Last Mile Delivery Market Outlook:

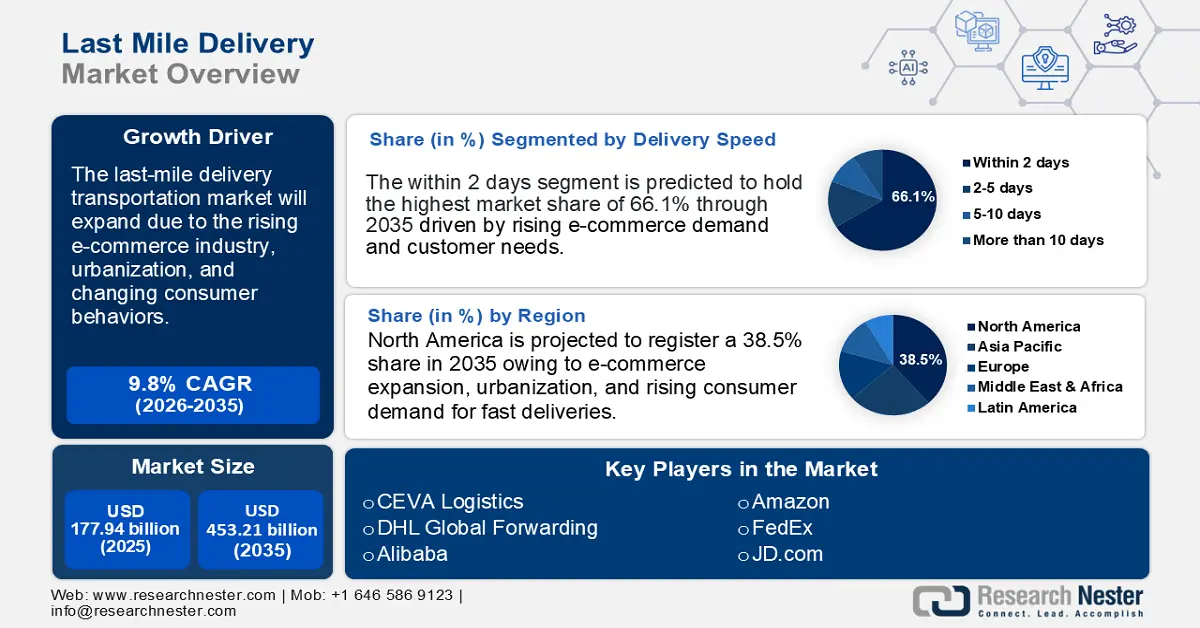

Last Mile Delivery Market size was over USD 177.94 billion in 2025 and is poised to exceed USD 453.21 billion by 2035, witnessing over 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of last mile delivery is estimated at USD 193.63 billion.

The last mile delivery market is experiencing rapid growth attributed to the rapidly expanding e-commerce industry across the world. The rise of online shopping driven by platforms such as Amazon, Alibaba, and Flipkart has significantly increased the demand for last-mile delivery services. Consumers expect faster, same-day or next-day delivery pushing logistics companies to optimize their delivery networks. According to a 2024 report published by the International Trade Administration (ITA), the global B2B e-commerce gross merchandise value (GMV) grew from USD 14,874 billion in 2020 to USD 28,082 billion in 2024 and is estimated to reach USD 36,163 billion by 2026.

Additionally, the expansion of quick commerce (Q-Commerce) that focuses on delivering groceries, food, and essentials within 10-30 minutes has intensified the need for efficient last-mile logistics. Companies such as DoorDash, Uber Eats, and Gorillas are investing in hyper-local delivery networks to meet this demand. Furthermore, the COVID-19 pandemic has reshaped consumer buying patterns worldwide. The World Economic Forum 2021 Report states that COVID-19 has transformed the last mile logistics with e-commerce deliveries rising to 25% in 2020 and 10-20% of the increased demand still prevails post-pandemic. The report also projects that consumers buy a wide variety of goods online. For example, 56% of millennials choose online shopping and home delivery as an alternative to being more ecologically aware of their surroundings.

