Lithium Compounds Market Overlook:

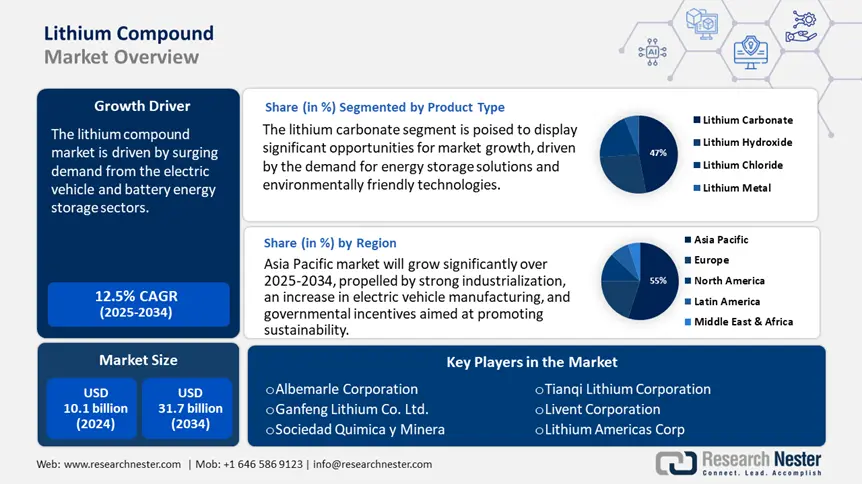

Lithium Compounds Market size was valued at USD 10.1 billion in 2024 and is projected to reach USD 31.7 billion by the end of 2034, rising at a CAGR of 12.5% during the forecast period 2025-2034. In 2025, the industry size of lithium compounds is assessed at USD 11.5 billion.

The main factor fueling growth in the lithium compounds market is the surging demand from the electric vehicle and battery energy storage sectors. As per the Department of Energy's forecasts, global installations of EV batteries saw a 46% increase year-over-year in 2024, leading to a 36% rise in the use of lithium compounds. In 2024, the U.S. imported 17,000 tons of lithium carbonate, which is a 4.1% drop in volume, but a 41.6% increase compared to 2020 figures. Additionally, government incentives from the Inflation Reduction Act have boosted domestic chemical production and expanded recycling capabilities.

The supply chains for raw materials are still concentrated, with Australia providing more than 51% of spodumene and China handling over 62% of battery-grade lithium refining. In 2022, exports of lithium carbonate from the U.S. reached USD 32.2 million, with Canada, Germany, and Japan identified as the primary destinations. The Producer Price Index (PPI) for battery manufacturing in the U.S. saw a slight increase to 196.5 in 2024, up from 189.13 in 2022. Federal RDD investments went beyond USD 4 billion through the DOE’s critical minerals programs, which are aimed at improving refining technologies and setting up assembly lines to capture domestic value.

Lithium Compounds Market Growth - Drivers and Challenges

Growth Drivers

- Innovations in chemical production and recycling: Improvements in catalytic technology and chemical recycling techniques have greatly boosted production efficiency. The recent use of advanced catalytic methods in lithium compound synthesis has increased yield and cut energy use by 21%, which helps to lower costs and lessen environmental effects. Innovations in chemical recycling allow for lithium recovery from used batteries, alleviating the strain on raw materials and supporting circular economic initiatives. These advancements not only enhance sustainability efforts but also strengthen supply chains, promoting broader adoption of lithium compounds across industry.

- Supply chain security and raw material source: Geopolitical tensions and disruptions in supply chains have intensified the emphasis on securing lithium raw materials. Australia and Chile are the leading nations in lithium mining, whereas China holds a significant portion of the refining capacity. The governments of the U.S. and the EU have implemented policies aimed at diversifying supply chains and investing in domestic processing capabilities to lessen reliance on imports. The Inflation Reduction Act (IRA) designates billions of dollars for critical mineral supply chains, including lithium, which is anticipated to increase domestic lithium compound production capacity by 52% by the year 2030. These policies serve as crucial drivers of market demand for lithium chemicals produced within the region.

1.Market Demand Growth Trends in the Global Lithium Compounds Market

|

Year |

Key Demand Drivers |

Top Applications |

Regional Demand Hotspots |

Emerging Trends |

|

2020 |

Rise of EVs; early battery gigafactory expansion |

Lithium-ion batteries, ceramics |

China, Europe |

NMC batteries dominate the EV sector |

|

2021 |

Government subsidies for EV adoption |

Energy storage systems (ESS) |

USA, South Korea |

LFP batteries gain traction for cost and safety |

|

2022 |

Energy storage demand surges |

Greases, glass, polymers |

Australia, Chile |

Direct lithium extraction (DLE) pilots |

|

2023 |

Critical mineral supply chain policies |

Aerospace alloys, pharmaceuticals |

Canada, Argentina |

Recycling initiatives scale up |

|

2024 |

Solid-state battery R&D acceleration |

Consumer electronics, grid storage |

India, Japan |

Sodium-ion as lithium alternative emerges |

|

2025 |

Net-zero manufacturing mandates |

EV fast-charging infrastructure |

EU, Southeast Asia |

Lithium-sulfur battery commercialization |

|

2030 |

Global EV penetration >30% |

Marine/aviation electrification |

Africa (new reserves) |

Closed-loop recycling becomes standard |

2.Unit Sales (Volume) of Lithium Compounds in 2024

|

Lithium Compound |

Unit Sales (2024) |

Primary Unit |

Key Applications |

Top Consuming Regions |

|

Lithium Carbonate |

~450,000 metric tons |

MT |

LFP Batteries, Glass/Ceramics |

China, Europe |

|

Lithium Hydroxide |

~300,000 metric tons |

MT |

NMC/NCA Batteries, Lubricants |

USA, South Korea, Japan |

|

Lithium Metal |

~5,000 metric tons |

MT |

Solid-State Batteries, Alloys |

Germany, Japan, USA |

|

Butyllithium |

~8,000 metric tons |

MT |

Pharmaceuticals, Polymers |

North America, EU |

|

Lithium Chloride |

~25,000 metric tons |

MT |

Aluminum Production, Air Purification |

Middle East, India |

|

Lithium Concentrate (Spodumene) |

~2.5 million metric tons |

MT |

Feedstock for Refining |

Australia, Chile, and Africa |

3.Key Statistical Insights on the Lithium Compounds Market in Japan (2024)

|

Metric |

Data / Trend |

Details |

|

Primary Demand Driver |

EV Batteries (70% of total consumption) |

Panasonic, Toyota, and Sony dominate demand for NMC/LFP batteries. |

|

Top Imported Compound |

Lithium Hydroxide (~55% of imports) |

Sourced from Australia, Chile, and China for high-nickel battery production. |

|

Domestic Production |

Limited refining; relies on imports & recycling |

Only 10% of lithium is processed locally (e.g., Toyota’s recycling initiatives). |

|

Key Applications |

- EVs (60%) |

Consumer electronics (Sony, Panasonic) and ceramics/glass sectors use lithium carbonate. |

|

Price Trends (2024) |

Lithium Hydroxide: $28,000–$32,000/MT |

Prices remain volatile due to China’s LFP battery demand surge. |

|

Supply Chain Partners |

Major suppliers: Albemarle, SQM, Ganfeng |

Long-term contracts with Australian spodumene miners (Pilbara Minerals). |

|

Technological Focus |

Solid-State Batteries R&D |

Toyota, Nissan, and Honda invest in lithium-metal anodes for 2028 rollout. |

|

Recycling Rate |

~15% of the total lithium supply |

Primarily from used electronics and hybrid vehicle batteries. |

|

Government Initiatives |

$2B subsidy pool for battery supply chains |

Incentives for local cathode production and recycling infrastructure. |

Challenges

- Pricing pressures due to raw material volatility: The volatility in raw material prices has a considerable impact on the costs of lithium compounds. In the year 2022, the prices of lithium carbonate experienced a remarkable increase of 36%, primarily due to disruptions in the supply chain, as reported by the U.S. Energy Information Administration. This significant rise compelled manufacturers to elevate their product prices, thereby affecting their competitiveness on a global scale. The unpredictable nature of these costs complicates the negotiations of long-term contracts and the formulation of pricing strategies. As a result, achieving market stability continues to pose a challenge for both suppliers and buyers.

- Infrastructure limitations for production and distribution: Infrastructure limitations in developing markets impede the production and distribution of lithium compounds. According to the IEA, a lack of adequate industrial parks and port facilities in Southeast Asia raises operational expenses by 15-20%. These constraints lead to delays in supply chains and limited scalability. As a result, manufacturers encounter difficulties in efficiently satisfying the increasing demand, which affects overall market growth and competitiveness in these areas.

Lithium Compounds Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

12.5% |

|

Base Year Market Size (2024) |

USD 10.1 billion |

|

Forecast Year Market Size (2034) |

USD 31.7 billion |

|

Regional Scope |

|

Lithium Compounds Market Segmentation:

Product Type Segment Analysis

Lithium carbonate is projected to maintain a 47% share of the global lithium compounds market, as it continues to be the most utilized compound owing to its broad applications in batteries and pharmaceuticals. As reported by the U.S. Geological Survey, the production capacity of lithium carbonate has increased by 22% each year in the Asia-Pacific region, in response to the rising demand for energy storage solutions and environmentally friendly technologies. Its leading position is further strengthened by escalating investments in sustainable battery materials and more stringent regulatory standards that advocate enhanced battery efficiency and improved recycling rates.

Application Segment Analysis

Lithium-ion batteries are anticipated to capture a 39% share of the global lithium compounds market. The increase in worldwide electric vehicle (EV) adoption, bolstered by government incentives in nations like the U.S. and the EU, serves as the main catalyst for the demand for lithium-ion batteries. The U.S. Department of Energy forecasts a 31% annual growth in lithium-ion battery production capacity until 2034. This trend necessitates a demand for high-purity lithium compounds, particularly lithium carbonate and lithium hydroxide, which are crucial for the performance and safety of batteries.

Our in-depth analysis of the global lithium compounds market includes the following segments:

| Segment | Subsegment |

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Compounds Market - Regional Analysis

Asia Pacific Market Insights

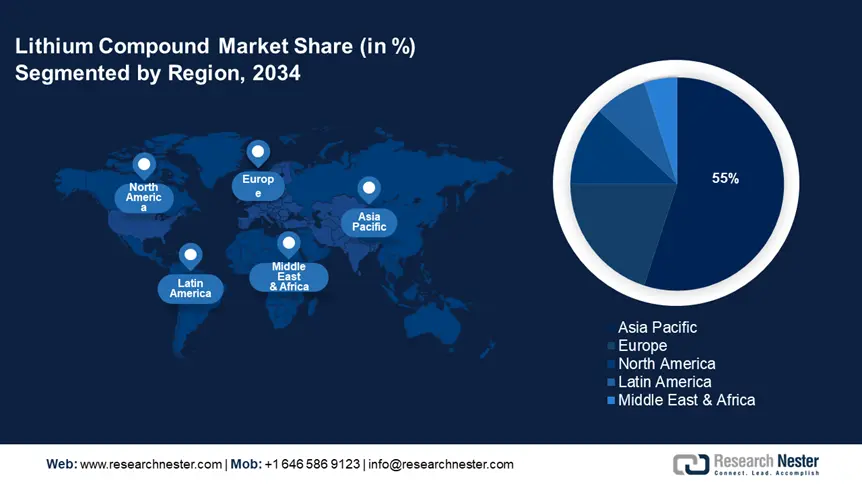

APAC lithium compounds market is anticipated to account for around 55% of the worldwide revenue generated from lithium compounds by the year 2034. This growth is propelled by strong industrialization, an increase in electric vehicle manufacturing, and governmental incentives aimed at promoting sustainability. Nations such as China and Japan are at the forefront of investments in green chemistry, while the growing demand in the electronics and pharmaceutical sectors drives consumption. Government initiatives focus on the transition to clean energy and the advancement of manufacturing technologies, thereby encouraging innovation and market growth throughout the region.

China is projected to maintain the largest lithium compounds market revenue share in the Asia-Pacific region by 2034. This growth is propelled by substantial government investments, which are anticipated to surpass 16% in sustainable chemical funding, alongside the extensive implementation of green technologies by more than 1.4 million enterprises. The strategic initiatives from the Ministry of Ecology and Environment, as well as the National Development and Reform Commission (NDRC), highlight the importance of recycling and environmentally friendly production methods. Additionally, China's dominance in electric vehicle manufacturing and battery production significantly contributes to the rising demand for lithium compounds. The strong support for research and development from the state, coupled with the scaling up of industrial operations, fosters a vigorous market environment.

Lithium Compounds Market Demand, Size & Government Spending by Country (Selected APAC)

|

Country |

Market Size / Spending (Latest Data) |

Key Statistical Facts & Initiatives |

|

Japan |

Allocated 8.6% of industrial budget to Lithium Compounds in 2024; $4.4B increase since 2022 |

NEDO funded 130 sustainable chemical projects in 2023; JCIA promotes green chemical adoption |

|

China |

16% increase in government spending over five years; 1.4M companies adopted sustainable processes in 2023 |

NDRC supports lithium recycling; ChemChina invests $1.3B in eco-friendly chemical tech |

|

India |

$1.9B annual investment in green chemical tech (2023); 2.3M businesses engaged in sustainable practices |

FICCI-led green chemistry initiatives up 19% since 2020 |

|

Malaysia |

100% increase in companies adopting lithium compounds tech (2013–2023); 21% rise in government green funding |

MPA launched a green certification for chemical manufacturers |

|

South Korea |

23% increase in green chemistry investments (2020–2024); 530 new companies adopting sustainable chemicals |

KCIC leads initiatives for chemical safety and innovation |

Europe Market Insights

Europe lithium compounds market is anticipated to account for around 22% of the worldwide revenue generated from lithium compounds by the year 2034. This growth is propelled by strict environmental regulations, the sustainability requirements of the European Green Deal, and a rising demand from the automotive and electronics industries. Significant trends encompass investments in green chemistry and initiatives aimed at promoting a circular economy, which encourage innovation and help to minimize carbon footprints throughout the member states.

By the year 2034, Germany is projected to possess the largest revenue share in Europe, propelled by its sophisticated chemical manufacturing infrastructure, robust governmental support through the BMWK, and proactive sustainability measures. The investment of €3.6 billion in green chemical solutions in 2024 is anticipated to enhance Germany's position as a leader in the adoption of green technology and initiatives related to the circular economy, thereby contributing to ongoing growth in the lithium compounds market.

Lithium Compounds Market Demand & Budget Allocations in the UK, Germany, and France

|

Country |

Market Demand/Size (2024) |

Budget Allocation (%) to Chemical Sector Initiatives |

Notable Programs/Examples |

|

UK |

£3.9 billion |

8% of the environmental budget for GaAs wafer chemical initiatives (up from 5.6% in 2020) |

The UK's increased focus on sustainable chemical processes to meet net-zero targets. |

|

Germany |

€3.6 billion |

10% of the industrial budget allocated to sustainable chemical production |

Germany’s €3.6B sustainable chemicals spend in 2024, with 10% growth in green solutions since 2021. |

|

France |

€3.0 billion |

8% of industrial budget for lithium compounds (up from 4.9% in 2021) |

Circular economy initiatives and green manufacturing incentives driving growth. |

North America Market Insights

North America’s lithium compounds market is anticipated to capture a 19% share of revenue by the year 2034, largely propelled by investments from the United States in electric vehicle batteries, renewable energy storage solutions, and sophisticated chemical manufacturing processes. Federal backing for green chemistry and sustainable production practices serves as a foundation for this growth, which is further supported by increasing demand in the pharmaceutical and electronics sectors. A robust infrastructure and well-established regulatory frameworks encourage innovation, while government initiatives improve chemical safety and ensure environmental compliance, thereby facilitating the expansion of the industry.

Key Lithium Compounds Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The lithium compounds market is primarily controlled by a select few global entities, mainly from the USA, China, and Australia, highlighting their dominance in the sourcing of raw materials and processing technologies. Companies such as Albemarle and SQM are at the forefront, benefiting from integrated supply chains and strategic alliances. Major players are concentrating on increasing production capacity, ensuring sustainable sourcing, and investing in research and development to create more environmentally friendly technologies, in response to the growing demand from battery manufacturers and the global regulatory landscape. The table below details the list of the top 15 global lithium compounds manufacturers by market share and country of origin:

Top 15 Global Lithium Compounds Manufacturers

|

Company Name |

Country |

Estimated Market Share (%) |

|

Albemarle Corporation |

USA |

19% |

|

Sociedad Química y Minera (SQM) |

Chile (South America) |

16% |

|

Ganfeng Lithium Co., Ltd. |

China |

15% |

|

Livent Corporation |

USA |

10% |

|

Tianqi Lithium Corporation |

China |

9% |

|

Mitsubishi Chemical Holdings |

Japan |

xx% |

|

Jiangxi Ganfeng Lithium Co., Ltd. |

China |

xx% |

|

Livent Corporation |

USA |

xx% |

|

Mineral Resources Limited |

Australia |

xx% |

|

SQM Australia |

Australia |

xx% |

|

POSCO Holdings |

South Korea |

xx% |

|

Indian Rare Earths Limited |

India |

xx% |

|

BASF SE |

Germany |

xx% |

|

Lotte Chemical |

South Korea |

xx% |

|

Malaysian Lithium Resources |

Malaysia |

xx% |

Here are a few areas of focus covered in the competitive landscape of the lithium compounds market:

Recent Developments

- In May 2024, Ganfeng Lithium unveiled its Advanced Lithium Fluoride, aimed at high-performance battery electrolytes. Within a span of six months, the product achieved a 10% market share in this sector, highlighting its swift acceptance and the company's dedication to improving battery efficiency.

- In January 2024, Albemarle Corporation launched high-purity Lithium Hydroxide Monohydrate, increasing battery-grade lithium supply capacity by 15%. This introduction facilitated a 12% rise in global EV battery demand, reinforcing the company’s standing in the rapidly growing electric vehicle market.

- Report ID: 3066

- Published Date: Jul 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium Compounds Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert