Lawn Mowers Market Outlook:

Lawn Mowers Market size was valued at USD 25.31 billion in 2025 and is set to exceed USD 48.87 billion by 2035, registering over 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lawn mowers is estimated at USD 26.86 billion.

The key driver of the lawn mowers market's growth is the rising need for green areas and maintaining them. As more people move into cities, the call for parks, gardens, and public spaces goes up. Lawn mowers are crucial in maintaining these green spots, making them vital for the landscaping industry. Also, the increase in green spaces and the booming demand for landscaping services fuel the market's steady rise.

The worldwide lawn mowers market is set to see notable growth in the near future. The market bounced back to its pre-COVID levels in 2021, thanks to a surge in demand for battery-powered lawn mowers, especially in North America and Europe. The market is constantly evolving, with new features and models being introduced to stay eco-friendly. The demand for lawn mowers is shaped by factors like the growth of green spaces, weather patterns, and more time spent on gardening tasks.

Key Lawn Mowers Market Insights Summary:

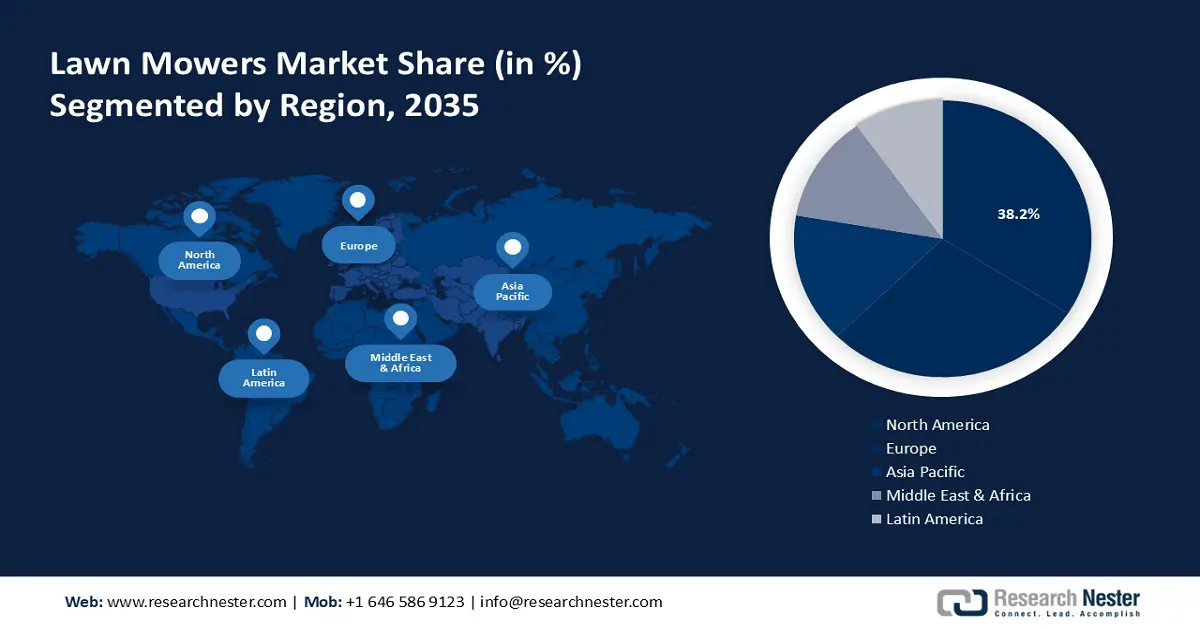

Regional Highlights:

- North America lawn mowers market will hold more than 44% share by 2035, driven by increased spending on garden activities and lawn care.

Segment Insights:

- The electric (power type) segment in the lawn mowers market is projected to achieve a 87% share by 2035, driven by eco-conscious consumers and advancements in battery tech.

- The residential segment in the lawn mowers market is expected to capture a 63% share by 2035, attributed to DIY yard care trends and increased residential landscaping.

