Lacrimal Devices Market Outlook:

Lacrimal Devices Market size was over USD 163.69 million in 2025 and is anticipated to cross USD 254.21 million by 2035, witnessing more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lacrimal devices is assessed at USD 170.32 million.

Increased screen time, environmental pollution, and aging populations are major contributors to the rising incidence of dry eye syndrome, lacrimal duct obstruction, and other tear-related disorders. According to Vision Center, in January 2025, 77% of adults say they have symptoms of digital eye strain, and 93.5% of adults use digital devices for more than two hours a day on average. Prolonged digital device usage strains the eyes, while pollution leads to chronic discomfort. These factors drive the demand for tools such as stents, plugs, and implants, fostering growth in the market as more patients seek effective, long-term solutions.

Additionally, innovations in biomaterials, micro-surgical techniques, and minimally invasive procedures have significantly improved the effectiveness of lacrimal devices, making treatments safer and more comfortable for patients. Advanced biomaterials enhance biocompatibility, reducing complications and increasing device longevity. Micro-surgical techniques allow for precise implantation, minimizing recovery time, and minimally invasive procedures further improve patient experience, reducing the need for extensive surgeries. These advancements drive wider adoption among healthcare providers, increasing demand and contributing to the overall expansion of the market.

Key Lacrimal Devices Market Insights Summary:

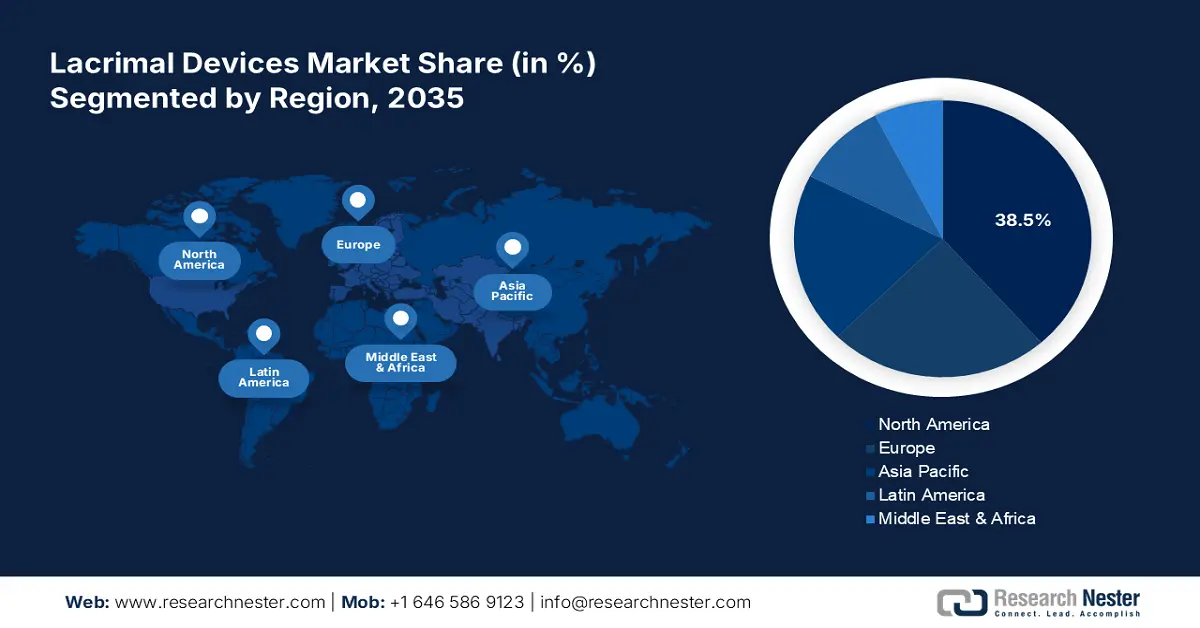

Regional Highlights:

- North America holds a 38.5% share in the Lacrimal Devices Market, driven by the increasing prevalence of dry eye syndrome, lacrimal duct obstruction, and chronic conjunctivitis, positioning it for sustained growth through 2035.

- The APAC Lacrimal Devices Market is forecasted to achieve the fastest CAGR by 2035, fueled by awareness campaigns on eye health and advancements in diagnostic technologies.

Segment Insights:

- The Dry eye segment is expected to hold the majority of market share by 2035, driven by rising cases of dry eye syndrome due to aging populations, increased screen time, and environmental factors.

- The Stents Segment is expected to achieve a 28.4% share by 2035, driven by the increasing prevalence of lacrimal duct obstruction, particularly among infants.

Key Growth Trends:

- Enhancing medical facilities and services

- Rising medical tourism and affordable treatment options

Major Challenges:

- Limited reimbursement options

- Economic burden of costly treatments

- Key Players: Medennium, BVI Lacrimedics Inc..

Global Lacrimal Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 163.69 million

- 2026 Market Size: USD 170.32 million

- Projected Market Size: USD 254.21 million by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Lacrimal Devices Market Growth Drivers and Challenges:

Growth Drivers

- Enhancing medical facilities and services: According to IBEF, the Indian healthcare industry, which is supported by both the public and private sectors, continued to grow healthily in 2023 and is estimated to value USD 372 billion by January 2025. Investments from government and private sectors are enhancing ophthalmology clinics and hospitals, improving access to specialized eye care. This improves the diagnosis and management of lacrimal disorders, driving demand for advanced devices including stents and plugs. As healthcare facilities adopt new ophthalmic technologies, patient outcomes improve, leading to further adoption of these devices and contributing to the expansion of the lacrimal devices market.

- Rising medical tourism and affordable treatment options: Countries with advanced ophthalmic care, such as Japan and India, are becoming key destinations for medical tourists seeking affordable yet high-quality lacrimal surgeries. The availability of skilled ophthalmologists, state-of-the-art medical facilities, and cost-effective treatment options attract international patients. This growing influx of medical tourists increases the demand for lacrimal devices, such as stents and plugs, boosting their adoption in surgical procedures. As a result, the medical tourism trend is significantly driving the growth of the market.

Challenges

- Limited reimbursement options: In certain regions, the lack of insurance coverage for lacrimal devices and related surgical procedures creates a significant barrier for patients seeking treatment. Without adequate reimbursement policies, the financial burden on patients increases, limiting their ability to access necessary care. This is particularly challenging in countries with public healthcare systems, where limited funding and reimbursement options for specialized treatments, such as lacrimal devices, may result in delayed or inadequate care, ultimately hindering extension in the market.

- Economic burden of costly treatments: Lacrimal devices, such as stents and plugs, often come with high price tags, limiting their availability, particularly in emerging markets with constrained healthcare budgets. The steep cost of treatment may discourage patients from choosing these devices, even when advised by healthcare professionals. This challenge is particularly evident in regions where access to advanced ophthalmic care is limited, or healthcare funding is insufficient, slowing the adoption of lacrimal devices in these areas.

Lacrimal Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 163.69 million |

|

Forecast Year Market Size (2035) |

USD 254.21 million |

|

Regional Scope |

|

Lacrimal Devices Market Segmentation:

Product (Intubation sets, Tubes, Stents, Cannula & spatula, Dilator, Punctal plugs Others)

Stents segment is expected to capture lacrimal devices market share of around 28.4% by the end of 2035. The segment is growing due to the increasing prevalence of lacrimal duct obstruction, especially among infants. According to the NLM, the prevalence of this condition in infants was approximately 6% to 20% as of August 2023. Minimally invasive stent procedures offer quicker recovery and reduced complications compared to traditional surgeries, driving their adoption. Technological advancements have improved the biocompatibility and effectiveness of lacrimal stents, further boosting demand. Additionally, rising awareness of ophthalmic disorders and improved healthcare access are fueling market enlargement, particularly in developed and emerging economies.

Application (Dry eye, Glaucoma, Epiphora, Drainage obstruction, Lacrimal gland inflammation, Others)

Based on the application segment, the dry eye segment is poised to garner the majority of market share over the forecast period. The surge in this segment is attributed to rising cases of dry eye syndrome, driven by aging populations, increased screen time, and environmental factors. According to the UCLA Health report, published in January 2025, the annual number of new cases of this symptom is expected to be 3 million. Additionally, technological advancements in tear conservation and stimulation therapies are enhancing treatment efficacy. Expanding healthcare infrastructure and accessibility to specialized ophthalmic care further contribute to the lacrimal devices market growth.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lacrimal Devices Market Regional Analysis:

North America Market Statistics

By 2035, North America lacrimal devices market is set to dominate over 38.5% revenue share. The increasing prevalence of conditions such as dry eye syndrome, lacrimal duct obstruction, and chronic conjunctivitis-driven by factors such as aging populations, prolonged screen exposure, and environmental influence is fueling demand for lacrimal devices. According to Frontiers Media S.A., in February 2024, the prevalence of DED varies by area, with North America having a prevalence of 4.6%. In response, leading companies and research institutions in North America are investing in R&D to create innovative lacrimal devices. These efforts are leading to product advancements, improved treatment efficacy, and expanded market opportunities.

The advanced healthcare system in the U.S. ensures that patients have access to specialized ophthalmic treatments for lacrimal disorders, which include conditions affecting tear production and drainage. This access facilitates the adoption of innovative devices and therapies designed to help manage these disorders effectively. Additionally, increased public awareness of eye health, alongside improved diagnostic methods, allows for earlier detection and treatment of lacrimal conditions. As a result, there is a growing demand for these specialized devices, significantly contributing to the expansion of the lacrimal devices market. This proactive approach, bolstered by continuous technological advancements, enhances patient outcomes and overall eye health.

In Canada, the aging population is contributing to a significant rise in age-related eye disorders, notably dry eye syndrome and lacrimal duct obstructions. This trend is creating an increased demand for lacrimal devices designed to manage these conditions effectively. Public health campaigns, such as the Canadian Association of Optometrists’ GetEyeWise initiative, are playing a crucial role in raising awareness about the importance of eye health. These efforts are resulting in earlier diagnoses and treatments for lacrimal disorders, further boosting the utilization of the market.

Asia Pacific Market Analysis

The APAC lacrimal devices market is slated to garner the fastest CAGR over the forecast period. Awareness campaigns on eye health and advancements in diagnostic technologies are driving early detection and treatment of lacrimal disorders, boosting demand for ocular equipment such as stents and plugs. Additionally, increased investment in healthcare infrastructure across the Asia Pacific is improving access to ophthalmic care. Government initiatives and private sector funding are enhancing diagnostics facilities, leading to higher adoption of lacrimal devices. These factors collectively contribute to the strong growth of the market in this region.

The geriatric population in China is contributing to a higher presence of age-related eye disorders such as dry eye syndrome and lacrimal duct obstruction, increasing demand for lacrimal devices such as stents and plugs. Additionally, advancements in diagnostic technologies have enabled more accurate detection of lacrimal disorders, promoting early treatment and boosting the demand for effective devices. These factors, combined with improved healthcare access, are driving the demand in the market in China.

Government and private investments in the ophthalmic care sector in India are enhancing access to specialized treatments, leading to the widespread adoption of advanced lacrimal devices in hospitals and eye clinics. For instance, in 2021, the Invest India Investment Grid estimated that there were over 600 investment possibilities with a combined value of USD 32.0 billion. Additionally, the expanding medical device manufacturing sector in India is producing affordable lacrimal implants and stents, making treatment more accessible. This combination of improved healthcare infrastructure and cost-effective solutions is driving the demand for lacrimal devices, fueling lacrimal devices market growth across both urban and rural areas.

Key Lacrimal Devices Market Players:

- FCI Ophthalmic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medennium

- BVI

- Lacrimedics Inc

- Rumex International Co

- Bess Medical Technology GmbH

- Braintree Scientific

- JEDMED

- Walsh Medical Devices Inc

- Nordic Pharma

- INNOVIA MEDICAL

Leading companies in this market are investing in advanced biomaterials to develop more biocompatible and durable stents and plugs, enhancing patient comfort and treatment efficacy. Innovations in minimally invasive surgical techniques are improving success rates for lacrimal duct obstruction treatments. Additionally, companies are integrating smart diagnostics and AI-driven imaging solutions, enabling early detection and personalized treatments, ultimately expanding the adoption of lacrimal devices in ophthalmic care. These key players are:

Recent Developments

- In October 2024, LACRIFILL Canalicular Gel, launched by Nordic Pharma, is driving growth in the lacrimal devices market by offering an innovative solution for treating dry eye through tear drainage occlusion.

- In March 2021, INNOVIA MEDICAL acquired Lacremedics, a manufacturer and distributor of occlusion therapy devices for treating dry eye disease. This acquisition allowed INNOVIA MEDICAL to expand its existing ophthalmic product line.

- Report ID: 7180

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lacrimal Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.