Lead Mining Software Market - Growth Drivers and Challenges

Growth Drivers

- AI agents for autonomous prospecting: Predictable and timely follow‑up at the top of the funnel is needed by organizations to prevent leakage and impose SLAs. This is driving the adoption of agentic AI that captures inbound interest, qualifies, and automates scheduling. In September 2024, Salesforce previewed Winter ’25 features including Agentforce SDR Agent to automatically engage inbound leads, qualify, and schedule meetings. This institutionalizes first‑touch consistency and expands coverage without incremental headcount. Consequently, teams can redeploy human effort to complex selling while maintaining uniform first‑response quality.

- Content‑to‑activation supply chains: Enterprises are compressing the distance between creative production and performance feedback to scale winning variants quickly. This connection enables audiences and creatives to co‑evolve in regulated workflows. In April 2024, Adobe rolled out Frame.io V4 to speed up creative collaboration, review, and approvals for marketing content, enabling faster production for best‑of‑funnel assets. This increases iteration cycles per week and enhances conversion efficiency on measurable timelines. Subsequently, merging content and activation fuels lasting gains in qualified pipeline and channel ROI.

- Integrated, data‑rich GTM platforms: Key players in the market are converging enrichment, intent, identity, and activation to implement uniform scoring and eligibility across teams. This eliminates reconciliation mistakes that prolong revenue cycles. In September 2024, HubSpot released Breeze and Copilot with AI agents for content and prospecting, and Breeze Intelligence introduced enrichment, buyer intent, and form shortening that auto‑updates Smart CRM. This enhances intake quality and reduces time‑to‑value for high‑fit prospects. As a result, streamlined stacks advance governance, predictability, and revenue throughput.

AI-Driven Efficiency Gains in Sales/Marketing

Reflexive decision-making demands tools that deliver real-time lead intelligence, automate prioritization, and integrate seamlessly with CRM workflows. Lead mining software bridges the gap between data and action, enabling sales teams to engage prospects instantly while providing strategic insights for faster reflective decisions.

|

Initiative |

Efficiency Gain |

|

AI-Powered Lead Prioritization |

40% increase in sales productivity e.g., Microsoft’s "Daily Recommender" |

|

Real-Time Territory Redistribution |

Reduced planning cycles from annual to just-in-time, e.g., biopharma case |

|

Automated Campaign Execution |

Milliseconds to optimize outreach e.g., AdTech platforms |

|

Rapid Implementation Timelines |

9 months → 2 months for sales force restructuring e.g., high-tech company |

Source: HBR

Source: UNCAD

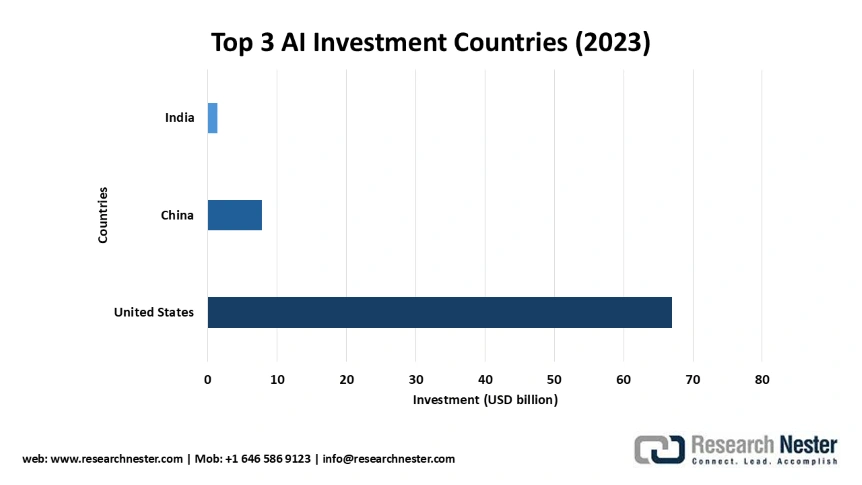

Dominant AI investment in the U.S. directly accelerates innovation in lead mining software, enabling advanced features like predictive lead scoring, natural language processing for intent signals, and seamless CRM integrations. Meanwhile, investments in China and India foster competitive, cost-efficient AI tools for globalized lead generation and outsourced sales operations, expanding market access and functionality for businesses worldwide.

Challenges

- Privacy, provenance, and policy drift: International buyers confront a patchwork of privacy regulation and tight controls on sensitive information that make cross‑border enrichment difficult. This sets a higher standard for transparent profiling, minimization, and clear opt‑outs in prospecting. The California Attorney General released updated CCPA materials in March 2024 that explained rights to know, delete, correct, and restrict use of sensitive information. This creates demand for platforms that demonstrate a lawful basis and have jurisdiction‑conscious audit trails. As a result, providers need to architect policy‑conscious pipelines that scale to international operations.

- Misuse risk from surveillance technologies: Public scrutiny of commercial spyware raises the stakes for defining ethical enrichment and intrusive surveillance. Purchasers increasingly demand evidence of consent, provenance, and purpose limitation throughout data use. In March 2023, the U.S. and allies released a joint statement to push back against abuse of commercial spyware, announcing tighter controls and rights‑respecting norms. This lifts governance to a competitive imperative and not merely an add‑on. In practice, apparent safeguards and open processing are core to vendor choice.

Lead Mining Software Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 17.4 billion |

|

Regional Scope |

|