Laboratory Centrifuge Market Outlook:

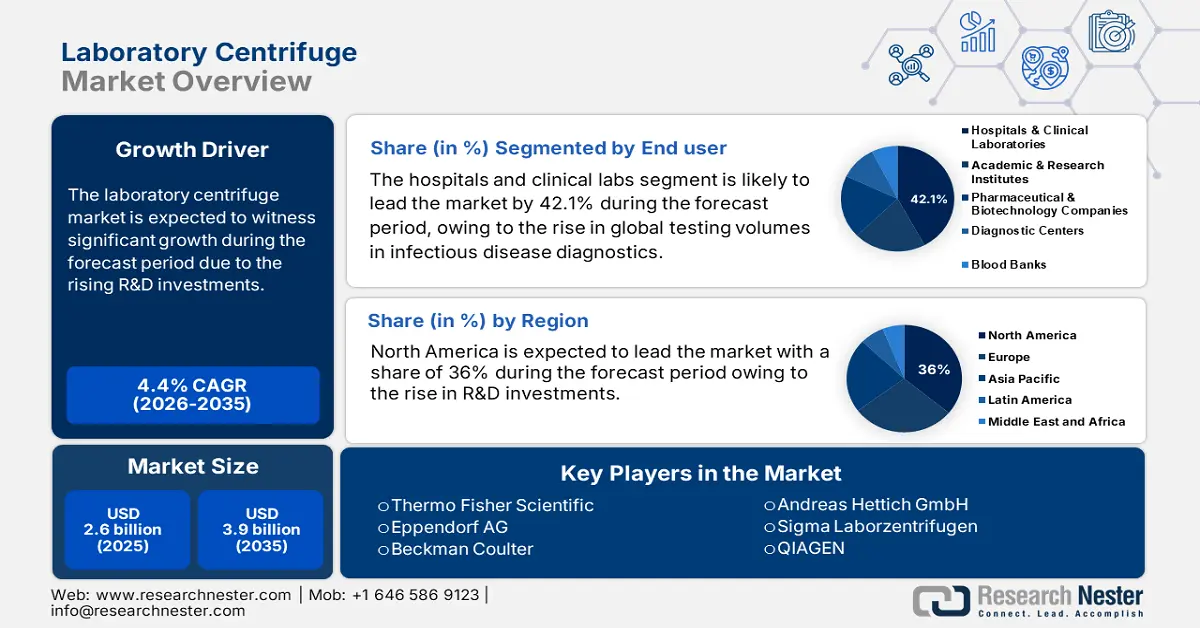

Laboratory Centrifuge Market size was valued at USD 2.6 billion in 2025 and is projected to reach USD 3.9 billion by the end of 2035, rising at a CAGR of 4.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of laboratory centrifuge is assessed at USD 2.7 billion.

The laboratory centrifuge market is driven by rising R&D investments, the increasing prevalence of infectious diseases, advancements in technology and rotor design, and the broadening applications of laboratory centrifuges. Additionally, the rise in chronic disease occurrence and advanced product developments will boost the laboratory centrifuge market growth in the upcoming years. Laboratory settings are a vital process in the healthcare sector, and innovations such as high-speed and automated centrifuges are actively enhancing the accuracy and efficacy, resulting in quality outcomes. For example, the Allegra V-15R benchtop centrifuge, which was launched in February 2022 by Beckman Coulter, is a compact model focusing on enhanced safety and boosted laboratory efficacy. These user-friendly models have made them accessible to small research and clinical labs.

On the trading side, as per the OEC report published in 2023, the world trade of centrifuges is USD 90.6 billion, which is a rise of 1.06% since 2022. Centrifuges are ranked in the 35th position in the global trade values, which is nearly 0.4% of the world trade value. Further, the leading exporters of centrifuges are Germany, the U.S., and China. Import dependence on critical subassemblies has made the industry sensitive to global logistics costs and tariffs. Further, the U.S. imports precision laboratory materials from Germany, Japan, and China; on the other hand, the regional assembly lines North Carolina, Massachusetts, and parts of California. Moreover, the investments in research, development, and deployment are related to expanded modernization in public health goals and advanced research projects in lab automation and diagnostic surgeries, which have centrifuges playing a significant role in sample integrity.

