LED Backlight Driver Market Outlook:

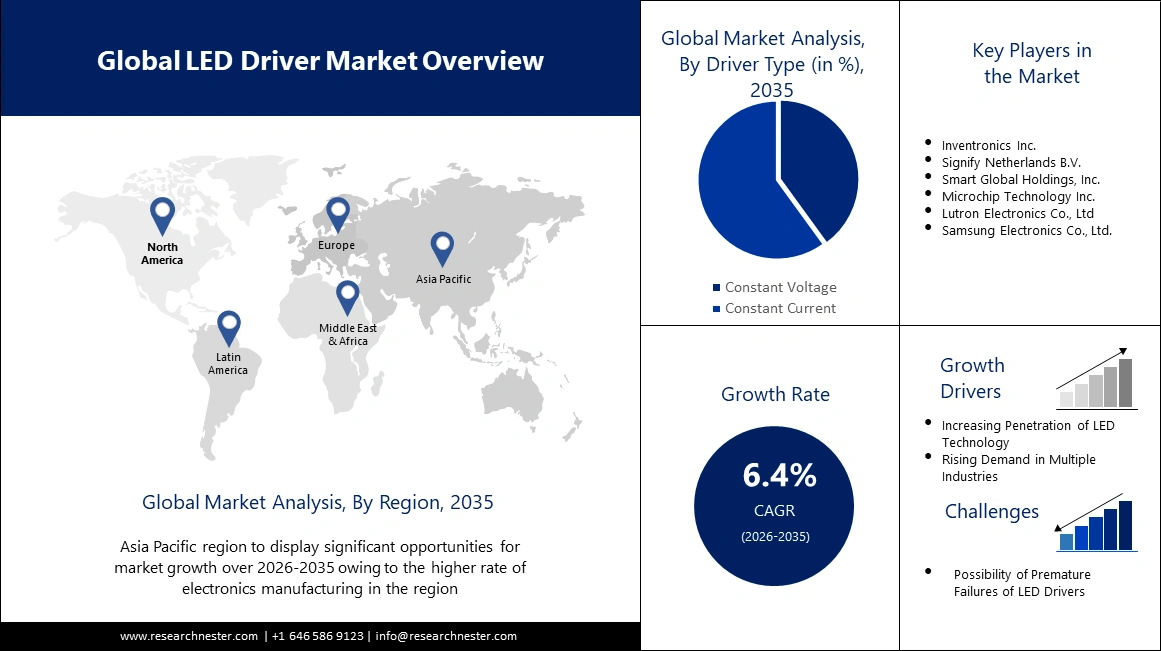

LED Backlight Driver Market size was valued at USD 5.15 billion in 2025 and is set to exceed USD 9.58 billion by 2035, expanding at over 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of LED backlight driver is evaluated at USD 5.45 billion.

The growing need for energy-efficient lighting solutions is expected to boost global LED backlight driver market growth during the forecast period. LED backlighting has become the go-to option for several applications as sustainability and energy efficiency has become crucial. For instance, in January 2024, Sony demonstrated notable improvements in brightness and power economy when it revealed its cutting-edge mini-LED backlight technology. A miniature integrated circuit driver in the new technology allows for fine control over dimming levels, enhancing image quality while using less electricity.

Another significant factor fueling the expansion of the LED backlight driver market is the rapidly growing consumer electronics sector. Rising customer preference for gadgets with excellent visual capabilities and high-quality screens has significantly increased the demand for advanced LED backlight drivers. These LED backlight drivers offer better user interfaces, power savings, and superior visual experiences and are crucial for managing the illumination of touchscreen displays and improving their visibility and readability.

Key LED Backlight Driver Market Insights Summary:

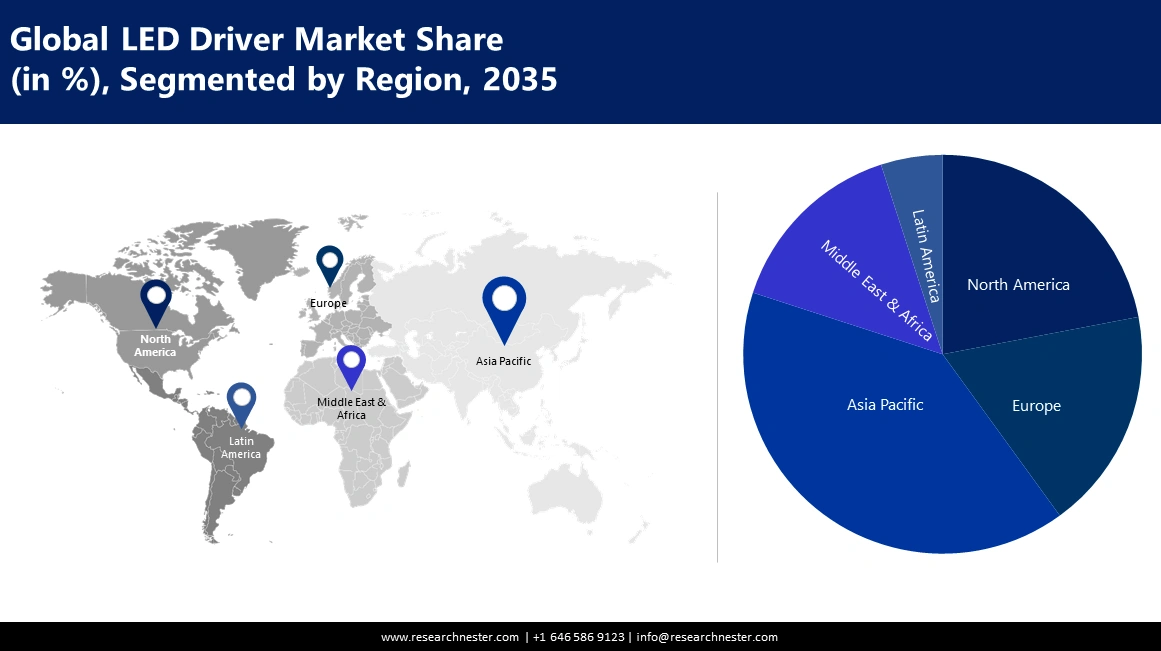

Regional Highlights:

- North America commands a 35.2% share of the LED Backlight Driver Market, fueled by rapid advancements in LED backlight technology, supporting strong growth through 2026–2035.

- Asia Pacific’s LED backlight driver market is set for stable growth by 2035, driven by availability of advanced LED backlight drivers and rising demand for energy-efficient products.

Segment Insights:

- The Consumer Electronics segment is expected to hold a significant market share by 2035, driven by the widespread adoption of LED lighting in TVs and smartphones.

- The Constant Current LED Drivers segment of the LED Backlight Driver Market is projected to hold over 40.3% share by 2035, driven by the growing need for energy-efficient lighting in electronics and automotive sectors.

Key Growth Trends:

- Growing need for energy-saving technologies

- Technological Developments in LED technology

Major Challenges:

- Intricate technical procedures

- High initial cost

Key Players: Analog Devices, Inc., Infineon Technologies, Maxim Integrated, NXP Semiconductors, Diodes Incorporated, ON Semiconductor, STMicroelectronics, and Texas Instruments.

Global LED Backlight Driver Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.15 billion

- 2026 Market Size: USD 5.45 billion

- Projected Market Size: USD 9.58 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 14 August, 2025

LED Backlight Driver Market Growth Drivers and Challenges:

Growth Drivers

- Growing need for energy-saving technologies: The global market is driven by the growing need for sustainable solutions and the increased emphasis on energy conservation. Both consumers and businesses are becoming aware of their energy usage due to rising energy prices and programs to lower carbon footprints. Since LED technology is significantly more efficient than conventional lighting options, it provides a significant advantage.

- Technological Developments in LED technology: Rising innovations that incorporate IoT capabilities, including the creation of Smart LED technologies is a key factor expected to drive global market growth. These developments significantly enhance the user experience across a range of applications, from smartphones to televisions, by enabling more effective power management, dimming capabilities, and brightness and color temperature control.

For instance, in November 2021, Allegro MicroSystems, Inc., announced the expansion of its automotive lighting portfolio with the addition of a new product for advanced driver assistance system (ADAS) applications. The A80803 is a unique product that uses patented intellectual property and multi-topology conversion to facilitate seamless high/low/high beam transitions in a single IC.

Challenges

-

Intricate technical procedures: Complex technical procedures are involved in the design and production of LED backlight drivers. This intricacy results from the requirement to manage heat dissipation, integrate precise control systems, and guarantee compatibility with a range of display technologies. Complex integrated circuits and advanced engineering are needed for high-performance backlight drivers to offer the best possible brightness, color accuracy, and dimming control. Some manufacturers may find it more difficult to innovate or effectively compete in the market as a result of this technological obstacle, which can also result in increased development and manufacturing expenses.

- High initial cost: When compared to conventional lighting technologies, LED backlight systems might have a substantially higher initial cost. This pricing covers the cost of incorporating sophisticated backlight drivers and accompanying parts in addition to the cost of the LEDs. Although LED technology saves money over time by being more energy efficient, some consumers and businesses may be put off by the initial outlay, especially those on a limited budget or undertaking technological changes for the first time.

LED Backlight Driver Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 5.15 billion |

|

Forecast Year Market Size (2035) |

USD 9.58 billion |

|

Regional Scope |

|

LED Backlight Driver Market Segmentation:

Type (Constant Current LED Drivers, Constant Voltage LED Drivers, Others)

The constant current LED drivers segment is estimated to hold LED backlight driver market share of over 40.3% by the end of 2035. The demand for constant current LED drivers rises as sectors including consumer electronics, automotive, and ambient lighting place a greater emphasis on high-quality and energy-efficient lighting solutions. In March 2023, Cree LED unveiled the J Series 5050C, an E-Class LED that achieves 228 lumens per watt (LPW) at 70 CRI, 4000K, and 1W, the highest efficacy in the industry for high-power LEDs. These cutting-edge LEDs may produce up to three times as much light as rival 5050 LEDs while yet being just as effective. The reason constant current LED drivers are so popular is that they maintain a steady forward current regardless of changes in the input voltage.

Application (Consumer Electronics, Automotive, Industrial, Signage, Others)

The consumer electronics segment in LED backlight driver market is likely to hold a significant share by the end of 2035 due to the growing use of TVs and smartphones across the globe and the high usage of advanced LED backlight drivers in modern electronics. The increasing need for energy-efficient lighting in the consumer electronics sector has encouraged users to switch to LED lighting. As solid-state lighting (SSL) requires no upkeep and can provide steady brightness effectively, it offers a strong value proposition and return on investment. This led to the replacement of traditional light sources by LED illumination, including incandescent light bulbs and compact fluorescent lamps (CFLs).

Our in-depth analysis of the market includes the following segments

|

Type |

|

|

Technology |

|

|

Output Power |

|

|

Form Factor |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

LED Backlight Driver Market Regional Analysis:

North America Market Analysis

North America LED backlight driver market is anticipated to account for revenue share of around 35.2% by 2035 owing to rapid advancements in LED backlight technology, presence of key manufacturers, and rising sales of electronics and displays. Companies in the region are also heavily investing in R&D activities. For instance, in June 2024, Melexis announced the launch of MLX81123, an addition to its LIN RGB series. This product is expected to increase competitiveness and guarantee business continuity for its clients by utilizing a new supply chain.

The U.S. is one of the largest LED backlight driver market in North America. One major factor driving the widespread use of high-definition and ultra-high-definition screens in consumer devices is the need for complex backlighting systems to improve visual quality. The demand for sophisticated backlight drivers is also being increased by the U.S. car industry's growing integration of LED technology into dashboard displays and infotainment systems, among other vehicle components.

The market is expanding due to the presence of reputable semiconductor manufacturers in Canada as well as a rise in R&D activity. Growing environmental concerns and the demand for energy-efficient systems are also driving the LED backlight driver market.

Asia Pacific Market Analysis

Asia Pacific LED backlight driver market is expected to experience a stable CAGR during the forecast period. Sales of LED backlight drivers are expected to rise due to the availability of advanced LED backlight drivers, and rising customer preference for energy-efficient goods. The demand for LED backlight drivers has increased significantly in recent years as a result of the growing use of LED instruments in numerous industries and the pervasiveness of consumer electronics goods.

China's vast consumer goods and electronics industries are driving the LED backlight driver market growth in this country. Advanced LED backlight drivers are in great demand due to the increasing domestic consumer electronics consumption and the move toward higher-resolution displays, like 4K and 8K. Moreover, increasing use of LED technology for external and interior lighting in China's expanding automobile sector is expected to boost LED backlight driver market growth in the coming years.

Due to the country's high rate of consumer electronics adoption and sophisticated technology sector, the South Korea market for LED backlight drivers is expanding quickly. One important factor is the nation's emphasis on innovation, particularly in the areas of display technology and high-resolution screens. OLED and high-dynamic-range (HDR) technologies are two of the cutting-edge display solutions being researched by South Korean businesses; these technologies necessitate advanced backlight drivers.

Key LED Backlight Driver Market Players:

- ACE LED

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Analog Devices, Inc.

- Infineon Technologies

- Maxim Integrated

- NXP Semiconductors

- Diodes Incorporated

- ON Semiconductor

- STMicroelectronics

- Texas Instruments

The LED backlight driver market has been expanding significantly as a result of the growing need for high-quality, energy-efficient display technologies for a variety of devices, including monitors, smartphones, tablets, and televisions. The LED backlight driver market has become more competitive as manufacturers work to improve customers' visual experience while using less energy. Key players in the market are focused on developing advanced solutions and expanding their product base through several strategies such as mergers and agreements, acquisitions, partnerships, product launches, and license agreements.

Here are some leading players in the LED backlight driver market:

Recent Developments

- In August 2024, Diodes Incorporated introduced the AL58221, a new 12-channel, constant-current LED driver. It has twelve 24V-rated open-drain outputs that can sink up to 60mA of high-accuracy current with a quick transient response. The usual tolerance for the regulated output current is ±0.1%, and the accuracy of the LED current from channel to channel is ±1%.

- In April 2023, ACE LED declared the Mini-Rail Constant Power Linear Emergency LED Driver's release. Weighing 0.83" high and 1" broad, it is the smallest LED driver in the industry. The Mini-Rail features an incredibly efficient LiFePO4 battery, an isolated relay driver, and a broad output voltage range. While providing consistent power for more than 90 minutes in emergencies, it provides creative solutions for various lighting applications.

- Report ID: 6621

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

LED Backlight Driver Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.