Global Kitchenware Market

- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Competitive Landscape

- Competitive Intelligence

- Outcome: Actionable Insights

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT Analysis

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- All Clad

- American Kitchen

- AVIAS

- Fissler

- Hexclad Cookware

- IMUSA USA

- Le Creuset India

- LongCap Lamson Products LLC

- Meyer UK

- Our Place

- OXO

- Pro Cook

- Regalware

- Tramontina India

- TTK Prestige Ltd.

- The Vollrath Co., L.L.C.

- Venus Kitchenware Co., Ltd.

- WUSTHOF

- ZWILLING

- Ongoing Technological Advancements

- Technology Trends in The Kitchenware Market

- Price Benchmarking

- SWOT Analysis

- Product Type Scenario

- Innovative Material Analysis

- Key End-User

- Patent Evaluation

- Recent Developments

- Root Cause Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Global Segmentation (USD Million), 2019-2037, By

- Product Type, Value (USD Million)

- Cookware

- Pots & Pans

- Pressure Cookers & Slow Cookers

- Dutch Ovens & Casseroles

- Griddles & Skillets

- Steamers & Poachers

- Induction-compatible Cookware

- Bakeware

- Baking Sheets & Trays

- Cake & Muffin Pans

- Loaf Pans & Bread Molds

- Pie & Tart Pans

- Ramekins & Custard Cups

- Rolling Pins & Pastry Boards

- Kitchen Tools & Gadgets

- Utensils

- Measuring Tools

- Mixing Bowls & Colanders

- Can Openers & Jar Openers

- Garlic Presses, Graters, and Zesters

- Kitchen Shears & Scissors

- Cutting Boards & Chopping Mats

- Mortar & Pestles

- Cutlery

- Chef’s Knives, Paring Knives, Santoku Knives, Utility Knives

- Carving Knives & Cleavers

- Bread Knives & Serrated Knives

- Knife Blocks & Sharpeners

- Flatware

- Cookware

- Material Type, Value (USD Million)

- Stainless Steel

- Aluminum

- Copper

- Glass

- Others

- Price Range, Value (USD Million)

- Economy

- Mid-Range

- Premium/Luxury

- End user, Value (USD Million)

- Residential Kitchens

- Commercial Kitchens

- Institutional Use

- Distribution Channel, Value (USD Million)

- Online

- E-commerce Platforms

- Brand Websites

- Offline

- Supermarkets & Hypermarkets

- Department Stores

- Specialty Kitchenware Stores

- Local & Independent Retailers

- Online

- Regional Synopsis, Value (USD Million), 2019-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Product Type, Value (USD Million)

- Cross Analysis of Product Type w.r.t End User, 2019-2037 (USD Million)

- Global Overview

- North America Market

- Overview

- Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type, Value (USD Million)

- Cookware

- Pots & Pans

- Pressure Cookers & Slow Cookers

- Dutch Ovens & Casseroles

- Griddles & Skillets

- Steamers & Poachers

- Induction-compatible Cookware

- Bakeware

- Baking Sheets & Trays

- Cake & Muffin Pans

- Loaf Pans & Bread Molds

- Pie & Tart Pans

- Ramekins & Custard Cups

- Rolling Pins & Pastry Boards

- Kitchen Tools & Gadgets

- Utensils

- Measuring Tools

- Mixing Bowls & Colanders

- Can Openers & Jar Openers

- Garlic Presses, Graters, and Zesters

- Kitchen Shears & Scissors

- Cutting Boards & Chopping Mats

- Mortar & Pestles

- Cutlery

- Chef’s Knives, Paring Knives, Santoku Knives, Utility Knives

- Carving Knives & Cleavers

- Bread Knives & Serrated Knives

- Knife Blocks & Sharpeners

- Flatware

- Cookware

- Material Type, Value (USD Million)

- Stainless Steel

- Aluminum

- Copper

- Glass

- Others

- Price Range, Value (USD Million)

- Economy

- Mid-Range

- Premium/Luxury

- End user, Value (USD Million)

- Residential Kitchens

- Commercial Kitchens

- Institutional Use

- Distribution Channel, Value (USD Million)

- Online

- E-commerce Platforms

- Brand Websites

- Offline

- Supermarkets & Hypermarkets

- Department Stores

- Specialty Kitchenware Stores

- Local & Independent Retailers

- Online

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Product Type, Value (USD Million)

- Cross Analysis of Product Type w.r.t End User, 2019-2037 (USD Million)

- Overview

- Europe Market

- Overview

- Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type, Value (USD Million)

- Cookware

- Pots & Pans

- Pressure Cookers & Slow Cookers

- Dutch Ovens & Casseroles

- Griddles & Skillets

- Steamers & Poachers

- Induction-compatible Cookware

- Bakeware

- Baking Sheets & Trays

- Cake & Muffin Pans

- Loaf Pans & Bread Molds

- Pie & Tart Pans

- Ramekins & Custard Cups

- Rolling Pins & Pastry Boards

- Kitchen Tools & Gadgets

- Utensils

- Measuring Tools

- Mixing Bowls & Colanders

- Can Openers & Jar Openers

- Garlic Presses, Graters, and Zesters

- Kitchen Shears & Scissors

- Cutting Boards & Chopping Mats

- Mortar & Pestles

- Cutlery

- Chef’s Knives, Paring Knives, Santoku Knives, Utility Knives

- Carving Knives & Cleavers

- Bread Knives & Serrated Knives

- Knife Blocks & Sharpeners

- Flatware

- Cookware

- Material Type, Value (USD Million)

- Stainless Steel

- Aluminum

- Copper

- Glass

- Others

- Price Range, Value (USD Million)

- Economy

- Mid-Range

- Premium/Luxury

- End user, Value (USD Million)

- Residential Kitchens

- Commercial Kitchens

- Institutional Use

- Distribution Channel, Value (USD Million)

- Online

- E-commerce Platforms

- Brand Websites

- Offline

- Supermarkets & Hypermarkets

- Department Stores

- Specialty Kitchenware Stores

- Local & Independent Retailers

- Online

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product Type, Value (USD Million)

- Cross Analysis of Product Type w.r.t End User, 2019-2037 (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2019-2037, By

- Product Type, Value (USD Million)

- Cookware

- Pots & Pans

- Pressure Cookers & Slow Cookers

- Dutch Ovens & Casseroles

- Griddles & Skillets

- Steamers & Poachers

- Induction-compatible Cookware

- Bakeware

- Baking Sheets & Trays

- Cake & Muffin Pans

- Loaf Pans & Bread Molds

- Pie & Tart Pans

- Ramekins & Custard Cups

- Rolling Pins & Pastry Boards

- Kitchen Tools & Gadgets

- Utensils

- Measuring Tools

- Mixing Bowls & Colanders

- Can Openers & Jar Openers

- Garlic Presses, Graters, and Zesters

- Kitchen Shears & Scissors

- Cutting Boards & Chopping Mats

- Mortar & Pestles

- Cutlery

- Chef’s Knives, Paring Knives, Santoku Knives, Utility Knives

- Carving Knives & Cleavers

- Bread Knives & Serrated Knives

- Knife Blocks & Sharpeners

- Flatware

- Cookware

- Material Type, Value (USD Million)

- Stainless Steel

- Aluminum

- Copper

- Glass

- Others

- Price Range, Value (USD Million)

- Economy

- Mid-Range

- Premium/Luxury

- End user, Value (USD Million)

- Residential Kitchens

- Commercial Kitchens

- Institutional Use

- Distribution Channel, Value (USD Million)

- Online

- E-commerce Platforms

- Brand Websites

- Offline

- Supermarkets & Hypermarkets

- Department Stores

- Specialty Kitchenware Stores

- Local & Independent Retailers

- Online

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product Type, Value (USD Million)

- Cross Analysis of Product Type w.r.t End User, 2019-2037 (USD Million)

- Overview

- Latin America Market

- Overview

- Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type, Value (USD Million)

- Cookware

- Pots & Pans

- Pressure Cookers & Slow Cookers

- Dutch Ovens & Casseroles

- Griddles & Skillets

- Steamers & Poachers

- Induction-compatible Cookware

- Bakeware

- Baking Sheets & Trays

- Cake & Muffin Pans

- Loaf Pans & Bread Molds

- Pie & Tart Pans

- Ramekins & Custard Cups

- Rolling Pins & Pastry Boards

- Kitchen Tools & Gadgets

- Utensils

- Measuring Tools

- Mixing Bowls & Colanders

- Can Openers & Jar Openers

- Garlic Presses, Graters, and Zesters

- Kitchen Shears & Scissors

- Cutting Boards & Chopping Mats

- Mortar & Pestles

- Cutlery

- Chef’s Knives, Paring Knives, Santoku Knives, Utility Knives

- Carving Knives & Cleavers

- Bread Knives & Serrated Knives

- Knife Blocks & Sharpeners

- Flatware

- Cookware

- Material Type, Value (USD Million)

- Stainless Steel

- Aluminum

- Copper

- Glass

- Others

- Price Range, Value (USD Million)

- Economy

- Mid-Range

- Premium/Luxury

- End user, Value (USD Million)

- Residential Kitchens

- Commercial Kitchens

- Institutional Use

- Distribution Channel, Value (USD Million)

- Online

- E-commerce Platforms

- Brand Websites

- Offline

- Supermarkets & Hypermarkets

- Department Stores

- Specialty Kitchenware Stores

- Local & Independent Retailers

- Online

- Country Level Analysis, Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Product Type, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Value (USD Million), Current and Future Projections, 2019-2037

- Increment $ Opportunity Assessment, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Product Type, Value (USD Million)

- Cookware

- Pots & Pans

- Pressure Cookers & Slow Cookers

- Dutch Ovens & Casseroles

- Griddles & Skillets

- Steamers & Poachers

- Induction-compatible Cookware

- Bakeware

- Baking Sheets & Trays

- Cake & Muffin Pans

- Loaf Pans & Bread Molds

- Pie & Tart Pans

- Ramekins & Custard Cups

- Rolling Pins & Pastry Boards

- Kitchen Tools & Gadgets

- Utensils

- Measuring Tools

- Mixing Bowls & Colanders

- Can Openers & Jar Openers

- Garlic Presses, Graters, and Zesters

- Kitchen Shears & Scissors

- Cutting Boards & Chopping Mats

- Mortar & Pestles

- Cutlery

- Chef’s Knives, Paring Knives, Santoku Knives, Utility Knives

- Carving Knives & Cleavers

- Bread Knives & Serrated Knives

- Knife Blocks & Sharpeners

- Flatware

- Cookware

- Material Type, Value (USD Million)

- Stainless Steel

- Aluminum

- Copper

- Glass

- Others

- Price Range, Value (USD Million)

- Economy

- Mid-Range

- Premium/Luxury

- End user, Value (USD Million)

- Residential Kitchens

- Commercial Kitchens

- Institutional Use

- Distribution Channel, Value (USD Million)

- Online

- E-commerce Platforms

- Brand Websites

- Offline

- Supermarkets & Hypermarkets

- Department Stores

- Specialty Kitchenware Stores

- Local & Independent Retailers

- Online

- Country Level Analysis, Value (USD Million)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Product Type, Value (USD Million)

- Cross Analysis of Product Type w.r.t End User, 2019-2037 (USD Million)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

- Legal Disclaimer

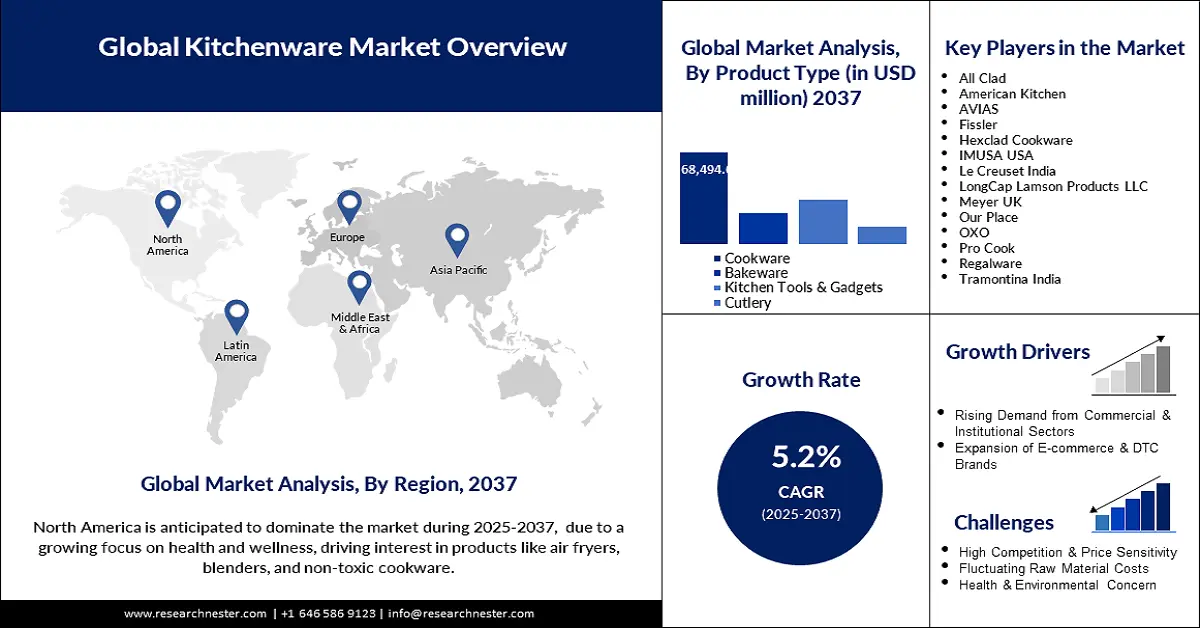

Kitchenware Market Outlook:

Kitchenware Market size was valued at USD 73.2 billion in 2024 and is projected to reach a valuation of USD 140.5 billion by the end of 2037, rising at a CAGR of 5.2% during the forecast period, i.e., 2025-2037. In 2025, the industry size of kitchenware is estimated at USD 75.8 billion.

The kitchenware market is undergoing a shift due to changing tastes and preferences of consumers, increased consciousness about sustainability, and the integration of digital technologies in the retail sector. In July 2024, Made In Cookware official opened its online store in Canada to provide consumers with easy access to restaurant-quality cookware for home and professional use. This move symbolizes the increasing demand for premium and performance-focused kitchen products that are not only practical but also aesthetic. At the same time, large-scale exhibitions have become platforms for introducing new generations of kitchen appliances, AI tools, and health-oriented systems that attract the attention of the younger generation, such as Gen Z and millennials.

Trends such as lifestyle improvements, health consciousness, and the growth of fast-food chains are creating a need for innovative and aesthetically appealing cookware and kitchen utensils. In March 2025, Wendy’s announced its expansion plan to open 1,000 restaurants around the globe by 2028, with specific expansion across Europe, thus indicating a healthy upstream market for commercial-grade kitchenware. At the same time, the India e-commerce environment is in a state of regulatory transformation with innovations like ONDC that are making it easier for rural and SME manufacturers to reach a broader market. With governments promoting digital trade inclusion and the consumer focusing on home-based cooking experiences, the kitchenware industry is set to experience steady, wide-ranging growth.

Key Kitchenware Market Market Insights Summary:

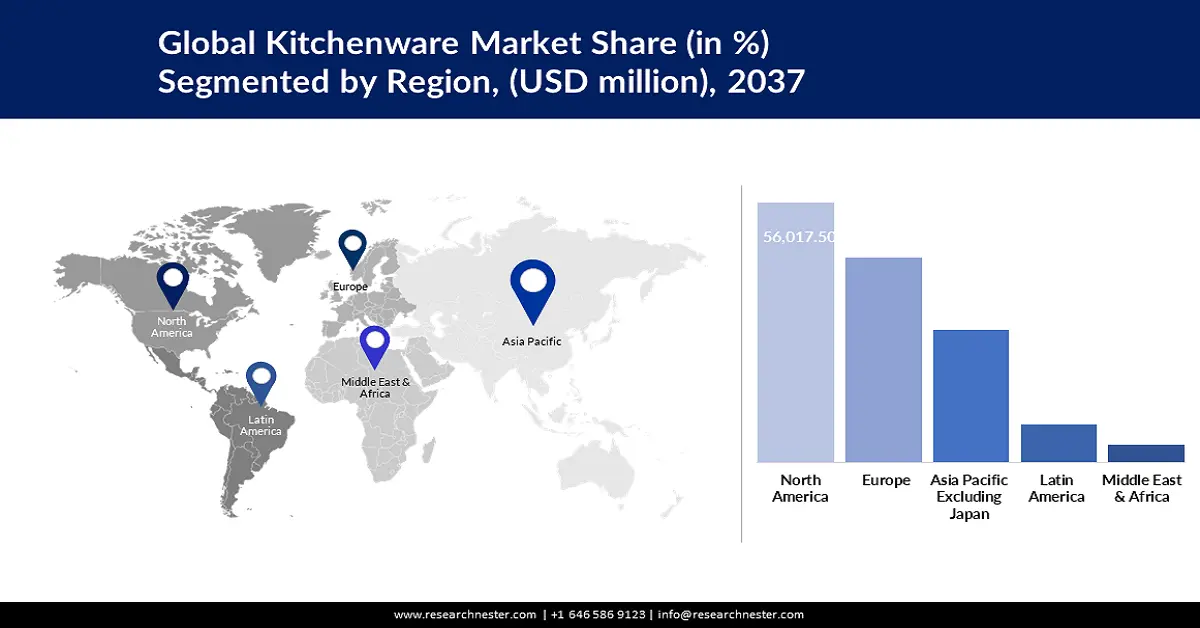

Regional Insights:

- North America is projected to capture a commanding 39.8% share of the kitchenware market by 2037, reflecting strong consumer inclination toward premium and innovative products, bolstered by technological advancements in kitchen tools and rising meal-preparation culture.

- Asia Pacific is expected to expand at a CAGR of 5.9% during 2025–2037, indicating accelerating regional momentum, stimulated by rising disposable income levels, strengthening domestic manufacturing, and rapid growth of digital retail ecosystems.

Segment Insights:

- The cookware segment is expected to account for a substantial 50.9% share of the kitchenware market by 2035, highlighting its central role in household consumption patterns, reinforced by urbanization-driven lifestyle shifts and demand for multifunctional cooking solutions.

- The stainless steel segment is anticipated to secure a dominant 49.3% share by 2037, reflecting sustained material preference across consumer tiers, attributed to durability, hygiene advantages, and design-led sustainable innovation.

Key Growth Trends:

- Influence of social media and consumer experience

- Waste reduction and environmentally friendly products

Major Challenges:

- Material safety and regulatory compliance

- Supply chain disruptions and fluctuations in demand

Key Players: All Clad, American Kitchen, AVIAS, Fissler, Hexclad Cookware, IMUSA USA, Le Creuset India, LongCap Lamson Products LLC, Meyer UK, Our Place, OXO, Pro Cook, Regalware, Tramontina India, TTK Prestige Ltd., The Vollrath Co., L.L.C., Venus Kitchenware Co., Ltd., WUSTHOF, ZWILLING

Global Kitchenware Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 73.2 billion

- 2025 Market Size: USD 75.8 billion

- Projected Market Size: USD 140.5 billion by 2037

- Growth Forecasts: 5.2% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 14 August, 2025

Kitchenware Market - Growth Drivers and Challenges

Growth Drivers

- Influence of social media and consumer experience: Social media and influencer marketing are revolutionizing the way consumers interact with kitchenware through the creation of new content. Intuit Credit Karma’s 2024 survey reveals that 69% of Gen Z and 58% of millennials are aware that social media affects their spending decisions. Functionality and beauty are now non-negotiable with brands such as Caraway using pastel hues to introduce limited edition collections that are marketed through influencers. Organic social marketing techniques are shortening product cycles, intensifying engagement, and generating demand across social media.

- Waste reduction and environmentally friendly products: People are shifting from conventional coatings and materials to eco-friendly ones due to the change in their attitude towards the environment. In September 2024, Neoflam released a new series of PFOA-free, ceramic-coated cookware for safer and more environmentally friendly cookware. The trend is in line with the increasing concern over PFAS chemicals and growing regulatory pressure in global markets. Today, it has become possible for leading brands to incorporate advanced surface technologies that minimize impact on the environment and health. This shift toward sustainable and non-toxic materials is not limited to the premium segment. Still, it has been observed across the affordable segment as well due to the increased awareness among consumers and the implementation of policies.

