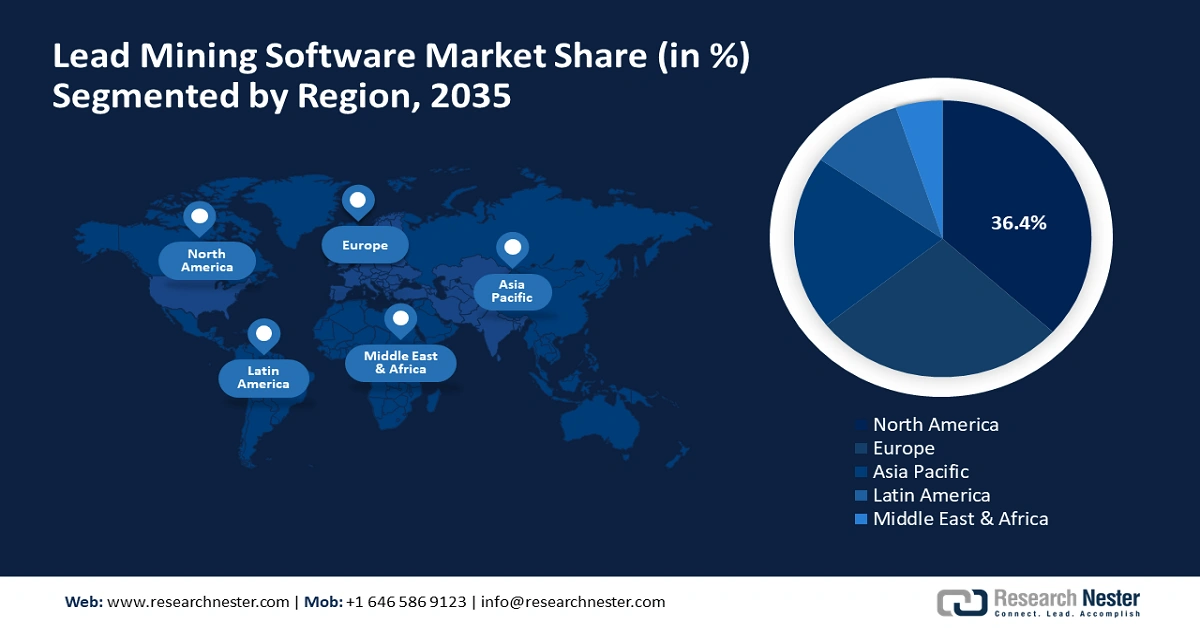

Lead Mining Software Market - Regional Analysis

North America Market Insights

North America is expected to hold a 36.4% market share during the forecast period, with vendor density, early adoption of agents, and established RevOps practices as anchors. Lifecycle validation and safety testing before scaling automation across teams is a categorical requirement. In November 2024, Salesforce released Agentforce Testing Center to assess agents with simulated data prior to deployment, enhancing governance and dependability at scale. This aligns with North America's risk posture and speeds production‑grade adoption. Therefore, agent deployments are growing with more robust assurance frameworks.

The U.S. is anticipated to lead by combining bold AI roadmaps with compliant privacy and security guardrails that inform procurement. A recurring buyer requirement is elevation coupled with auditability and minimization criteria for targeting and profiling. In October 2024, Salesforce GA highlighted agents working across sales, service, marketing, and commerce, managing tasks beyond chat with accuracy and context. This trend keeps U.S. deployments at the leading edge of compliant automation. Therefore, U.S. programs tend to be a model of reference for worldwide scale‑outs.

Canada's contribution is predicted to increase as policy clarity and secure‑digital‑economy goals facilitate compliant analytics. An example national driver is to focus on privacy‑protective data environments and cybersecurity readiness, influencing enterprise GTM. In January 2025, the U.S. Department of Justice completed national security protections limiting bulk transfers of sensitive personal information to countries of concern, a cross-border message that companies in Canada commonly take into account while architecting governed data streams. As a result, compliant, consolidated platforms are poised to grow across mid-market and enterprise accounts as policy-aligned operations become table stakes.

APAC Market Insights

The lead mining software market in Asia Pacific is projected to register a CAGR of 37% from 2026 to 2035, driven by mobile‑first buyers, accelerated SaaS penetration, and e‑commerce scale. A real‑world enabler is streamlined, integrated stacks that minimize deployment and maintenance overhead for lean teams. This enables rapid wins in rapidly expanding APAC markets with constrained ops capacity. As a result, integrated SaaS platforms will be expected to take outsized share where agility is the determinant.

China is predicted to dominate a large percentage of APAC due to localization, platform ecosystems, and controlled access patterns for agent execution. A key policy trend shaping enterprise adoption is the state’s move to standardize safety, labeling, and filing obligations for AI services before they scale broadly. In mid‑March 2025, Chinese regulators adopted Measures for Labeling of AI‑Generated Synthetic Content that require explicit or metadata‑based labels on AI‑generated text, audio, images, and video, effective September 1, 2025. Consequently, partnerships and deployments that demonstrate policy‑grade controls and filing compliance are best positioned to capture share in China’s governed, high‑scale market.

India is expected to garner stable growth with digital‑first SMEs and large IT‑led businesses ramping up compliant acquisition. A procurement determinant is consent provenance and grievance workflows in terms of national regulations. For example, India released the Draft Digital Personal Data Protection Rules in February 2025 to bring into operation the DPDP Act, 2023, enhancing informed consent, erasure rights, and redressal. Therefore, suppliers with consent-conscious enrichment and verifiable journeys are likely to drive adoption in enterprise and upper-mid markets.

Europe Market Insights

Europe lead mining software is poised to record steady growth from 2026 to 2035, characterized by GDPR caution and explainable, AI-governed preference. An ongoing buyer requirement is platforms with retention controls, purpose limitation, and consent proof to maintain long-term compliance. Furthermore, a favourable policy environment encourages vendors to capture data handling and decision logic end‑to‑end. Therefore, adoption is quantified yet tenacious, with long‑term vendor partnerships driving Europe market expansion.

Germany is expected to retain a leading position across Europe, thanks to its industrial B2B foundation and strict bar for reliability and auditability. Buyers in Germany are prioritizing sovereign digital infrastructure, secure data flows, and lifecycle‑assured automation as federal policy sharpens around digital sovereignty and infrastructure acceleration. In June 2025, Germany's governing coalition passed legislation attributing “preeminent public interest” to fiber and mobile broadband expansion through 2030, streamlining approvals and planning, and reinforcing the national push for a sovereign administrative cloud and stronger cybersecurity oversight.

The UK is predicted to contribute to the sustained growth of Europe through 2035 by fusing innovation with enhanced governance and identity confirmation. Customers ask for quick yet compliant experimentation that does not sacrifice auditability in lead activities. In March 2024, the UK government published the Digital Development Strategy 2024–2030, setting measurable priorities for secure data sharing, standards adoption, and identity assurance across public programs to accelerate trusted digital transformation. This direction strengthens demand for lead operations that preserve auditability and consent provenance while enabling agile testing of audiences and creative.