Lead Mining Software Market Outlook:

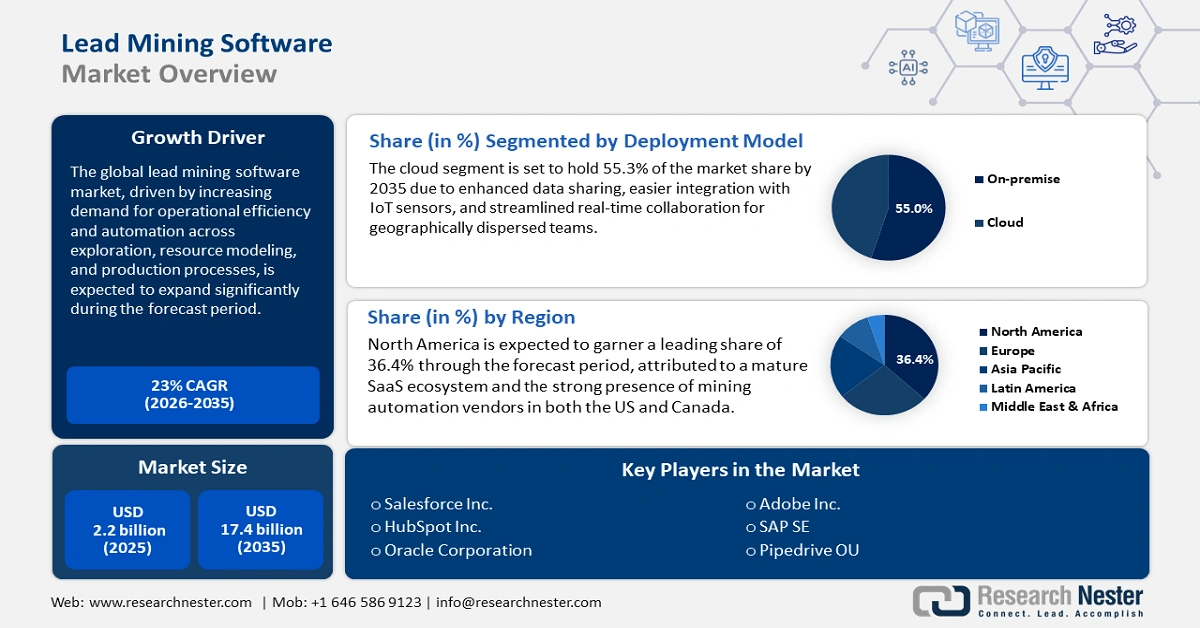

Lead Mining Software Market size is valued at USD 2.2 billion in 2025 and is projected to reach a valuation of USD 17.4 billion by the end of 2035, rising at a CAGR of 23% during the forecast period, i.e., 2026-2035. In 2026, the industry size of lead mining software is estimated at USD 2.7 billion.

The lead mining software market is expanding owing to the transition from siloed tools to AI-native, single-stack growth platforms that convert top-of-funnel intent into qualified opportunities with lower handoffs and tighter governance. One of the main drivers of growth is the merging of content, targeting, and measurement into one loop that increases experimentation and activation. In May 2024, Salesforce announced Einstein 1 Marketing and Commerce innovations to automate the creation of briefs, the generation of content, and promotions for more effective inbound capture and conversion. This aligns creative iteration directly with governed activation to increase lead capture and conversion speed at scale. As orchestration constricts, platforms that execute on this loop will be able to maintain accelerated test–learn cycles and better acquisition economics.

Privacy expectations are driving product design to consent provenance and responsible enrichment that are built into go‑to‑market implementation. To enable compliant activation, providers are formalizing lawful bases, retention windows, and opt‑out treatment within capture and scoring processes. The U.S. Federal Trade Commission in April 2024 updated its portals of guidance on privacy and data security to enterprises, reaffirming consumer data protection obligations. This keeps outreach and enrichment policy‑informed as campaigns grow regionally and channel‑specific. Consequently, buyers prefer tools that have verifiable consent trails, auditable processing, and clear governance.