Lab-on-a-Chip Market Outlook:

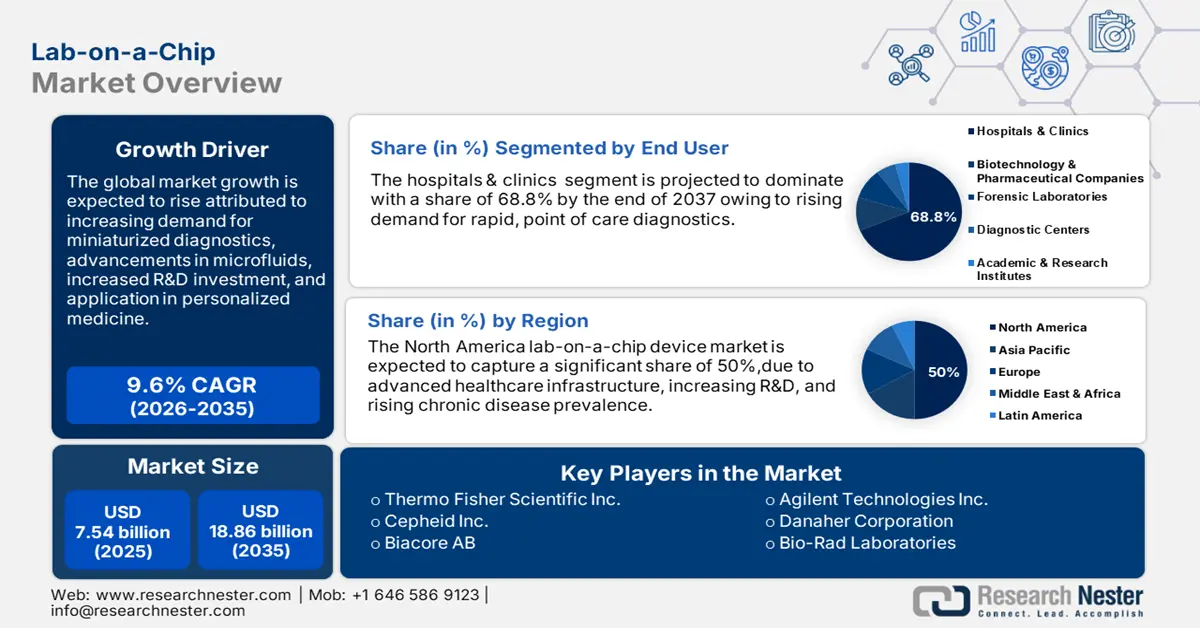

Lab-on-a-Chip Market size was valued at USD 7.54 billion in 2025 and is likely to cross USD 18.86 billion by 2035, registering more than 9.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lab-on-a-chip is assessed at USD 8.19 billion.

Point-of-care testing enables rapid, on-site diagnostics, reducing reliance on centralized labs. Lab-on-a-chips, being compact and efficient, are essential in both developed and resource-limited settings. The growing demand for faster diagnostics in managing chronic diseases such as diabetes, cancer, and cardiovascular conditions, as well as during infectious diseases outbreaks, is driving their adoption. For instance, approximately 38.4 million people of all ages, or 11.6% of the U.S. population, had diabetes in 2021, according to CDC research published in May 2024. With precise results from minimal samples, lab-on-a-chips play a crucial role in early diagnosis, disease monitoring, and personalized treatment planning, fueling lab-on-a-chip market growth.

Additionally, innovations in microfluidics have significantly enhanced the performance of lab-on-a-chip, making them more efficient, accurate, and cost-effective. Sysmex Corporation introduced a point-of-care testing system in June 2023 that uses a special and exclusive microuidic technology to quickly determine antibiotic susceptibility in Europe. Advancements in material science and the integration of biosensors have allowed for more precise diagnostics and monitoring. Automation of complex laboratory processes on a single chip has expanded the applications of lab-on-a-chips across genomics, proteomics, and drug discovery. These innovations not only streamline laboratory workflows but also open new avenues for research and personalized healthcare, driving lab-on-a-chip market growth.

