Lithium Niobate Market Outlook:

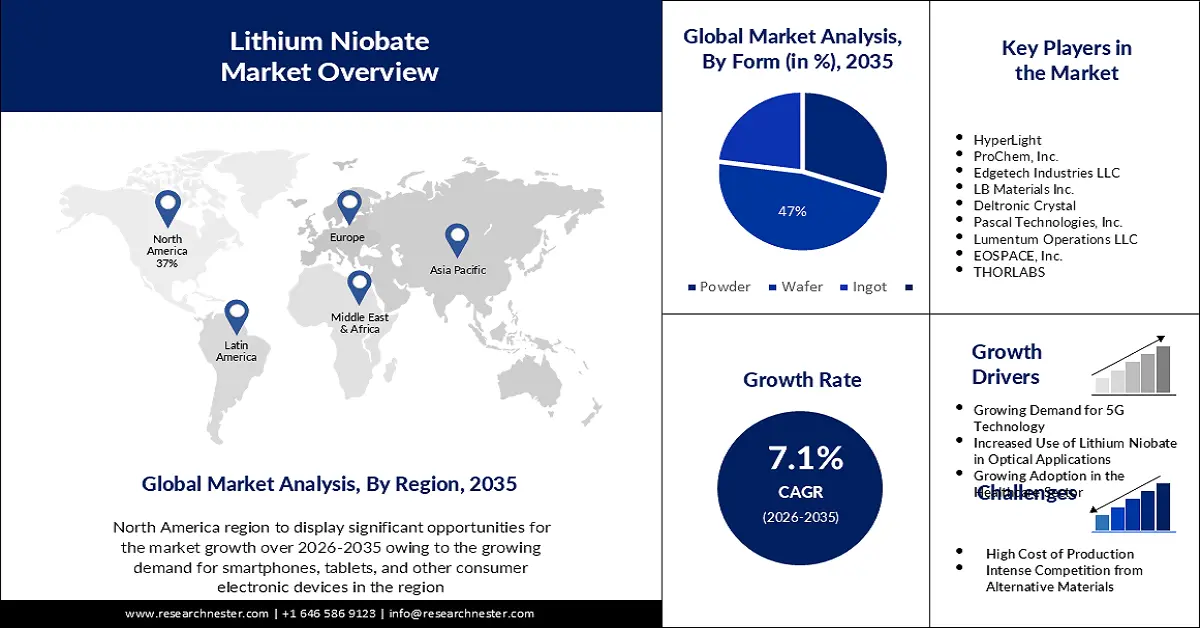

Lithium Niobate Market size was valued at USD 4.54 billion in 2025 and is set to exceed USD 9.01 billion by 2035, expanding at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lithium niobate is estimated at USD 4.83 billion.

The market for lithium niobate is largely driven by telecommunication applications; component integration enhances the value of optical networks. These days, network security is crucial for effective communications, which is why lithium niobate facilitates the integration of various routing via spatial switches. As per a report, 422.1 million people were victims of data breaches in 2022, an increase of more than 40% from 2021. As a result, the lithium niobate market is expanding due to the rising need for network security driven by the growing number of breaches.

Since the action requires light stimulation to occur, lithium niobate has found use as an electrostatic tweezer in recent years. Since the tweezing action is limited to the lighted area, this phenomenon enables highly flexible fine manipulation of micrometer-scale particles. Because these powerful fields can have a wide range of effects on live creatures, they are now finding applications in biophysics and biotechnology. For instance, it has been demonstrated that iron-doped lithium niobate stimulated by visible light causes cell death in tumoral cell cultures. Therefore, the growing application of lithium niobate in biosciences is bolstering its growth in the projected period.

Key Lithium Niobate Market Insights Summary:

Regional Highlights:

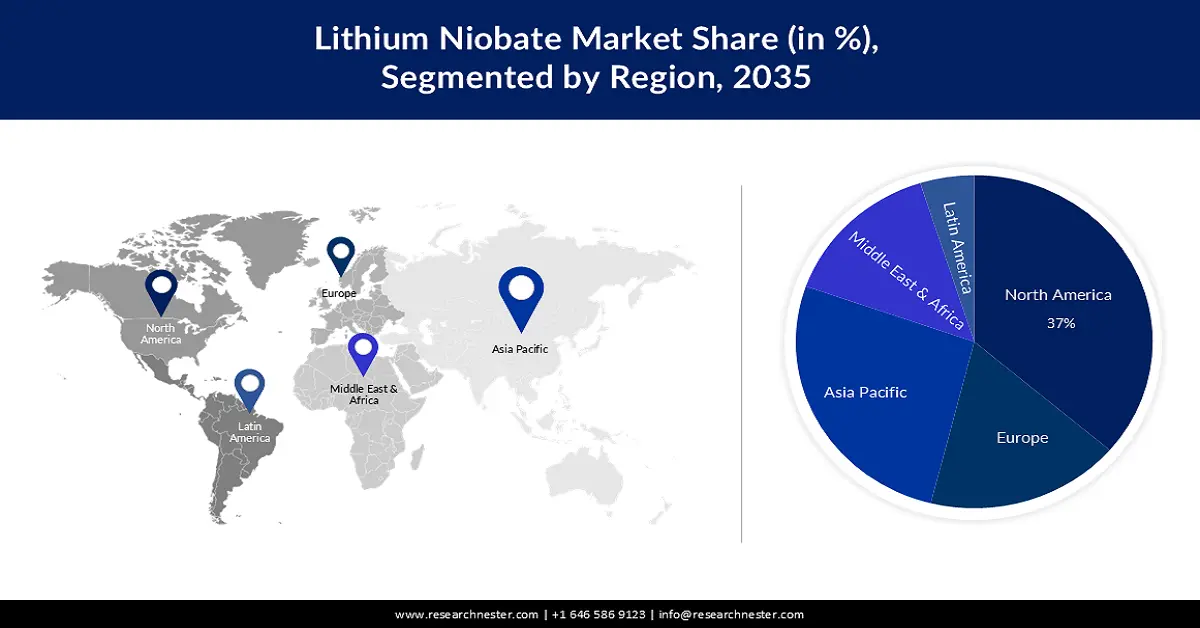

- North America is set to capture a 37% share by 2035, driven by rising demand for consumer electronics and advancements in photonics and quantum computing technologies for the lithium niobate market.

- Asia Pacific is anticipated to hold a 27% share by 2035, impelled by the expansion of 5G networks and growing demand for high-speed data transmission.

Segment Insights:

- Wafer segment is projected to account for 47% share by 2035 in the lithium niobate market, owing to the rising demand for compact components and integrated electronic devices.

- Industrial-grade segment is expected to hold a 44% share by 2035, propelled by the increasing adoption of advanced sensing, imaging technologies, and industrial automation.

Key Growth Trends:

- Growing Demand for 5G Technology

- Increased Use of Lithium Niobate in Optical Applications

Major Challenges:

- High Cost of Production

- Intense Competition from Alternative Materials may Hinder Lithium Niobate Market Growth

Key Players: iXblue Group, HyperLight, ProChem, Inc., Edgetech Industries LLC, LB Materials Inc., Deltronic Crystal, Pascal Technologies, Inc., Lumentum Operations LLC, EOSPACE, Inc., THORLABS.

Global Lithium Niobate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.54 billion

- 2026 Market Size: USD 4.83 billion

- Projected Market Size: USD 9.01 billion by 2035

- Growth Forecasts: 7.1%

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Singapore, Taiwan, Vietnam, Brazil

Last updated on : 27 November, 2025

Lithium Niobate Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand for 5G Technology - 5G networks require advanced components like lithium niobite for their super-fast speeds and enhanced performance. This material is ideal for creating efficient devices that can handle the high frequencies and data rates of 5G networks. As more countries and companies roll out 5G technology, the demand for lithium niobite continues to rise, driving the growth of the lithium niobate market. As per a report, worldwide, there will be more than 1.41 billion 5G subscriptions by 2025. For connectivity innovations like 5G technology and wireless networking, lithium niobate modulators are used to deliver dependable internet access. Therefore, the market for lithium niobate modulators is anticipated to have a large amount of opportunity due to technical improvements and the deployment of 5G network technology in the telecommunications department.

- Increased Use of Lithium Niobate in Optical Applications - The lithium niobate market is expanding due to the material's increasing use in optical applications. Modulators and switches, for example, are made of this incredibly versatile substance. It is a top option for optical components because of its special qualities, which include a high optical damage threshold and excellent electro-optic coefficients. The growing reliance of sectors such as data centers, telecommunications, and aerospace on optical technologies is driving up demand for lithium niobite and propelling the market expansion. For instance, by December 2023, there will be about 10,978 data center locations worldwide. Therefore, the growing number of these data centers is also escalating the lithium niobate market growth.

- Growing Adoption in the Healthcare Sector - Because of its extraordinary qualities, lithium niobate is widely employed in the healthcare industry to create cutting-edge medical devices such as sensors and ultrasound transducers. High piezoelectric coefficients and biocompatibility of the material are essential for precise and secure medical device development. The use of lithium niobite in the healthcare industry is expanding along with the demand for cutting-edge medical technology. The desire for more accurate and effective medical equipment that can enhance patient care and results is accelerating the growth of the market.

Challenges

- High Cost of Production - Higher production costs are a result of the complicated and costly lithium niobite manufacturing process. For some applications, this may make it less competitive when compared to other materials. As a result, the high cost of producing the material could prevent the lithium niobite industry from expanding.

- Intense Competition from Alternative Materials may Hinder Lithium Niobate Market Growth

- Concerns Regarding Environmental Degradation May Hamper Market Growth

Lithium Niobate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 4.54 billion |

|

Forecast Year Market Size (2035) |

USD 9.01 billion |

|

Regional Scope |

|

Lithium Niobate Market Segmentation:

Form Segment Analysis

Wafer segment for the lithium niobite market is anticipated to hold the largest share of 47% during the forecast period. Compact components are increasingly in demand as electronic devices shrink and integrate into each other. Wafertype lithium niobite enables the manufacture of miniaturized and integrated devices, such as filters, resonators, or modulators, which makes it ideal for use in telecommunications, photonics, and integrated optics. Additionally, good optical quality, low optical loss, and high electro-optic coefficients are among the remarkable optical and electro-optic features offered by wafer-type lithium niobite. In addition, there is a need for components capable of operating across all wavelengths given the growing demand for data transfer and telecommunications at speeds exceeding 100 Mbps. Because of its broadband capabilities, wafer-type lithium niobite is becoming more and more in demand in the communications industry.

Grade Segment Analysis

Lithium niobate market for the industrial grade is expected to hold the second-largest share of 44% during the forecast period. The quality, consistency, and cost-effectiveness of industrial-grade lithium niobite have been further enhanced by ongoing improvements in processes and techniques for the synthesis of materials. This has led to enhanced performance characteristics, such as better clarity of light, reduction in loss of light, and increased electrooptic coefficients that have expanded its applicability for industrial applications. The increasing demand for advanced sensing and imaging technologies in the field of industry applications like machine vision, environment monitoring, quality control, and automation is another factor driving the adoption of industrial-grade lithium niobate. In addition, the need for infrastructure development, communication networks, and industrial automation, which is accelerating the growth of the industrial-grade segment, is growing as emerging markets continue to grow and develop. For instance, by 2025, industrial automation systems are projected to be implemented globally for a total estimated cost of USD 181.6 billion.

Our in-depth analysis of the global lithium niobate market includes the following segments:

|

Form |

|

|

Grade |

|

|

Application |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Niobate Market - Regional Analysis

North American Market Insights

North America industry is set to hold largest revenue share of 37% by 2035. The growing demand for smartphones, tablets, and other consumer electronic devices in the region is propelling the growth of the market. Also, North America is a hub for research and development in advanced technologies such as photonics and quantum computing. For instance, the US government's investments in QC research are intended to advance this technology to address some of the most difficult issues in national security, engineering, and science. Currently, research is focused on using quantum computing technologies to enhance results in financial and climate modeling, drug development, and cryptography. Lithium niobate is a crucial material in these fields due to its ability to manipulate light and its excellent nonlinear optical properties. Therefore, this factor is propelling the growth of the lithium niobate market in the region.

APAC Market Insights

Lithium niobate market in Asia Pacific is poised to hold a share of 27% by the end of 2035. Asia Pacific is a hub for electronic manufacturing, and lithium niobate is used in various electronic devices such as smartphones, tablets, and other consumer electronic devices. As per a report, in terms of online sales, it is projected that by 2024, online outlets for consumer electronic devices will account for 34.4% of overall income. Furthermore, With the expansion of 5G networks and the demand for high-speed data transmission, there’s a growing need for lithium niobate in telecommunications infrastructure, particularly for components like optical modulators and switches.

Lithium Niobate Market Players:

- iXblue Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HyperLight

- ProChem, Inc.

- Edgetech Industries LLC

- LB Materials Inc.

- Deltronic Crystal

- Pascal Technologies, Inc.

- Lumentum Operations LLC

- EOSPACE, Inc.

- THORLABS

Recent Developments

- Leading high-tech manufacturer and designer of innovative photonics components, Exail, introduces a novel low Vπ LiNbO3 phase modulator intended for high-power laser applications. Due to its ultra-low Vπ (up to 16 GHz), this novel modulator minimizes power consumption while providing stability across time, temperature, and vibration for Coherent Beam Combination (CBC) and Spectral Beam Combination (SBC). This modulator is specifically made to handle optical inputs of up to 300 mW at 1060 nm, making it perfect for the creation of high-power lasers.

- With thin-film lithium niobate (TFLN) technology, HyperLight is the industry leader in end-to-end photonic integrated circuit (PIC) solutions. The company recently announced the release of its new transmitter (Tx) PICs, which support 1.6 Tbits per wavelength in coherent communications links and 200 Gbits per lane in direct-detection data center transceivers. The PICs from HyperLight fit into standard form factor transceivers and have CMOS-level drive voltages and ultrahigh electro-optic bandwidth, which can enable wall-plug efficiency of as little as 5 pJ/bit.

- Report ID: 5698

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium Niobate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.