Liquid Packaging Market Outlook:

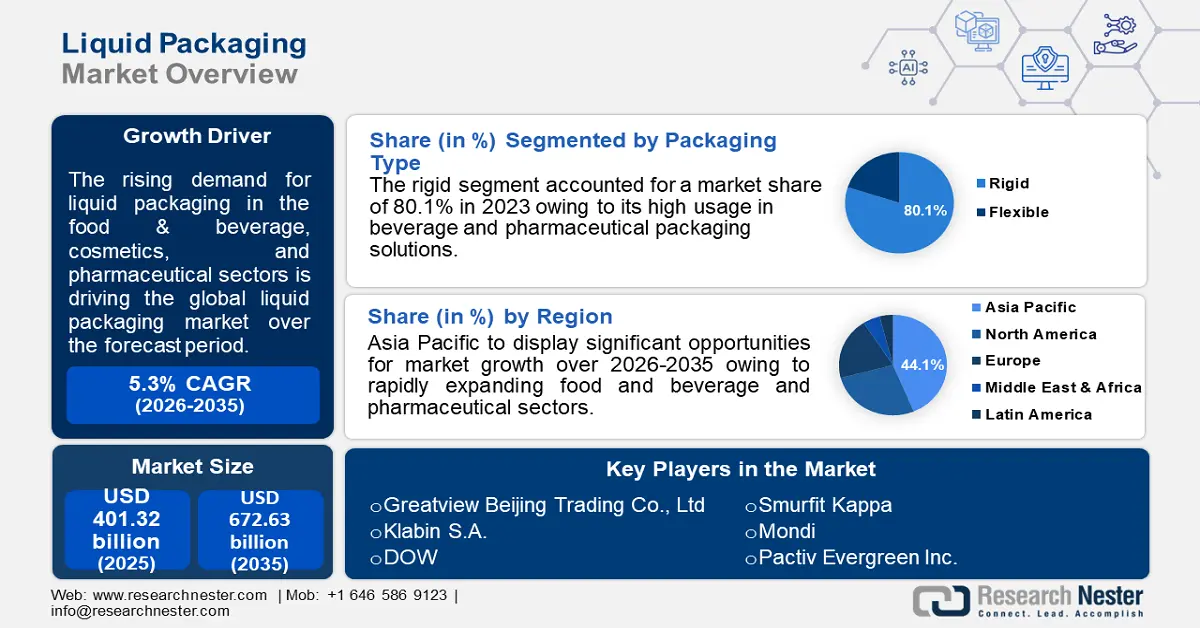

Liquid Packaging Market size was valued at USD 401.32 billion in 2025 and is expected to reach USD 672.63 billion by 2035, registering around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of liquid packaging is evaluated at USD 420.46 billion.

The liquid packaging market has witnessed substantial changes due to growing awareness about sustainability among producers, customers, and regulatory agencies. There has been a high demand for eco-friendly packaging solutions due to rising awareness of environmental problems such as resource depletion and plastic pollution. To lessen the environmental impact of their products, manufacturers are investing to promote the use of recyclable, biodegradable, and reusable packaging materials. For example, bio-based plastics provide a sustainable substitute for traditional petroleum-based plastics. They are made from renewable resources like sugarcane and maize starch.

Furthermore, lighter packaging materials are adopted by customers concerned about the environment and lowering transportation expenses and carbon emissions. The adoption of sustainable packaging practices is further accelerated by regulatory frameworks and efforts aimed at encouraging sustainability, such as the Circular Economy Action Plan of the European Union and numerous plastic ban measures globally. For instance, in March 2023, Sainsbury’s announced the launch of its new liquid detergent online and in all stores, designed to assist customers in reducing plastic at home.

Key Liquid Packaging Market Insights Summary:

Regional Highlights:

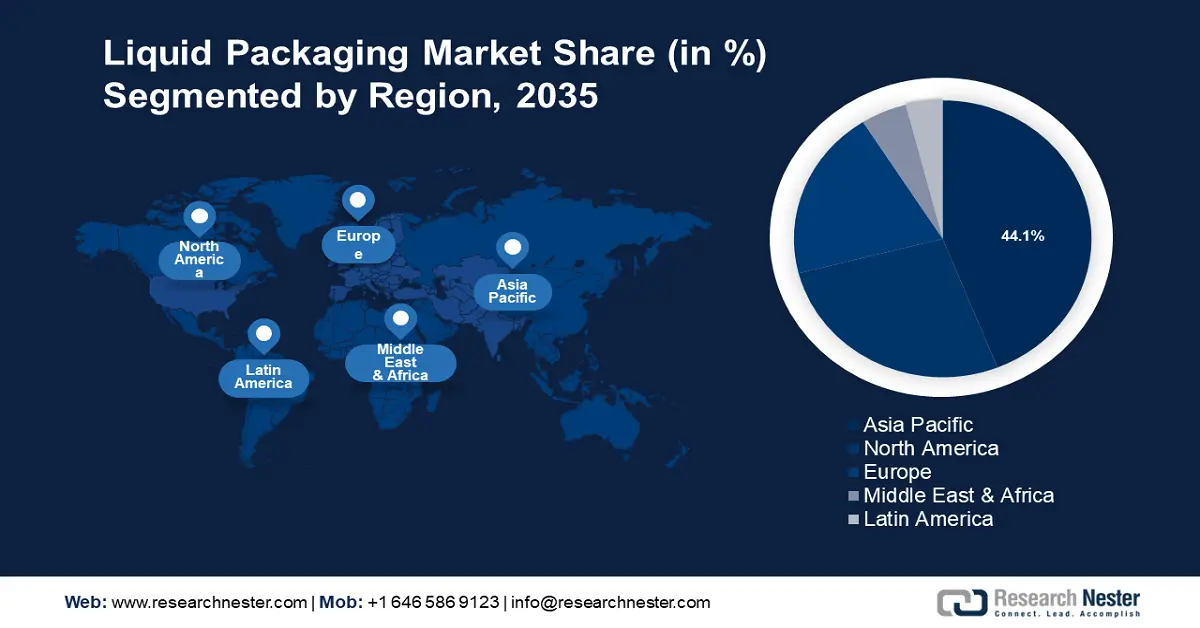

- The Asia Pacific liquid packaging market achieves a 44% share by 2035, driven by favorable government policies and growth in food, beverage, and pharmaceutical industries.

Segment Insights:

- The rigid segment in the liquid packaging market is anticipated to experience significant growth till 2035, driven by its robust protection, long shelf life, and widespread use in beverage, pharmaceutical, and household care packaging.

- The aseptic packaging segment in the liquid packaging market is projected to achieve notable revenue share by 2035, driven by the demand for fresh products with extended shelf life, eliminating the need for preservatives in the food and pharmaceutical industries.

Key Growth Trends:

- Growing demand for liquid packaging for food products and pharmaceuticals

- Technological developments in packaging

Major Challenges:

- Exorbitant cost of eco-friendly packaging options

- Logistics and supply chain concerns

Key Players: Greatview Beijing Trading Co., Ltd, Klabin S.A., DOW, Smurfit Kappa, Mondi, Pactiv Evergreen Inc., Refresco Group, Reynolds Group Ltd..

Global Liquid Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 401.32 billion

- 2026 Market Size: USD 420.46 billion

- Projected Market Size: USD 672.63 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 18 September, 2025

Liquid Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for liquid packaging for food products and pharmaceuticals: The rising demand for liquid packaging in the food and beverages, cosmetics, and pharmaceutical sectors is a key factor driving the global liquid packaging market over the forecast period. The benefits of flexible liquid packaging such as the capacity to preserve freshness and extend the shelf life of food, lower costs associated with packaging food items, eliminate material waste, and ease of package customization, all contribute to the growth of the liquid packaging market. In October 2022, Witt India announced the launch of Leak-Master Easy for pharma packaging.

- Technological developments in packaging: Innovations in packaging materials and techniques have led to the development of more robust, lightweight, and environmentally friendly packaging solutions. Technological advancements that improve the functionality and appeal of liquid packaging include high-barrier films, aseptic packaging, and smart packaging technologies. High-barrier films provide superior protection against oxygen, moisture, and light, extending the shelf life of liquid products by up to 50%.

- Growing consumer demand for beverages: The growing need in the beverage industry is a major driver of the global liquid packaging market. Convenient, ready-to-drink beverages are becoming most popular among consumers, which has increased demand for creative and effective packaging solutions. Bottled water particularly, has experienced exponential growth due to increasing health consciousness and concern about the cleanliness of the water.

Challenges

- Exorbitant cost of eco-friendly packaging options: Though eco-friendly packing options are in high demand, the costs with recyclable, compostable, and biodegradable packaging materials are more expensive to produce than standard plastic packaging. Small and medium-sized enterprises may find it difficult to adopt eco-friendly packaging alternatives due to budget constraints.

- Logistics and supply chain concerns: Supply chain bottlenecks, fluctuations in raw material availability, and increased transportation costs can all hinder the timely manufacture and distribution of packing materials. Timely delivery of packaging materials to manufacturers without compromising quality is crucial; yet, delays may lead to lost profits and halts in production. Thus, this can affect the overall operations, restraining the liquid packaging market growth.

Liquid Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 401.32 billion |

|

Forecast Year Market Size (2035) |

USD 672.63 billion |

|

Regional Scope |

|

Liquid Packaging Market Segmentation:

Packaging Type Segment Analysis

The rigid segment will account for 80.1% of the liquid packaging market share by 2035. Rigid packaging such as bottles, cans, and cartons, provides robust protection and longevity, necessary for products that need to be stable and tamper-evident. Different types of rigid packaging are used in beverage and pharmaceutical packaging solutions and household care items due to their superior qualities over other forms of packaging, such as their long shelf life and ease of handling and transportation.

Many companies are enhancing their product offerings to cater to the rising demand. For instance, in November 2023, Sonoco signed an agreement to acquire Clear Pack Company to expand its operations for rigid packaging plastic containers and provide a broader range of packaging solutions.

Technique Segment Analysis

The aseptic packaging segment in the liquid packaging market is set to garner a notable share in the forecast period due to its high demand because of its capacity to preserve product freshness, increase shelf life, and eliminate the need for preservatives in the food and pharmaceutical industry. Blowing molding technology, well-known for its affordability and versatility has advanced owing to the growing demand for custom-shaped bottles, particularly in the beverage industry.

For example, in January 2024, the Chinese aseptic packaging company Shandong NewJF Technology Packaging Co. Ltd (NEWJF) purchased 28.22% of Greatview Aseptic Packaging. NEWJF aims to maintain its position in liquid product packaging by streamlining its processes and fostering innovation in the rapidly growing sector.

Our in-depth analysis of the liquid packaging market includes the following segments:

|

Packaging Type |

|

|

Raw Material |

|

|

Technique |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Liquid Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 44% by 2035. This can be attributed mainly to favorable government policies, rapidly growing food and beverage and pharmaceutical industries, and the relocation of production facilities to the area because of lower labor and operational expenses.

The market’s growth is aided by the adoption of creative packaging solutions in China and the expansion of e-commerce. The preference for affordable and lightweight packing options contributes to the expansion of the market in this area.

The liquid packaging market in South Korea is expanding due to the rising demand for drinks, dairy products, and other liquids. This has resulted in increasing demand for liquid packaging in the dairy sector. In 2023, milk was the most consumed dairy product in South Korea accounting for 1.33 million metric tons volumes.

In Japan, smart packaging technology is revolutionizing the liquid packaging sector. These technologies integrate components such as temperature sensors, RFID tags, and QR codes to provide customers with real-time product information. Product safety is increased, inventory control is improved, and monitoring and tracing is made easier with intelligent packaging.

North America Market Insight

North America liquid packaging market is expected to witness significant growth during the forecast period. Innovation in liquid packaging solutions is encouraged by the nation's cutting-edge packaging infrastructure and technological prowess. Strict legal requirements about environmental sustainability and packaging safety encourage the use of cutting-edge packaging technology even more. According to a survey in April 2024, over 53% of people said they could spend an extra 10% on sustainably packaged food.

The U.S. is one of the largest contributors to the expansion of the liquid packaging market in North America due to the significant demand for liquid packaging and the increasing adoption of paper products over other hazardous materials in the area. Other factors such as technological advancements in packaging technology, expansion of the food and beverages industry and pharmaceutical sector, and rising inclination towards online shopping are expected to drive sales of liquid packaging in the U.S.

Liquid Packaging Market Players:

- Elopak

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Greatview Beijing Trading Co., Ltd

- Klabin S.A.

- DOW

- Smurfit Kappa

- Mondi

- Pactiv Evergreen Inc.

- Refresco Group

- Reynolds Group Ltd.

- Amcor plc

- Scientex Berhad

Key competitors in the liquid packaging industry compete fiercely with one another in an attempt to increase their market share through sustainability and innovation. With their wide range of products and commitment to R&D, businesses like Tetra Pak International S.A. and Amcor Limited dominate the market. These industry pioneers never stop coming up with new ideas to offer cutting-edge, environmentally responsible packaging options. They are adopting several strategies such as mergers and acquisitions, product launches, and joint ventures among others to retain their market position and enhance their product base.

Here is a list of key players operating in the global liquid packaging market:

Recent Developments

- In November 2023, SEE announced the launch of a new automated packaging system, CRYOVAC Brand 308 CE for liquid products. This system can pack around 28 packs per minute and is capable of handling hot as well as cold products.

- In August 2022, Greatview Aseptic Packaging Co. Ltd. announced plans to purchase the assets of Alternapak Production S.r.l, a supplier of aseptic cartons to major participants in the liquid food business in Europe, the Middle East, and the America.

- In May 2022, Elopak AS and GLS partnered to provide environmentally friendly packaging options to Indian consumers. Under the "ALPAK" brand, GLS offers customers a variety of roll-fed aseptic cartons with comprehensive service support. The company intends to offer auxiliary solutions, as well as aseptic Pure-Pak cartons and fresh Pure-Pak cartons.

- Report ID: 6355

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Liquid Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.