Key Lab-on-a-Chip Market Insights Summary:

Regional Highlights:

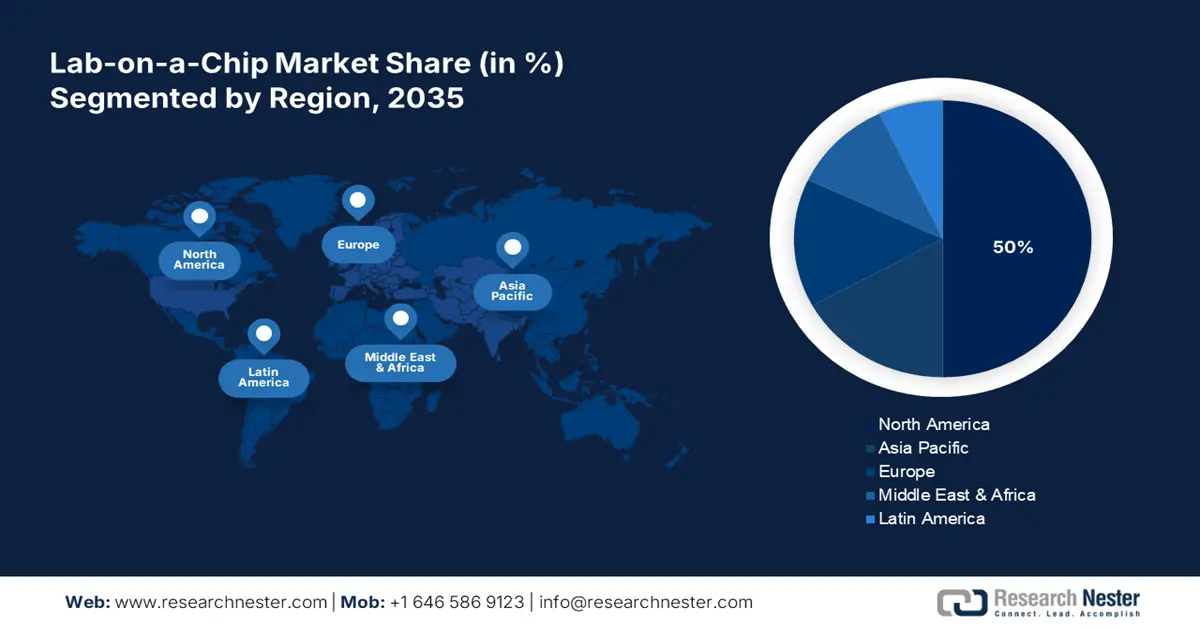

- North America lab-on-a-chip market will hold around 50% share by 2035, driven by chronic disease prevalence and government investments in diagnostic R&D.

- Europe market will achieve the fastest growth from 2026 to 2035, attributed to rising point-of-care diagnostics and microfluidics innovation.

Segment Insights:

- The hospitals & clinics segment in the lab-on-a-chip market is projected to capture a 68.80% share by 2035, fueled by the demand for rapid diagnostics in clinical settings.

- The microfluidics segment in the lab-on-a-chip market is forecasted to hold the majority share by 2035, attributed to diagnostic miniaturization and improved testing efficiency.

Key Growth Trends:

- Government & private investment in biotechnology

- Expanding application in drug development & research

Major Challenges:

- Approval from regulatory authorities

Key Players: Agilent Technologies Inc., Becton, Dickinson and Company, Danaher Corporation, Bio-Rad Laboratories, Abbott Laboratories, Hoffmann-La Roche AG, PerkinElmer Inc., IDEX Corporation, Thermo Fisher Scientific Inc., Cepheid Inc., Biacore AB, BASF, Biomillenia, Syensgo, Emulseo, Microchip Technology.

Global Lab-on-a-Chip Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.54 billion

- 2026 Market Size: USD 8.19 billion

- Projected Market Size: USD 18.86 billion by 2035

- Growth Forecasts: 9.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 9 September, 2025

Lab-on-a-Chip Market Growth Drivers and Challenges:

Growth Drivers

- Government & private investment in biotechnology: Significant funding for research and development in biotechnology plays a crucial role in accelerating the commercialization of lab-on-a-chips. Government initiatives, such as grants and subsidies, along with private sector investments, fuel innovation in diagnostic and therapeutic technologies. In August 2024, the U.S. National Science Foundation invested USD 14 million in seven interdisciplinary projects under the EFRI: Biocomputing through EnGINeering Organoid Intelligence program. This funding advances lab-on-a-chips, increasing efficiency and versatility, driving market growth.

- Expanding application in drug development & research: Lab-on-a-chips are revolutionizing pharmaceutical research by offering a platform for efficient drug screening, toxicity studies, and biomarker analysis. Their ability to simulate complex biological processes on a microchip allows researchers to conduct experiments faster and with greater precision, ultimately accelerating drug development timelines. This not only reduces costs but also enhances the accuracy and reliability of results. As a result, the growing use of lab-on-a-chips in drug discovery significantly contributes to the lab-on-a-chip market expansion, particularly in pharmaceutical and biotechnology industries.

Challenges

- High development cost: developing lab-on-a-chips involves considerable investment in research, development, and manufacturing processes, which can be financial challenges for many companies. Integrating advanced technologies such as microfluidics, biosensors, and automation into compact, reliable systems drives up costs significantly. This financial burden often limits the ability of smaller companies and startups to enter the market and innovate. The high costs associated with design, production, and testing further impede the commercialization of new lab-on-a-chips, hindering market expansion.

- Approval from regulatory authorities: Lab-on-a-chips are used in critical diagnostic and therapeutic applications, requiring them to meet strict regulatory standards set by health authorities such as the FDA and EMA. These regulatory processes ensure that the devices are safe and effective for patient use. However, the need for extensive testing, documentation, and compliance with these regulations can be time- consuming and costly. The complexity of obtaining regulatory approval often delays market entry, hindering the timely availability of new lab-on-a-chip market.

Lab-on-a-Chip Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 7.54 billion |

|

Forecast Year Market Size (2035) |

USD 18.86 billion |

|

Regional Scope |

|

Lab-on-a-Chip Market Segmentation:

End User

The hospital & clinics segment is likely to dominate lab-on-a-chip market share of around 68.8% by the end of 2035. The segment’s growth is due to the increasing need for rapid, accurate diagnostics in critical healthcare settings. Lab-on-a-chip- devices enble point -of -care testing, reducing reliance on centralized labs and offering quick results for conditions, such infections and chronic diseases. Their compact design, high precision, and ability to analyze small sample volumes make them ideal for hospital use, improving patient outcomes and driving adoption in clinical settings worldwide.

Technology

Based on technology, the microfluids segment is anticipated to hold majority lab-on-a-chip market share by the end od 2035. The segment’s growth is attributed to its pivotal role in enabling the miniaturization of diagnostic and analytical processes. Microfluidics technology allows for precise control of fluids at the microscale, improving the efficiency and sensitivity of lab-on-a-chips. In December 2024, Syensgo collaborated with Emulseo integrating advanced solutions, enhancing droplet-based microfluidic analyses and driving growth in the market. Its ability to streamline processes, reduce costs, and enable high-throughput testing in various applications, including diagnostics and drug development, makes it a key driver of lab-on-a-chip market growth.

Our in-depth analysis of the global market includes the following segments:

|

End User |

|

|

Technology |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lab-on-a-Chip Market Regional Analysis:

North America Market Insights

North America lab-on-a-chip market is projected to dominate revenue share of around 50% by the end of 2035. The region has a well-established healthcare, supporting the adoption of advanced diagnostic tools such as lab-on-a-chips. Hospitals and diagnostic labs rely on LOC technology for faster, more accurate diagnostics, driving market growth. Additionally, the rising prevalence of chronic diseases such as cancer and diabetes has increased the demand for early detection and monitoring solutions. According to a June 2024 CDC report, 1,777,566 new cases of aggressive cancer were reported in the United States year 2021. Known for their precision and efficiency, lab-on a chips are becoming essential in the addressing these healthcare challenges, further boosting their adoption.

The U.S. government and private organizations are significantly investing in biotechnology and medical research, accelerating the development and commercialization of Lab-on-a-chips for applications such as genomics, proteomics, and drug discovery. Additionally, the rising focus on personalized medicine has amplified the demand for market, as they enable precise, patient-specific diagnostic and therapeutic solutions. These advancements and investments are driving innovation, expanding the scope of lab-on-a-chip market, and supporting its growing adoption in the healthcare sector.