- Smart cooking technology integration: Smart kitchenware is the innovation that is emerging as an intelligent kitchen companion. In January 2023, VersaWare Technologies launched smart kitchen utensils that use artificial intelligence to provide nutrition recommendations. These devices are designed for wellness-conscious households who want to get a technologically empowered health check during cooking. Smart kitchen appliances, including those as simple as induction cooktops and as complex as smart measuring instruments, are paving the way for a new age of data-driven cooking. The integration with voice assistants and mobile applications takes it a notch higher, making cooking and everything related to it a connected way of life.

Challenges

- Material safety and regulatory compliance: Concerns over chemical coatings remain relevant in global markets, and kitchenware manufacturers face the pressure of meeting new consumer and regulatory expectations. High regulatory standards for materials such as PFAS and heavy metals are putting pressure on companies to come up with better solutions. Moreover, adherence to different standards and certification across the globe may be a challenge and expensive to manufacturers, especially those on the small scale. This requires a strong commitment to research and development, as well as quality assurance systems to ensure that products meet the current safety standards and do not pose legal and brand-related risks.

- Supply chain disruptions and fluctuations in demand: The challenges affecting the kitchenware industry include raw material volatility, increased transportation costs, and geopolitical risks, which affect its supply and demand. Unpredictable changes in the cost of materials, for instance, steel or aluminum, can distort the profit margins and the overall pricing model. In addition, political instability and trade barriers lead to interruptions in supply and make the market unpredictable. These risks have made it important for organizations to develop supply chain risk management strategies and diversify sourcing to avoid disruptions.

Kitchenware Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

5.2% |

|

Base Year Market Size (2024) |

USD 73.2 billion |

|

Forecast Year Market Size (2037) |

USD 140.5 billion |

|

Regional Scope |

|

Kitchenware Market Segmentation:

Product Type Segment Analysis

The cookware segment is anticipated to hold the highest share of 50.9% in the kitchenware market during the forecast period, due to factors such as urbanization, cooking trends, and functionality. In August 2024, Jindal Lifestyle launched Arttd’inox, which incorporates Vida, Stellar, and Timber cookware collections that are both stylish and functional. These innovations are targeted toward upwardly mobile consumers who want to elevate their cooking experience. This is because cookware is used often and has positive connotations related to daily routine, family, and health. Innovative uses, including outdoor and dual-purpose pots and pans, are extending the category’s applicability. In March 2024, Le Creuset launched its first matte black outdoor cookware range designed specifically for cooking over flames. This shift is a result of trends that point toward wanting more versatile, multi-environment cooking tools. From cooking ranges in apartment buildings to small barbecues in the backyard, cookware remains an integral part of the modern kitchen.

Material Type Segment Analysis

Stainless steel is expected to take the largest share of 49.3% by 2037 owing to its durability, hygiene, and sleek appearance. In July 2024, Our Place launched a stainless-steel tagine hybrid, as it pays homage to Moroccan food and culture but also aligns with other cooking styles around the world. Its induction and gas compatibility, and appearance make it a favorite of enthusiasts and professionals alike. Sustainable innovation is also contributing to the growth of this segment. In October 2024, BergHOFF introduced a range of stainless-steel utensils with handles made of bamboo that can be recycled, combining sustainability and design. Such developments are in sync with current trends where consumers want products that are durable and require minimal maintenance. Stainless steel remains the go-to material as a durable and fashionable material across tiers and regions of retail.

Our in-depth analysis of the kitchenware market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material Type |

|

|

Price Range |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Kitchenware Market - Regional Analysis

Asia Pacific Insights

Asia Pacific is forecasted to experience a CAGR of 5.9% from 2025 to 2037 due to an increase in disposable income, domestic manufacturing, and digital retail markets. Carote made its IPO debut in Hong Kong in July 2024, where the company’s shares rose by an astonishing 64%, which is an indicator of the global retail interest in Asian brands. Government-backed platforms are also helping rural and SME producers to increase distribution, thus boosting the penetration of regional markets.

China continues to be a significant producer and innovator of kitchenware products. In August 2024, LocknLock achieved 15% year-on-year growth in overseas sales because of the rising trend of health-conscious and modern design cookware. Consumers are drawn to simple designs, compact functionality, and safer materials, while global consumers enjoy scale economies and enhanced quality. These dynamics cement China’s leadership in both volume and design.

