Lithium Derivatives Market Outlook:

Lithium Derivatives Market size was over USD 5.18 billion in 2025 and is anticipated to cross USD 9.1 billion by 2035, growing at more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lithium derivatives is assessed at USD 5.45 billion.

The global lithium derivatives market is experiencing rapid growth due to the increasing demand for lithium-ion batteries in the electric vehicle (EV) sector. The International Energy Agency reported that in 2023, about 14 million new electric vehicles were registered worldwide, increasing the total number of electric vehicles on the road to 40 million. In 2023, 3.5 million more electric cars were sold than in 2022, a 35% increase from the previous year. Compared to 2018, which was only five years ago, this is more than six times higher. Over 250,000 new registrations were made per week in 2023, surpassing the yearly amount from 2013, a decade earlier. Therefore, the surging sales of these vehicles are expanding the growth of the lithium derivates market. Larger and more effective batteries result from technological developments in battery design and materials as the EV market grows. Due to improved energy density and battery longevity, this trend not only improves EV performance and range but also has a major impact on lithium demand.

Additionally, material handling equipment has also improved to meet the shifting needs of different sectors as a result of industries becoming more automated. The material-handling equipment industry has seen several technological advancements over time. Numerous advancements in technology necessitate battery-powered solutions from industrial trucks, automated material handling and lifting devices such as AGVs, elevating equipment, and intralogistics systems. Forklifts, robots, and ground support equipment are among the many pieces of material-handling machinery that are increasingly using lithium-ion batteries. Unlike lead acid batteries, whose reduced charge negatively affects speed and lifting capacity, these batteries continuously deliver appropriate power regardless of the amount of charge left.

Also, the increasing global trade activities of lifting machinery, including forklifts, cranes, and automated material handling equipment, is significantly driving the lithium derivatives market owing to the growing adoption of lithium-ion batteries in industrial vehicles. This trend is expected to continue as industries seek cost-effective, eco-friendly, and high-efficiency power solutions for material handling and logistics operations.

|

Country |

Revenue of Lifting Machinery Exports (USD billion) |

Country |

Revenue of Lifting Machinery Imports (USD billion) |

|

China |

6.88 |

U.S. |

5.58 |

|

Germany |

5.16 |

Germany |

2.32 |

|

Italy |

2.48 |

UK |

1.44 |

|

Netherlands |

1.82 |

France |

1.38 |

|

U.S. |

1.79 |

China |

1.3 |

Source: OEC

The Observatory of Economic Complexity (OEC) reported that with a USD 35.1 billion total commerce in 2022, lifting machinery ranked 127th in the world in terms of product trade. Lifting machinery exports increased by 5.05% between 2021 and 2022, from USD 33.4 billion to USD 35.1 billion. Lifting machinery commerce accounts for 0.15% of global trade.

Key Lithium Derivatives Market Insights Summary:

Regional Highlights:

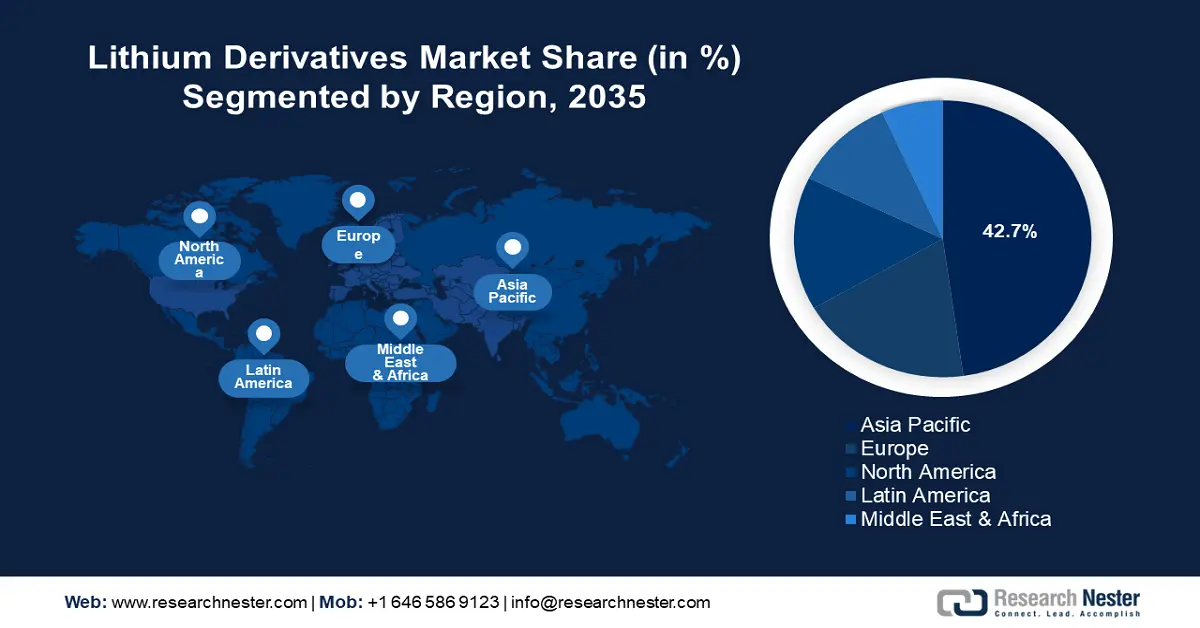

- Asia Pacific leads the Lithium Derivatives Market with a 42.7% share, propelled by booming electronics and electric vehicle sectors, ensuring robust growth through 2035.

- Europe's Lithium Derivatives Market is set for rapid growth through 2026–2035, propelled by EV adoption and expansion of gigafactories.

Segment Insights:

- The Lithium Carbonate segment is projected to hold a 36% market share by 2035, driven by its increasing utilization in manufacturing glass, ceramics, and lithium-ion batteries, as well as expanding demand for electric vehicles and energy storage solutions.

- The Batteries segment is expected to capture a significant share in the Lithium Derivatives Market from 2026-2035, propelled by the growing need for lithium-ion batteries in automotive, consumer electronics, and energy storage.

Key Growth Trends:

- Surging demand in industrial and pharmaceutical applications

- Expanding refining and mining capacities

Major Challenges:

- Increasing lithium prices

- Geopolitical influences

- Key Players: Albemarle Corporation, FMC Corporation, SQM SA, Tianqi Lithium Corp, Ganfeng Lithium Co., ltd., General Lithium (Haimen) Corporation, ZHONGHE Co., Ltd., Cornish Lithium Plc., Exxon Mobil Corporation, LG Chem Ltd..

Global Lithium Derivatives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.18 billion

- 2026 Market Size: USD 5.45 billion

- Projected Market Size: USD 9.1 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Australia, United States, Japan, Germany

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Lithium Derivatives Market Growth Drivers and Challenges:

Growth Drivers

- Surging demand in industrial and pharmaceutical applications: In industrial sectors, lithium carbonate and lithium hydroxide are widely used in the production of ceramics, glass, lubricants, and air treatment systems. Their ability to enhance durability, heat resistance, and efficiency makes them essential for high-performance applications. additionally, lithium-based greases offer superior thermal stability, benefiting industries such as automotive, aerospace, and heavy machinery. In the pharmaceutical industry, lithium compounds, particularly lithium carbonate, are a key ingredient in mood stabilizers used to treat bipolar disorder and depression.

The rising prevalence of mental health disorders and increasing healthcare investments are driving demand for these medications. The World Health Organization reported that about 40 million people, or 0.53% of the world's population, or 1 in 150 adults, suffered from bipolar illness in 2019. Although men and women are almost equally likely to have bipolar illness, the evidence that is currently available shows that women are diagnosed with the disorder more frequently. Therefore, as industries seek high-performance materials and healthcare demand grows, lithium derivatives are becoming indispensable, fueling the global lithium derivatives market expansion. - Expanding refining and mining capacities: The development of sustainable mining techniques, including direct lithium extraction (DLE), enhances efficiency while reducing environmental impact. Additionally, increasing local refining capacities helps streamline supply chains, reduce dependency on imports, and stabilize prices, making lithium derivatives more accessible for downstream applications. This supply-side growth directly supports the expanding global lithium-ion battery market, reinforcing the transition to clean energy and electrified transportation.

In July 2024, Eramet became the first European business to generate battery-grade lithium carbonate on an industrial scale when it opened its direct lithium extraction operation in Argentina. At full capacity, Centenario Phase 1 is expected to extract and manufacture 24,000 t/year of battery-grade lithium carbonate, placing it in the first quartile of the cost curve for the lithium sector. Also, with an increasing demand from electric vehicle (EV) manufacturers, energy storage solutions, and consumer electronics, countries rich in lithium resources – such as Australia, Chile, Argentina, and China – are investing heavily in new extraction projects and advanced refining technologies.

World mine production of lithium by country, 2022

|

Ranking |

Country |

Tons |

Percentage of the Total |

|

1 |

Australia |

61,000 |

47.2% |

|

2 |

Chile |

39,000 |

30.2% |

|

3 |

China |

19,000 |

14.7% |

|

4 |

Argentina |

6,200 |

4.8% |

|

5 |

Brazil |

2,200 |

1.7% |

|

6 |

Zimbabwe |

800 |

0.6% |

|

7 |

Portugal |

600 |

0.5% |

|

8 |

Canada |

500 |

0.4% |

|

World Total |

|

129,300 |

100.0% |

Source: Government of Canada

The World Economic Forum revealed that the demand for lithium is expected to increase to 1.5 million tons of lithium carbonate equivalent (LCE) by 2025 and more than 3 million tons by 2030 as a result of increased battery and electric vehicle production worldwide.

Challenges

- Increasing lithium prices: The surging prices of lithium can significantly impede the growth of the lithium derivatives market by elevating production costs and squeezing profit margins for manufacturers, which in turn may lead to higher prices for end products. This cost escalation can slow down investments in critical applications, such as lithium-ion batteries for electric vehicles and renewable energy storage systems, ultimately dampening lithium derivatives market demand.

To counteract these challenges, long-term agreements and contracts for future lithium supply offer a strategic solution. By securing a steady and predictable supply of lithium at predetermined prices, these contracts help stabilize production costs and reduce exposure to market volatility. This not only enables manufacturers to plan their investments with greater certainty but also fosters a more resilient supply chain, thereby supporting sustained growth in the lithium derivatives market despite the inherent price fluctuations in raw lithium. The fact that investors require price visibility and risk management tools to de-risk their investments and finance new projects is reflected in the steady growth in trading in lithium futures contracts. - Geopolitical influences: In areas where political unrest or policy unpredictability prevails, investments in mining and refining infrastructure may be delayed or halted, leading to reduced production capacity and inconsistent supply of raw lithium. This volatility can result in abrupt price fluctuations and hinder long-term planning for manufacturers who rely on a steady flow of lithium for derivative production. Also, these disruptions lead to limited access to critical technologies and expertise, compounding supply challenges.

To resolve this, favorable government policies regarding mining operations, environmental standards, and export regulations can boost production. Also, companies can diversify their supply chains by investing in mining and refining operations in regions with stable political environments, reducing reliance on a single country or area. Moreover, fostering public-private partnerships and engaging with international organizations can encourage the development of robust legal and regulatory frameworks, ensuring more consistent operational conditions.

Lithium Derivatives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 5.18 billion |

|

Forecast Year Market Size (2035) |

USD 9.1 billion |

|

Regional Scope |

|

Lithium Derivatives Market Segmentation:

Type (Lithium Hydroxide, Lithium Carbonate, Lithium Concentrate, Lithium Metal, Butyl Lithium, Lithium Chloride, Others)

lithium carbonate segment is poised to account for lithium derivatives market share of more than 36% by the end of 2035. The growth of this segment can be attributed to its increasing utilization in the manufacturing of glass, ceramics, and lithium-ion batteries. Due to its superior chemical and physical properties, lithium carbonate serves as a vital raw material in the production of lithium-based chemicals and products. It plays an essential role in the development of ceramic and glass materials that possess enhanced characteristics, including high durability and thermal resistance.

Furthermore, there exists significant potential for expansion in several areas, such as increasing lithium carbonate production capacity, exploring new applications in industries such as electronics and aerospace, and investing in research and development to improve battery performance. Recent trends include the advancement of solid-state batteries with greater energy density, the integration of artificial intelligence into battery management systems, and the investigation of innovative extraction methods aimed at reducing production costs. In the coming years, the market is expected to sustain its growth due to the rising demand for electric vehicles and the necessity for reliable energy storage solutions.

Application (Batteries, Lubricants, Pharmaceutical Drugs, Metallurgic, Glass & Ceramic, Aluminum Smelting & Alloys, Polymers, Others)

By application, the batteries segment in lithium derivatives market is poised to garner a significant share during the assessed period. The segment’s dominance is driven by the growing need for batteries, especially lithium-ion batteries, across various industries, including consumer electronics, automotive, and energy storage systems. The International Energy Agency reported that the demand for automotive lithium-ion (Li-ion) batteries rose from roughly 330 GWh in 2021 to 550 GWh in 2022, mostly due to an increase in sales of electric passenger cars, which saw a 55% rise in new registrations in 2022 compared to 2021. Due to their exceptional energy storage capacity and high electrochemical potential, lithium derivatives—particularly lithium compounds like lithium hydroxide and carbonate—are crucial to the production of lithium-ion batteries.

Our in-depth analysis of the global lithium derivatives market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Derivatives Market Regional Analysis:

APAC Market Statistics

Asia Pacific in lithium derivatives market is anticipated to hold over 42.7% revenue share by the end of 2035. The regional market growth is influenced by the rapidly expanding electronics sector and the growing popularity of electric vehicles. The Asia Pacific region has become a center for the production of consumer electronics and has seen notable developments in electronic manufacturing. Also, as governments push for carbon neutrality and technological advances continue, the lithium derivatives market is expected to expand significantly.

China has become a powerful force with unheard-of authority over the world's lithium supply chain. China plays a crucial role in this important industry, as evidenced by the fact that six of the top 10 lithium-ion battery producers worldwide are from China. China is now the epicenter of lithium-ion battery manufacturing and refinement owing to its supremacy, which is supported by strategic government assistance and careful vertical integration, accelerating the lithium derivatives market growth. The Organization for Research on China and Asia reported that China secured an 80% stake in worldwide lithium chemical production, a 78% share of cathode production, and an astounding 70% share of cell manufacture for the electric car sector while possessing less than 7% of the world's lithium deposits. A startling 75% of the world's battery manufacturing capacity was in China in 2022.

Furthermore, in India, government initiatives such as subsidies and incentives under the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, are further fueling the demand. In July 2023, the Press Information Bureau and the Central Bureau of Communication published that the Ministry of Heavy Industries allocated a total budget of USD 1.15 billion to implement Phase II of the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme. The primary objective of this phase is to facilitate the electrification of public and shared transportation. Additionally, the scheme aims to provide demand incentives for 7,090 e-buses, 500,000 e-three wheelers, 55,000 e-four-wheeler passenger vehicles, and 1,000,000 e-two wheelers.

Furthermore, the scheme encompasses the development of necessary charging infrastructure to support this transition. India is focusing on reducing its dependence on lithium imports by exploring domestic reserves in states like Jammu & Kashmir, Karnataka, Rajasthan, and Jharkhand, which shows promise for building a local battery manufacturing value chain. The Ministry of Mines has established Khanji Bidesh India Limited (KABIL) to secure strategic minerals from abroad. In January 2024, KABIL signed a USD 24 million agreement to explore lithium in five areas in Argentina, granting it exclusive rights for assessment and prospecting.

Europe Market Analysis

Europe lithium derivatives market is estimated to grow at a rapid rate during the projected period. The increasing adoption of electric vehicles (EVs), coupled with government policies promoting battery production and energy storage solutions, has significantly boosted the demand for lithium-based compounds. According to the European Environment Agency, in 2023, all 27 EU member states saw further advancements in the adoption of electric vehicles, including cars and vans. 7.7% of new van registrations and 22.7% of new automobile registrations were for electric cars. The number of new electric vehicles registered increased from 2 million in 2022 to 2.4 million in 2023. Additionally, the expansion of gig factories across the continent, along with advancements in battery recycling and innovation, further strengthens the market, making lithium derivatives a critical component in Europe’s energy transition.

Furthermore, the lithium derivatives market is expanding in the UK and Germany as a result of the increasing demand for lithium as a key component in EV batteries and renewable energy storage systems. As both countries aim to reduce carbon emissions and transition to cleaner energy sources, the shift towards EVs and the expansion of energy storage solutions have created a surge in lithium demand. This growing lithium derivatives market is also supported by advancements in battery technology and the need for more efficient energy storage systems.

Key Lithium Derivatives Market Players:

- Albemarle Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FMC Corporation

- SQM SA

- Tianqi Lithium Corp

- Ganfeng Lithium Co., ltd.

- General Lithium (Haimen) Corporation

- ZHONGHE Co., Ltd.

- Cornish Lithium Plc.

- Exxon Mobil Corporation

- LG Chem Ltd.

Key players in the lithium derivatives market are significantly investing in research and development to broaden their product offerings, which will further fuel the growth of the lithium derivatives market. To strengthen their presence, market participants are also pursuing various strategic initiatives, including launching new products, establishing contractual agreements, engaging in mergers and acquisitions, increasing investments, and collaborating with other organizations. To thrive in an increasingly competitive landscape, the lithium derivatives industry needs to provide cost-effective solutions that can help it endure and expand.

Recent Developments

- In November 2024, Cornish Lithium officially opened the UK's first low-emission lithium hydroxide demonstration plant, marking an important step in the country's transition to renewable energy by 2030.

- In November 2024, Exxon Mobil Corporation and LG Chem signed a non-binding memorandum of understanding (MOU) to establish a multiyear offtake arrangement for up to 100,000 metric tons of lithium carbonate.

- Report ID: 7111

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium Derivatives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.