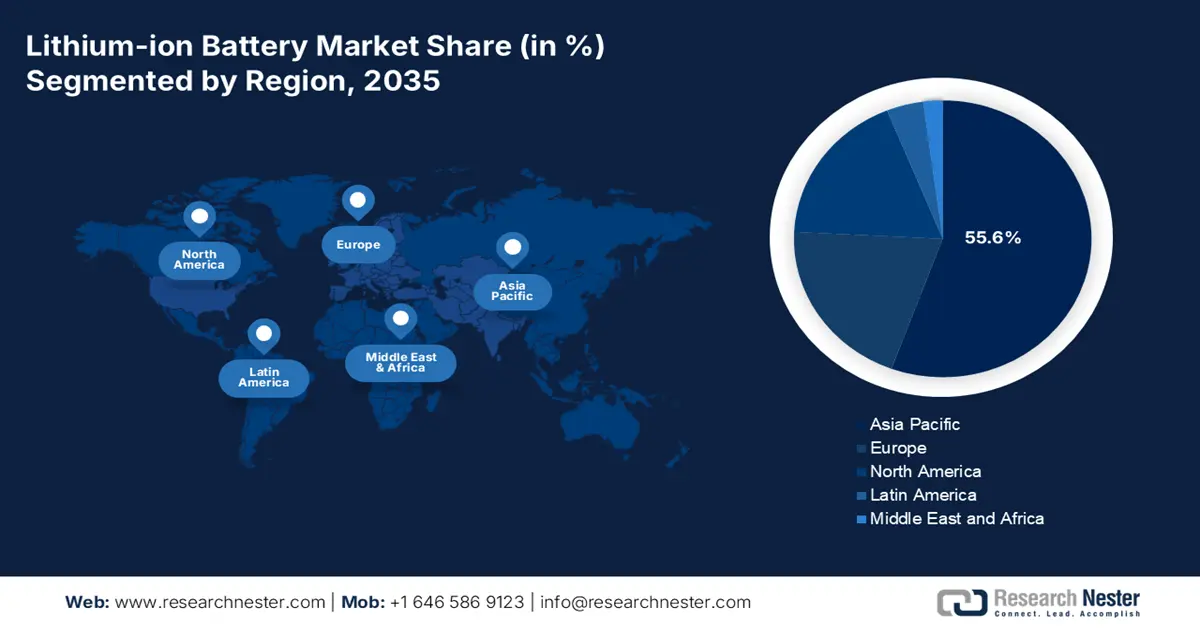

Lithium-ion Battery Market - Regional Analysis

APAC Market Insights

The Asia Pacific lithium-ion battery market is anticipated to garner the highest share of 55.6% by the end of 2035. The market’s upliftment in the region is highly propelled by robust contributions from India, South Korea, and Japan, along with China’s integrated grid-scale storage, rapid electric vehicle adoption, and supply chain. According to an article published by the EIA Government in May 2025, the country imported nearly 12 million short tons of processed and raw battery minerals. This accounts for 44% of interregional trade, and exports nearly 11 million short tons of battery materials, components, and packs, or 58% of interregional trade as of 2023. In addition, the country also domestically produced an estimated 18%, which is 33,000 short tons, of the global mined lithium as of 2023, and regional organizations also control 25% of the international lithium mining capacity, thus suitable for bolstering the market’s exposure.

The market in China is growing significantly due to pack integration, cell manufacturing, precursor chemicals, refining, and end-to-end scale across mining. As per an article published by the English Government in December 2025, the overall output of lithium-ion batteries has exceeded 580 GWh between January and October. In addition, the output of lithium-ion batteries utilized for customer products surpassed 84 GWh, and the installed capacity of power batteries for the newest energy vehicles (NEVs) in at nearly 224 GWh in the first 10 months. Moreover, there has been a boom in the country’s lithium-ion battery sector, which came amid the rising consumer demand for NEVs. Regarding this, between January to November, 5.0 million units of new energy passenger cars have been sold through retail channels in the nation, increasing by 100.1%, thus denoting an optimistic outlook for the market.

The lithium-ion battery market in India is also growing due to chemical processing, robust localization of battery manufacturing, grid modernization, and a surge in electric vehicle adoption. As stated in an article published by WRI India Organization in May 2025, the overall industry is continuously experiencing rapid growth, with a yearly demand projected to increase from 10.8 GWh as of 2022 to 160.3 GWh by the end of 2030. Besides, to diminish this dependency, the country is ramping up the localized lithium-ion battery manufacturing capacity, which is projected to reach 150 GWh yearly by 2030, readily supported by private sector investments and governmental incentives. Furthermore, the domestic manufacturing of these batteries has also reached 18 GWh in 2023, therefore making it suitable for uplifting the market.

North America Market Insights

North America lithium-ion battery market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled, owing to domestic supply chain investments, grid-scale storage facilities, and an increase in the demand for electric vehicles. According to an article published by the EIA Government in August 2024, there has been an increase in battery electric vehicles (BEVs), plug-in hybrid electric vehicles, and hybrid vehicles in the U.S. from 17.8% to 18.7% as of 2024. Additionally, there has been a slight upsurge in the hybrid and electric vehicle market share, which is primarily fueled by hybrid electric vehicle sales, which increased by 30.7% year-over-year (YoY). Meanwhile, hybrid sales catered to 8.6% of the overall light-duty market within the same year and surged to 9.6%, thereby making it suitable for boosting the market in the region.