The kitchenware industry in India is gradually shifting towards digitalization and is experiencing the entry of start-ups. In December 2024, Indus Valley received USD 2.7 million in funding to scale up its toxin-free cookware made from natural materials. Digital platforms such as ONDC and GeM are helping rural producers directly reach out to urban consumers, thus helping the regional brands gain an edge. The emphasis on cost, environmental sustainability, and locality has allowed Indian kitchenware brands to gain a considerable market share.

North America Market Insights

North America is estimated to account for 39.8% of the global kitchenware market share through 2037, supported by technological advancements in tools, increasing popularity of meal prep, and a robust home improvement market. In October 2024, HexClad received funding from Studio Ramsay Global, utilizing Gordon Ramsay’s culinary expertise to expand hybrid cookware. Consumers in the region are now quality-conscious, health-conscious, and digitally connected, making North America the ideal market for the next generation of kitchenware.

The market for kitchenware in the U.S. is experiencing a significant shift in focus toward wellness and digitization. At CES 2024, Exobrew introduced an advanced brewing device with a monthly subscription service that combines the benefits of a technological solution with the quality of handmade beer. Government focus on indoor air quality, like the issue with gas stoves, is also driving the uptake of induction-based and energy-efficient cooking devices. Among the key drivers that pull the American buyers towards the products, there is a pursuit of a better lifestyle and compliance with the regulations.

The kitchenware industry in Canada is experiencing higher premium imports and localized partnerships. In July 2024, Aequs India signed a deal with Tramontina to manufacture and distribute cookware in Canada, thus providing world-class quality with a local touch. This shows that there is an increasing trend of cross-continental affiliations in the global market. Canadian consumers are actively choosing products made from sustainable materials and products with multiple uses, while direct-to-consumer channels make international kitchenware more accessible.

Key Kitchenware Market Players:

- All Clad

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American Kitchen

- AVIAS

- Fissler

- Hexclad Cookware

- IMUSA USA

- Le Creuset India

- LongCap Lamson Products LLC

- Meyer UK

- Our Place

- OXO

- Pro Cook

- Regalware

- Tramontina India

- TTK Prestige Ltd.

- The Vollrath Co., L.L.C.

- Venus Kitchenware Co., Ltd.

- WUSTHOF

- ZWILLING

The global kitchenware market is comprised of traditional manufacturers, new-age companies that have started their journey in the online space, and conglomerates that have diversified their portfolios. Some of the major players in the global market include All Clad, American Kitchen, AVIAS, Fissler, HexClad Cookware, IMUSA USA, Le Creuset India, LongCap Lamson Products LLC, Meyer UK, Our Place, OXO, Pro Cook, Regalware, Tramontina India, and TTK Prestige Ltd. Differentiation now hinges on storytelling, cross-platform presence, and alignment with lifestyle values.

A partnership between Spotlight and celebrity chef Manu Feildel to launch ‘The Culinary Co by Manu’ in June 2024 is a clear indication of the trend of celebrity chefs entering the kitchenware brand market and how it can leverage on celebrity endorsement to gain a new channel for distribution. This trend is in line with the current trends in the kitchenware market driven by the emphasis on design, wellness, and sustainability, and the brands that can strike a balance between the trends and the brand’s identity are likely to dictate the future direction of the industry.

Here are some leading companies in the kitchenware market:

Recent Developments

- In February 2025, The Middleby Corporation announced plans to spin off its food processing business into a standalone public company. This strategic move aims to create two independent entities, allowing each to focus on their core competencies and drive innovation in their respective markets.

- In February 2025, Tramontina announced the establishment of a new manufacturing facility in Hubballi, Karnataka, as part of its strategy to make India a global hub for kitchenware production. The facility, developed in partnership with Aequs, will serve both domestic and international markets.

- In June 2024, Happycall Co. Ltd. announced plans to expand its global presence by entering the European market. The company aims to introduce its premium cookware products, including non-stick pans and pressure cookers, to European consumers, leveraging its reputation for quality and innovation.

- Report ID: 6745

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Kitchenware Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.