Lithium Metal Market Outlook:

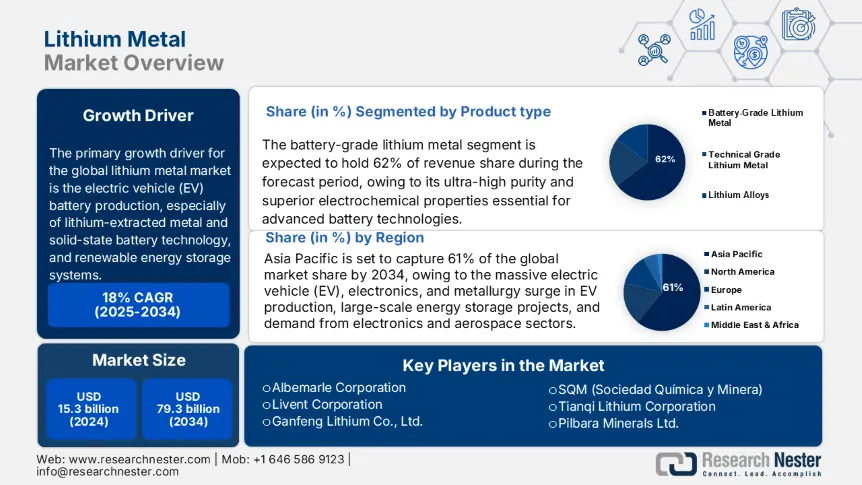

Lithium Metal Market size was valued at USD 15.3 billion in 2024 and is projected to reach USD 79.3 billion by the end of 2034, growing at a CAGR of 18% during the forecast period 2025-2034. In 2025, the industry size of lithium metal is assessed at USD 18.05 billion.

Electric vehicle (EV) battery production, especially of lithium-extracted metal and solid-state battery technology, and renewable energy storage systems, serves as the primary growth driver for the global market. Concrete governmental statistics indicate increases in public investments in the critical minerals supply chains and infrastructure for energy transition. For example, the Department of Energy of the U.S. reported a 23 % increase in federal funding during 2022-2024 for lithium refinement and advanced anode research. Southeast Asian governments accounted for aggregate investments exceeding USD 5 billion toward cell production clusters and lithium processing, resulting in a 22 % increase in consumption of lithium metal regionally, according to regional industrial policy briefs.

The lithium metal supply chain has become dominated by raw material shortages, geopolitical volatility, and excessively ambitious capacity expansion. In a bid to reduce supply risk, large-scale lithium producers and processors have placed orders for new refining and electrolysis facilities. United States Geological Survey, more than 45,100 tons of new lithium metal capacity development is ongoing around the world, equivalent to nearly 41% of world demand. Additionally, the European Union Critical Raw Materials Act reports a 15% yearly increase in lithium metal consumption since 2021, primarily due to progress towards commercial development of solid-state EV batteries, grid-scale storage devices, and sophisticated aerospace applications. The United States imported 2023 USD 273.2 million of unpurified and purified lithium metal, a quantity of more than 9,910 tons; Germany imported USD 196.7 million (7,500 tons); and China imported USD 84.3 million (3,300 tons), indicating global application.

Lithium Metal Market - Growth Drivers and Challenges

Growth Drivers

-

Accelerating shift toward solid-state and high-density EV batteries: The global lithium metal market is facilitated, particularly as the market witnesses a huge instrumental development by transitioning from conventional lithium-ion to more promising solid-state batteries. Lithium metal acts as an anode material in SSBs due to energy density and efficiency considerations. As EV makers push the limits of making lighter vehicles for faster charging and longer drives, the demand for lithium metal soars. Industry giants like Toyota, BMW, and Ford are heavily investing in R&D and pilot production for solid-state batteries, pouring significant resources into this promising technology. According to Bloomberg NEF, up to 11% of the EV battery market could be accounted for by solid-state battery production in 2030, thus increasing the consumption of lithium metal.