Key Laboratory Centrifuge Market Insights Summary:

Regional Highlights:

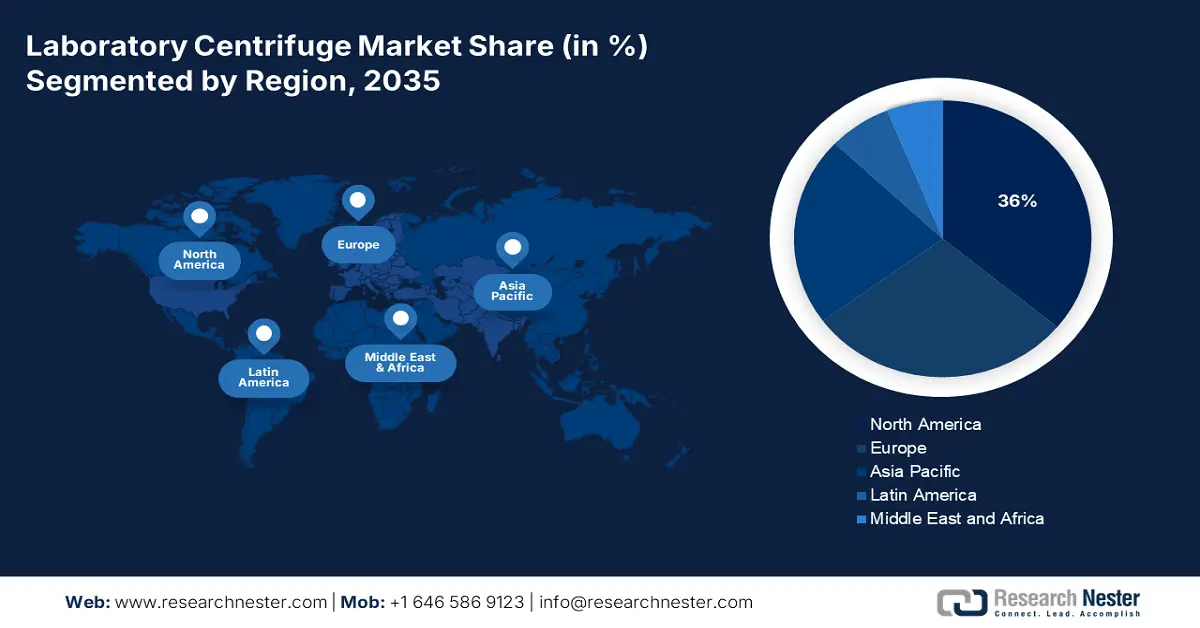

- North America is anticipated to capture a 36% share at a 6.1% CAGR by 2035 in the laboratory centrifuge market, supported by escalating R&D investments and rapid adoption of technologically advanced centrifuge systems.

- Asia Pacific is poised to be the fastest-growing region with a 22.2% share at a 7.0% CAGR by 2035, driven by expanding biopharma R&D activities and rising diagnostic needs across major economies.

Segment Insights:

- Hospitals and clinical labs are projected to secure a 42.1% share by 2035 in the laboratory centrifuge market, supported by rising diagnostic volumes and expanding lab infrastructure in developing regions.

- Benchtop centrifuge is anticipated to command a 34.6% share by 2035, underpinned by its compact design, versatility, and affordability for decentralized and mid-throughput diagnostic operations.

Key Growth Trends:

- Rising focus on personalized medicine

- Advancements in technology influencing laboratory devices

Major Challenges:

- Lack of knowledge in clinical technicians

Key Players: Thermo Fisher Scientific (U.S.), Eppendorf AG (Germany), Beckman Coulter (Danaher) (U.S.), Andreas Hettich GmbH (Germany), Sigma Laborzentrifugen (Germany), QIAGEN (Netherlands), Hitachi Koki (Koki Holdings) (Japan), Sartorius AG (Germany), OHAUS Corporation (U.S.), Labnet International (U.S.), HERMLE Labortechnik GmbH (Germany), Hunan Kaida Scientific (China), KUBOTA Corporation (Japan), Bio-Rad Laboratories (U.S.), NuAire Inc. (U.S.), Tomy Digital Biology Co., Ltd. (Japan), Medis Instruments (Switzerland), Daihan Scientific (South Korea), REMI Group (India), Koki Holdings (Himac) (Japan)

Global Laboratory Centrifuge Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.6 billion

- 2026 Market Size: USD 2.7 billion

- Projected Market Size: USD 3.9 billion by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 18 August, 2025

Laboratory Centrifuge Market - Growth Drivers and Challenges

Growth Drivers

- Rising focus on personalized medicine: The progress in proteomics and genomics is driving the demand in centrifuge equipment. The growing occurrence of chronic diseases, continuous innovation and increased diagnostic testing are supporting on market expansion. Further, manufacturers are inventing new product and advanced benchtop centrifuge models aiding a wide range of applications including blood separation and high throughput screening. These modern systems are designed to offer flexible configurations and programmable functions, allowing laboratories to streamline workflows and meet the evolving demands of clinical and research settings.

- Advancements in technology influencing laboratory devices: Modern centrifuges are featuring in automation, improved accuracy, high speeds and enhancing the workflow with reduced human errors. User friendly and compact designs are making the centrifuges as more accessible device in clinics. Further new models are focusing on digital interfaces and better security features. For instance, Eppendorf has launched a multipurpose centrifuge device 5910 Ri in April 2021 to boost the efficiency in test outcomes across diverse clinical and research environments. Technology is expected to remain a major growth driver in the coming years.

- Increase in patient pool and disease occurrence: The growing burden of the patient pool is driving the laboratory centrifuges. Diseases such as diabetes, cancer, and cardiovascular diseases need extensive diagnostic testing and monitoring that highly relies on the lab equipment. Centrifuges play a major role in analyzing the components in blood and urine to diagnose the disease. Nowadays, hospitals are highly focused on personalized treatment and early detection, and the use of centrifuges is also expected to rise. This rising demand propels the laboratory centrifuge market expansion mainly in diagnostic centers, research institutes, and hospitals.

Challenges

- Lack of knowledge in clinical technicians: Even with the advanced equipment availability, there is a shortage of trained lab technicians’ limits centrifuge usage. The NLM report published in March 2025 have stated that more than 71% of the technicians do not have formal centrifuge training. Many rural and underserved areas operate with underqualified staff leading the misuse and prenatal errors. Further, the global health authorities have stated that digital training platforms are required to improve technician skills. These training aim to enhance the process quality, reduce error and support adoption to expand the market.

Laboratory Centrifuge Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 2.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.9 billion |

|

Regional Scope |

|

Laboratory Centrifuge Market Segmentation:

End user Segment Analysis

In the end user segment, hospitals and clinical labs led the laboratory centrifuge market and is poised to hold the share value of 42.1% by 2035. The segment is driven by the growing global testing volumes in infectious disease diagnostics and chronic disease monitoring. Hospitals and clinical labs use laboratory centrifuges to separate the components from the samples such as blood or urine. Laboratory centrifuges are actively used in the hospital labs to reduce the prenatal error in diagnosis. Further, the increased constraints in infections and diseases continue to drive the investment in lab expansion mainly in developing regions.

Product Type Segment Analysis

Benchtop centrifuge lead the product type segment and is poised to hold the share value of 34.6% by 2035. The segment is driven due to their compact size, adaptability and affordability for low and mid throughput applications in clinics and diagnosis sectors. The cost of the benchtop mini centrifuge is 20 €, which is capable to remove the droplets, as per the NLM 2025 report published in March. According to the congress.gov report published in June 2024, NIH has allocated USD 52 million to support regional biocontainment laboratories including research work, facilities and devices. Further the centrifuges devices also plays a major role in aiding decentralized testing strategies.

