Krabbe Disease Treatment Market Outlook:

Krabbe Disease Treatment Market size was valued at USD 3.04 billion in 2025 and is likely to cross USD 6.04 billion by 2035, registering more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of krabbe disease treatment is assessed at USD 3.23 billion.

Krabbe disease also known as globoid cell leukodystrophy is an inherited rare condition impacting myelin that protects and covers nerve cells generating neurological disorders. According to Mount Sinai Organization, there is a 25% chance of children inheriting the condition in cases of both parents carrying the disease-related genes. Hearing issues, difficulty in feeding, loss of vision, sensitivity and irritability to loud noise, changes in muscle tone, unusual fever, and vomiting are the symptoms doctors observe to track the disease in their patients. Tests such as blood tests, cerebrospinal fluid (CSF) evaluation, MRI, nerve conduction velocity, and genetic testing are initiated by health experts to examine the symptoms, thus uplifting the market.

Globally, the incidence rate of krabbe disease depend upon birth rates which differ from nation to nation. For instance, presently the krabbe disease outbreak is 1 out of 100,000 in the Europe region, and 1 out of 250,000 in the U.S. The mortality rate is more than 90%, at least in the first two years of life as reported by the NLM in August 2023. Additionally, the adult onset krabbe disease is sporadic, accounting for less than 10% of the population globally by NLM 2021 report. Besides, 85%-90% of people are diagnosed with krabbe disease through enzyme activity constituting the infantile-onset, and 10%-15% fall into the category of later onset, thus positively impacting the krabbe disease treatment market.

Key Krabbe Disease Treatment Market Insights Summary:

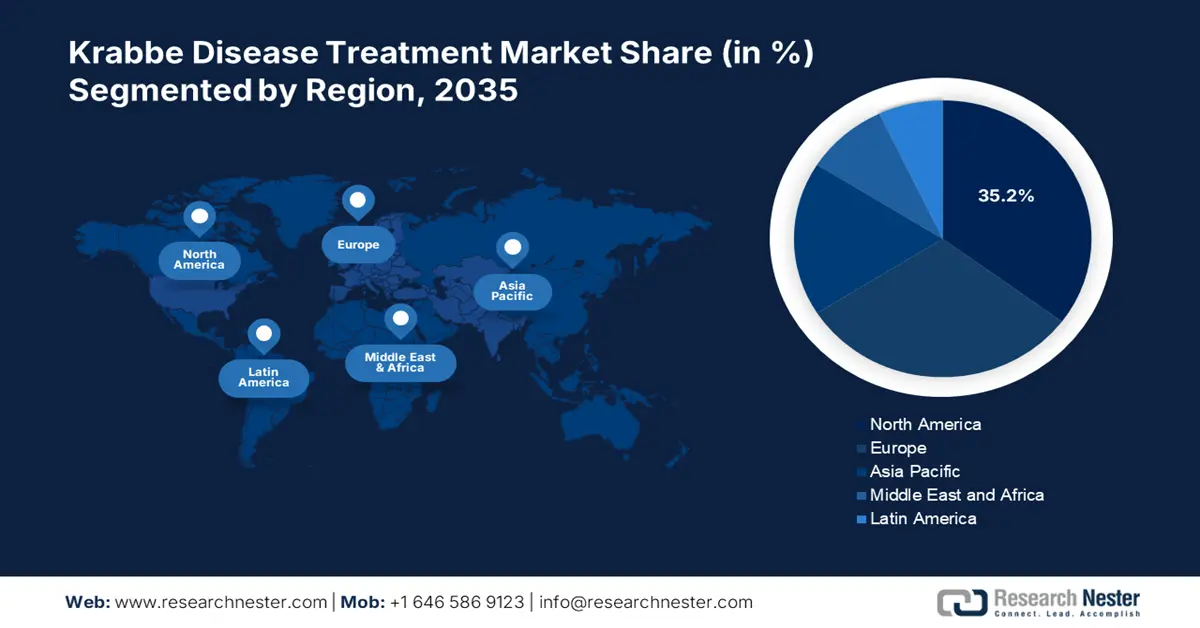

Regional Highlights:

- North America Krabbe disease treatment market will account for 35.20% share by 2035, driven by increasing deficiency awareness, birth demographics, and medical initiatives for Krabbe disease.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, attributed to increasing awareness, reimbursement policies, and improved treatment facilities for rare diseases.

Segment Insights:

- The anticonvulsants segment in the krabbe disease treatment market is expected to achieve significant growth till 2035, driven by the effectiveness of anticonvulsants in managing seizures associated with Krabbe disease.

Key Growth Trends:

- Newborn screening

- Pharmacological chaperone therapy

Major Challenges:

- Government restrictions for rare diseases

Key Players: Pfizer Inc., Abbott Laboratories, Johnson & Johnson Services, Inc, Sanofi-Aventis SA, Teva Pharmaceutical Industries Ltd., Acorda Therapeutics Inc..

Global Krabbe Disease Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.04 billion

- 2026 Market Size: USD 3.23 billion

- Projected Market Size: USD 6.04 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: Germany, Japan, India, Brazil, South Korea

Last updated on : 18 September, 2025

Krabbe Disease Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Newborn screening: The krabbe disease treatment market currently comprises no particular cure. However, there are supportive therapies that assist in the management of the disease, especially among children. For instance, newborn screening is useful in identifying diseases that interrupt the health or survival of children on a long-term basis. At present, this technique is available across New Jersey, Missouri, Kentucky, New York, Tennessee, Illinois, Indiana, Ohio, Georgia, Pennsylvania, Minnesota, and South Carolina. Newborn screening includes the transplantation of stem cells within 4-6 weeks of age, denoting quality improvement of life for affected children, thus driving the market.

- Pharmacological chaperone therapy: It is an inherent therapy for genetic diseases, effectively driving the growth of the krabbe disease treatment market. There is diversity in protein targets of this therapy- enzymes like transferases determine 45%, transporters constitute 28%, and receptors comprise 15%, as stated by the NLM in January 2020. These proteins comprise various subcellular localization and are transformed across the endoplasmic reticulum in large numbers. Thereby, the therapy tends to bind and stabilize β‐galactocerebrosidase (GALC) to combat inappropriate folding and escape breakdown, thus allowing lucrative transportation of enzymes to the lysosome and assisting in the market growth.

Challenges

-

Restricted patients for clinical studies: The krabbe disease treatment market is subjected to limitations in the number of patients for clinical trials. Additionally, ethical constraints, complexity in generating accurate trial numbers, and maintenance costs are practical challenges affecting the market. However, in March 2022, Passage Bio, Inc. stated that the initial patient diagnosed with early infantile Krabbe disease has been treated with PBKR03, a gene therapy utilizing adeno-associated virus (AAV) delivery, in the global Phase 1/2 clinical trial known as GALax-C. Despite this, inadequate medical trials still pose limitation in the upliftment of the market.

- Government restrictions for rare diseases: The NLM 2020 report published that the prevalence of rare diseases around the world accounts for 3,585 cases which is 3.5% to 5.9% of the global population, adversely affecting the krabbe disease treatment market. Lifelong disorders, absence of compensatory support, cost-effective treatments, and long diagnostic odyssey are a few unmet requirements that create a gap among patients suffering from rare diseases. As a solution to this, the U.S. Food and Administraion (FDA) in October 2024 approved medical treatments based on the Orphan Drug Act since 7,000 rare diseases severely affected over 30 million population in the U.S. Additionally, this initiation includes the participation of caregivers, drug manufacturers and patients, to create awareness and support the krabbe disease treatment market.

Krabbe Disease Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 3.04 billion |

|

Forecast Year Market Size (2035) |

USD 6.04 billion |

|

Regional Scope |

|

Krabbe Disease Treatment Market Segmentation:

Therapy Insights Segment Analysis

Based on the therapy insights, anticonvulsants segment is set to account for krabbe disease treatment market share of more than 38.4% by the end of 2035. Anticonvulsant medication helps in overcoming seizures, different from the ones caused due to epilepsy. Phenytoin has become one of the best anticonvulsant drugs to manage the disease. According to NIH in August 2023, its average monthly cost is USD 30 and its pervasive regular usage along with limited therapy-based index, a considerable portion results in prevention and management of the disease. Additionally, the combined use of topiramate and 4-aminopyridine reduces the severity and frequency of seizures by reducing abnormal functionalities, hence uplifting the market growth.

Our in-depth analysis of the global market includes the following segments:

|

Therapy Insights |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Krabbe Disease Treatment Market Regional Analysis:

North America Market Insights

North America in krabbe disease treatment market is anticipated to account for around 35.2% revenue share by 2035. There is an increased deficiency in the GALC enzyme within the region, leading to psychosine accumulation and further resulting in the reduction of neural myelination. Besides, increase in birth demographics by 0.98%, constituting 340.1 million population since 2023 within the region is a major reason for the emergence of later-onset disease as reported by the Census Bureau in December 2024. The disease commences in childhood, adolescence, and adulthood and the survival instinct depends upon the rigidity of the condition, denoting awareness of the market.

The U.S. krabbe disease treatment market is growing owing several factors. According to the HRSA Maternal and Child Health 2023, 1 in 100,000 people suffer from the disease. Out of these, babies are mostly affected and approximately 15 babies in the U.S. suffer severely. An estimation of about 10 babies remain alive due to the implementation of adequate treatment, especially through state-run medical initiatives that confine the parental education process through appropriate evaluation, management of disease, diagnostic testing, and effective follow-up. The U.S. Secretary of Health and Human Services has provided a list known as the Recommended Uniform Screening Panel (RUSP) that provides medical therapies to combat the disease, thus propelling market growth.

The krabbe disease treatment market in Canada is witnessing significant growth since children are vigorously suffering from the disease. As per the Canadian Paediatric Surveillance Program 2020 report, 16 cases of paediatric-onset leukodystrophies (LD) were evaluated out of which 44% were from Ontario and 31% from Western Canada, and the remaining were from other parts of the country. Moreover, the symptoms ranged from 55% cases delayed due to development, 44% comprised regression, 38% faced abnormal muscle tone, 31% comprised seizures and another 31% denoted behavioral changes. All these factors are responsible for the growth of the industry within the forecast period.

APAC Market Insights

APAC krabbe disease treatment market is projected to be the fastest growing region due to the awareness and visibility of the disease. As per the report by IQVIA 2024, the region has registered approximately 7,000 to 8,000 rare disorders and only 5% are currently under treatment. However, there has been improvement in treatment facilities for rare diseases. For instance, in Taiwan, people affected by rare disorders are entitled to up to 70% reimbursement on orphan-based drugs and people with low income are subjected to 100% reimbursement. Therefore, the market is expected to gain development and evolution due to all these factors.

The krabbe disease treatment market in India is expecting substantial growth due to an increase in its prevalence, accounting for 70 cases due to genetic disorders. Patients diagnosed with juvenile-onset range between 2 to 5 years of age and among adult-onset patients, symptoms generally appear during adulthood. Currently, there is absence of awareness since it is a rare disease, but the presence of other genetic and rare diseases including Tay-Sachs disease, it is expected that the industry will gain more attention, especially among adult psychiatrists and neurologists.

The krabbe disease treatment market in China is gaining traction due to the increasing frequency of the disease with a major focus on adult-onset krabbe disease. Among the China population suffering from the disease, there has been identification of GALC mutations denoting a link between phenotypes and genotypes. Brain MRI as a treatment solution is a considerable therapy to overcome the spread of the disease. Based on clinical trials, adult-onset krabbe disease is considered heterogeneous owing to the inclusion of a pyramidal tract with high incidence cause. Based on these factors, the industry is facing immense attention and awareness suitable for market development.

Krabbe Disease Treatment Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Abbott Laboratories

- Johnson & Johnson Services, Inc

- Sanofi-Aventis SA

- Teva Pharmaceutical Industries Ltd.

- Acorda Therapeutics Inc.

- CENTOGENE N.V.

- Novartis AG

- Polpharma

Companies dominating the krabbe disease treatment market are rapidly gaining exposure due to the rise in awareness of the disease. Standardized tools for diagnosing the disease along with increase in research and development are rising factors to boost the industry. Also, genetic testing, eye examination, nerve condition, and guided visualization are effectively propelling the treatment requirement of the disease. In April 2024, TeleRare Health introduced a virtual health center to diagnose krabbe diseases globally and provide patients with access to latest treatments and specialists.

Recent Developments

- In October 2024, Fiocruz and GEMMA Biotherapeutics declared a deal to provide fund for research on gene-based therapy treatments in Brazil, in purview of the Unified Health System (SUS). The objective is to gain approval for gene therapy programs to enhance the treatment of krabbe disease.

- In June 2024, GC Biopharma and Novel Pharma reported the U.S. FDA approval of the Fast Track Designation for the joint development of MPSIIIA (Sanfilippo syndrome Type A) treatment about curing krabbe disease.

- Report ID: 7102

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Krabbe Disease Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.