Key Last Mile Delivery Market Insights Summary:

Regional Highlights:

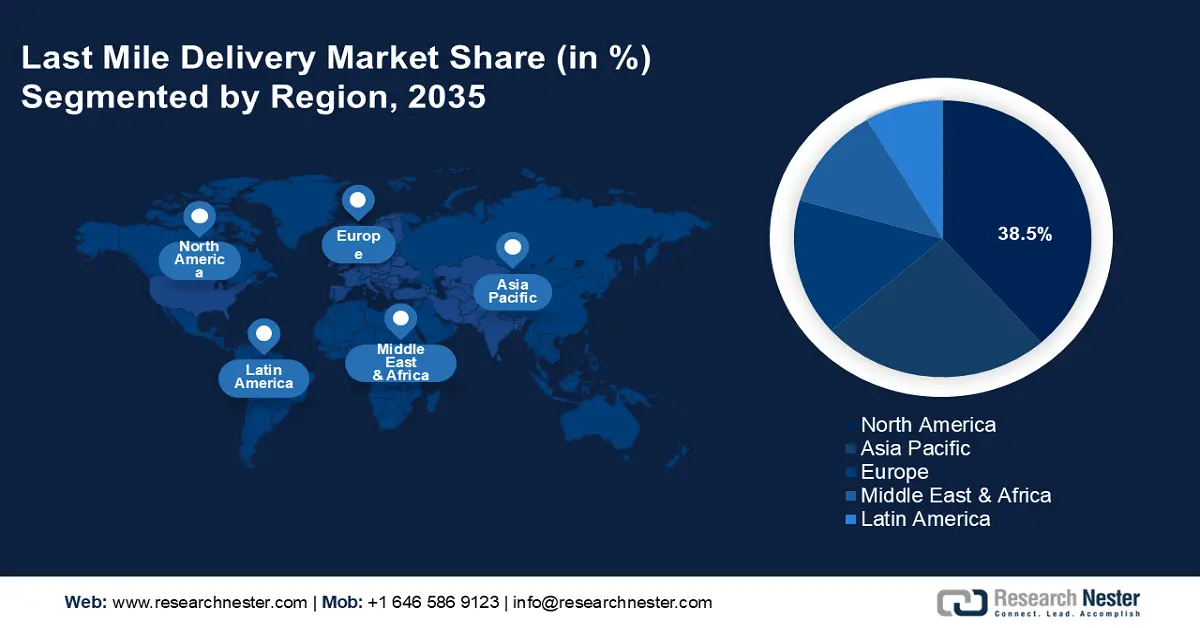

- North America commands a 38.5% share in the Last Mile Delivery Market, driven by rapid expansion of the e-commerce sector, urbanization, and rising consumer demand for fast deliveries, ensuring strong growth through 2035.

- The Asia Pacific region is expected to experience the fastest growth in the Last Mile Delivery Market from 2026 to 2035, driven by rapid e-commerce growth, high urban congestion, and demand for faster deliveries.

Segment Insights:

- The Within 2 Days segment is expected to dominate with a 66.1% share by 2035, propelled by the expanding e-commerce sector and demand for rapid delivery.

- Two-Wheeler Vehicles segment are expected to experience rapid growth by 2035, driven by their speed and low operating costs in urban delivery settings.

Key Growth Trends:

- Urbanization and changing consumer behavior

- Technological advancements in last-mile deliveries

Major Challenges:

- Workforce and labor shortages

- Failed deliveries and issues in returns and reverse logistics

- Key Players: DHL Global Forwarding, FedEx Corporation, Interlogix Pty. Ltd., J&J Global Limited, Kerry Logistics Network Limited.

Global Last Mile Delivery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 177.94 billion

- 2026 Market Size: USD 193.63 billion

- Projected Market Size: USD 453.21 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, Brazil, Mexico

Last updated on : 13 August, 2025

Last Mile Delivery Market Growth Drivers and Challenges:

Growth Drivers

- Urbanization and changing consumer behavior: Rapid urbanization and high population density in cities are increasing the need for efficient last-mile delivery solutions. Moreover, due to urbanization, there has been a change in consumer behavior such as demand for same day or next-day delivery has increased driving investments in last-mile logistics. For instance, according to a news report published by Amazon in February 2025, Amazon recorded the fastest speed in 2024, delivering over 9 billion items on the same or the next day around the world. Additionally, Amazon Prime members saved nearly USD 95 billion on fast and free delivery which accounts for saving over USD 500 on their deliveries in 2024. The rising consumer expectations for convenience, real-time tracking, and flexible delivery options such as contactless delivery are shaping the last mile delivery market.