Key Growth Trends:

- Growth of the Landscaping Industry

- DIY Trends and Gardening Based Hobbies

Major Challenges:

- Supply Chain Issues

- Environmental Regulations

Key Players: Deere & Company, The Toro Company, Husqvarna AB, MTD Products Inc., Ariens Company, Honda Power Equipment, Kubota Corporation, Briggs & Stratton, LLC, STIHL Holding AG & Co. KG, Robomow (Miimo by Honda).

Global Lawn Mowers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.31 billion

- 2026 Market Size: USD 26.86 billion

- Projected Market Size: USD 48.87 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Lawn Mowers Market Growth Drivers and Challenges:

Growth Drivers

-

Growth of the Landscaping Industry - The landscaping services sector is on an upswing, fueled by more building work in the commercial space. This surge is pushing up the demand for commercial lawn cutters, particularly across the Americas and Europe. The introduction of cutting-edge technology in golf courses and big parks is further driving lawn mowers market growth. The expansion in commercial building isn't just a boon for construction; it's creating ripple effects in related sectors such as landscaping. Businesses are investing in well-kept outdoor spaces to attract customers and create a positive work environment, highlighting the importance of commercial-grade lawn equipment.

-

DIY Trends and Gardening Based Hobbies – The DIY trend is catching on fast, bringing more homeowners into the fold of lawn care activities. This shift is having a positive impact on the lawn mowers market. The DIY culture has democratized lawn maintenance. It's no longer seen as a chore or an outsourced service. Instead, it's becoming a form of leisure and self-expression for many homeowners. This mindset shift is significantly influencing consumer behavior, with people opting more for products that enable them to maintain their lawns efficiently and enjoyably.

-

Remote Work and Flexible Hours - As remote work and flexible hours become more common, people find they have extra time for hobbies like gardening. This change is helping the residential lawn mowers segment grow. the global work-from-home phenomenon has altered daily schedules. The newfound flexibility means individuals can allocate time for personal care and home improvement projects, including gardening. This development is unlikely to reverse soon, suggesting a sustained demand for residential lawn mowers.

Challenges

-

Supply Chain Issues - The lawn mowers sector, like many others, has faced supply chain issues. Landscaping pros and suppliers are dealing with shortages of raw materials and delays in getting trucks and gear. Plus, costs are going up. These hurdles can halt production and slow down delivery, making it hard to satisfy orders and meet customer needs on time.

-

Environmental Regulations - The industry is also under the lens for its environmental impact. Gas mowers pollute the air and are noisy, pushing a demand for greener options. Authorities have set emission limits for small motors, and there's a call for tougher rules on these machines. lawn mowers market must shift towards more eco-friendly mowers to align with these demands and customer expectations.

Lawn Mowers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 25.31 billion |

|

Forecast Year Market Size (2035) |

USD 48.87 billion |

|

Regional Scope |

|

Lawn Mowers Market Segmentation:

Product Type Segment Analysis

Robotic segment is projected to hold lawn mowers market share of more than 42.6% by 2035. The segment growth can be attributed to increased urbanization, a desire for easy and quick lawn care, and the use of smart technology. These mowers work best for small to mid-size lawns. It's expected that the robot mowers market will grow beyond USD 3.5 billion by 2035. Quick and efficient solutions are in high demand, leading to a rise in the adoption of robotic mowers. These devices are perfect for handling smaller lawns, fitting seamlessly into the fast-paced urban lifestyle. In the residential realm, there's a noticeable trend towards these mowers, especially in the more cost-effective range. This has propelled the residential sector to the forefront of the robotic mowers market.

Power Type Segment Analysis

In lawn mowers market, electric segment is likely to capture revenue share of over 87% by 2035. The segment growth is because of the increasing need for eco-friendly practices, cutting down on emissions, and the call for quieter, more efficient ways to cut grass. The appeal for battery-run mowers comes from longer-lasting batteries, affordable prices, and a shift towards gear that cuts down on pollution. Electric mowers come in two types: with cords and without. The kind without cords is becoming more favored because they're easy to move around with.

End Users Segment Analysis

By the end of 2035, residential segment is expected to account for lawn mowers market share of more than 63%. The segment growth can be attributed to the vast number of homes with yards and gardens, a growing interest in DIY yard care, and the low cost and ease of use of push mowers for home use. The residential market was worth USD 17 billion in just 2022. This sub segment is likely to stay at the top due to more homeowners looking to improve their outdoors and a higher need for easy-to-use and effective mowers. Non-residential lawn mowers, which include business and public use, is pushed forward by more business places being built and the need for good yard care tools.

Our in-depth analysis of the lawn mowers market includes the following segments:

|

Product Type |

|

|

Power Type |

|

|

End Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lawn Mowers Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 44% by 2035. The market growth in the region is attributed to the boost in spending on garden activities which has led to more people buying lawn mowers. The trend of making backyards look better in North America has pushed up the need for these machines, mainly for keeping lawns and gardens in shape. A lot of homes in North America have small gardens and lawns, showing a deep interest in gardening and lawn care in this area. Also, increased construction work in North America has increased the demand for lawn care tools, adding to the growth of the lawn mowers market.

United States plays a key role in this market's expansion. The US lawn care market is predicted to grow from USD 37 billion in 2024 to USD 50 billion by 2029, with a growth rate of 5.8% per year, which helps the market grow. Large green spaces in the Northeast and Western parts of the US fuel the need for lawn mowers.

Canada also impacts the lawn mower market in North America. The need for lawn mowers in Canada comes from advancements in technology, the need to replace old machines with modern, digital ones, and the cost-effectiveness of these machines. The Canadian market for electric lawn mowers is set to grow due to a focus on protecting the environment and a preference for quieter, more efficient lawn mowing options.

Europe Market Insights

The Europe region is set to huge growth for the lawn mowers market during the forecast period and will hold the second position owing to factors like new product offerings, and advances in technology. Notably, the creation of quieter lawn mowers, meeting the EU's strict rules, stands out in this market. Also, government support for smart city advancements in European countries is boosting the lawn mowers sector. For instance, the push for smart technology, such as robotic mowers in cities like London, is expanding the market.

In the UK, there's a rising demand for lawn mowers, especially robotic ones. Lawns' aesthetic appeal and the swift adoption of cutting-edge technology, like path planning and land measuring, are driving market expansion. The residential sector in the UK holds the largest market share, at 63%, for lawn mowers.

In Germany, the market for lawn mowers, valued at USD 1.21 billion in 2021, is forecast to grow to USD 1.8 billion by 2027. Germany is poised to claim a bigger part of the European market by 2027, indicating strong growth potential. The country's pursuit of durable, efficient, and user-friendly mowers has cemented its industry leadership. Germany's embrace of tech-driven solutions in homes and the uptake of smart technologies are fuelling growth in home use.

Lawn Mowers Market Players:

- John Deere

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ego

- American Lawn Mower Company

- Ryobi

- Greenworks

- Honda

- Toro

- Troy-Bilt

- Husqvarna

- Black+Decker

Lawn mowing companies are constantly coming up with new innovations to improve the precision of lawn mowers and reduce human labour taken to operate them. In compliance with growing concerns for the environment, several companies are adopting greener practices in manufacturing and product outcomes. Following are the companies leading the lawn mowers market.

Recent Developments

- EGO - EGO has inked a key deal with John Deere, a top name in high-grade turf gear. This pact lets both brands offer EGO's electric yard care tools via John Deere distributors. This move taps into the core strengths of both firms and broadens the reach of EGO's top-tier battery-driven outdoor power equipment (OPE) across John Deere's esteemed and wide dealer network. Under this deal, EGO's full lineup of mowers, blowers, trimmers, hedgers, chainsaws, and snow blowers will hit the shelves at John Deere outlets in the USA and Canada by autumn 2023.

- Honda - The brand-new Honda HRN216 Series of lawn cutters is a fresh start, taking over from the well-liked HRR Series, boosting the lawn cutting game with extra power, tough build, easy use, and simple upkeep. The latest HRN mowers bring nine percent more power and 18 percent more torque compared to the HRR versions, making it easy for the user to deal with thick, stubborn grass while ensuring a neat, even trim. Powered by the new Honda GCV170 engine, the HRN Series steps up the game in power and torque, making maintenance easier and use more straightforward with a bigger fuel tank opening, simpler oil changes, and trusted, reliable starts every time.

- Report ID: 6140

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lawn Mowers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.