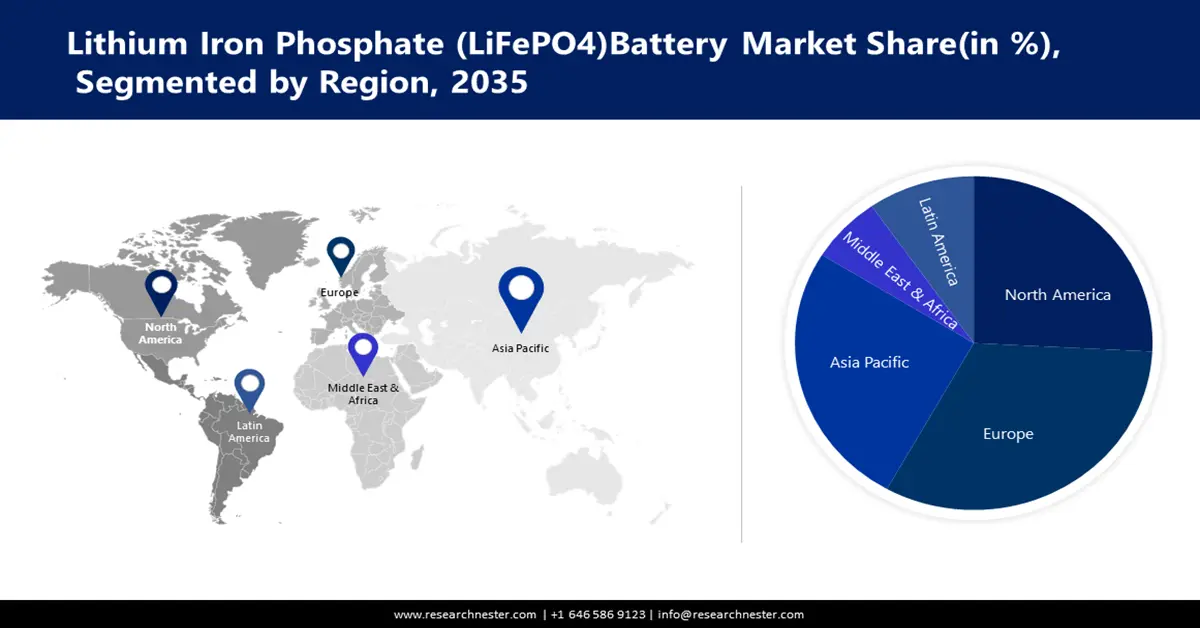

Lithium Iron Phosphate Battery Market Regional Analysis:

APAC Market Insights

Asia hosts the largest energy workforce due to a wide population-base, lower labor costs, and sizable clean energy production sectors, and brisk investments. China’s capacity to manufacture LFP cells and individual battery units has grown manifold. By 2021, China-based companies were generating about 90% of the global LFP powder. In 10 years, Shenzhen Dynanonic, a local company increased its annual LFP capacity to 265,000 tons from 500 tons. Unlike other firms, Dynanonic has integrated a solution-based method similar to Süd-Chemie hydrothermal process used in Montreal. Other China-based battery businesses have started expanding overseas to strengthen their lithium iron phosphate (LiFePO4) battery market position. For instance, Gotion High-Tech, a veteran LFP batteries and cathode materials producer in China, plans to build 100 GW h of battery cell capacity across other countries in the next 3 years. In June 2022, the company, whose biggest shareholder is Volkswagen, disclosed its plans to inaugurate its first LFP battery facility in Europe.

Energy employment by economic activity and by key region & country, in 2022 (thousand workers)

|

Region/Country |

Employment |

|

China |

19,300 |

|

India |

8,400 |

|

Rest of APAC |

8,700 |

|

Europe |

7,700 |

|

North America |

7,100 |

|

Africa |

4,300 |

|

CSA |

4,200 |

|

Middle East |

3,900 |

|

Eurasia |

2900 |

Source: IEA

China has a high manufacturing capacity of LiFePO4 batteries, with most factories that produce LFP using a standardized solid-state process. Shenzhen Dynanonic has led the China LiFePO4 battery market, in terms of LFP shipment volume, valuing a production capacity of 120,000 tons in 2021 and is anticipated to reach to 145,000 tons with new facilities in the forthcoming years. Also, Guizhou Anda Energy Technology quickly emerged as a prominent player, with a yearly capability utilization of 60,000 tons, supplying high-quality materials to some of the top battery manufacturers including BYD. Fulin Precision Metal in collaboration with CATL and BYD aims at expanding its capacity to 65,000 tons during the forecast period. Other than above, Pulead Technology Industry, BTR New Energy Materials, Tianjin STL Energy Technology, Chongqing Terui Battery Materials and Yantai Zhuoneng Battery Materials are producing and supplying LFP in China and around the globe.

North America Market Forecast

North America LiFePO4 battery market is expected to garner a significant revenue share by the end of 2035, attributed to the presence of some market giants and rising investments. Nano One in Canada is advancing clean technology for affordable LiFePO4 production, while ICL is leading the North America region with an investment of USD 400 million for a new manufacturing facility. The diverse needs for energy storage systems and EV batteries, ranging from high capacity and fast charging to long cycling life, is driving expansion of LEP in the region.

Commercial-scale lithium production in the U.S. has gained momentum over the last few years due to rising government focus in the form of fundings and grants to decouple from China’s influence on its manufacturing processes. In 2022, the U.S. DOE selected 12 projects funded with USD 1.6 billion to support the domestic production of lithium, innovate battery components, promote recycling, and bring in new technologies to boost the country’s lithium reserves. Furthermore, the U.S. Inflation Reduction Act has rolled out tax incentives to consolidate battery materials supply, sourcing, and EV manufacturing in U.S.-partner countries. U.S. demand for LFP batteries, particularly in the passenger EV segment is anticipated to continue outstripping domestic production capacity. According to c&en, the estimated U.S. LEP capacity will be over 150 GW/year by 2030.

Lithium import-export comparative analysis through 2023 (in Watts)

|

Salient Statistics |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Imports for consumption |

2,620 |

2,460 |

2,640 |

3,270 |

3,400 |

|

Exports |

1,660 |

1,200 |

1,870 |

2,440 |

2,300 |

|

Price, annual average-nominal, battery-grade lithium carbonate, dollars per metric ton |

12,100 |

8,600 |

12,600 |

68,100 |

46,000 |

Source: USGS