Application Segment Analysis

Under the application, the clinical diagnostics lead segment is poised to hold a laboratory centrifuge market share value of 28.8% by 2035. The segment is driven by the growing emphasis on personalized medicine and early detection. Clinical diagnostics is the place where every technician needs to have an updated knowledge of centrifuges, and as per the NLM report published in March 2025, 72% of the lab technicians have well-versed knowledge in centrifuge devices, indicating the potential in using laboratory environments and reducing prenatal errors.

Our in-depth analysis of the global laboratory centrifuge market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Rotor Design |

|

|

Model |

|

|

Application |

|

|

End user |

|

|

Trade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Laboratory Centrifuge Market - Regional Analysis

North America Market Insights

North America is the dominating region in the laboratory centrifuge market and is expected to hold the market share of 36% at a CAGR of 6.1% by 2035. The region is driven by the rising R&D investments, rapid development of innovative products, and advancements in healthcare infrastructure. The region is redefining the laboratory process with the latest technology such as Meling Biomedical has launched the CT-G185R, which is a high-speed benchtop refrigerated centrifuge widely used in diagnostics and biomedical research due to its peak performance and enhanced safety, as per the Meling Biomedical report in December 2024. The U.S. and Canada are driving the region with the increasing demand for high-throughput diagnostics and personalized medicine.

The laboratory centrifuge market in the U.S. is driven due to the demand for diagnostic sample processing and supported by government investment. The NIH article published in June 2025 depicts that nearly USD 48 billion is allocated to medical research, including universities, hospitals, laboratories, and other institutions. Further, the growing adoption of the latest technology, including centrifuges in the laboratory for food safety testing, is gaining attention. Laboratory automation and AI-enabled diagnostics also aid the procurement of high-speed centrifuges in the healthcare sector. Moreover, strong regulatory frameworks in the pharmaceutical and healthcare sectors use laboratory centrifuges to fuel the market growth.

Centrifuge Import Data in the U.S. (2025)

|

Product Details |

Quantity |

Country |

Supplier |

Buyer |

|

Labware |

4213 CTN |

China, New York |

Zhejiang Runlab Technology |

MTC BIO INC |

|

Vacuum Blood Collection Tubes Centrifuge |

93 CTN |

China, Miami |

Jiangsu Kangjian Medical Apparatus Co Limited |

Boco Dental Regenerative LLC |

|

Centrifuges filtering purifying machinery |

24 |

Italy |

Atlas Filtri SRL |

Atlas Filtri North America LLC |

|

Labware |

4823 CTN |

Republic of Korea, New York |

Zhejiang Runlab Techn |

MTC BIO INC |

Source: NIH

Market Concentration of Centrifuge Imports in Canada

|

Number of Importers |

Value of Imports (Can$) |

Cumulative % of Imports |

|

3 |

26,112,267 |

35.68% |

|

6 |

36,212,063 |

49.48% |

|

10 |

42,713,559 |

58.36% |

|

15 |

47,073,912 |

64.32% |

|

20 |

49,913,799 |

68.20% |

|

25 |

52,376,866 |

71.56% |

|

43 |

58,884,182 |

80.45% |

|

All (Total Importers) |

59,189,540 |

100.00% |

Source: ISED

APAC Market Insights

The APAC is the fastest-growing region in the laboratory centrifuge market and is poised to hold the market share of 22.2% at a CAGR of 7.0% by 2035. The region is driven by the growth in biopharmaceutical R&D and rising diagnostic demands. The rise in public health spending across Japan, China, India, Malaysia, and South Korea also surges the market demand. Companies in Asia Pacific are actively expanding their presence via strategic partnerships, mergers and acquisitions, and investments in the latest technologies. With a rise in large population and experiencing new health concerns, the region is adopting advanced technology for personalized medicine, biobanking, and infectious disease testing.

India

India is experiencing a rapid shift in the laboratory centrifuge market. The market in India is built by many regional players aiming for simple and low-cost centrifuge devices. As per the Science Direct micro journal article published in February 2024, the smartphones are connected with low-cost centrifuges to separate plasma in the blood, and the result has given a 99.9% accuracy and purity in just 140 seconds. Further, India has also developed a portable spinning disc system to analyze multiple diagnostic parameters from just a single drop of body fluid. The platform is mainly designed to validate Complete Blood Count (CBC) tests.