Lab-on-a-chip are vital in personalized healthcare, enabling precise, patient-specific diagnostics and treatments. With a growing emphasis on tailored medical solutions, their integration into clinical and research settings, is expanding rapidly in Canada. Additionally, Canada has strong healthcare infrastructure, coupled with significant investments in modernizing diagnostic labs and hospitals, creates a supportive environment for the widespread adoption of lab-on-a-device technologies. Following increases of 4.5% in 2023 and 1.7% in 2022, new data from CIHI, released in November 2024, projects that health care spending in Canada would rise by 5.7% in 2024. These factors collectively drive the market growth and foster advancements in precision diagnostics and personalized medicine.

Europe Market Insights

In Europe, the lab-on-a-chip market is growing with the fastest CAGR throughout the forecast period. The increasing adoption of point of care testing in Europe, driven by the demand for rapid diagnostics in remote and resource-limited settings, has significantly boosted the need for Lab-on-a chips. These portable, user-friendly tools are ideal for on-the-spot diagnostics, making them essential for timely healthcare delivery. Additionally, ongoing advancements in microfluidics technology have improved the efficiency, miniaturization, and cost-effectiveness of lab-on-a-chips. As a result, their applications are expanding across diagnostics, drug development, and point of care testing, further supporting lab-on-a-chip market growth.

Germany has led microfluids research, resulting in more efficient, precise, and cost-effective lab-on-a-chips. These advancements enhance lab-on-a-chip applications in diagnostics, drug discovery, and environmental testing. Additionally, the Germam government’s significant investment in the biotechnology sector fosters research and development in lab-on-a-chip technologies, encouraging lab-on-a-chip market growth. Research and development spending in Germany has been 3.1% of GDP since 2020, according to Germany Trade & Invest in March 2024.This support helps commercialize innovations, making Germany a key player in advancing lab-on-a-chip capabilities, expanding their adoption in medical research, diagnostics, and other industries.

The U.K. is enhancing its healthcare infrastructure by adopting advanced medical technologies, which supports the integration of lab-on-a-chips into clinical and research settings. Additionally, significant government investments in healthcare innovation and biotechnology research are driving the development and commercialization of lab-on-a-chips. This financial backing accelerates the growth of the market by fostering the adoption of cutting-edge diagnostic tools, further boosting demand and expanding the application of lab-on-a-chip market in healthcare.

Lab-on-a-Chip Market Players:

- Agilent Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson and Company

- Danaher Corporation

- Bio-Rad Laboratories

- Abbott Laboratories

- Hoffmann-La Roche AG

- PerkinElmer Inc.

- IDEX Corporation

- Thermo Fisher Scientific Inc.

- Cepheid Inc.

- Biacore AB

Key companies in the lab-on-a-chip market are driving innovation through strategic partnerships, advanced technologies, and product development. Companies are introducing cutting-edge solutions, such as AI-powered diagnostic tools, precision systems for drug development, and advanced testing devices for medical imaging. In October 2019, BASF and Biomillenia collaborate using microbiome-on-a-chip-technology to discover dermocosmetic ingredients, enhancing skin health by modulating and maintaining diverse skin microbiota. Their focus on miniaturization, automation, and cost-effectiveness is enhancing lab-on-a-chip applications, revolutionizing healthcare, diagnostics, and research capabilities.

Recent Developments

- In December 2024, Microchip Technology released PolarFire FPGA and SoC solutions enhance medical imaging and robotics, driving innovation and precision in lab-on-a-chip applications.

- In November 2024, Abbott Laboratories invested in AI-guided TAVI system advances precision in severe aortic stenosis treatment, fostering innovation and growth in lab-on-a-chip application for diagnostics.

- In August 2024, FDA approved Agilent’s MAGE-A4 IHC 179 pharmDx enables precise synovial sarcoma diagnostics, advancing personalized medicine and boosting lab-on-a-chip adoption in targeted therapies.

- Report ID: 3929

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lab-on-a-Chip Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.