- Technological advancements in last-mile deliveries: Innovations such as AI-powered route optimization, GPS tracking, autonomous vehicles, drones, and delivery robots are improving efficiency and reducing operational costs in last-mile delivery. For instance, in February 2025, Uber expanded its robot food delivery service to New Jersey. Partnering with Avride, Uber introduced autonomous robots capable of delivering food orders from participating restaurants. These robots can travel up to 5mph and cover 31 miles on a single charge. Further, the integration of blockchain and IoT is enhancing transparency and security in supply chains.

- Increasing demand for sustainability and green logistics: The growing environmental concerns and stricter emission regulations are pushing logistics providers to adopt eco-friendly solutions. Thus, governments and businesses are focusing on reducing carbon emissions by adopting electric vehicles, bicycles, and alternative fuel-powered delivery fleets. For instance, in January 2025, Amazon announced the purchase of over 150 electric heavy goods vehicles (HGVs) for its UK operations. This includes 140 Mercedes Benz eActross 600 and eight Volvo FM Electric trucks. This move aims to reduce carbon emissions and is part of Amazon’s broader plan to have 1,500 electric trucks in Europe by 2027. These newly introduced zero exhaust emission vehicles are expected to deliver more than 350 million packages every year. It also helps in supporting their goal of achieving net zero emissions by 2040.

Challenges

- Workforce and labor shortages: The last mile delivery sector heavily relies on drivers, couriers, and gig workers to meet the growing demand for fast deliveries. However, workforce shortages and labor-related challenges put pressure on logistics providers. Driver shortages and rising wages impact the availability of delivery personnel, especially during peak seasons. Additionally, gig workers for DoorDash and Uber Eats have unpredictable availability affecting service consistency.

- Failed deliveries and issues in returns and reverse logistics: Missed deliveries, incorrect addresses, and customer unavailability increase costs and inefficiencies. Further, handling returns is expensive and complex, especially in industries such as fashion and electronics. Many companies struggle with efficient return policies, leading to higher costs and inventory management challenges.

Last Mile Delivery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 177.94 billion |

|

Forecast Year Market Size (2035) |

USD 453.21 billion |

|

Regional Scope |

|

Last Mile Delivery Market Segmentation:

Vehicle Type (Two Wheeler Vehicle, Robots/AGVs, Light Duty Vehicles, Medium & Heavy Duty Vehicles)

The two-wheeler vehicle segment in last mile delivery market is expected to register rapid growth between 2026 and 2035. Two-wheelers including motorcycles, scooters, and e-bikes play a crucial role in last-mile delivery due to their speed and maneuverability. They are widely used for food delivery, e-commerce, and courier services, especially in urban areas with heavy traffic. The low operating costs and fuel efficiency of two-wheelers make them a preferred choice for quick and cost-effective deliveries. According to a January 2024 report by Borzo, the most preferred two-wheelers among gig delivery riders are Hero Splendor, Honda Activa, Suzuki Access, Hero Passion, and TVS Jupiter. The report also states that in the electric bike segment, TVS holds the highest share accounting for 41.6%, followed by Yulu at 32% and Ather at 10.5%. The rise of electric two-wheelers i.e., e-bikes and e-scooters is further driving sustainability in last-mile deliveries.

Delivery Speed (Within 2 Days, 2-5 Days, 5-10 Days, More than 10 Days)

The within 2 days segment is estimated to account for more than 66.1% last mile delivery market share by the end of 2035, owing to rapidly expanding e-commerce sector and rising customer needs for the fastest delivery. Companies use micro fulfillment centers, automated warehouses, and AI-driven route optimization to meet tight deadlines. For instance, in February 2025, express logistics partner DTDC launched 2-4 hour and same-day delivery services to remain competitive in the booming e-commerce space. The company opened its first Dark Store in Bengaluru to boost hyperlocal fulfillment and last-mile deliveries. Additionally, retail giants such as Walmart, Amazon, and Target invest heavily in regional distribution networks to ensure faster deliveries. These initiatives reflect the ongoing efforts by major retailers to optimize their logistics networks and fulfill customer expectations for swift delivery.

Our in-depth analysis of the global last mile delivery market includes the following segments:

|

Vehicle Type |

|

|

Delivery Speed |

|

|

Cargo Type |

|

|

End use |

|

|

Ownership |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Last Mile Delivery Market Regional Analysis:

North America Market Analysis

North America last mile delivery market is poised to hold revenue share of over 38.5% by the end of 2035, due to rapid expansion of the e-commerce sector, urbanization, and rising consumer demand for fast deliveries. Major players such as Amazon, FedEx, UPS, and Walmart are investing in micro fulfillment centers, AI-driven logistics, and electric delivery vehicles to improve efficiency. The region is witnessing a shift towards sustainable solutions including EV fleets, drones, and autonomous delivery robots. Moreover, the demand for same day and next-day delivery services is becoming an industry standard driving intense competition and innovation.

The U.S. last mile delivery market is driven by high e-commerce penetration, consumer demands for ultra-fast shipping, and expanding urban logistics networks. Companies are adopting AI-powered route optimization, warehouse automation, and third-party logistics partnerships to enhance delivery speed. The rise of subscription-based and on-demand delivery services is reshaping the industry, particularly in the retail and grocery sectors. Additionally, the push for electric vehicles, drones, and autonomous delivery solutions is accelerating sustainability efforts in urban and suburban areas.

The last mile delivery market in Canada is growing due to rising e-commerce demand, vast geographic challenges, and increasing urbanization. Major e-commerce giants are expanding their business in Canada. For instance, according to a 2024 report by Amazon, the company expanded its last-mile delivery network in Canada by introducing five new delivery stations viz. Burnaby, Calgary (Rocky View County), Windsor, Ottawa, and Richmond Hill. Companies are investing in cold chain logistics for grocery and pharmaceutical deliveries, adapting to the country’s extreme weather conditions. The use of drones, electric vehicles, and alternative delivery models is expanding.

Asia Pacific Market Analysis

The Asia Pacific last mile delivery market is expected to expand at the fastest rate through 2035 driven by rapid e-commerce growth, high urban congestion, and demand for faster deliveries. Top companies are adopting bike couriers, autonomous delivery robots, and AI-powered logistics to navigate dense cities efficiently. The rise of quick commerce is transforming grocery, and retail deliveries, emphasizing speed and convenience. Further, government support in investments for introducing electrified fleets, smart infrastructure, and cross-border logistics enhances last-mile efficiency.

The last mile delivery market in China is expanding rapidly driven by high consumer demand for same-day and instant deliveries. For instance, in 2023, Cainiao Network, the logistics company of China’s tech giant Alibaba launched a half-day delivery in Beijing to fulfill consumers' expectations. Additionally, companies in China utilize highly automated warehouses, AI-driven logistics, and a vast network of couriers on electric scooters to meet efficiency needs. Moreover, the expansion of the logistics network also drives market growth.

The last mile delivery market in India is booming due to rapid e-commerce growth, increasing smartphone penetration, and rising demand for hyperlocal deliveries. In India, technology serves as the pillar for the rise of quick commerce platforms as it fulfills ultra-fast deliveries and unique customer experiences. Companies are leveraging bike-based deliveries, local store partnerships, and AI-driven logistics to navigate diverse terrains and traffic conditions. The rise of quick commerce i.e., 10–30-minute deliveries is transforming grocery and food delivery with players such as Zepto, Blinkit, and Swiggy Instamart leading the space. For instance, to enhance consumer experience, quick commerce platform Blinkit launched Bistro, as a new 10-minute food delivery app in January 2025.

Key Last Mile Delivery Market Players:

- Cargo Carriers Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alibaba

- Amazon

- CEVA Logistics

- CJ Logistics Corporation

- Concargo Private Limited

- DB SCHENKER

- DHL Global Forwarding

- FedEx Corporation

- Interlogix Pty. Ltd.

- J&J Global Limited

- Kerry Logistics Network Limited

The last mile delivery market is dominated by global giants such as Amazon, UPS, FedEx, and DHL, leveraging advanced logistics networks for ultra-fast shipping. E-commerce leaders such as Alibaba, JD.com, and Walmart invest in AI-driven route optimization and fulfillment centers to enhance efficiency. Additionally, quick commerce players such as Zepto, Blinkit, and Instamart are reshaping urban delivery with on-demand 10–30-minute services. Here are some leading players in the last mile delivery market:

Recent Developments

- In November 2024, FedEx Express Corporation introduced 31 electric vehicles (EVs) i.e., custom-built Mercedes-Benz eVito 112 panel vans to its existing fleet in Singapore. These panel vans will work for parcel pickup and delivery operations across the country. The EVs can carry up to 923 kg load capacity and travel up to 321 kilometers on a full charge. By using these vans, FedEx expects to reduce carbon emissions by about 148 metric tons each year.

- In May 2024, Bajaj Auto and Flipkart announced a strategic partnership to boost the adoption of electric vehicles (EVs) in Flipkart's last-mile delivery operations.

- Report ID: 7241

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Last Mile Delivery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.