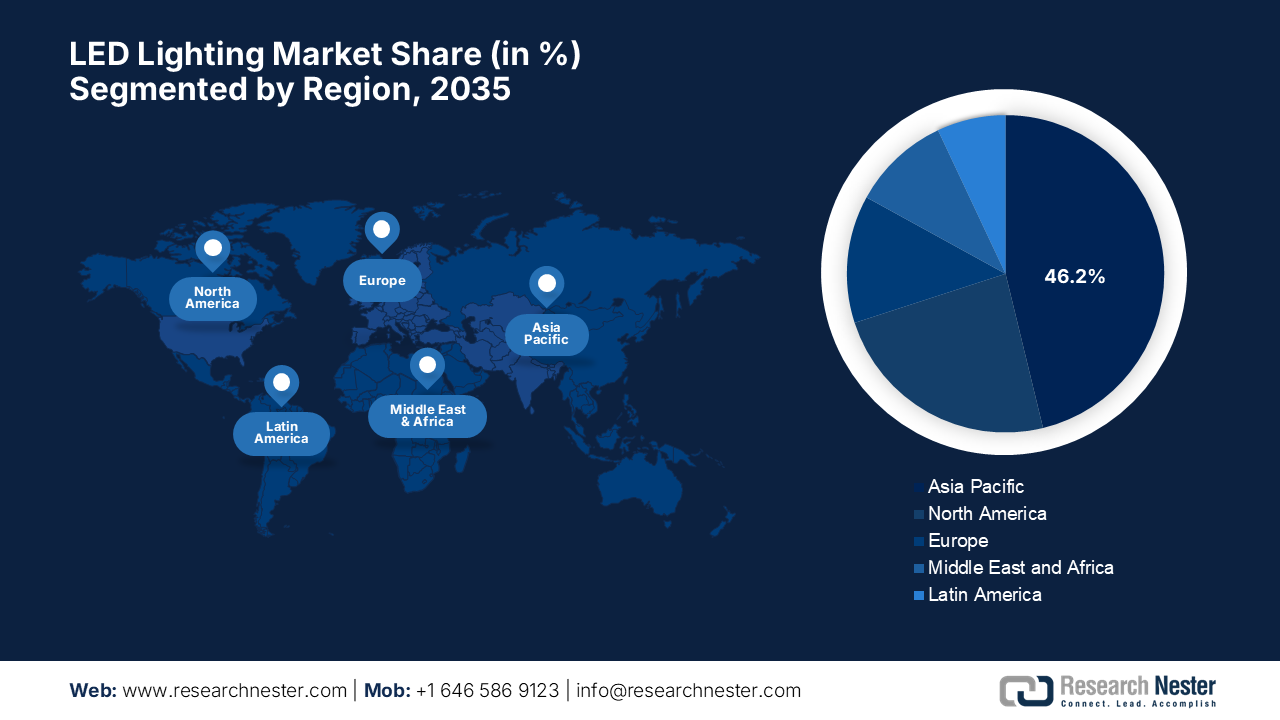

LED Lighting Market - Regional Analysis

APAC Market Insights

Asia Pacific is predicted to capture the largest revenue share of 46.2% in the global market over the forecasted years. The region’s dominance in this field is supported by infrastructure projects across prominent countries and governments' energy-saving mandates. Also, the expanded utilization of smart home solutions is fostering a profitable business environment for pioneers in this field. In November 2025, Itron, Inc. announced that it had partnered with Connected Lighting Solutions (CLS) in Australia to expand smart lighting infrastructure through the Itron Engage sales channel partner program. In this regard, CLS will leverage its domestic expertise in LED street lighting to deploy Itron’s networked lighting controller hardware and CityEdge software platform, thereby enabling advanced capabilities such as remote monitoring, adaptive schedules, and real-time outage detection. In addition, this collaboration also aims to improve urban lighting efficiency, reduce emissions, and support councils and utilities in transitioning to connected smart streetlights nationwide.

China is representing strong dominance over the regional landscape of the LED lighting market since it hosts extensive infrastructure investments, governmental focus on phasing out inefficient lighting. The country also benefits from its massive manufacturing ecosystem that supports both domestic deployment and export of LED products on an international scale. Signify, in August 2023, announced that it had inaugurated its largest LED lighting manufacturing facility in Jiujiang, China, through its joint venture with Klite, which is producing high-quality LED lamps and luminaires for both domestic and international markets. Besides, the company also highlighted that this is a 200,000-square-meter factory that hosts advanced manufacturing, automation, and intelligent logistics to enhance both innovation and sustainability in production. Hence, this strategic expansion strengthens Signify’s global supply chain, supports China’s sustainability goals, and reinforces the company’s leadership in the market.

India market is efficiently growing due to the presence of national programs such as the Smart Cities Mission and energy efficiency campaigns such as UJALA, which have significantly increased LED adoption in households and public projects. On the other hand, rising residential construction and demand for affordable LED fixtures across urban and rural areas are also propelling a profitable business environment. According to the article published by the Ministry of Commerce & Industry in January 2025, the country’s government under the PLI Scheme for White Goods has selected 24 companies in the third round to invest Rs. 3,516 crore (approximately USD 423.37 million) in manufacturing components for ACs and LED lights, thereby enhancing domestic production capabilities. Besides, this initiative is a part of a broader program involving 84 companies with total investments of Rs. 10,478 crore (approximately USD 1.26 billion) that are collectively aiming to strengthen the component ecosystem, boost domestic value addition, and integrate the country into global supply chains.

Applicants Provisionally Selected in the 3rd Round of PLI Scheme for White Goods (LED Lights) with Committed Investment in INR and USD FY 2021‑23

|

Applicant Name |

Eligible Products |

Committed Investment (Rs. Crore) |

Committed Investment (USD Million) |

|

Ikio Solutions Private Limited |

LED Modules, Mechanical Housing, LED Transformers, LED Light Management Systems (LMS), LED Engines, LED Drivers, Heat Sinks, Diffusers |

41.00 |

493.98 |

|

Lumax Industries Limited |

LED Drivers |

60.00 |

722.89 |

|

Neolite ZKW Lightings Private Limited |

LED Modules |

23.66 |

285.06 |

|

Dhruv Industries Limited |

Metallized film for capacitors |

16.00 |

192.77 |

|

Uno Minda Limited |

LED Drivers, PCB including Metal Clad PCBs, LMS, Ferrite Cores, Diffusers, Heat Sinks, Drum Cores, Wire Wound Inductors, Mechanical Housing, LED Modules, LED Engines, LED Chips |

19.82 |

238.67 |

|

HQ Lamps Manufacturing Co. Private Limited |

LED Drivers, Mechanical Housing |

10.00 |

120.48 |

|

Intelux Electronics Private Limited |

LED Driver, LED Modules, LED Engines, PCB including Metal Clad PCBs, LED Light Management System, LED Transformers |

51.50 |

620.48 |

|

Hella India Automotive Private Limited |

LED Drivers |

17.84 |

214.94 |

Source: Ministry of Commerce & Industry

North America Market Insights

North America is efficiently growing in the global LED lighting market owing to the presence of key market players who are introducing smart lighting solutions. These smart solutions are automated, and they can be monitored through mobile applications or additional connected devices, thereby enabling remote operations as well. In this regard, Lumileds in September 2024 announced that it has launched the LUXEON 5050 HE Plus LEDs, which deliver 199 lumens per Watt and reduce power consumption by over 18% for outdoor and industrial lighting applications. The firm notes that these high-efficiency LEDs support sustainability goals by reducing material usage in heatsinks and drivers, and enabling low-carbon or off-grid lighting solutions. The product also features advanced thermal management, precise flux binning, and robust packaging, wherein the LUXEON 5050 HE plus offers superior performance for municipal, commercial, and industrial lighting.

The U.S. is the powerhouse of innovations in the market, which strongly benefits from a vast consumer base. The country’s consumer pool prefers smart home systems that are compatible with different platforms. In December 2025, Cree LED announced that it had partnered with SANlight to integrate its J series LEDs into SANlight’s new STIXX-Series horticulture luminaires, delivering up to 3.1 μmol/J efficiency and lifetimes exceeding 53,000 hours. The modular, space-saving fixtures also feature advanced optics, uniform light distribution, and IP68-rated protection for a very reliable performance in diverse growing environments, including vertical farming. In addition, this collaboration combines Cree LED’s technology leadership with SANlight’s expertise in photobiology to optimize plant growth and yield for commercial and home growers, hence contributing to overall market growth.

Canada has a huge opportunity to capitalize on the regional LED lighting market effectively, attributable to government policies requiring energy efficiency labeling. Urban infrastructure projects in major cities and increasing integration in various sectors, including agriculture, support the rising demand for LED lighting. In August 2025, Aelius LED, which is a Canada-based horticultural lighting company, announced that it had launched a rebate kick-back program for licensed cultivators in British Columbia and Ontario, offering up to 10% extra per rebated fixture through provincial energy rebate programs such as BC Hydro, FortisBC, and Save on Energy. This program allows participants to receive benefits as cash, future credits, additional fixtures, or pass the value to their customers, with no cap on total rewards. The program ran until November 7, 2025, and the initiative aimed to help growers maximize rebates, invest in energy-efficient LED lighting, hence indicating a positive market outlook.

Europe Market Insights

Europe is yet another dominant force in the global LED lighting market that is constantly promoting energy conservation. The region focuses on reducing e-waste, wherein the market is positively influenced by stringent regulations and eco‑design directives that phase out inefficient lighting technologies. According to the article published by the government of the UK in January 2023, under the Department for Business, Energy & Industrial Strategy, it announced a few proposals to raise minimum energy performance standards for lighting across Great Britain. The initiative aims to make homes and businesses more energy-efficient by ensuring only high-efficiency lighting, such as LED bulbs, is available, potentially saving households around £2,000-£3,000 (approximately USD 2,400 to 3,600) over the bulbs’ lifetime. The government expects reductions in energy usage and up to 1.7 million tonnes of carbon emissions by 2050. These proposals complement broader energy efficiency programs, including the ECO4 and ECO+ schemes, the public sector decarbonisation scheme, and the It all adds up campaign.

In Germany, the LED lighting market benefits from environmental standards and industrial leadership in technology innovation. The aspects of high electricity costs drive fast retrofits in commercial infrastructure, whereas the smart building deployments and energy performance contracting enhance LED integration in industrial as well as residential segments. In this context, LEDVANCE in January 2025 announced the acquisition of Germany-based lighting company loblicht to enhance its portfolio with high-quality design luminaires for workspaces, offices, and public spaces. Besides, this move strengthens the firm’s project expertise and global brand offerings, leveraging loblicht’s reputation for innovation and lighting solutions. Furthermore, Loblicht will benefit from LEDVANCE’s international footprint and customer network, hence creating new growth opportunities.

In the U.K., the LED lighting market is backed by green building practices and domestic government initiatives, which are encouraging LED replacements and smart lighting networks. Commercial modernization projects and urban lighting upgrades in the country also contribute to a dynamic market landscape. For instance, in July 2025, Anglia Components announced that it had entered into a franchise agreement with Lifud Technology, which is one of the most prominent manufacturers of high-quality LED drivers. Besides, this partnership allows Anglia to pair its LED lighting products with Lifud’s wide range of driver modules, thereby promoting both energy efficiency and sustainability. In addition, Anglia represents its commitment to green initiatives, including reduced product miles, recyclable packaging, and smart premises facilitation, whereas Lifud highlighted its focus on technology, quality, and building a collaborative ecosystem.