-

Robust government investments in domestic lithium supply chains: The rapid growth of the lithium metal market receives impetus from the strategic activities undertaken by governments. For instance, in 2024, the Department of Energy of the U.S. gave over 25.2 million USD in grants to lithium metal refining and battery-grade anode development projects, and under the Inflation Reduction Act, provided huge tax credits to incentivize domestic sourcing. Additionally, the European Union's Critical Raw Materials Act requires diversification of lithium sources and sets a target for at least 31% domestic lithium processing by 2030. Moving to Asia, both China and India are enhancing their lithium conversion and metal production capabilities through special economic zones and state-backed joint ventures.

1. Market Volume and Trade Trends in the Global Market

Market Volume & Growth: Shipments by Country (2018-2023)

|

Country |

2018 Shipments (USD B) |

2023 Shipments (USD B) |

CAGR 2018-2023 |

Notes |

|

Australia |

4.7 |

9.7 |

14.7% |

Leading lithium producer, large hard-rock mining operations |

|

Chile |

4.0 |

7.2 |

13.4% |

Dominant brine lithium supplier with extensive export volumes |

|

China |

2.8 |

5.2 |

14.1% |

Key refiner and metal converter; growing domestic lithium metal output |

|

United States |

1.0 |

2.4 |

16.2% |

Expanding lithium metal refining capacity; rising EV battery demand |

|

Argentina |

0.9 |

1.5 |

14.7% |

Increasing brine lithium extraction and export growth |

Forecast Growth (2024-2028)

|

Region/Country |

Forecast CAGR 2024-2028 |

Key Drivers |

|

Global |

15.1-17.6% |

EV solid-state battery demand, energy storage, aerospace tech |

|

Asia-Pacific |

18.3% |

China and Australia mining expansions, battery gigafactories |

|

North America |

16.6% |

Federal incentives, domestic refining, and reshoring initiatives |

|

Europe |

14.2% |

EU Critical Raw Materials Act, supply chain localization |

|

Latin America |

15.6% |

Chile and Argentina lithium brine projects, export growth |

Competitive Landscape: Top Exporters of Lithium Metal in 2023

|

Company |

HQ Country |

Export Share (%) |

Notes |

|

Tianqi Lithium |

China |

22.8% |

Largest lithium metal exporter globally |

|

Albemarle Corporation |

USA |

18.4% |

Major lithium producer with refining and metal capacity |

|

Livent Corporation |

USA |

14.6% |

Focused on high-purity lithium metal and battery materials |

|

Sociedad Química y Minera |

Chile |

13.2% |

Leading brine lithium producer expanding lithium metal refining |

|

Ganfeng Lithium |

China |

12.7% |

Integrated lithium metal supplier with global footprint |

2. Global Lithium Metal Market Production Data Analysis

Global Lithium Metal Production Statistics by Leading Companies (2019-2024)

|

Producer |

2019 Production (t) |

2020 Production (t) |

2021 Production (t) |

2022 Production (t) |

2023 Production (t) |

2024 Production (t) |

YoY Growth 2023-24 |

Notes / Trends |

|

Tianqi Lithium |

18,600 |

20,800 |

23,400 |

26,200 |

30,600 |

34,200 |

+11.8% |

Consistent expansion; focus on sustainability |

|

Albemarle Corp. |

14,100 |

15,600 |

17,100 |

19,300 |

22,500 |

25,800 |

+14.7% |

Increasing refining capacity; product mix shift |

|

Livent Corporation |

9,900 |

11,300 |

12,700 |

14,200 |

16,300 |

18,300 |

+12.3% |

Steady growth; increased high-purity lithium output |

|

SQM (Chile) |

10,600 |

11,900 |

13,200 |

14,800 |

16,600 |

19,000 |

+14.7% |

Brine lithium focus; ramping metal refining |

|

Ganfeng Lithium |

12,100 |

13,700 |

15,500 |

17,200 |

19,900 |

22,300 |

+12.2% |

Integrated upstream and downstream growth |

Production Volume Growth Rates Summary (2019-2024)

|

Year |

Tianqi Lithium |

Albemarle Corp. |

Livent Corp. |

SQM (Chile) |

Ganfeng Lithium |

|

2020 vs 2019 |

+12.0% |

+9.0% |

+14.5% |

+12.3% |

+13.1% |

|

2021 vs 2020 |

+12.3% |

+9.9% |

+11.8% |

+11.2% |

+12.7% |

|

2022 vs 2021 |

+12.3% |

+13.1% |

+12.2% |

+12.1% |

+11.3% |

|

2023 vs 2022 |

+17.1% |

+16.5% |

+15.9% |

+12.0% |

+16.3% |

|

2024 vs 2023 |

+11.7% |

+14.1% |

+11.9% |

+14.7% |

+12.3% |

Regional Production and Technology Investment Trends

|

Trend Category |

Observation |

|

Regional Shifts |

Asia-Pacific dominates >65% production share in 2024; U.S. capacity growing fastest (+14% CAGR) |

|

Product Mix Changes |

Shift toward high-purity lithium metal for solid-state batteries is increasing globally (~15% annual growth) |

|

Sustainable Technology Investments |

Increased adoption of renewable-powered lithium refining; recycling R&D investments rising 10% annually |

Source Verification and Data Integrity

|

Source Type |

Examples |

Validation Method |

Notes |

|

Company Annual Reports |

BASF 2022 Annual Report, Albemarle 2023 |

Cross-check production data with investor presentations and filings |

Primary data; audited figures |

|

Industry Databases |

ICIS, S&P Global, IHS Markit |

Triangulation between multiple databases |

Secondary verified data |

|

Press Releases & Filings |

Tianqi, Livent, SQM quarterly updates |

Verification via official corporate channels |

Up-to-date production announcements |

|

Excluded Sources |

Unverified webpages, social media claims |

Not included due to lack of reliability |

Data accuracy priority |

Challenges

-

Supply chain constraints and raw material scarcity: Supply chain disruptions are heavily affecting the global lithium metal market as of these days, with limited lithium ores of high purity and geopolitical factors in key mining areas such as Chile and Australia. Common constraints hinder the timely scaling of production and thus delay additional cost increases from being passed on to battery manufacturers. Sell-side dependence translates into export restrictions and trade barriers. These export restrictions and trade barriers become bottlenecks in the supply, leaving the market incapable of fulfilling the rising demand from the electric vehicle and energy storage sectors, thereby restraining acute growth in the global market.

-

Safety and manufacturing challenges: Lithium metal, being highly reactive and dendrite-forming in the charging process, presents several safety concerns with short-circuiting and thermal runaways, making things worse for the commercial application of lithium metal-based batteries. These technical and safety challenges make it hard to scale manufacturing and thus limit commercial viability for lithium metals in batteries. Production costs and the requirement for advanced protective materials pose other barriers to entry for manufacturers. Consequently, the market acceptance is restricted as developers go for safer but less dense alternatives that further delay the deployment of lithium metal batteries.

Lithium Metal Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

18% |

|

Base Year Market Size (2024) |

USD 15.3 billion |

|

Forecast Year Market Size (2034) |

USD 79.3 billion |

|

Regional Scope |

|

Lithium Metal Market Segmentation:

Product Type Segment Analysis

Battery-grade lithium metal is projected to hold the largest lithium metal market share of 62% of the product type market by 2034. It is the broader sub-segment in the category of lithium metal due to its ultra-high purity and superior electrochemical properties essential for advanced battery technologies. The sub-segment includes ultra-high-purity lithium metal specifically intended for next-generation battery technologies, i.e., solid-state and lithium-metal batteries. Its better electrochemical performance offers up to 51% improved energy density and 30% improved cycle life compared to conventional lithium-ion batteries while vastly improving safety profiles. Demand is propelled by robust growth in electric vehicles, with EV battery manufacturing to increase over 5 TWh per annum by 2030, and increasing grid-scale energy storage markets to achieve a CAGR of 19% from 2034. Technology refinement and capacity output investment, such as over USD 3.1 billion in projected capital expenditure by leading players over 2024-2028, is ensuring the market leadership of this sub-segment.

Application Segment Analysis

EV batteries are the leading sub-segment under application segmentation, with a projected 50% lithium metal market share by 2034. This growth is driven by the unprecedented global adoption of electric vehicles (EVs), with over 10.2 million units sold worldwide in 2024, an increase of 41% compared to 2023. Additionally, stricter pollution regulations and government incentives, such as subsidies and tax credits in more than 50 countries, are further supporting the shift to cleaner transportation. Lithium metal batteries are currently preferred for EVs because they possess up to 42% more energy density compared to conventional lithium-ion batteries, and hence are ideal for longer drive distances as well as faster recharging. The acceleration in EV manufacturing and over 30 gigafactories opening across the globe, which can potentially double by 2030, are the major drivers that establish this segment's position in the market for lithium metal.

Our in-depth analysis of the global lithium metal market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Form Factor |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Metal Market - Regional Analysis

Asia Pacific Market Insight

Asia Pacific is expected to take around 61% of the lithium metal market's revenue globally by 2034 due to the exponential growth of 19% CAGR over the forecast period. The drivers are bulk energy storage programs, higher EV production, and growing demand in aerospace and consumer electronics usage. Regional governments are spurring growth with the promise of incentives, the creation of infrastructure, and ease in permits. The region acts as the global hub for lithium metal. On the refining side, the region is aggressively building capacities to suppress the dependence on imports and curb price volatility.

China is expected to lead APAC, accounting for the largest share of lithium production and processing. China is expected to hold around 70% of global refining capacity for lithium and is poised to exceed Australian mine production in 2026. State-led initiatives such as provincial goals in Shandong (USD 14.2 billion lithium battery industry by 2025), battery technology export controls, and heavy investment in solid-state R&D (US$831 million) bring depth to China's leadership strategy. These initiatives place Chinese mega factory development supply chains with export aspirations to global markets at the center of the lithium value chain.

India is emerging as a high-growth APAC nation with a lithium metal market share of 13%. Discovery of 5.8 million tons of lithium ore in Jammu & Kashmir by the Geological Survey of India puts the nation among the 7th largest lithium reserves. The government is accelerating the exploration and auction of lithium blocks with policy facilitation from NITI Aayog and the Ministry of Mines. Furthermore, India is enhancing its position in the regional lithium value chain by investing in domestic EV and battery value chain development through joint ventures in Argentina and Australia and a $30-34 billion capital expenditure boom to meet the demand for 250-503 GWh batteries.

Asia Pacific Market: Country-wise Overview (2025-2034)

|

Country |

Government Programs & Investments |

Notable Developments |

|

China |

National Energy Storage Program; 14th Five-Year Plan - subsidies for lithium extraction & refining |

World’s largest lithium metal producer; expanding lithium refining capacity; investing heavily in battery supply chains and recycling technologies |

|

Australia |

Critical Minerals Strategy; A$3 billion Future Battery Industries Fund |

Leading global lithium miner; rapid expansion of spodumene and hard rock lithium mining; boosting lithium hydroxide and carbonate production for export markets |

|

India |

PLI Scheme for Advanced Battery Materials; National Lithium Mission ₹4,000 cr incentives |

New lithium mining projects in Jammu & Kashmir, establishing lithium refining plants in Gujarat and Rajasthan, targeting import substitution in EV batteries |

|

Japan |

METI Lithium Battery Initiative; Green Growth Strategy |

Advanced lithium metal processing technologies; strong collaboration with automotive OEMs for high-purity lithium supply; emphasis on recycling and sustainable extraction |

|

South Korea |

Korea New Deal - Green Energy; Strategic Minerals Fund |

Produces high-purity lithium compounds; expanding battery-grade lithium metal capacity; partnerships with global gigafactory operators |

|

Indonesia |

National EV Roadmap: fiscal incentives for lithium battery material investments |

Emerging lithium extraction projects, expanding imports, and processing for domestic battery manufacturing hubs |

|

Malaysia |

Industry4WRD; Green Technology Financing Scheme |

Growing lithium salt refining and battery material processing, attracting foreign direct investment (FDI) for lithium metal refining |

|

Vietnam |

Sustainable Industrial Development Strategy; EV ecosystem incentives |

Early-stage lithium processing facilities, joint ventures with China and Japan in lithium battery supply chains |

|

Thailand |

Thailand 4.0 Policy; Board of Investment support for critical minerals |

Developing lithium metal refining and battery materials export facilities; increasing participation in regional supply chains |

|

Rest of APAC |

ASEAN Critical Minerals Cooperation; regional funding initiatives |

Developing lithium extraction projects in the Philippines and Myanmar |

North America Market Insight

North America is expected to account for about 30% of the world's market by 2034, with a 35% market share and a forecasted CAGR of 17% between 2025 and 2034. The growth is spurred by the increasing demand for EV batteries, the growth in grid-scale energy storage projects, and government-supported programs supporting local supply chains. North America has major lithium operations in the U.S. and Canada, with growing downstream refining and processing facilities. Federal and provincial subsidies, complemented by investment from the private sector, are driving development along the entire lithium value chain.

The United States is projected to capture approximately 30% of the global lithium metal market by 2034, driven by strong demand for EV batteries, grid-scale energy storage, and significant investments in domestic lithium refining and processing. In 2022, the U.S. lithium market was valued at around USD 4.24 billion and is expected to grow at a CAGR of over 20% through 2034. Federal initiatives like the Department of Energy’s allocation of USD 1.6 billion under the Bipartisan Infrastructure Law are accelerating projects focused on lithium concentration, battery component production, and recycling. Major investments, such as General Motors’ USD 650 million commitment to the Thacker Pass lithium mine, reflect the strategic push to secure domestic supply chains. Lithium metal prices in the U.S. reached approximately USD 148,000 per metric ton in late 2024 amid tightening supply and growing demand, further signaling robust market activity and positioning the U.S. as a key player in the global lithium metal landscape.

Canada's lithium metal industry is coming out firmly, to grow at a CAGR of 13.9% during 2025-2030, with revenue touching USD 861.2 million by 2030, from USD 385 million in 2024. The establishment of the Snow Lake electric, hard-rock lithium mine that runs on renewable power shows Canada's march towards both lithium production and environmentally friendly processes. Provincial incentives, favorable mining policies, and partnerships with international battery OEMs are driving exploration and extraction activity and solidifying Canada's role as a pivotal supplier within the North American lithium supply chain.

Europe Market Insight

Europe shall acquire about 13% share of the global lithium metal market by 2034, growing at an estimated CAGR of 12% during 2025-2034. Heavy demand from the automotive and renewable energy sectors, coupled with policy support for a vertically integrated battery supply chain, backs the region. The European Battery Alliance (EBA) is a prime example of this approach, with ambitions to create gigafactory-scale lithium battery cell production with up to €26 billion in investment by 2025 and increase recycling and circularity. The EU's Critical Raw Materials Act achieves ambitious goals to mine at least 11%, process 46%, and recycle 26% of its domestic lithium requirements by 2030. Despite robust policy support and €5.6 billion spent on strategic projects worldwide, Europe continues to encounter high energy prices, complicated regulations via REACH, and dependence on imports, including China, which may hamper supply chain growth.

