Lignin Market Outlook:

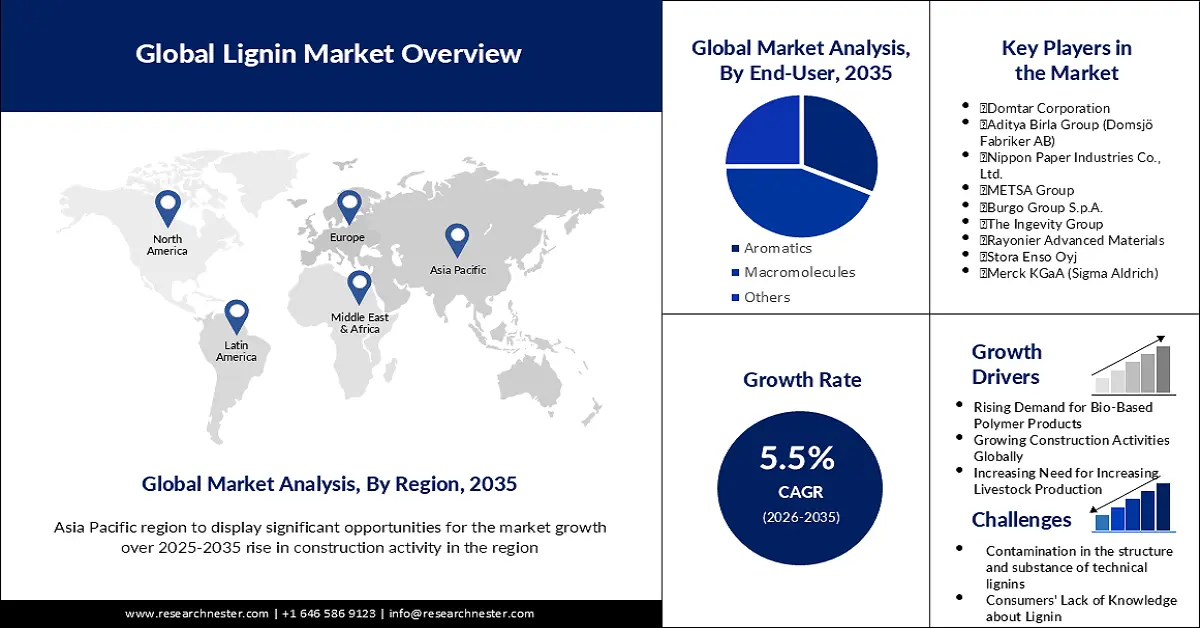

Lignin Market size was over USD 1.04 billion in 2025 and is projected to reach USD 1.78 billion by 2035, witnessing around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lignin is assessed at USD 1.09 billion.

The market growth is driven by growing need for lignin in animal feed and organic products, as well as its application in the creation of macromolecules utilized in the creation of bitumen, biofuels, and bio-refinery intermediates. In the United States, there are around 5,800 animal food producers that produce over 284 million tons of finished feed and animal feed every year.

Additionally, the market revenue is impelled by usage of lignin on roadways to lessen ecological worries emerging from dust particles in the atmosphere. Air pollution is responsible for 11.65% of all fatalities worldwide. It is also a major contributory variable for the burden of disease. As a result, lignosulfonate is employed in a variety of applications, including animal feed pellets, ceramics, fiberglass insulation, soil stabilizers, and recyclable plastic. The increasing requirement for concrete additives, adhesives, and binders in construction is likely to drive the market expansion.

Key Lignin Market Insights Summary:

Regional Highlights:

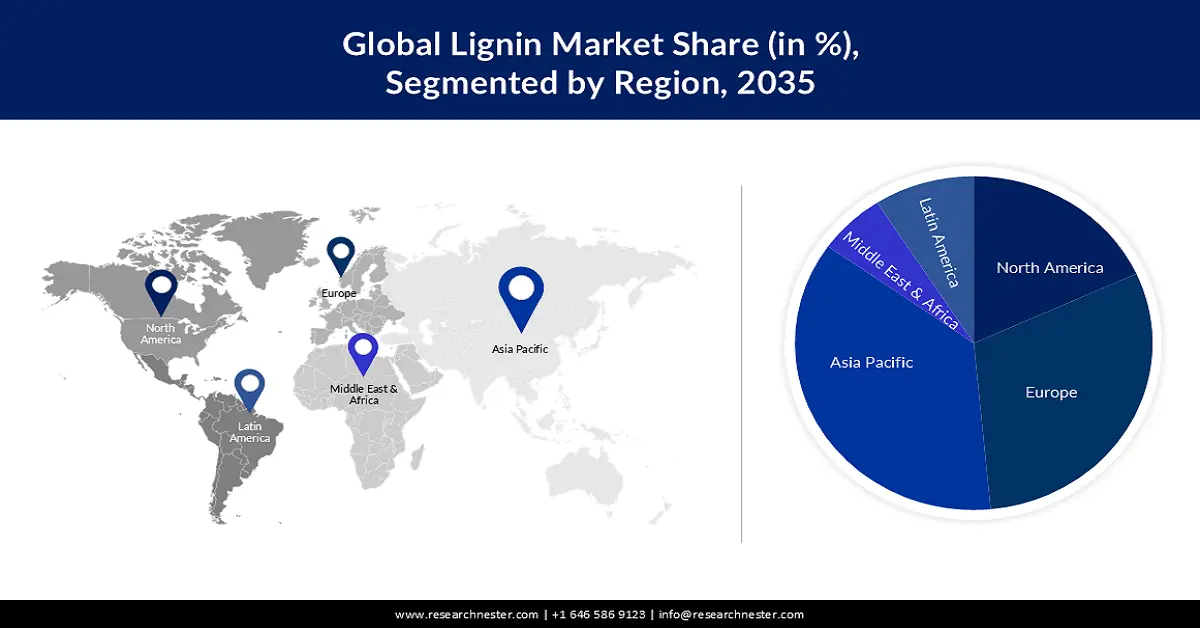

- North America lignin market will hold around 35% share by 2035, driven by aromatic applications and substantial R&D for biopolymers.

- Europe market will capture a 25% share by 2035, driven by EU emissions regulations and demand from vehicle production industries.

Segment Insights:

- The ligno-sulphonates segment in the lignin market is forecasted to achieve a 39% share by 2035, fueled by wide application in oil & gas, building, and ceramics industries for reducing viscosity and improving formulation.

- The macromolecules segment in the lignin market is forecasted to secure a 35% share by 2035, driven by the increasing use of carbon fibers in lightweight vehicles and buildings due to their durability and efficiency.

Key Growth Trends:

- Rising Demand for Bio-Based Polymer Products

- Growing Construction Activities Globally

Major Challenges:

- The Cost of Transportation of Raw Lignin is a Lot More Than the Cost of The Products

- Contamination in the structure and substance of technical lignins limits the market

Key Players: Borregaard LignoTech, Domtar Corporation, Aditya Birla Group (Domsjö Fabriker AB), Nippon Paper Industries Co., Ltd., METSA Group, Burgo Group S.p.A., The Ingevity Group, Rayonier Advanced Materials, Stora Enso Oyj, Merck KGaA (Sigma Aldrich).

Global Lignin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.04 billion

- 2026 Market Size: USD 1.09 billion

- Projected Market Size: USD 1.78 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Sweden

- Emerging Countries: China, India, Japan, Brazil, Germany

Last updated on : 8 September, 2025

Lignin Market Growth Drivers and Challenges:

Growth Drivers

- Rising Demand for Bio-Based Polymer Products- Petroleum is a major supplier of energy in the United States and several other nations. Toxic chemicals are released into the air when petroleum items are burned. Carbon dioxide emissions aid in global warming. Additional chemicals in the air contribute to a variety of ailments, notably heart, and respiratory problems. To address these concerns, governments and companies have proposed laws and regulations encouraging the consumption of bio-based items and supplies such as lignin. According to estimations, the bio-based revenue of all chemical sales reached 12.3% in 2015 and 22% by 2020 in Europe.

- Growing Construction Activities Globally- Previously, lignin sulphonate was used on roadways for surface stabilization and dust management. Lignin-based solutions are both more secure and economical than petroleum- and salt-based options commonly used on road surfaces. As reported by the US Census Bureau, the worth of construction investment on highway and road projects in the United States in 2022 was expected to be USD 109.81 billion, a rise of 9 percent from 2021. As a result, rising road-building expenditures are likely to drive the consumption of lignin-based products during the forecast period.

- Increasing Need for Increasing Livestock Production- In India, the overall livestock population across rural and urban areas is 514.11 million and 22.65 million, respectively, with a rural population portion of 95.78% and a rural population proportion of 4.22%.

- The Growing Requirement for Lignin in Animal Feed- The UK is a significant manufacturer of concentrated animal feed, feed nutrients, and unmixed feeds. As reported by the Office for National Statistics (UK), manufacturers' revenues of farm animal feed in 2021 totaled 5.14 billion British pounds (USD 7.07 billion), a 15.8% rise from 2020.

- Usage of Aromatic Lignin in the Chemical Sector- The worldwide chemical industry's overall sales were expected to exceed 4.7 trillion US dollars in 2021.

Challenges

- The Cost of Transportation of Raw Lignin is a Lot More Than the Cost of The Products

- Contamination in the structure and substance of technical lignins limits the market

- Consumers' Lack of Knowledge about Lignin and Lignin Items- The dearth of knowledge regarding the benefits and applications of lignin is projected to stymie the expansion of the lignin industry among industrial and business end-users. Lignin is employed in a variety of industries, ranging from chemicals to food and beverages. However, a lack of research into the potential applications for this material may limit demand in the coming years.

Lignin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.04 billion |

|

Forecast Year Market Size (2035) |

USD 1.78 billion |

|

Regional Scope |

|

Lignin Market Segmentation:

Source Segment Analysis

The ligno-sulphonates segment share is set to exceed 39% by 2035. In the oil and gas business, lignosulfonates are employed to reduce mud viscosity during deep oil well drilling. In 2023, the Global Oil & Gas Exploration & Production industry is estimated to be worth $4.3 trillion in revenue.Lignosulfonates are frequently used to produce smooth clay slips for pottery.

It is also widely employed as an intermediary in the fusing of many products. Calcium lignosulfonate, sodium lignosulfonate, and magnesium lignosulfonate are all types of lignosulfonate. Ligno-sulfonates are widely used in the building, pottery, oil and gas, chemical compounds, and animal feed ingredients sectors. It is also implemented in the organic polymerization process.

Application Segment Analysis

The macromolecules segment is predicted to dominate around 35% market share by 2035. As carbon fibers become increasingly employed as portable materials in the building and vehicle sectors, the significance of macromolecules is projected to grow. Carbon fibers, carbon, biofuels, bitumen, enzymes for bio-refineries, and activated carbon are made from the macromolecules. Carbon fibers are growing more widespread as the aerospace and automotive sectors want lighter materials. Furthermore, because of their better durability and efficiency, lightweight vehicles are expected to witness increased demand.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Source |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lignin Market Regional Analysis:

North American Market Insights

North America industry is anticipated to dominate majority revenue share of 35% by 2035, propelled by escalating aromatic uses and substantial R&D by significant firms. The United States Environmental Protection Agency (EPA) has offered monetary support to promote the development of biopolymers and bio-refinery, which is predicted to drive lignin consumption. Furthermore, evolving movements within the chemical production sector for the use of bio-based raw materials in manufacturing methods are expected to encourage the usage of bio-refinery, fueling the popularity of lignin as a catalyst in this region.

Europe Market Insights

The Europe lignin market is estimated to account for 25% share by the end of 2035. Regulations limiting the release of greenhouse gases, together with a strong biopolymer industrial base in France, Belgium, Germany, and the Netherlands, are expected to drive demand. The existence of large vehicle production facilities, together with the rising demand for compact motor vehicles, is likely to boost the regional market revenue

Furthermore, ascending aromatic application of lignin in aromatic alcohol, along with extensive research and development by various prominent players will fuel the market growth in the region. Germany, being a significant hub for the aviation and automobile sectors, saw a growth in demand for carbon fibers from these sectors. For instance, in Italy, car output in 2021 is expected to reach 795,856 units, up 2% from 2020. This is predicted to raise lignin demand in this region. Lignin is utilized to make low-cost carbon fibers without sacrificing efficiency.

APAC Market Insights

The market in the Asia Pacific region is expected to record the highest CAGR in the lignin market during the forecast period, owing to rise in construction activity in nations, including China, India, Japan, and South Korea backed by an increasing population. Additionally, increasing usage of lignin in the paper and pulp industry is estimated to propel the market in the region. Growing knowledge of the advantageous effects of lignin in livestock feed among breeders and keepers will boost the market demand. Furthermore, the presence of a thriving pulp and paper-producing sector in the region will impel the market size.

Lignin Market Players:

- Borregaard LignoTech

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Domtar Corporation

- Aditya Birla Group (Domsjö Fabriker AB)

- Nippon Paper Industries Co., Ltd.

- METSA Group

- Burgo Group S.p.A.

- The Ingevity Group

- Rayonier Advanced Materials

- Stora Enso Oyj

- Merck KGaA (Sigma Aldrich)

Recent Developments

- Metsa and Fortum collaborated to create an extraordinary R&D program based on sustainable resources that are renewable. The primary goal of the partnerships is to offer valuable end-products derived from ingredients such as straws, lignin, and hemicellulose.

- Stora Enso Oyj and Northvolt signed a partnership development contract for environmentally friendly batteries comprised of lignin-based hard carbon derived from Nordic woods.

- Report ID: 3038

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lignin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.