Laser Diode Market Outlook:

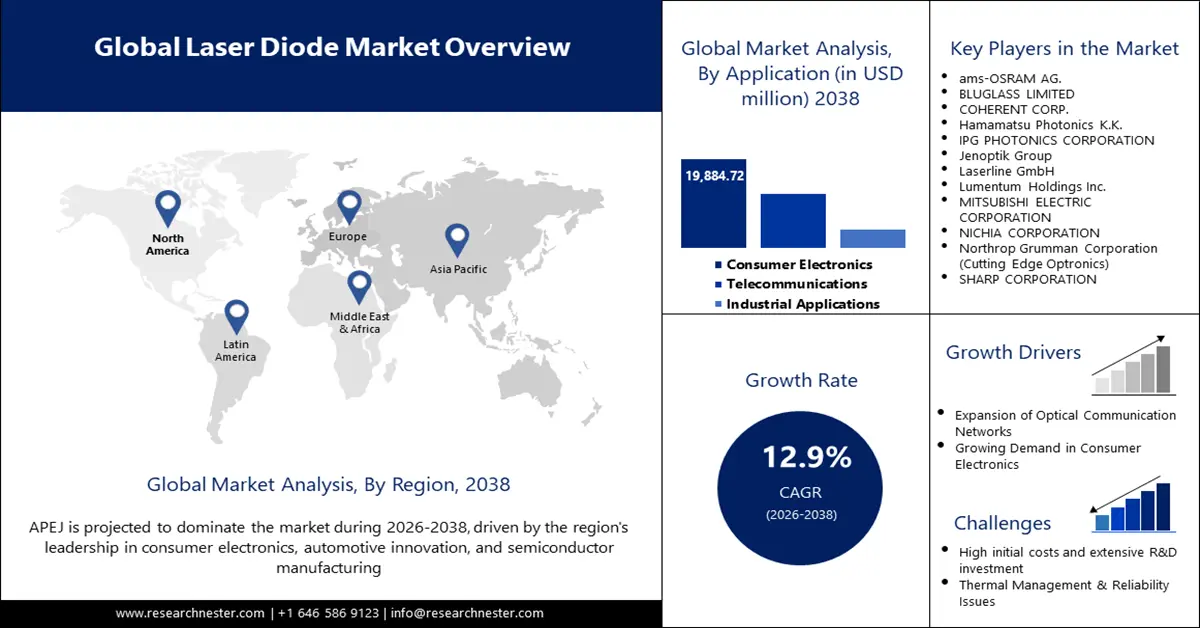

Laser Diode Market size was valued at USD 9.9 billion in 2025 and is projected to reach a valuation of USD 46.5 billion by the end of 2038, rising at a CAGR of 12.9% during the forecast period, i.e., 2026-2038. In 2026, the industry size of laser diode is estimated at USD 10.8 billion.

The laser diode market is going through a phase of extensive expansion, driven by the growing applications in a wide variety of high-tech markets such as optical communications, industrial material processing, and life sciences. Strategic development of manufacturing capacity to fulfill this growing global demand is one of the major drivers. Hamamatsu Photonics declared the completion of a new South Korean facility in March 2025 to strongly reinforce production capacity for semiconductor failure analysis equipment. This is also supported by government policies around the globe, i.e., the U.S. CHIPS Act and the EU Chips Act, which are committing huge investments to develop domestic semiconductor and photonics supply chains, offering fertile ground for market growth and innovation.