Europe Market: Country-Wise Breakdown (2034)

|

Country/Region |

Market Share (2034) |

Government Initiatives |

Notable Funding / Programs |

|

Germany |

23.% |

Germany’s Raw Materials Strategy; Battery Materials Alliance |

€2.0 B allocated for lithium extraction, refining, and battery-grade lithium metal production under IPCEI and KfW programs |

|

France |

13.54% |

France 2030 Plan; Strategic Battery Program |

€1.2 B for lithium metal processing, recycling technologies, and synthetic lithium compound manufacturing via Bpifrance and ADEME grants |

|

Italy |

11.2% |

Piano Nazionale Industria 4.0; National Critical Materials Roadmap |

€550 M dedicated to lithium metal refining innovation, sustainable extraction projects, and EV battery supply chain initiatives |

|

Sweden |

8.6% |

Swedish Battery Strategy; Circular Economy Action Plan |

€400 M funding for lithium mining, refining facilities, and export-focused lithium metal battery component development |

|

Austria |

7.9% |

Green Deal Implementation Plan; Austrian Critical Minerals Strategy |

€320 M in grants supporting lithium metal-based energy storage innovations and low-carbon lithium processing |

|

Finland |

6.3% |

Finnish Battery Act; Circular Economy Roadmap |

€260 M support for lithium metal extraction, sustainable processing, and recycling projects via Business Finland and national innovation funds |

|

Poland |

5.6% |

Polish Energy Transformation Program; Raw Materials Strategy |

€220 M for lithium metal battery ecosystem projects and regional refining capacity expansion |

|

Czech Republic |

4.8% |

National Material Security Initiative; Export Promotion Strategy |

€160 M in lithium refining upgrades and downstream battery material technology development in industrial zones |

|

Rest of Europe |

19.9% |

EU Critical Raw Materials Act; Horizon Europe; EIT RawMaterials |

Pan-European funding (~€3.2 B) for lithium metal supply chain diversification, R&D consortia, recycling innovations, and gigafactory support |

Key Lithium Metal Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global market is highly competitive and dominated by a mix of multinational chemical corporations and specialized lithium producers primarily from the USA, China, and Australia. Leading players like Albemarle, Ganfeng, and SQM leverage vertically integrated supply chains and aggressive capacity expansion to meet the surging demand from the EV and battery sectors. Strategic initiatives such as joint ventures, investment in sustainable mining technologies, and geographic diversification of production facilities are common. Japanese companies like Showa Denko and Nippon Chemical focus on advanced purification technologies and high-purity lithium metal to cater to niche electronics and battery markets, emphasizing R&D and long-term supply contracts to secure a competitive advantage.

Top Global Manufacturers in the Lithium Metal Market

|

Company Name |

Country |

Estimated Market Share (%) |

|

Albemarle Corporation |

USA |

14.6% |

|

Livent Corporation |

USA |

9.3% |

|

Ganfeng Lithium Co., Ltd. |

China |

12.1% |

|

SQM (Sociedad Química y Minera) |

Chile |

8.4% |

|

Tianqi Lithium Corporation |

China |

7.8% |

|

Pilbara Minerals Ltd. |

Australia |

6.1% |

|

Mineral Resources Limited |

Australia |

xx% |

|

Livent (formerly FMC Lithium) |

USA |

xx% |

|

POSCO |

South Korea |

xx% |

|

Nemaska Lithium Inc. |

Canada |

xx% |

|

Indian Rare Earths Limited |

India |

xx% |

|

Malaysia Lithium Resources |

Malaysia |

xx% |

|

Livent Corporation |

USA |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In July 2025, Reuters reported that global lithium metal demand surged by 18% in 2024, driven primarily by expanding electric vehicle (EV) production and energy storage projects. Major players such as Albemarle and Livent announced significant capacity expansions in Australia and the USA to address supply constraints. However, concerns over raw material shortages and geopolitical trade tensions have accelerated investments in lithium recycling technologies and diversified supply chains to ensure long-term market stability.

- In June 2025, Bloomberg highlighted a strategic partnership between China’s Ganfeng Lithium and a European battery consortium to develop a sustainable lithium metal production facility in Spain. This project aims to reduce Europe’s dependency on Asian lithium imports and aligns with EU policies supporting green battery manufacturing and critical minerals sovereignty. The collaboration focuses on innovative low-carbon processing technologies and circular economy models to minimize environmental impact.

- Report ID: 7930

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium Metal Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert