Liquid Fabric Softeners Market - Regional Analysis

North America Market Insights

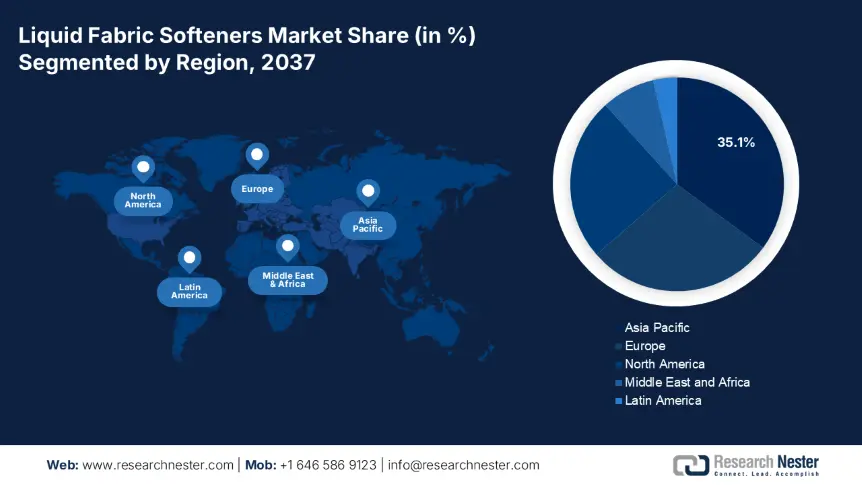

By 2037, the Asia Pacific liquid fabric softeners market is expected to hold 35.1% of the market share due to growing urbanization, the rise of high-end laundry, and growing awareness of the importance of not only washing but also concern for fabrics. The market is expected to grow at a compound annual growth rate (CAGR) of 3.8% from 2025 to 2037, from an estimated USD 3.2 billion in 2025 to USD 4.9 billion by 2037. Some of the key contributors account for more than 35% regional share given their huge populations, a growing middle class, and increased product penetration in Tier II and III cities.

China represents the largest liquid fabric softeners market with a size of USD 1.3 billion in 2025, growing to an estimated USD 1.8 billion by 2037, at a CAGR of 4.3%. The market is thriving given the trends around premiumization, coupled with the expansion of e-commerce retail, and rising consumer preference for fragrances, softness, and long-lasting softness in fabrics. All of the key major players are focusing on even newer innovative, targeted softeners that capture antibacterial and anti-static properties, aligned with consumers' expectations around hygiene.

India's liquid fabric softeners were valued at USD 411 million by 2025 and are estimated to reach USD 661 million by 2037, growing at a CAGR of 4.4%. Growth is particularly driven by increasing disposable income, higher washing machine penetration, and the aggressive marketing of brands such as Comfort (HUL) and Ezee (Godrej). Further, the trends of rising urbanization and continuing improved laundering habits are widening adhesive adoption around the product, particularly by middle-income groups who seek clothes that are soft, fragrant, and that have easy iron finishes.

Country-Wise Insights on the Liquid Fabric Softeners Market in APAC

|

Country |

Rising Disposable Income (Per Capita, USD, 2023) |

Urbanization Rate (% of Population, 2023) |

Evolving Consumer Lifestyles (Key Trends) |

|

China |

$12,850 |

64% |

Demand for premium & eco-friendly fabric softeners; smart home laundry products rising |

|

Japan |

$42,440 |

92% |

High preference for hypoallergenic & fragrance-free softeners; convenience-driven purchases |

|

South Korea |

$34,990 |

82% |

Tech-savvy consumers favor innovative laundry products; growth in online bulk purchases |

|

India |

$2,410 |

35% |

Rising middle-class adoption; shift from traditional methods to liquid softeners |

|

Australia |

$60,430 |

86% |

Strong demand for sustainable & plant-based fabric conditioners |

|

Indonesia |

$4,870 |

57% |

Increasing awareness of fabric care; urban consumers prefer international brands |

|

Vietnam |

$3,690 |

38% |

Young urban population driving demand; preference for affordable mid-range products |

|

Thailand |

$7,230 |

52% |

Growth in scented & luxury fabric softeners; rising laundry service industry |

|

Philippines |

$3,950 |

47% |

Increasing penetration in urban households; preference for tropical fragrances |

|

Malaysia |

$11,120 |

78% |

Halal-certified & eco-conscious products gaining traction |

Europe Market Insights

Europe market is expected to hold 28.5% of the liquid fabric softeners market share and is expected to reach USD 4.6 billion by 2037, with a CAGR of 3.2% from 2025 to 2037. The market will grow because of premiumization trends, sustainability-based formulations, and eco-labeling, incentivizing consumer trust and purchase decisions. An increase in concentrated softeners and scent innovation indicates that major players like Henkel and Unilever are investing in R&D and resources to keep up with competition and consumer demand.

Germany is now expected to approach USD 951 million by 2037, which represents a compound annual growth rate, CAGR, of 2.8% between 2025 and 2037. For 2024, 71% of households will use liquid fabric softeners regularly, and these are mainly purchased from dermatological tested/skin-sensitive softeners, and sustainability in particular is extremely important. Sustainable, eco-friendly softening products account for over 31% of Germany's liquid fabric softeners market. Major competitors in the country include Lenor and Vernel, and both brands are using biodegradable formulations to meet changing consumer expectations, learning and improving on consumer perceptions of green consumerism.

The U.K. is now expected to reach USD 741 million by 2037, which represents a CAGR of 2.8% between 2025 and 2037. Approximately 69% of households will purchase a liquid fabric softener at least once a month, and the trend continues to grow as consumers in households are drawn to the convenience of concentrated products that reduce waste. Unilever's Comfort and P&G's Lenor exist as market leaders in the region. The U.K. liquid fabric softeners market is also tied to scent trends and environmentally safe formulations, with the spectrum of eco-labeled or plant-based products amounting to greater than 26% share in 2024.

|

Country |

Consumer Awareness of Fabric Care (% of Households, 2023) |

Demand for Premium Clothing (Key Trends) |

Key Market Drivers for Liquid Fabric Softeners |

|

Germany |

78% |

High demand for luxury & sustainable apparel |

Preference for eco-friendly, hypoallergenic softeners; strong retail private labels |

|

France |

75% |

Rising premium athleisure & designer wear |

Growth in floral & luxury fragrances; focus on fabric longevity |

|

UK |

72% |

Fast fashion decline; shift to high-end basics |

Online sales surge (Amazon, Tesco); demand for concentrated formulas |

|

Italy |

68% |

Strong luxury fashion sector (e.g., wool, silk care) |

Premium fabric conditioner sales linked to high-end detergents |

|

Spain |

65% |

Increasing mid-tier branded clothing purchases |

Preference for budget-friendly but effective softeners; supermarket dominance |

|

Netherlands |

70% |

Sustainable & minimalist wardrobe trends |

Leading market for biodegradable & refillable softeners |

|

Sweden |

73% |

High spend on durable, eco-conscious clothing |

Plant-based & cold-water compatible formulas thrive |

|

Switzerland |

77% |

Luxury outdoor & performance wear |

Niche demand for pH-neutral, dye-free softeners |

|

Poland |

60% |

Growing middle-class investment in better apparel |

Rising adoption of mid-range international brands |

|

Russia |

55% |

Premium winter wear & formal attire focus |

Price sensitivity but growth in imported premium softeners |

North America Market Insights

North America market is expected to hold 24.7% of the liquid fabric softeners market share due to rising interest in premium laundry care products and environmentally-friendly formulas. The market was valued at USD 1.54 billion in 2024, and is expected to reach USD 2.19 billion by 2037, growing at a CAGR of 2.8%. Growth drivers include brands introducing plant-based formulas to comply with upcoming legislation with regards to the use of hazardous chemicals, as well as growing consumer demand. Given high per capita consumption, detergent usage, and additional laundry loads, it is evident that the usage of these products is deep-rooted in this region.

The U.S. accounted for over 83% revenue share valued at USD 1.26 billion in 2024. It is expected to grow at a CAGR of 3.1% from 2024 to 2037. This will be aided due to new patented micro-encapsulation technology, which improves fragrance delivery (fabrics will soften and smell fresher longer), and consumers embracing concentrated formulas, which drive down waste. This market will remain retail-driven driven being brand-led, but there is more competition via e-commerce and private label penetration from Walmart’s Great Value and Target.

Canada was valued at USD 281 million in 2024 and is projected to reach USD 381 million in 2037 with a CAGR of 2.5%. Market growth is driven by continuing urbanization, higher acceptance of premium scented variants, and increasing awareness of environmentally friendly options. Brands are still pursuing retail opportunities. However, environmentally conscious Canadians are slowly changing their fabric softener use to alternatives, requiring market players to innovate biodegradable and allergen-free alternatives.