Lithium Iodide Market Outlook:

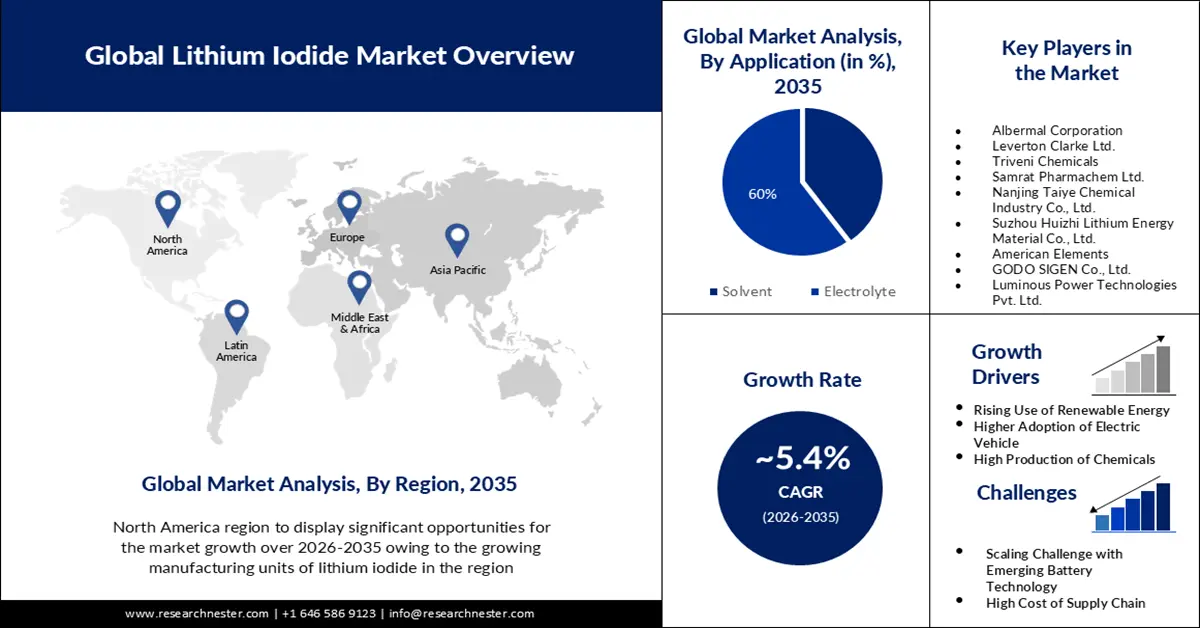

Lithium Iodide Market size was valued at USD 117.16 million in 2025 and is set to exceed USD 198.24 million by 2035, expanding at over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lithium iodide is estimated at USD 122.85 million.

The growing use of lithium iodide in the chemical industry is driving market growth, as lithium iodide can act as a catalyst or a co-catalyst in various chemical reactions. It is particularly used in certain organic synthesis reactions, such as the coupling of organometallic compounds and halogenation reactions.

The rising demand for renewable energy is also expected to boost the lithium iodide market growth. According to the analysis, renewables will be responsible for more than 90% of global electricity expansion over the next five years. Wind and solar will account for more than 90% of new renewable electricity capacity installed over the next five years. Lithium iodide has potential applications in certain types of solar cells, specifically perovskite solar cells. It aids the crystallization and formation of the perovskite layer and improves the efficiency of power generation from solar cells.

Key Lithium Iodide Market Insights Summary:

Regional Highlights:

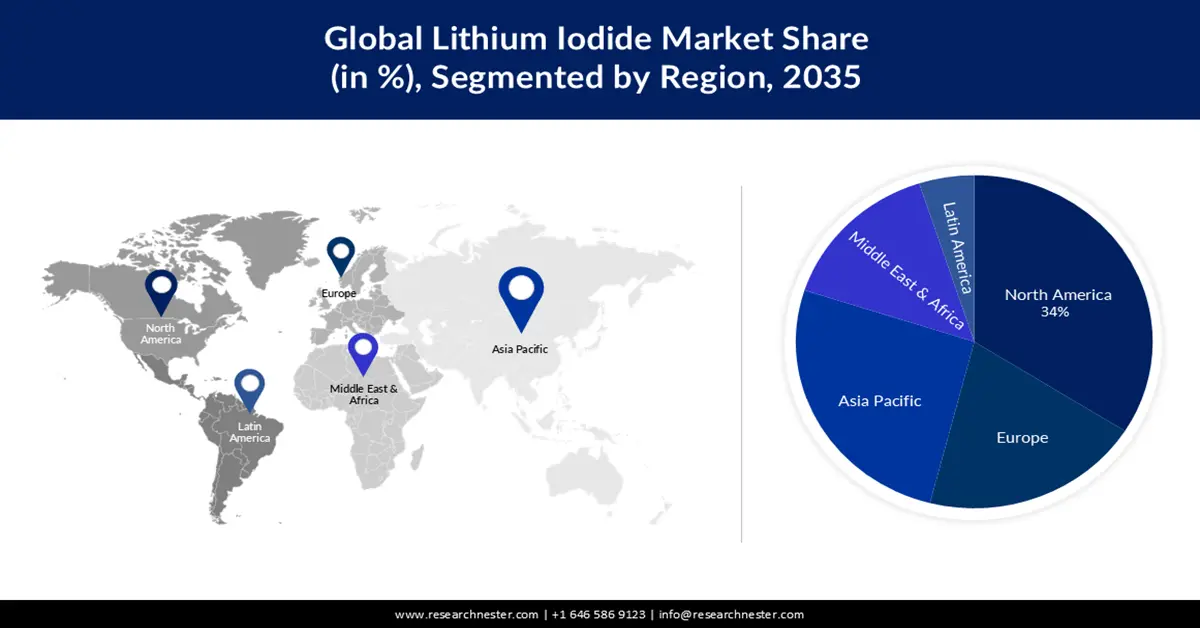

- North America is predicted to secure a 34% share of the lithium iodide market by 2035, stemming from the expanding presence of lithium iodide manufacturing units in the region.

- By 2035, the Asia Pacific region is expected to attain about a 26% share, supported by heightened investments in battery production infrastructure.

Segment Insights:

- The electrolyte segment is projected to command a 60% share of the lithium iodide market by 2035, supported by the rising adoption of lithium iodide electrolytes in next-generation solid-state lithium-ion batteries.

- By 2035, the electronic segment is estimated to capture around a 40% share, bolstered by escalating demand for consumer electronics powered by lithium-ion batteries.

Key Growth Trends:

- Rising Demand for Electric Vehicles

- Increasing Popularity of Lithium Battery

Major Challenges:

- Safety Concerns Associated with Lithium Iodide

- Cost and Supply Chain Considerations

Key Players: HELM AG, Albermal Corporation, Leverton Clarke Ltd., Triveni Chemicals, Samrat Pharmachem Ltd., Nanjing Taiye Chemical Industry Co., Ltd., Suzhou Huizhi Lithium Energy Material Co., Ltd., American Elements, GODO SIGEN Co., Ltd., Luminous Power Technologies Pvt. Ltd.

Global Lithium Iodide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 117.16 million

- 2026 Market Size: USD 122.85 million

- Projected Market Size: USD 198.24 million by 2035

- Growth Forecasts: 5.4%

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Indonesia, Australia

Last updated on : 25 November, 2025

Lithium Iodide Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Demand for Electric Vehicles – In China, the EU, and the United States, the average share in total sales of electric vehicles is anticipated to be nearly 60% by 2030. Lithium-ion batteries are the preferred choice for electric vehicles due to their high energy density, long cycle life, and lightweight nature.

- Increasing Popularity of Lithium Battery – The global demand for lithium-ion batteries is expected to climb elevenfold between 2020 and 2030, accounting for more than 2 terawatt-hours by the end of year 2030. Lithium iodide can be used as an electrolyte additive in lithium-sulfur batteries. Moreover, the addition of lithium iodide to the electrolyte improves the overall performance, stability, and cycling life of batteries, enabling their commercial viability.

