Global Market Size, Forecast, and Trend Highlights Over 2025-2037

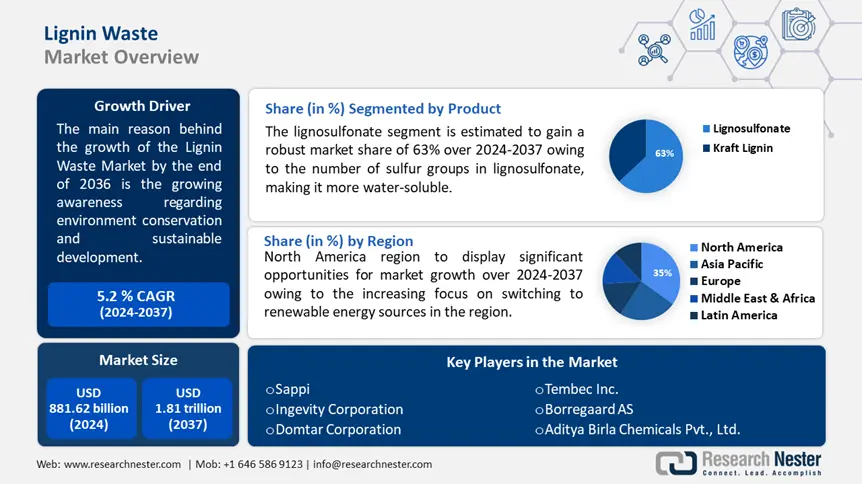

Lignin Waste Market size was valued at USD 881.62 billion in 2024 and is set to exceed USD 1.81 trillion by 2037, expanding at over 5.7% CAGR during the forecast period i.e., between 2025-2037. In the year 2025, the industry size of lignin waste is evaluated at USD 924.33 billion.

People started realizing the importance of environmental conservation and the need for sustainable products for the planet to prevent climatic changes and stop diversity loss. Growing awareness about waste applications from lignin in various sectors contributes to lignin waste market growth. Moreover, low-quality lignin can be extracted from waste products derived from biorefineries and the pulp & paper industry. According to the Royal Society of Chemistry in 2024, around 100 million tons of lignin is produced annually, of which only 2% is recovered from the total for material utilization.

Lignin Waste Market: Growth Drivers and Challenges

Growth Drivers

-

Lignin as a source of bioenergy - The feedstock derived from lignin has a high potential to be used as a biofuel. Additionally, lignin as a fuel produces more energy during combustion as compared to other materials such as cellulose.

As per a report in 2021, around 26.6 kJ/g of heat is created during the combustion process of lignin resulting in a high amount of energy production due to the presence of reactive groups in lignin for natural substances made up of polymer. Around 50 million tons of lignin are produced annually across the world, of which 98% to 99% is burned to produce steam and process energy. Around 1% to 2% is derived from the sulfite pulp industry and is used in chemical conversion to produce lignosulfonates. - Production of lignin in the pulp & paper industry and use as a substitute for petroleum-based - The pulp and paper industry is the largest producer of lignin because it is produced as an industrial by-product producing tons of lignin annually as a result of the pulping process. Some amount of the lignin produced is used in valuable industrial processes, and the rest is burned to generate energy and recover chemicals.

For instance, pulp and paper products are producing 50–70 million tons of lignin annually worldwide and by 2030 it is predicted that the lignin production will reach 225 million tons per year.

Challenges

-

Restricted awareness of uses of lignin waste in developing nations - People living in developing nations are not aware of the benefits of lignin which is projected to hinder the lignin waste market growth. Lignin-based products which are derived from lignin waste are less competitive.

- High cost linked with research & development (R&D) - The cost associated with the R&D sector is quite high as people prefer using lignin as an additive for green construction. The quality of the product received from the source can be variable hindering the extensive adoption of lignin.

Lignin Waste Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.7% |

|

Base Year Market Size (2024) |

USD 881.62 billion |

|

Forecast Year Market Size (2037) |

USD 1.81 trillion |

|

Regional Scope |

|

Lignin Waste Segmentation

Product (Lignosulfonate, Kraft Lignin)

Lignosulfonate segment is estimated to dominate lignin waste market share of around 63% by the end of 2036. The segment growth can be due to the presence of more sulfur groups in lignosulfonate. It is a water-soluble derivative of lignin waste and is produced during the sulfite pulping process for producing paper from wood.

They have generally more sulfur groups, and thus, a higher degree of sulfonation than that of kraft lignin. Moreover, they act as an alternative to non-renewable binders in wood-based materials. As per a recent report, lignosulfonate accounts for 90% of the commercial lignin present in the market.

Application (Concrete Admixtures, Animal Feed Binders, Dyestuff)

In lignin waste market, concrete admixtures segment is set to hold revenue share of over 57.5% by the end of 2036. The segment growth can be attributed to the properties required in lignin waste to make it suitable to act as an additive including water reduction, increased strength, and easy control over time. Lignin acts as a binding medium to hold the matrix of cellulose fibers together in a rigid-woody structure.

Furthermore, concrete admixtures are taken as an environment-friendly and sustainable product to use as an additive. According to the Portland Cement Association, Water-reducing admixtures usually reduce the required water content for a concrete mixture by about 5 to 10 percent due to which they are more stable over a wider range of temperatures.

Our in-depth analysis of the lignin waste market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lignin Waste Industry - Regional Synopsis

North American Market Statistics

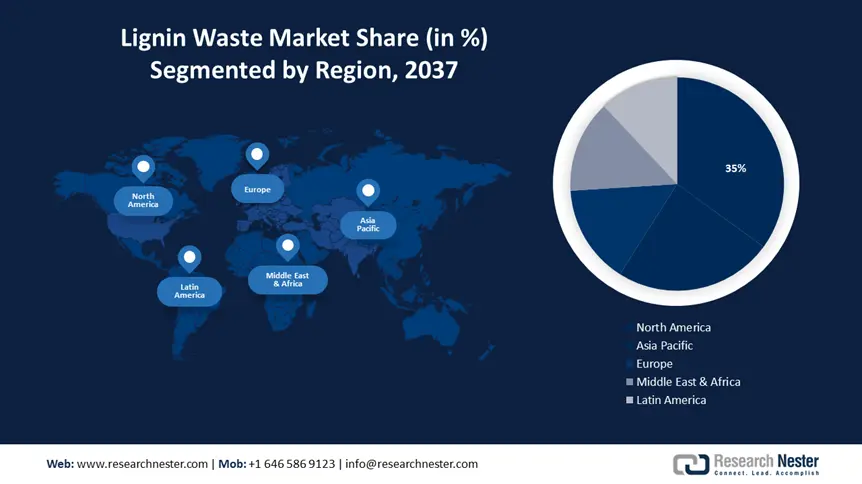

North America industry is anticipated to account for largest revenue share of 35% by 2037. The market growth is also expected on account of the increasing focus on switching to renewable energy sources in the region. According to the U.S. Energy Administration Information, 8.43 quadrillion energy is produced from renewable sources out of which 8.24 quads is consumed in 2023.

In the US, continuous innovations and research and development activities are taking place aiming to develop new applications and improve the quality of lignin waste. Lignin can be converted to advanced biofuels used for aviation or marine vessels. RenFuel provides the technology for bio-oil LIGNOL, which can be added to any crude or vegetable oil and after hydrotreating it in a refinery gives petrol, diesel, aviation, and marine fuels fully efficient like conventional fuels.

In Canada, lignin is recovered by dismantling and fractionation of residual wood, resulting in depolymerization to marketable products such as bio-jet fuel. This biofuel would benefit Canada economically as well as environmentally by avoiding greenhouse gas emissions. According to the Canada Energy Regulator, the total primary energy available to Canada from biomass is around 1,800 petajoules (PJ) per year.

APAC Market Analysis

The Asia Pacific region will also encounter huge growth for the lignin waste market during the forecast period and will hold the second position owing to the development of efficient processes for lignin waste valorization and increasing use of lignin in various sectors such as UV protection materials in this region.

Lignin is an excellent light absorber due to its phenolic structure. The absorbance of light in the UV-B range (280–320 nm) provides the potential for lignin to be used as a natural UV protective material. These UV protection films are biodegradable and renewable for various applications. According to a recent report, UV absorbance of 10 wt% lignin-SPF 15 sunscreen increased by more than 40%. Moreover, lignin microparticles from organic acid lignin as a UV absorber which is a significant SPF value increase in pure hand lotion from SPF 1 to 3.53 at 5 wt% dosage of lignin. Furthermore, the UVA/UVB ratio (0.690.72) for this lignin indicated that they exhibit superior properties.

The lignin waste market growth in Korea is attributed to the leading regional revenue due to the growing demand for lignin waste in the construction sector along with its use as animal feed. As per the latest report, feed production in South Korea amounted to around 21.5 million tons in 2023. Animal feed production in South Korea has increased slowly and exceeded 20 million tons for the first time in 2019 due to increased pig sows, breeding stocks, and the potential for calf production.

In China, increasing investments in the development of lignin-based products such as carbon fibers and 3D printing materials.

Companies Dominating the Lignin Waste Landscape

- Green Agrochem

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sappi

- Ingevity Corporation

- Domtar Corporation

- Tembec Inc.

- The Dallas Group of America

- ECHEMI Digital Technology Co., Ltd.

- Lignol Energy Corporation

- Aditya Birla Chemicals Pvt. Ltd.

- Borregaard AS

The major players in the lignin waste market are offering a detailed portfolio of biodegradable and renewable products from lignin waste. These companies introduced advanced technologies to convert lignin waste into biofuel and other usable components.

Recent Developments

- Ingevity Corporation announced that a study conducted by consulting firm Environmental Resources Management (ERM), London, U.K., has determined the carbon-negative properties of its lignin-based Polyfon H dispersant completely offset the volume of greenhouse gas (GHG) emissions associated with its manufacture, resulting in a carbon footprint 122% lower than fossil carbon-based alternatives and positively impacting climate change.

- Sappi Southern Africa has achieved GMP+ Feed Safety Assurance (FSA) 2020 certification (animal feed certification scheme) for Pelletin which is a lignin-based product used as an additive in animal feed manufacturing. This makes Sappi the second organization in Africa to attain this prestigious certification.

- Report ID: 6166

- Published Date: Jan 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lignin Waste Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert