Light Duty Truck Market Outlook:

Light Duty Truck Market size was over USD 1.71 trillion in 2025 and is projected to reach USD 4.01 trillion by 2035, witnessing around 8.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of light duty truck is evaluated at USD 1.85 trillion.

The light duty truck market is growing as stricter regulations and a heightened sense of environmental awareness prompt consumers and businesses to opt for vehicles that produce lower emissions and offer improved fuel efficiency. The Climate Change Authority reported that vehicle emissions regulations apply to more than 70% of light vehicles sold worldwide today. In absolute terms, the EU and Japan have the most aggressive standards for 2020 and beyond. China's and the US's 2020 criteria are anticipated to move these countries from efficiency levels comparable to Australia's to levels much closer to the world leaders, taking advantage of the higher rates of reduction that can be achieved when beginning with a less efficient fleet.

Moreover, manufacturers employ stronger materials for automobile interiors and structures while lowering weight. To reduce weight, they are also getting rid of extra tires and shrinking other equipment. According to the U.S. Department of Energy (DOE), a vehicle's fuel efficiency can increase by 6 to 8 percent for every 10% reduction in weight. Additionally, lightweight materials assist counteract the possible weight gain from emerging technology like connected and driverless cars. Therefore, these factors have propelled the demand for light-duty trucks.

Key Light Duty Truck Market Insights Summary:

Regional Highlights:

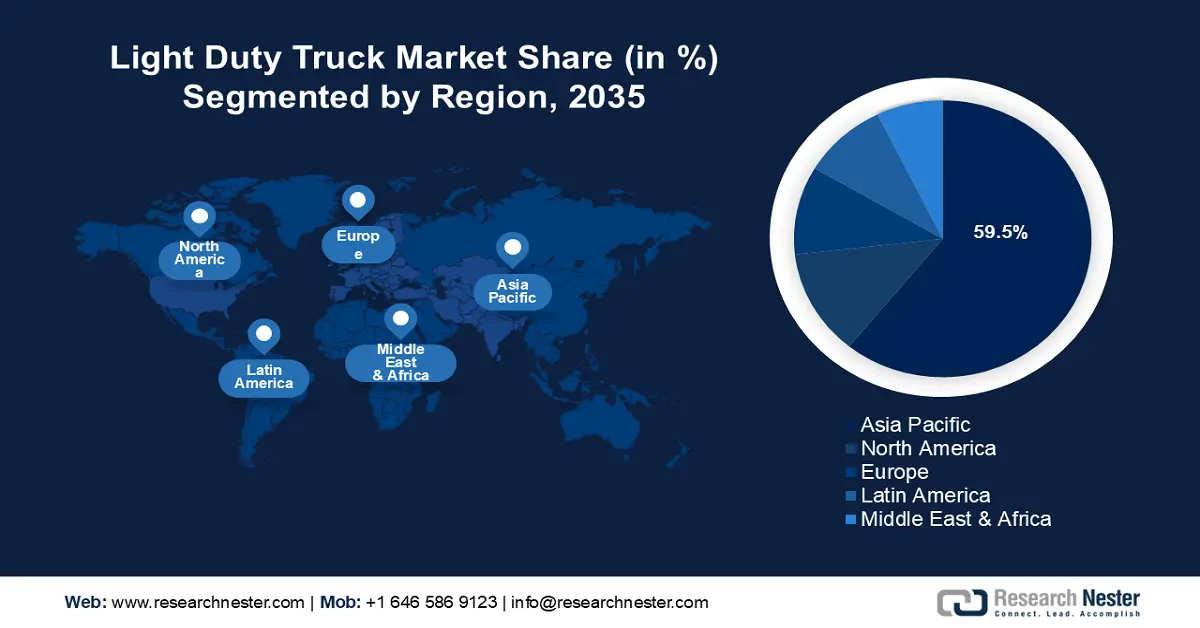

- Asia Pacific dominates the Light Duty Truck Market with a 59.5% share, supported by diverse transportation needs, government legislation for greener vehicles, and e-commerce expansion, fostering robust growth through 2026–2035.

Segment Insights:

- The Diesel segment is forecasted to exceed 95.5% market share by 2035, propelled by diesel-powered trucks offering improved fuel efficiency and uptime.

- The Commercial segment is poised for significant growth through 2035, fueled by the rising need for last-mile delivery solutions across industries.

Key Growth Trends:

- Increasing consumer spending

- Integration of autonomous and ADAS technologies

Major Challenges:

- Fluctuating raw material prices

- Limited off-road capability

- Key Players: Scania AB, Stellantis N.V., Daimler Vehicle AG, TuSimple Holdings, Inc., Hino Motors, Ltd., Tesla, Inc., The Volvo Group, Paccar Inc., BMW AG, Ford Motor Company.

Global Light Duty Truck Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.71 trillion

- 2026 Market Size: USD 1.85 trillion

- Projected Market Size: USD 4.01 trillion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (59.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Light Duty Truck Market Growth Drivers and Challenges:

Growth Drivers

- Increasing consumer spending: Businesses need effective last-mile logistics due to the growing demand for quick and easy online order delivery. International Trade Administration predicted that by 2027, global B2C e-commerce sales will reach USD 5.5 trillion at a consistent compound annual growth rate of 14.4%. Light-duty trucks are perfect since they can move packages across cities while navigating congested streets and tight spaces. The necessity for efficient delivery methods will drive demand for light-duty vehicles as e-commerce expands.

Additionally, the need for timely delivery of materials is becoming increasingly critical in light of the growth in construction activities. There is a rising requirement for these trucks to deliver smaller items, such as bricks, lumber, and drywall, directly to construction sites. Furthermore, an increase in the acquisition of light-duty trucks is observed for rental services catering to individuals who require transportation for a limited duration. This service benefits families in the process of relocating and businesses in need of transport for events. - Integration of autonomous and ADAS technologies: Advanced Driver Assistance Systems (ADAS) and autonomous lightweight trucks have become viable ways to improve truck safety by reducing risks and preventing collisions. Radar and camera technology are used by ADAS systems to identify possible crashes, alert drivers, or take over the vehicle to prevent collisions. Moreover, autonomous trucks offer cutting-edge capabilities such as eco-driving, adaptive cruise control, and platooning, they become potent allies in the worldwide fight against climate change.

Light-duty truck manufacturers are striving to build safe, advanced, and fuel-efficient trucks, driving the light duty truck market. For instance, in March 2023, Continental and HERE Technologies, the premier location data and technology platform, equipped IVECO commercial vehicles in the EU with Intelligent Speed Assistance (ISA) and fuel-saving features. These will be delivered via Continental's eHorizon platform, which aggregates and delivers HERE map content, with data exchange facilitated by Continental's scalable 4G/5G telematics control unit. - Growing adoption rates of electric and hybrid powertrains: Electric and hybrid powertrains are gaining popularity due to environmental economic and technological factors. Stricter regulations to reduce vehicle emissions are being enforced by governments, which encourages automakers to develop more ecologically friendly and fuel-efficient automobiles. Advances in battery technology and powertrain design optimize performance, efficiency, and range. As a result, manufacturers such as Toyota, Ford, and Rivian have launched electric and hybrid truck models to meet these regulations. As environmentally concerned buyers look for cars that fit their sustainability objectives, this trend is driving light duty truck market size and the adoption of cutting-edge technologies like hybrid and electric powertrains.

Challenges

- Fluctuating raw material prices: The cost of the raw materials used to make cars has fluctuated frequently, which has affected the automotive industry. To maximize profits, automakers often raise the total cost of their automobiles due to the rising cost of raw materials. Consequently, this limits the light duty truck market expansion during the predicted period.

- Limited off-road capability: Compared to larger, more durable trucks, light-duty trucks frequently have lower ground clearance and fewer off-road capabilities. A small vehicle might not have the performance or features needed to regularly drive over uneven terrain or participate in off-road activities. Therefore, this factor may hinder the widespread expansion of light-duty trucks.

Light Duty Truck Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 1.71 trillion |

|

Forecast Year Market Size (2035) |

USD 4.01 trillion |

|

Regional Scope |

|

Light Duty Truck Market Segmentation:

Fuel Type (Gasoline, Diesel, Electric)

Diesel segment is set to hold light duty truck market share of over 95.5% by the end of 2035. The segment is growing due to the recent introduction of diesel-powered light-duty trucks with improved fuel efficiency. The new series offers truck owners financial advantages by achieving industry-leading fuel efficiency and outstanding uptime. These trucks' increased mileage and less environmental impact are drawing in customers and organizations looking for cost-effective and environmentally friendly solutions, which is reviving interest in diesel as a fuel source.

From heavy-duty trucks to passenger automobiles, synthetics have become more popular in recent years as automakers work to fulfill increasingly stringent fuel economy and greenhouse gas emission regulations. Synthetics have been demonstrated to provide exceptional durability, longer engine life, all-temperature performance, and longer intervals between oil changes for light duty diesel engines, all of which reduce maintenance costs. Major players are striving to create the best synthetic oils for light-duty trucks and other vehicles due to the surging demand for logistics. For instance, in April 2022, Chevron released a premium full synthetic oil designed exclusively for the light duty diesel market: Chevron Delo XSP 15W-40. Chevron Delo XSP 15W-40 is intended for the light-duty diesel pickup driver or fleet manager who prefers the benefits of a complete synthetic.

Application (Commercial, Industrial)

The commercial segment in light duty truck market is estimated to gain a notable share in the forecast period. The increasing need for effective last-mile delivery solutions is driving the segment's growth. In addition to e-commerce, several other industries, such as local services, groceries, and pharmaceuticals, deliver goods to customers' homes. Light-duty trucks have become vital tools for satisfying this need because of their agility and versatility in urban settings. Companies are prioritizing these vehicles to streamline their delivery procedures, which leads to a rise in market expansion and adoption.

Our in-depth analysis of the global light duty truck market includes the following segments:

|

Fuel Type |

|

|

Application |

|

|

Drive Configuration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Light Duty Truck Market Regional Analysis:

APAC Market Statistics

Asia Pacific light duty truck market is predicted to account for revenue share of around 59.5% by 2035. The region's varied commercial and personal transportation needs are met by the new vehicles' cutting-edge features, increased efficiency, and contemporary looks. Moreover, governments are enacting legislation to promote greener and more efficient transportation alternatives, encouraging the use of electric and hybrid vehicles. According to the Asian Development Bank, Asia and the Pacific have the most active internet users (2.6 billion, or 52.8% of the global count). This has resulted in the expansion of e-commerce driving demand for delivery trucks and forcing logistics companies to invest in newer, more technologically capable vehicles to fulfill changing client demands.

According to Climate Change Research, in 2019, CO2 emissions from China's transport sector were 1274 million t, second only to the U.S. (1788 million t), accounting for 12.42% of the country's total CO2 emissions and 14.82% of global transport CO2 emissions. Therefore, as part of its initiatives to lessen air pollution and reliance on fossil fuels, the government is aggressively encouraging the use of electric vehicles. As companies seek to comply with the government's environmental objectives and take advantage of incentives and subsidies for purchasing electric vehicles, the demand for light duty trucks has increased.

The demand for light duty trucks has increased in India due to the number of end-use industries, including the food and beverage, construction, automotive, and healthcare sectors, which mostly depend on them for the transportation of finished items from production plants to retail locations. The automobile industry is one of the main drivers of economic expansion. For instance, in 2023, India produced 25.9 million automobiles annually. India's automobile industry is robust in terms of both exports and local demand.

North America Market Analysis

North America light duty truck market will garner a substantial share in the forecast period. The growing demand for these vehicles for family and personal use is driven by their adaptability and usefulness. Additionally, the region has a strong automotive infrastructure, which includes a large number of dealerships and service networks. Vehicle sales are also increased by economic variables like favorable financing alternatives and growing disposable incomes. The existence of significant automakers also guarantees that customers will have access to a wide variety of excellent light-duty vehicles.

In the U.S., larger vehicles like SUVs and pickup trucks are increasingly favored by consumers, dominating the light duty truck market. This trend is largely driven by lifestyle preferences, as buyers prioritize performance, spaciousness, and versatility. Strong economic conditions, such as rising disposable incomes and accessible financing options, have also contributed to the surge in vehicle sales. Trading Economics reported in 2024, the disposable personal income climbed from 21798.30 USD billion in August to 21855.80 USD billion in September. Additionally, advancements in technology within the light-duty truck sector are enhancing safety features and connectivity, attracting even more customers.

Furthermore, to maximize their investment, more buyers are on the lookout for vehicles that serve both personal and professional needs. As a result, compact vans and pickup trucks are gaining popularity due to their ample storage capacity, fuel efficiency, and ease of maneuverability in urban settings. Additionally, these trends have played a role in the growth of the light duty truck market in Canada.

Key Light Duty Truck Market Players:

- Scania AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stellantis N.V.

- Daimler Vehicle AG

- TuSimple Holdings, Inc.

- Hino Motors, Ltd.

- Tesla, Inc.

- The Volvo Group

- Paccar Inc.

- BMW AG

- Ford Motor Company

The light duty truck market for is distinguished by its competitive and dynamic environment, fueled by the growing need for effective transportation solutions across various industries. Numerous well-established firms and recent arrivals influence the competition by consistently aiming to develop in the areas of smart mobility, fuel efficiency, and design.

Recent Developments

- In November 2024, Stellantis N.V. presented the STLA Frame platform, a battery-electric, multi-energy platform designed for full-size body-on-frame pickup trucks and SUVs, an important segment in North America and select global markets.

- In April 2024, Daimler India Commercial Vehicles, a wholly-owned subsidiary of Daimler Vehicle AG, launched the all-electric light-duty vehicle Next Generation eCanter in the Indian market.

- Report ID: 6899

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Light Duty Truck Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.