Capital excels in Litigation financing and legal-finance advisory services to corporate clients. In 2025, the company raised USD 11.8 billion to settle litigations of corporate and legal firms.

- IMF Bentham: IMF Bentham is a litigation funding provider that was established in 2001 in Australia. The firm invests in corporate claims, commercial claims, international arbitration, and others. With coverage across the globe, IMF Bentham has successfully managed its global footprint in litigation funding

- Litigation Capital Management: Headquartered in Sydney, LCM offers third-party fund management and direct investments, keeping its core focus on single-case funding and portfolio funding.

- Therium Capital Management: The firm serves diverse disputes and portfolio funding with a strong focus on single cases and group litigation. It has a wide geographical footprint with presence in the UK, the US, Australia, and Spain.

Here are a few areas of focus covered in the competitive landscape of the litigation funding investment market:

The players operating in the litigation funding investment market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the litigation funding investment market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Corporate Landscape of the Global Litigation Funding Investment Market

Recent Developments

- In June 2025, Omni Bridgeway announced that it had been recognized as the leading global litigation funder in the Chambers 2025 Litigation Support Guide, earning the highest number of total recognitions as well as the most Band 1 rankings worldwide.

- Report ID: 2800

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.