Lawn & Garden Equipment Market Outlook:

Lawn & Garden Equipment Market size was valued at USD 42.14 billion in 2025 and is set to exceed USD 80.6 billion by 2035, registering over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lawn & garden equipment is estimated at USD 44.68 billion.

One of the things fueling the demand for ergonomic garden and lawn goods is the growing senior population. In a survey conducted, there were many benefits of leisure gardening among the 331 participants, aged 60 to 95 years in Australia. In addition, real estate developments have increased in all economies as a result of rising disposable income and falling property prices. This trend is expected to drive demand for gardening equipment over the predicted timeframe. It is also anticipated that the millennial trend of transforming outdoor areas into lounges, entertainment areas, outdoor kitchens, and gathering places would contribute to the lawn & garden equipment market's expansion.

Key Lawn and Garden Equipment Market Insights Summary:

Regional Highlights:

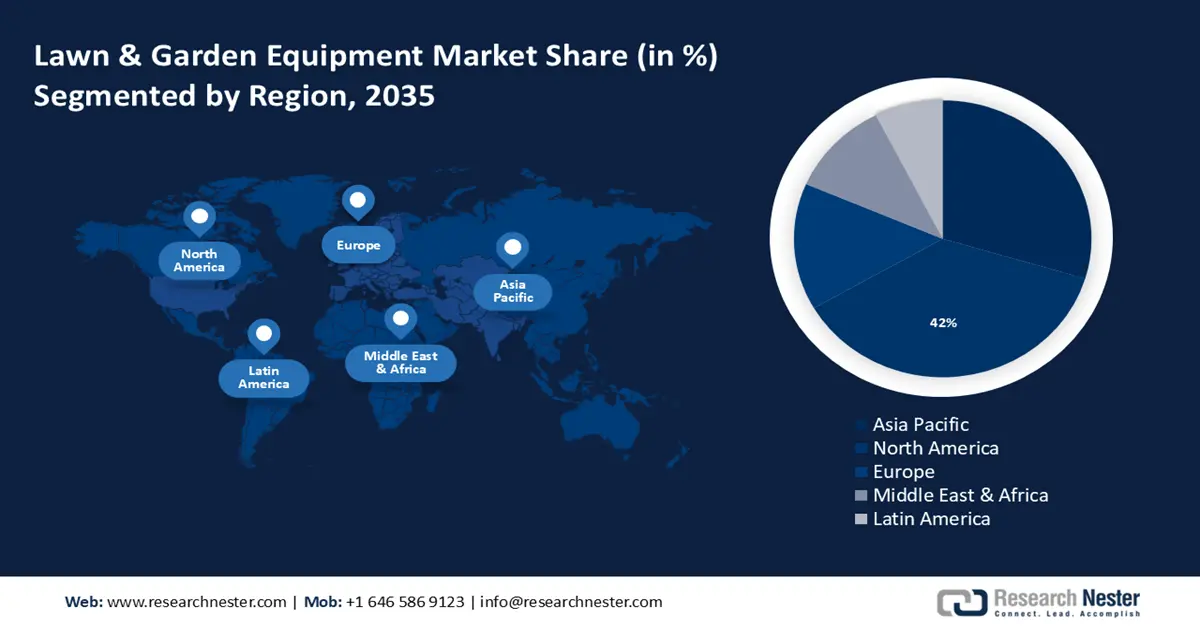

- The North America lawn & garden equipment market will secure over 42% share by 2035, driven by the dominance of major firms and high demand due to large yards and outdoor spaces.

- The Asia Pacific market will experience huge growth during the forecast timeline, driven by smart home device integration and government eco-city development initiatives.

Segment Insights:

- The residential segment in the lawn & garden equipment market is expected to capture a significant share by 2035, attributed to increased gardening activity and DIY landscaping trends.

- The e-commerce segment in the lawn & garden equipment market is anticipated to experience significant growth till 2035, driven by increasing manufacturer preference for digital sales channels.

Key Growth Trends:

- Growing uptake of eco

- Product innovations

Major Challenges:

- High pollutant levels linked to lawnmowing equipment that prevent market growth

- High cost of equipment

Key Players: Stanley Black & Decker, Inc., Husqvarna Group., Ariens Company, Briggs & Stratton Corporation, Falcon Garden Tools Pvt. Ltd., Deere & Company, Koki Holdings Co., Ltd., ANDREAS STIHL AG & Co. KG, The Toro Company, Makita Corporation.

Global Lawn and Garden Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 42.14 billion

- 2026 Market Size: USD 44.68 billion

- Projected Market Size: USD 80.6 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Lawn & Garden Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Growing uptake of eco–friendly green areas – One of the main factors propelling the growth of the lawn & garden equipment market is the increasing use of sustainable green spaces in residential and commercial structures, such as green walls, green roofs, and vertical gardens. Green areas are being included in building designs more often by urban planners and architects to improve air quality, lower ambient temperatures, and improve aesthetics.

For installation and upkeep tasks, there is a growing need for landscaping tools and equipment such as trimmers, pruners, tillers, and lawnmowers due to the growth of green structures and spaces. For expansive green areas, professional landscapers frequently use AI–based lawn management systems and sophisticated robotic mowers. The World Economic Forum's 2022 statistics indicate that by 2050, 80% of people on Earth are likely to live in cities, up from 55% at the current rate.

- Product innovations – To obtain a competitive edge in the lawn & garden equipment market, major manufacturers are concentrating on advances in terms of efficiency, robustness, battery performance, charging capacity, and noise reduction. Technological innovations such as GPS–enabled robotics.

The use of mowers, cloud–based fleet management programs, and smart lawn optimizer software is growing. Furthermore, product development is being driven by consumers' increased demand for cordless equipment because of its cheaper operating and maintenance expenses. The United Nations Department of Economic and Social Affairs has published estimates showing that through 2050, over 90% of population increase is expected to occur in Asia and Africa, where living standards are rising and cities are growing.

- Rising usage of smart robotic lawn mowers – Robotic lawn mowers are becoming increasingly popular because of their many advantages, including lower noise levels, lower emissions, higher–quality sod, and lower labor costs. Combining anti–theft alerts, mapping and location software, the Global location System (GPS), and Robotic mowers with smartphone connectivity offer remote access and convenience of usage.

A robotic lawn mower was possessed by over 2.5 million US households in 2021, up 25% from 2020, according to data from the Outdoor Power Equipment Institute. Throughout the projection period, developments in artificial intelligence (AI), internet of things (IoT), and autonomous navigation technologies will spur additional advancements in smart robots in lawn mowers sector

Challenges

- High pollutant levels linked to lawnmowing equipment that prevent market growth – Equipment for lawns and gardens is commonly used for various gardening tasks, including weeding and mowing, as well as for maintaining sports fields and gold fields. Nevertheless, there is a high amount of noise, vibration, and pollution related to these tools and equipment.

Customers are looking for cutting–edge goods that allow accurate operations, great efficiency, user safety, and minimal environmental damage because of the strict environmental regulations. Fossil fuel–powered equipment has a high potential for pollution, hence its use should be restricted. - High cost of equipment – One of the biggest obstacles to adoption is the high initial price of heavy–duty, commercial–grade landscaping equipment, such as robotic mowers, zero–turn mowers, compact tractors, turf cutters, and trash loaders. The expenses associated with converting fleets to battery–powder versions contribute to small contractors' and cost–conscious homeowners' reluctance. In underdeveloped nations, low–cost models and financing alternatives can enhance the adoption of technology among client segments that are sensitive to price.

Lawn & Garden Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 42.14 billion |

|

Forecast Year Market Size (2035) |

USD 80.6 billion |

|

Regional Scope |

|

Lawn & Garden Equipment Market Segmentation:

Product Type Segment Analysis

Lawn mowers segment in the lawn & garden equipment market is poised to register high growth till 2035. One element driving the market's growth is the quick adoption of technologically sophisticated equipment that offers customers greater comfort and convenience. Handheld power tools include leaf blowers, chainsaws, trimmers, and edgers. The necessity for lightweight, ergonomic equipment as well as the post–medium–term drop in Li–ion battery prices brought on by the crisis in Russian Ukraine are expected to propel the market.

Sales Channel Segment Analysis

E-commerce segment is estimated to dominate over 36% lawn & garden equipment market share by 2035. The bulk of OEM sales are made through third–party channels. The COVID–19 outbreak caused a temporary shutdown of hardware and home center stores, which resulted in a slight reduction in sales for the third–party channel sector. A compound annual growth rate (CAGR) of 6.4% is predicted for the home center segment over the projection period.

Online retail makes up the direct channel and will generate 15.15% of market revenue in 2021. Over the course of the projected period, it is anticipated that the growing preference of manufacturers for e–commerce platforms to boost their market presence and carry out commercial activities easily would support market expansion.

End–User Segment Analysis

By 2035, residential segment is poised to dominate over 52% lawn & garden equipment market share. The demand for garden equipment in the residential sector increased during the anticipated period. Demand is thought to have increased due to the rise in single–family houses and the increase in gardening equipment sales through internet channels.

In addition, the demand for gardening equipment in the domestic sector has increased due to the popularity of do–it–yourself backyard landscaping projects. In 2018, the average sales income of products in the home gardening business increased by 4.62% compared to the previous year. In 2020, two years later, the yearly growth rate almost doubled to 8.79%.

Additionally, sustainable home farming and gardening trends are increasing consumer requirements for more sophisticated tools to support the growth of vegetation in lawns & gardens. Furthermore, growing public awareness regarding holistic health and well–being has resulted in a high prevalence of vegetable gardening. Combined, these factors will fuel the residential applications of such equipment.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Sales Channel |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lawn & Garden Equipment Market Regional Analysis:

North America Market Insights

North American in lawn & garden equipment market is estimated to dominate over 42% revenue share by 2035. In regard to the existence of several dominant market firms, such as the Toro Company and Deere & Company, North America currently holds the largest market share. These devices' independence helps users cut down on time spent gardening, which makes the procedure easier.

Among the world's largest markets for lawn and garden tractors is the United States. A number of vendors with operations in Asia seek to export to the United States. Additionally, because of their vast yards, love of outdoor living spaces, proximity to large golf courses and sports fields, among other factors, average American households spend more on lawn & garden equipment. The National Golf Foundation, for example, (NGF) projected that the United States had more than 16,100 golf courses by the end of 2020. Consequently, this is increasing the use of garden equipment in American facilities.

Equipment for lawn and garden supplies hedge trimmers sold at Canadian retail stores between 2013 and 2020. In 2020, the quantity of lawn and garden supplies, equipment, and plants sold in retail stores in Canada was estimated to be USD 5.81 billion.

APAC Market Insights

The APAC region will also encounter huge growth for the lawn & garden equipment market. As more smart home devices are created, consumers are searching for items that can be watched over and managed by smartphones or other devices. This led to the development of smart water controls, which enable users to plan their water usage and get alerts when something goes wrong with the system. Furthermore, there is an increasing demand for personalized water solutions. Customers like products, such as plant management or irrigation systems, that can be customized to meet their specific needs and preferences.

The growing technological usage in the region's nations will contribute to the region's increased need for gardening equipment. It is anticipated that government–led eco–city development initiatives will propel China's garden equipment market forward. Chinese gardeners are benefiting greatly from the growing popularity of robotic models with connectivity and smart functions like mapping lawns and navigation, as well as from the introduction of user–friendly models and the growing interest in backyard aesthetics.

South Korea's share of the worldwide gardening equipment sector is predicted to grow as long as it remains a popular gardening destination and leisure activity. In 2024, the market in South Korea is expected to be worth USD 6.85 billion. The proactive strategy adopted by South Korea to sustain its gardening equipment industry combines innovation, industry cooperation, customer involvement, and government regulations that are conducive to the sector. Growing interest in home gardening, urbanization, and changing lifestyles have all contributed to a considerable increase in the demand for gardening equipment in South Korea in recent years.

Lawn & Garden Equipment Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stanley Black & Decker, Inc.

- Husqvarna Group.

- Ariens Company

- Briggs & Stratton Corporation

- Falcon Garden Tools Pvt. Ltd.

- Deere & Company

- Koki Holdings Co., Ltd.

- ANDREAS STIHL AG & Co. KG

The existence of a small number of significant companies allows the market to be classified as fragmented in nature. Their approach would involve drawing in new customers as well as keeping their present ones.

Recent Developments

- Ariens Company launched the OVIS high–slope brush mower, which can be operated remotely and tackles hilly and mountainous terrain, adds to Gravely®'s selection of commercial outdoor power equipment. Today at the largest outdoor power equipment trade event in North America, Equip Exposition in Louisville, Kentucky.

- Bosch is adding the GRA 18V2–46 Professional cordless lawnmower to its Professional 18V System portfolio in its new garden equipment section. Professionals may now mow up to 1,000 m2 with two ProCore 18V batteries with 12.0 Ah because it is the only 18V tool in the lineup to run on two 18V batteries. The GAL 18V2–320 Professional, which will be available starting this fall, is the first dual charger capable of charging two 18V batteries simultaneously at up to 16 amps, setting a new bar in charging speed.

- Report ID: 6239

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lawn and Garden Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.