Global LED Neon Lights Market

- Introduction

- Study Objective

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- LED Neon Flex

- Elemental LED

- Nova Flex LED

- Solid Apollo LED

- Lightstec

- Elstar

- INCISEON

- Honest Exhibition Limited

- A1designs

- Zhongshan J.M.X Electronics Co., Ltd.

- Beyond LED Technology

- Ongoing Technological Advancements

- Type Analysis for LED Neon Lights Market

- Price Benchmarking

- Patent Analysis

- SWOT Analysis

- Analysis of Strategic Initiatives Adopted by Key Players

- Analysis of Product Performance and Customer Insights

- Recent Development Analysis

- Supplier/Distributor Analysis

- EXIM Analysis

- Porter Five Forces Analysis

- Industry Risk Assessment

- Growth Outlook

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Type, Value (USD Million)

- Silicone

- PVC

- Others

- Application, Value (USD Million)

- Household

- Commercial

- Distribution Channel, Value (USD Million)

- Online Retail

- Offline Retail

- Regional Synopsis (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Type, Value (USD Million)

- Silicone

- PVC

- Others

- Application, Value (USD Million)

- Household

- Commercial

- Distribution Channel, Value (USD Million)

- Online Retail

- Offline Retail

- Country Level Analysis (USD Million)

- US

- Canada

- Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Type, Value (USD Million)

- Silicone

- PVC

- Others

- Application, Value (USD Million)

- Household

- Commercial

- Distribution Channel, Value (USD Million)

- Online Retail

- Offline Retail

- Country Level Analysis (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Type, Value (USD Million)

- Silicone

- PVC

- Others

- Application, Value (USD Million)

- Household

- Commercial

- Distribution Channel, Value (USD Million)

- Online Retail

- Offline Retail

- Country Level Analysis (USD Million)

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Thailand

- Singapore

- Malaysia

- Rest of Asia Pacific

- Type, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Type, Value (USD Million)

- Silicone

- PVC

- Others

- Application, Value (USD Million)

- Household

- Commercial

- Distribution Channel, Value (USD Million)

- Online Retail

- Offline Retail

- Country-Level Analysis (USD Million)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Type, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Type, Value (USD Million)

- Silicone

- PVC

- Others

- Application, Value (USD Million)

- Household

- Commercial

- Distribution Channel, Value (USD Million)

- Online Retail

- Offline Retail

- Country Level Analysis (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Type, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

LED Neon Lights Market Outlook:

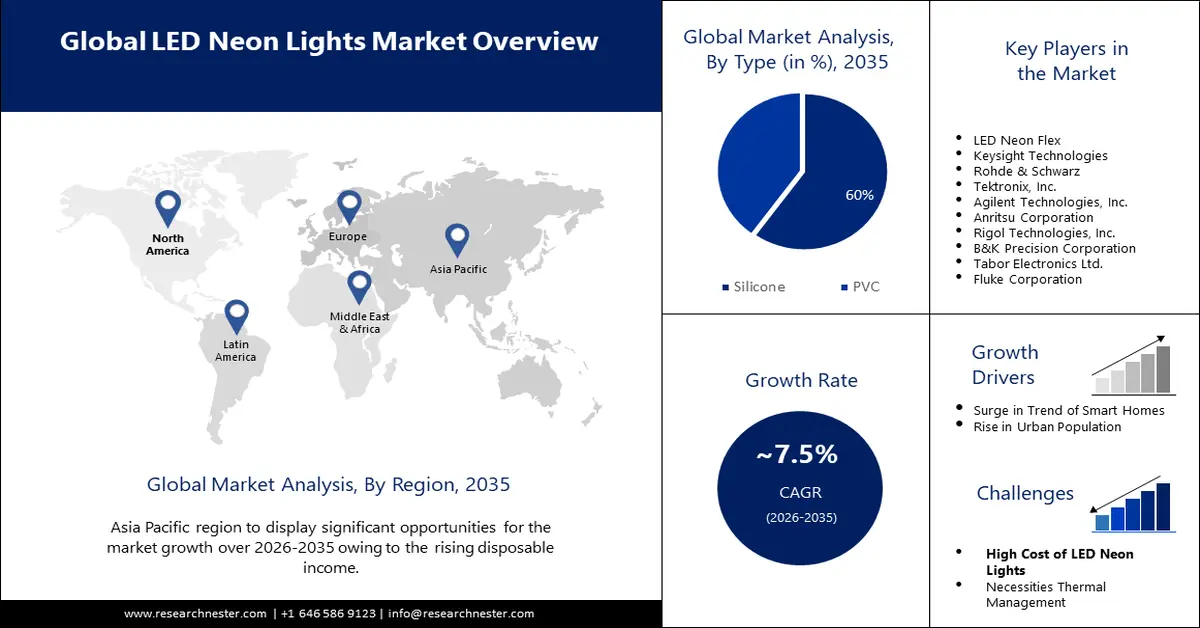

LED Neon Lights Market size was over USD 1.91 billion in 2025 and is projected to reach USD 3.94 billion by 2035, witnessing around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of LED neon lights is evaluated at USD 2.04 billion.

The industry is likely to witness exponential growth in the near future, driven by rising demands for energy-efficient, visually appealing lighting solutions using LEDs. Both consumers and businesses are looking for sustainability with low-cost alternatives to traditional lighting. As a result, LED neon lights make a strong case based on component longevity, low energy use, and flexibility of design. This is expected to open huge opportunities for manufacturers and suppliers to tap into this emerging trend and build up their market presence.

Companies engage in heavy R&D activities to enhance performance, and efficiency and offer customization options of the products offered in the LED neon lighting market. For instance, in August 2023, Environmental Lights introduced its new continuous side view RBG PixelControl Strip in sleek black finish LED lighting solutions. This new product emits a seamless line of light along the strip edge and creates neon effects. Apart from geographical expansion, companies have been entering into strategic partnerships and collaborations to extend their reach and serve a larger set of customers.

Governmental regulations and incentives have been crucial in shaping the LED neon lights market. Most governments around the world have been enforcing stiffer energy efficiency standards while encouraging the diffusion of green lighting technologies. This is reflected in the prohibition of inefficient lighting products in the European Union, which accelerated the shift towards LED lighting. Furthermore, broad supportive policies and financial incentives to businesses and consumers for investment in LED neon lights are driving the market expansion.

Key LED Neon Lights Market Insights Summary:

Regional Highlights:

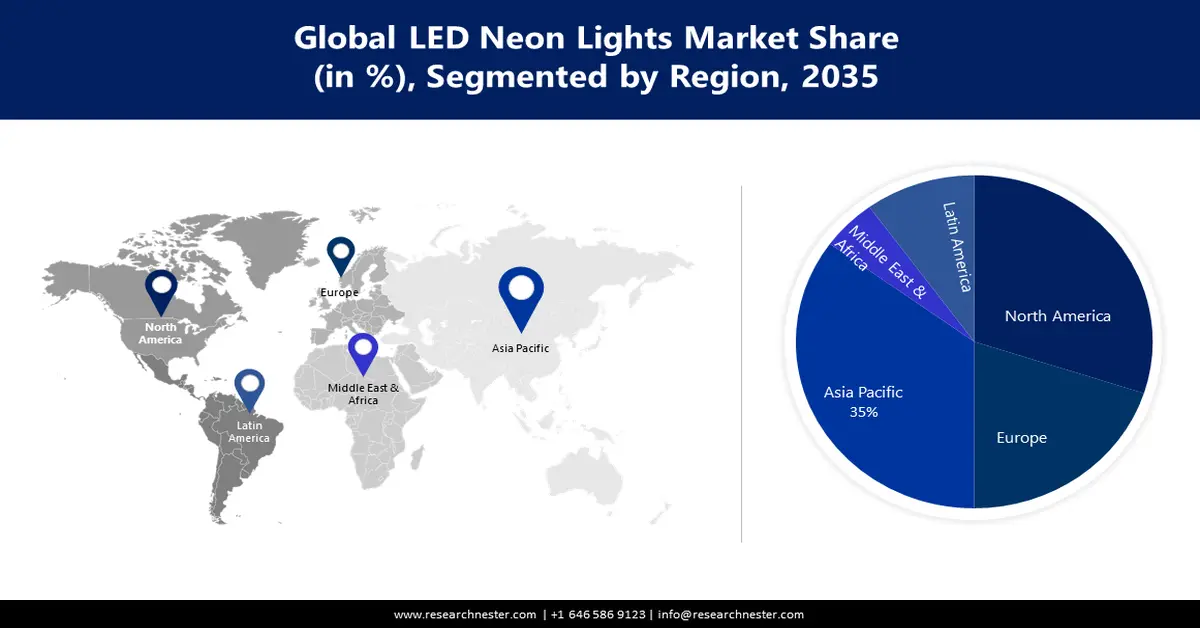

- Asia Pacific led neon lights market leads with a 53.20% share, propelled by rapid urbanization, improved disposable income, and a growing trend towards energy-efficient lighting solutions, forecast period 2026–2035.

- North America market will register substantial CAGR, fueled by increasing demand for energy-efficient and bespoke lighting solutions, forecast period 2026–2035.

Segment Insights:

- The commercial segment in the led neon lights market is anticipated to achieve substantial growth through 2035, driven by the high adoption of LED neon lights in signage, advertising, and interior design.

- The silicone segment in the led neon lights market is projected to achieve substantial growth by the forecast year 2035, fueled by high temperature and UV resistance of silicone-based LED neon lights.

Key Growth Trends:

- Rising adoption of LED neon lights for decoration purposes

- Growing demand for eco-friendly, affordable lights

Major Challenges:

- Higher upfront cost

- Complex installation

Key Players: Elemental LED, Nova Flex LED, Solid Apollo LED, Lightstec, Elstar, INCISEON, Honest Exhibition Limited, A1designs, Zhongshan J.M.X Electronics Co., Ltd., and Beyond LED Technology.

Global LED Neon Lights Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.91 billion

- 2026 Market Size: USD 2.04 billion

- Projected Market Size: USD 3.94 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (53.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

LED Neon Lights Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption of LED neon lights for decoration purposes- The increase in popularity of LED neon lights for decorative purposes has further boosted the LED neon lights market growth. These lights are flexible and visually attractive, making them suitable for use in various places such as homes, businesses, and functions. In February 2022, Environmental Lights introduced Pixel EcoFlex 4-in-1 LED Neon, a versatile new product that mixes RGB color blending with white as well as amber color choices. This will provide customers with additional choices for enhancing the aesthetic appeal of a space, hence stimulating more adoption of LED neon lights as decorative devices.

- Growing demand for eco-friendly, affordable lights: With growing consumer consciousness of environmental sustainability and a strong inclination toward cost-effective lighting solutions, there is an emerging demand for eco-friendly, affordable LED neon lights. Consumers actively seek alternatives to traditional lighting options with less carbon footprint and long-term cost savings. For example, in July 2024, Crazy Neon launched economical, customizable, and energy-efficient LED neon signs for modern spaces and varied needs. This launch answers the rising demand for energy efficiency and environmentally sustainable solutions.

- Improved LED technology: Improvements in LED technology is another factor driving the LED neon lights market. Dramatic improvements in brightness, color range, and flexibility create more value for both, consumers and businesses. For instance, Signify announced a new line of WiZ smart lighting products in June 2023, showing that the industry is ready for innovation and developing state-of-the-art solutions. Such technological developments enhance the performance and functionalities of LED neon lights and extend their areas of application, which drives further market growth.

Challenges

- Higher upfront cost: One major factor that holds back the widespread adoption of this particular LED lighting application, compared with traditional options, is the higher up-front cost of LED neon lights. This acts as a restraint to the price-sensitive consumer, typically found in countries with relatively lower average disposable incomes. As per World Population Review, the average disposable income in the U.S. is, for instance, roughly USD 54,854 as of 2024 per annum. This means that consumers are likely to find the upfront investment in LED neon lights to create a budget overload, hence the reduction in LED neon lights market reach and growth potential.

- Complex installation: The complex installation of the neon lights is another challenge to the market. This is because, unlike other traditional lighting options that can be easily installed by consumers, LED neon lights require some technical knowledge and expertise. This limits its accessibility to the market by people who lack such skills or are not willing to hire professionals to make an installation.

LED Neon Lights Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 1.91 billion |

|

Forecast Year Market Size (2035) |

USD 3.94 billion |

|

Regional Scope |

|

LED Neon Lights Market Segmentation:

Type Segment Analysis

The silicone segment in the LED neon lights market is projected to hold a revenue share of 44.4% by 2035 owing to its distinct set of characteristics that make it an ideal material for LED neon light production. The segment is witnessing a spike in demand due to the temperature resistance of silicone LED neon lights, which allows them to bear different temperatures without affecting performance.

Silicone LED neon lights adoption is on the rise as they are resistant to UV, making them able to be exposed to the sun for a more extended period without fading or deteriorating. As a result, companies are shifting their focus to launch smart LED neon lights made with silicone. For example, in April 2024, Hama launched its latest Neon LED light strip in Europe for indoor and outdoor use. This smart RGB light offers a wide color gamut and lighting effects that may be remotely adjusted by app or voice command. Such innovations are anticipated to drive the LED neon lights market growth by the end of 2035.

Application Segment Analysis

The commercial segment is anticipated to lead the LED neon lights market with a massive share of 57.9% during the forecast period owing to high use of LED neon lights in advertisement and sign industries, interior decoration, and outdoor lighting. Companies are focusing on utilizing applications of LED neon light such as energy efficiency, long lifespan, and high esthetic value to drive the demand among the commercial customer base. For instance, in July 2024, Nova Flex announced that it had formed a strategic partnership with ELA + Synergy, one of the top lighting and electrical solution providers that strive to ensure quality service and products to its customers across the New York Metro Territory.

Our in-depth analysis of the LED neon lights market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

LED Neon Lights Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is likely to dominate the LED neon lights market and capture a share of 53.2% during the forecast period. Some of the key drivers that add to this growth in the region include rapid urbanization, improved disposable income, and a growing trend toward attractive and energy-efficient lighting solutions. Furthermore, the existence of key manufacturers across the region further complements the growth in the market. China is anticipated to contribute significantly to the Asia Pacific market.

In 2024, China accounted for a 22.6% share of the LED neon lights market which is expected to grow further in the ensuing years. This growth has been attributed to the ongoing urbanization and infrastructural development projects that demand advanced lighting solutions. Moreover, the growing emphasis on sustainability and energy efficiency in China fosters an increased uptake of LED neon lights. For instance, in February 2024, Leyard announced its plan to launch its newest edition of LED display technology and integrated solutions.

India is another prominent contributor to the Asia Pacific LED neon lights market, which holds a 19.5% share during the forecast period. The market is rising due to factors such as an increase in disposable income, expansion in urbanization, and the developing interest in decorative lighting. For example, in April 2023, Signify extended its Philips Smart Wi-Fi ecosystem by introducing new and innovative products in India, such as smart LED downlighters, smart LED filament bulbs, and smart LED neon flex. Companies are developing innovative LED neon lights such as tunable whites, dimmable warm white lights, and millions of color options to suit changing Indian user needs.

North America Market Insights

North America region is projected to register substantial growth through 2035. One primary factor driving the demand in this region is the increasing demand for energy-efficient and bespoke lighting solutions in countries such as the United States and Canada.

Canada’s LED neon lights market is anticipated to hold a 15.1% share during the forecast period and is expected to accelerate further in the coming years. Primary drivers include growing urbanization, increasing disposable income, and improving spending on decorative lighting. Moreover, the rising application of LED neon lights in commercial, residential, and industrial sectors is also one of the primary factors driving market growth.

The U.S. LED neon lights market is set to grow at a stable rate in the forecast period. The presence of major manufacturers in this country, coupled with technological development and product innovation, is likely to further boost the market growth in the U.S. For example, in August 2021, Lucetta, the architectural specification division of Elemental LED declared its cooperation with PG Enlighten, expanding the company's presence in the Chicago lighting specification market.

LED Neon Lights Market Players:

- LED Neon Flex

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elemental LED

- Nova Flex LED

- Solid Apollo LED

- Lightstec

- Elstar

- INCISEON

- Honest Exhibition Limited

- A1designs

- Zhongshan J.M.X Electronics Co., Ltd.

- Beyond LED Technology

The LED neon lights market is highly competitive, with several firms competing to secure a foothold in the market. This has been coupled with tremendous efforts towards technological advancements, product innovation, and competitive pricing. Key players in the market include LED Neon Flex, Elemental LED, Nova Flex LED, Solid Apollo LED, and Lightstec, among others. These companies are making every effort to distinctly differentiate their products with respect to features, designs, and pricing. Firms are further investing in the RD process to enhance the performance, efficiency, and sustainability of respective LED neon lights.

In recent years, strategic partnerships and collaborations have also enhanced the LED neon lights market. These partnerships, therefore, bank on the individual strengths of companies and create opportunities for synergistic growth. For instance, in December 2023, NeonWill, announced their exciting collaboration with inspiration list Valioart, widely known for his lamps-as-animals illustration. This kind of collaboration is seen as one major way through which the competition within the market may further rise when firms strive to forge strategic alliances to gain the upper hand over others. Here are some leading companies in the LED neon lights market:

Recent Developments

- In March 2024, Lepro launched the latest inventions in RGB ambient room decoration, equipped with the world's first LightGPM-powered LED or neon solutions for residential use.

- In February 2024, Razer announced the newest addition to the Sneki Snek collection, a wall-mounted type LED neon gaming light.

- In November 2023, Ikea released its first smart RGB LED light strip in the Netherlands—the Ormanäs. From what can be discerned, it seems to be quite a simple strip and might not have individually addressable LEDs, which are now common in some of the higher-end strips.

- In August 2023, ORANT NEON launched a new line series of custom LED Neon signs. Tailor-made to bring the most outstanding quality and brilliant designs into reality, this series is about to transform personal and commercial lighting environments.

- Report ID: 5674

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

LED Neon Lights Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.