Key Laser Diode Market Insights Summary:

Regional Insights:

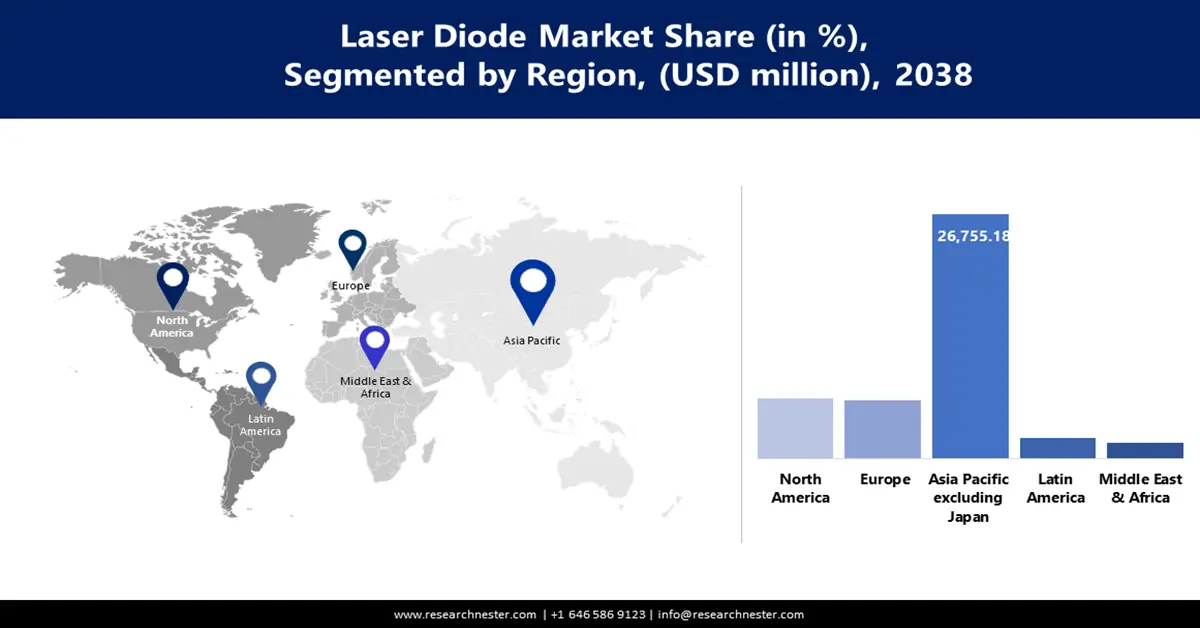

- The Asia Pacific excluding Japan Laser Diode Market is predicted to command a 57.4% share by 2035, bolstered by extensive manufacturing capacity, rapid technology adoption, and strong governmental backing for the electronics sector.

- North America is projected to record a 12.2% CAGR through 2026–2035, owing to growing onshoring trends, R&D strength, and sizable investments in semiconductor and photonics manufacturing.

Segment Insights:

- The Red Laser Diodes segment within the Laser Diode Market is forecasted to capture a 36.9% share by 2035, propelled by their extensive use across consumer electronics, medical, and barcode scanning applications.

- The Gallium Nitride (GaN) segment is anticipated to achieve a 14.4% CAGR from 2026 to 2035, impelled by its efficiency advantages and expanding adoption in blue and green laser systems and next-generation power electronics.

Key Growth Trends:

- Technological progress in materials and industrial processing

- Growing demand for AI and optical communications

Major Challenges:

- Production and scaling up production challenges

- Geopolitical risks and supply chain vulnerabilities

Key Players: Coherent Corp., Lumentum Holdings Inc., IPG Photonics Corporation, MKS Instruments, Inc., ams-OSRAM AG, Jenoptik AG, TRUMPF GmbH + Co. KG, Sony Group Corporation, Sharp Corporation, Hamamatsu Photonics K.K., Sumitomo Electric Industries, Ltd., ROHM Co., Ltd., BluGlass Limited, LG Innotek, Ushio, Inc.

Global Laser Diode Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.9 billion

- 2026 Market Size: USD 10.8 billion

- Projected Market Size: USD 46.5 billion by 2038

- Growth Forecasts: 12.9% CAGR (2026-2038)

Key Regional Dynamics:

- Largest Region: Asia Pacific excluding Japan (57.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States,China, Japan, Germany, South Korea

- Emerging Countries: India, Taiwan, Singapore, Canada, Netherlands

Last updated on : 23 September, 2025

Laser Diode Market - Growth Drivers and Challenges

Growth Drivers

- Technological progress in materials and industrial processing: Among the key drivers is the increasing adoption of high-power diode lasers in industrial processing and manufacturing. The lasers offer greater precision, quickness, and efficiency in welding, cutting, and additive manufacturing processes. Nichia and Furukawa Electric co-developed in June 2024 a blue laser diode module with an 800W output, a world-record brightness level that greatly increases its industrial application. This constant power and performance evolution is enabling new manufacturing capabilities, particularly in metals like copper, and creating demand for advanced laser systems across the industrial base.

- Growing demand for AI and optical communications: The explosive growth in data traffic and the continuous growth of AI-powered data centers have generated a colossal demand for high-bandwidth optical communication networks based on laser diodes. Lumentum in April 2025 reported breakthroughs in Indium Phosphide (InP) based photonic chip technologies that will enable such networks to be scalable and efficient. With applications such as AI and ML becoming the norm, requiring more sophisticated, high-bandwidth laser diodes, this trend is expected to gain further momentum.

- Increased use in life sciences and medicine: The healthcare and life sciences sectors are turning ever more to laser diodes for ever-wider applications, ranging from medical and surgical diagnostics to sophisticated analysis equipment. In October 2024, Ushio Inc. introduced a high-brightness 785nm, 200mW infrared laser diode for use in applications such as Raman spectroscopy and fluorescence microscopy. Demand for high-precision, reliable light sources in pharmaceutical research, medical imaging, and treatment therapy is creating enormous new opportunities for talented laser diode manufacturers and stimulating medical technology innovation.

Challenges

- Production and scaling up production challenges: One of the most significant challenges for the laser diode market is the inherent complexity and high capital cost of fabrication, which can affect manufacturing yields and restrict flexibility. The sophisticated wafer fabrication and packaging processes require high investment in specialized equipment and know-how. This came into sharp focus in January 2024 when Innolume GmbH increased Quantum Dot laser diode production by acquiring highly specialized equipment, a move which underlines the capital-intensive nature of high-end laser diode production scale-up and meeting increasing worldwide demand.

- Geopolitical risks and supply chain vulnerabilities: Laser diode manufacturing is vulnerable to geopolitical threats and supply chain disruptions, especially in the acquisition of critical semiconductor materials. In response, governments are implementing policies to encourage local manufacturing and diminish foreign dependency. For example, the European Union in 2024 provided €133 million in financing to pilot fabrication plants under the EU Chips Act. The action, designed to enhance the European sovereign photon supply chain, is an indicator of the strategic vulnerabilities and the global push to create more proximate and resilient manufacturing networks.

Laser Diode Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

12.9% |

|

Base Year Market Size (2025) |

USD 9.9 billion |

|

Forecast Year Market Size (2038) |

USD 46.5 billion |

|

Regional Scope |

|

Laser Diode Market Segmentation:

Wavelength Type Segment Analysis

The red laser diodes segment is poised to hold a 36.9% share during the forecast period, driven by their widespread applications in consumer electronics, medical, and barcode scanning. The high-power red laser diodes have also gained new applications with development, such as laser projection and horticultural lighting. Nichia, in November 2023, announced that it had started in-house production of a high-power red laser diode chip, with targeted introduction of packaged products during 2024. The move by a leading industry player reflects high confidence in the segment's continued growth and expanding base of applications. The segment is also supported by continuous innovation to improve the performance and reliability of the red laser diodes. The manufacturers are developing to provide higher power output, longer operating lifetime, and improved beam quality to cater to the demands of increasingly sophisticated applications.

Doping Material Segment Analysis

The Gallium Nitride (GaN) segment is anticipated to register a CAGR of 14.4% from 2026 to 2038. GaN-based laser diodes possess high efficiency and long life and are therefore well-suited for blue and green laser applications and next-generation power electronics applications. In January 2024, when BluGlass vertically integrated further by acquiring the equipment and processes of its contract manufacturer, GaNWorks Foundry. This is a move intended to enable in-house production of GaN-based laser diodes using the company's proprietary RPCVD technology. The investment reflects the growing strategic importance of GaN to the industry. The GaN segment is also spurred by the growing penetration of GaN into next-generation consumer and industrial products.

Application Segment Analysis

The consumer electronics industry is anticipated to reach a 40% laser diode market share by 2038, owing to rising applications of laser technology in a vast range of products, including AR glasses, smartphones, and home entertainment systems. In a significant development, TriLite partnered with ams OSRAM in September 2023 to integrate sub-assembled RGB laser diodes with the world's smallest AR smart glasses display module. The partnership reflects the vital role of laser diodes in making next-generation low-power, compact, high-performance consumer devices a reality. The segment is also driven by the miniaturization of laser diode technology, making it easily adoptable in smaller and more sophisticated products.

Our in-depth analysis of the laser diode market includes the following segments:

|

Segment |

Subsegments |

|

Wavelength |

|

|

Doping Material |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Laser Diode Market - Regional Analysis

APEJ Market Insights

Asia Pacific excluding Japan laser diode market is predicted to hold a 57.4% market share during the forecast period. This is attributed to the size of manufacturing in the region, the high rate of new technology adoption, and strong government support for the electronics sector. In December 2024, HSG Laser invested more than $68.3 million to establish a new high-power fiber laser production base in Jinan, China, a testament to the region's ambition and scale of investment. With its solid supply chains and growing domestic market, APAC excluding Japan, will be the hub of the world's laser diode market.

South Korea is the leading player in the APEJ laser diode market, leveraging its semiconductor manufacturing and advanced materials expertise. In June 2024, the Korean Electronics and Telecommunications Research Institute (ETRI) announced the commercial release of Quantum Dot (QD) lasers on 6-inch Gallium Arsenide (GaAs) wafers, a technology with the potential of significantly reducing the cost of manufacturing over traditional processes. Such innovation, coupled with shrewd investment in manufacturing capacity, underpins South Korea's leadership position in the manufacture and innovation of next-generation laser diodes.

India laser diode market is rapidly emerging as a significant hub in the global photonics landscape, driven by robust government initiatives and a growing domestic electronics manufacturing sector. The nation's strategic emphasis on localized production aligns with its broader Make in India initiative, aimed at strengthening the semiconductor and optoelectronics value chains. Recent expansions include the establishment of advanced research and development centers and production facilities focusing on next-generation laser diode technologies. With increasing demand from sectors such as consumer electronics, automotive, and telecommunications, India is witnessing accelerated growth, complemented by strong investments and collaborations to reduce reliance on imports and enhance technological self-sufficiency.

North America Market Insights

North America laser diode market is expected to rise at a 12.2% CAGR between 2026 and 2038, supported by robust government support, a robust R&D ecosystem, and large-scale investments in local manufacturing capacity. In January 2023, Cutting Edge Optronics, in direct response to a nearly 70% boost in demand for its laser diode products, announced an expansion to double its GaAs wafer cleanroom capacity in Missouri. This onshoring and capacity boost trend is a dominant characteristic of the local market, with the U.S. and Canada both attempting to bolster their local semiconductor and photonics supply chains.

The diversified market and large investment base in the U.S. make it a dominant player in the laser diode market with a strong emphasis on research and commercialization. Government support, including the CHIPS Act, which in December 2023 addressed a 25% tax credit for investment in local semiconductor manufacturing, is giving the industry a strong push. All these investments are creating a rich innovation ecosystem and solidifying the U.S.'s leadership in the world market.

Canada laser diode market is turning into a hub for innovation in laser diodes and photonics, encouraged by strategic public investment and mounting clusters of technology firms specializing in advanced technology. The government is taking several significant steps towards hybrid laser integration by applying wafer-scale flip-chip technology. Such cross-border cooperation, coupled with local efforts to build a healthy photonics ecosystem, is turning Canada into the focal point of next-generation laser diode development and commercialization.

Europe Market Insights

Europe laser diode market is likely to garner considerable growth between 2026 and 2038. In July 2023, the government committed up to €750 million to match EU Chips Act funding for IMEC's cleanroom expansion. This investment was intended to keep IMEC at the forefront of advanced nanoelectronics research and development, supporting the EU's goal of strengthening its semiconductor ecosystem and reducing reliance on external suppliers. Europe has a robust research institution and a high-tech firm ecosystem that is fueling innovation in laser technology. This emphasis on developing a resilient and autonomous supply chain is providing a healthy environment for growth and investment in Europe laser diode market.

Germany is leading the Europe laser diode market for laser diodes, focusing on high-power industrial lasers and research and development. In 2024, the German Federal Ministry for Education and Research (BMBF) launched Project DioHELIOS, a $19 million project to develop high-power laser diodes for use in fusion power plants as part of the country's Fusion 2040 initiative. This long-term vision, combined with the country's strong industrial base, ensures that the country will be among the leaders in laser diode technology and use.

The UK laser diode market is fostering a dynamic laser diode and photonics ecosystem through targeted research funding and support for innovative startups. In 2023, the UK Research Initiative (UKRI) announced a USD 2.58 million project led by the University of Sheffield to advance micro-displays and visible light communication using laser diodes. Furthermore, in June 2024, Vector Photonics, a spin-out from the University of Glasgow, secured significant funding to advance the commercialization of its unique Surface Coupling Laser (SCL) technology. These initiatives highlight the UK's commitment to nurturing cutting-edge research and translating it into commercial success.

Key Laser Diode Market Players:

- Coherent Corp.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lumentum Holdings Inc.

- IPG Photonics Corporation

- MKS Instruments, Inc.

- ams-OSRAM AG

- Jenoptik AG

- TRUMPF GmbH + Co. KG

- Sony Group Corporation

- Sharp Corporation

- Hamamatsu Photonics K.K.

- Sumitomo Electric Industries, Ltd.

- ROHM Co., Ltd.

- BluGlass Limited

- LG Innotek

- Ushio, Inc.

The laser diode market is highly competitive, with a mix of established global leaders and expert innovative players all vying for space in the market. Key players in the market are vying through relentless innovation in performance and efficiency, strategic acquisitions in order to broaden their tech platforms, and significant investments in broadening their global manufacturing base to meet the varied and growing needs of the market.A notable deal that reflects the competitive dynamics is LUMIBIRD's acquisition in October 2024 of Amplitude Laser Group's Continuum nanosecond laser product line. The strategic acquisition was intended to complement LUMIBIRD's solid-state laser portfolio and bring long-term support to existing customers globally. Such acquisitions are a typical feature of the market, with companies seeking to establish themselves, obtain new technology, and enhance their ability to serve a wide portfolio of applications in this high-speed and technology-driven business.

Here are some leading companies in the laser diode market:

Recent Developments

- In June 2025, Coherent Corp. introduced the SES18-880A-190-10, an 18W 880 nm single-emitter laser diode with 62% efficiency. Optimized for Diode-Pumped Solid-State (DPSS) systems, this laser diode is ideal for micromachining, semiconductor processing, and advanced packaging applications. The launch set new standards for performance and cost-effectiveness in the industry.

- In June 2025, BluGlass Inc., a subsidiary of BluGlass Limited, became an approved supplier to the Indian Ministry of Defence. The company received its first order of $230,000 from the Solid State Physics Laboratory (SSPL) for specialized Gallium Nitride (GaN) laser development services. This collaboration is aimed at benchmarking the fabrication process of GaN-based laser diodes.

- In May 2025, ams OSRAM expanded its high-power laser portfolio with the launch of the PLT5 488HB_EP cyan laser diode. This product was specifically designed for advanced life science applications. The enhanced laser performance enables faster, more accurate, and cost-effective analysis in laboratories and healthcare facilities.

- In March 2025, Oriental-laser introduced a series of water-cooled diode lasers for solid-state laser pumping and industrial applications. These systems utilize advanced water-cooling technology to deliver stable and efficient performance under high power output. The new series includes models such as HS-MI-400-5x2P-40-CW and HS-MI-600-5x3P-40-CW.

- Report ID: 7990

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Laser Diode Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.