Timeline and Technical Advancements in Centrifuge-Based Platelet-Rich Fibrin (PRF) Processing

|

Protocol |

Equipment Used |

Nomenclature |

|

|

2021 |

700 g for 8 min Followed by 10 min cooling of PRF with albumin gel |

Eppendorf centrifuge 5702 machine (Hamburg, Germany) |

Albumin-PRF (Alb-PRF) |

|

2022 |

700 g for 8 min |

Bio-PRF, Venice, Florida |

Horizontal PRF (H-PRF) |

|

2023 |

3000 rpm for 18 min |

REMI-R-303 |

PRF in patients with uncontrolled diabetic |

Source: NLM

Europe Market Insights

Europe is projected to hold the market share of 28.9% at a CAGR of 5.8% by 2035 in the laboratory centrifuges market. The region is driven due to the rising demand for advanced laboratory technologies in the healthcare sector. The demand is mainly high in pharmaceutical QA/QC labs and clinical microbiology, where ultracentrifuge equipment is essential with high speed for accuracy. Europe is actively investing in laboratory devices, as centrifuges reduce the test cost. According to the open research Europe article published in September 2022, states that without centrifuges, LAMP assays need an additional 65% of reagents, resulting in increased test cost. Hence, the region is indirectly accelerating adoption by enabling precision diagnostics initiatives.

Germany holds the largest share of the laboratory centrifuges market in Europe region. Germany is the top exporter and exports USD 14.1 billion of centrifuges in 2023, as per the OEC report. In 2023, Germany recorded one of the largest trade surpluses in centrifuges globally, accounting for USD 6.28 billion. The industrial infrastructure facilitates the production of centrifuge components, especially in Bavaria and Baden-Württemberg, which reduces the dependency on imports and supports strong domestic assembly lines. Further, it is supported by personalized medicine advancements and biopharma scaling.

Key Laboratory Centrifuge Market Players:

- Thermo Fisher Scientific (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eppendorf AG (Germany)

- Beckman Coulter (Danaher) (U.S.)

- Andreas Hettich GmbH (Germany)

- Sigma Laborzentrifugen (Germany)

- QIAGEN (Netherlands)

- Hitachi Koki (Koki Holdings) (Japan)

- Sartorius AG (Germany)

- OHAUS Corporation (U.S.)

- Labnet International (U.S.)

- HERMLE Labortechnik GmbH (Germany)

- Hunan Kaida Scientific (China)

- KUBOTA Corporation (Japan)

- Bio-Rad Laboratories (U.S.)

- NuAire Inc. (U.S.)

- Tomy Digital Biology Co., Ltd. (Japan)

- Medis Instruments (Switzerland)

- Daihan Scientific (South Korea)

- REMI Group (India)

- Koki Holdings (Himac) (Japan)

The global laboratory centrifuge market is very competitive and driven by the regulatory compliance, innovations in technology and ongoing research. Key players such as Thermo Fisher, Beckman Coulter, and Eppendorf are actively investing and focusing on safety measures, energy efficiency, and automations. Japan companies are expanding ultracentrifuge capabilities aiming on the advanced research applications. On the other hand, companies in India, China and South Korea are focusing on the cost effective solutions in the developing markets. Further, product launches, mergers and collaborations are reshaping the market.

Below is the list of some prominent players operating in the global laboratory centrifuge market:

Recent Developments

- In March 2025, Thermo Fisher Scientific has launched a sustainable large capacity and superspeed centrifuges with a natural refrigerant cooling system. The product has reduced 14% energy consumption compared to other models.

- In September 2024, Labcorp has acquired key assets of BioReference Health from OPKO Health, strengthening its global laboratory and diagnostic service offerings with the total purchase price of USD 237.5 million.

- Report ID: 7993

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Laboratory Centrifuge Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.