- Growing Demand for Nuclear Energy–By 2030, the global nuclear capacity must increase by approximately 10 GW per year. Moreover, nuclear energy might provide approximately 14% of global electricity by 2050, up from 10% currently. In nuclear reactors, specifically designs of molten salt reactors (MSRs), lithium, is used as a component in the coolant or fuel salt. The lithium component helps in regulating the reactivity and temperature within the reactor.

Challenges

-

Safety Concerns Associated with Lithium Iodide - While lithium iodide itself is not highly hazardous, safety concerns may arise when handling and working with chemicals in battery manufacturing processes. Proper safety protocols and handling procedures need to be in place to ensure worker safety and compliance with safety regulations. Thus, addressing safety concerns and ensuring safe handling practices can be a challenge for the lithium iodide market.

- Cost and Supply Chain Considerations

- Limited Scalability of Emerging Battery Technology

Lithium Iodide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 117.16 million |

|

Forecast Year Market Size (2035) |

USD 198.24 million |

|

Regional Scope |

|

Lithium Iodide Market Segmentation:

Application Segment Analysis

The electrolyte segment is expected to hold 60% share of the global lithium iodide market in 2035. The growth of the segment can be attributed to the increasing potential of lithium iodide electrolytes in emerging battery technologies, particularly solid-state lithium-ion batteries. These batteries are being developed as a promising alternative to conventional liquid electrolyte-based batteries. These batteries use solid-state electrolytes, which offer advantages such as improved safety, higher energy density, and wider operating temperature ranges.

End User Segment Analysis

By the year 2035, the electronic segment in the lithium iodide market is predicted to have a major share of roughly 40%. The growing demand for consumer electronics. By 2028, the volume of consumer electronics is estimated to reach 8,974.00 million units across the globe. The average amount of consumer electronics per person is expected to surpass 1.08 items in 2023. Lithium-ion batteries are extensively used in portable consumer electronic devices, such as smartphones, tablets, laptops, digital cameras, and wearable devices. These devices rely on lithium battery for energy storage needs. The high power-to-weight ratio and rechargeable nature of lithium-ion batteries make them ideal for such gadgets.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Product Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Iodide Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate majority revenue share of 34% by 2035, owing to rising manufacturing units of lithium iodide in the region.. The rising manufacturing units of lithium iodide in the region are driving lithium iodide market growth in the region. For instance, SQM, a Chilean lithium and iodine manufacturer, has submitted to the environmental assessment service SEA a USD 987 million project to expand the lithium capacity of its Carmen plant. By adopting new technology, the business hopes to raise the plant's lithium production to 270,000t/y by 2024.

APAC Market Insights

In 2035, the Asia Pacific lithium iodide market share is poised to account for around 26% by the end of 2035. Rising investment in the production of batteries is estimated to surge the growth of the market in the region. China presently manufactures 75% of all battery cell capacity and 90% of anode and electrolyte production. Increased investment in carbonate and hydroxide refinery facilities in the country has also resulted in it becoming the world's largest refiner of battery metals.

Lithium Iodide Market Players:

- HELM AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Albermal Corporation

- Leverton Clarke Ltd.

- Triveni Chemicals

- Samrat Pharmachem Ltd.

- Nanjing Taiye Chemical Industry Co., Ltd.

- Suzhou Huizhi Lithium Energy Material Co., Ltd.

- American Elements

- GODO SIGEN Co., Ltd.

- Luminous Power Technologies Pvt. Ltd.

Recent Developments

- January 2022: HELM AG announced the collaboration with Leverton to find a new firm LevertonHELM. This collaboration will boost the production capacity of battery-grade lithium chemicals in Europe by opening new manufacturing capacities in Basingstoke UK.

- February 2022: Luminous Power Technologies Pvt. Ltd. has announced the release of the "Li-ON" inverter series, a combination inverter with Lithium-ion batteries. The brand-new series, which is based on Li-ion batteries coincides with the concept of an integrated approach to science and technology for a sustainable future.

- Report ID: 5092

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium Iodide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.