The lithium-ion battery market in the U.S. is gaining increased traction due to policy support, federal funding, electric vehicle adoption, grid-scale storage, and safety and standards. As per an article published by the National Energy Technology Laboratory in October 2022, the Biden-Harris Administration, through the U.S. Department of Energy (DOE), declared that 20 companies received USD 2.8 billion to develop and expand commercial-scale infrastructures across 12 states to process and extract graphite, lithium, and other battery-specific materials. In addition, the federal investment has been predicted to be matched by recipients to leverage an overall USD 9 billion to bolster regional production, pertaining to clean energy technology, support governmental objectives, and create standard-paying employment opportunities, thus denoting an optimistic outlook for the overall market.

The lithium-ion battery market in Canada is also developing, owing to governmental investments, critical minerals strategy, sustainability, innovation, and international opportunity. As stated in an article published by the Government of Canada in October 2025, the Minister of Energy and Natural Resources declared a generous investment of more than USD 22 million under the Energy Innovation Program (EIP) to support 8 projects for assisting in accelerating battery advancement and production capacities across the country. Besides, in March 2025, the Government of Canada has readily partnered with Frontier Lithium Inc. to successfully make expansion in the production of tactical battery materials. Additionally, with the launch of the country’s first-ever Critical Minerals Strategy in 2023, the government has initiated suitable investments and overcome gaps to achieve standard processing facilities and mines, which positively impacts the market’s development.

8 Projects funded under the Battery Industry Acceleration Call in Canada (2025)

|

Project Name |

Company Name |

Location |

Fund Amount (USD) |

|

Qualification and Increased Production Efficiency of NOVONIX All-Dry, Zero-Waste Cathode Active Materials |

NOVONIX Battery Technology Solutions Inc. |

Bedford, Nova Scotia |

5,000,000 |

|

Scaling of Advanced Manufacturing Platform for Production of Coated Current Collectors |

Calumix Technologies Inc |

London, Ontario |

4,545,000 |

|

Advancing Electrified Mobility with Next-Generation Ultrahigh-Capacity Cylindrical Cells |

Flex-Ion Battery Innovation Center |

Windsor, Ontario |

3,319,640 |

|

Tin-based anode materials for lithium-ion and sodium-ion batteries |

Nanode Battery Technologies |

Edmonton, Alberta |

1,500,000 |

|

Méthode novatrice de production de SiOx pour batteries en continu |

HPQ Silicon Inc. |

Montreal, Quebec |

3,000,000 |

|

Power Capability Enhancement of 21700 cell designs |

E-One Moli Energy (Canada) Ltd |

Maple Ridge, British Columbia |

1,620,314 |

|

Enhanced low temperature performance of INR21700-P45B cells |

E-One Moli Energy (Canada) Ltd |

Maple Ridge, British Columbia |

1,067,499 |

|

Made-in-Canada Ultra High-Power Li-ion 21700 Cylindrical Battery Cells |

NanoXplore Inc. |

Saint-Laurent, Quebec |

2,750,000 |

Source: Government of Canada

Europe Market Insights

Europe lithium-ion battery market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by the rapid build-out of energy storage, regional mandates, and robust decarbonization policies. According to an article published by the Europe Commission in 2025, the region readily accounted for 17% of the international demand for batteries, which is expected to increase 14 times by the end of 2030. As stated in the April 2022 Eurobat Organization data report, a household photovoltaic+ battery system has the tendency to increase self-consumed electricity from almost 30% without storage facilities to nearly 60% to 70%. Besides, grid-scale storage integration, along with electric vehicle penetration support are also responsible for bolstering the market in the overall region.

Germany market is gaining increased traction due to the provision of large-scale Gigafactory investments, a dense supplier ecosystem, and automotive leadership. As per an article published by OECD in October 2025, small and medium-sized enterprises cater to 95% of enterprises in cleantech-based manufacturing industries across the overall region, and deliberately contribute to only 17% to export, which is far below the 37% average across all industries. Besides, Horizon Europe, with its budget of EUR 95.5 billion, is effectively leading the overall regional commitment to advancement with a suitable focus on sustainability and climate. Moreover, CEFIC and ECHA guidance on sustainable circularity and chemicals further tend to reinforce the country’s competitive position, which aligns with industrial policy with environmental objectives.

The lithium-ion battery market in France is also growing due to sustainable chemical processes, targeted funding for battery materials, recycling mandates, and the presence of robust circular economy strategies. As per an article published by OECD in June 2025, renewable energies readily play an increasing role in the national energy mix, effectively accounting for 13.3% of the overall energy supply and 27.1% of electricity as of 2023. Meanwhile, the country has successfully set itself to enhance its material productivity by 30% by 2030, resulting in production increasing the value from a few primary raw materials. Moreover, the non-metallic minerals extraction accounted for 62% of the regional extraction as of 2023 and 5.8 tons per person. Therefore, all these factors are gradually catering to the market’s upliftment in the overall country.