Keytruda Market Outlook:

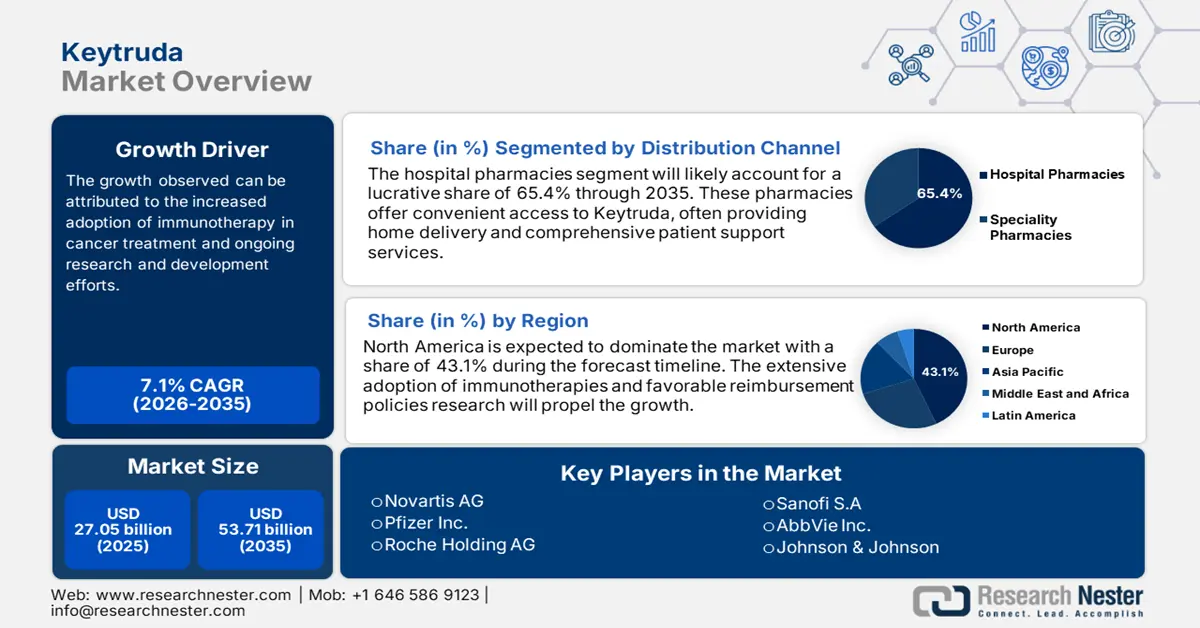

Keytruda Market size was over USD 27.05 billion in 2025 and is poised to exceed USD 53.71 billion by 2035, growing at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of keytruda is estimated at USD 28.78 billion.

The Keytruda market is gaining traction owing to the continuous research that states the efficacy of this drug, hence, boosting its adoption in oncology treatments. For instance, in September 2024, long-term overall survival (OS) data from the pivotal Phase 3 KEYNOTE-006 trial, evaluating KEYTRUDA (pembrolizumab), was released today by Merck. The data showed that more than 1/3rd (34.0%) of patients with advanced melanoma were still alive after receiving KEYTRUDA treatment, compared to 23.6% of patients treated with ipilimumab. In addition, the company, previously in December 2023, announced that KEYTRUDA can decrease the risk of death or distant metastasis by 65% and the risk of recurrence or death by 44% when paired with mRNA-4157 (V940).

Furthermore, the trend towards personalized medicine includes testing for biomarker expression of PD-L1, allowing for more tailored treatment and further optimization. For instance, in October 2021, Bristol Myers Squibb received European Commission approval for Opdivo (nivolumab) in combination with chemotherapy. It is for patients with advanced, recurrent, or metastatic esophageal squamous cell carcinoma in which the tumor cells express PD-L1 at a rate of 1%. In addition, there's been a growing incidence of cancer throughout the world due to aging populations. For instance, according to the American Cancer Society data, published in April 2024, there were 9.7 million cancer-related deaths and nearly 20 million new cases of cancer in 2022. It was projected that by 2050, there will be 35 million new cases of cancer.

Key Keytruda Market Insights Summary:

Regional Highlights:

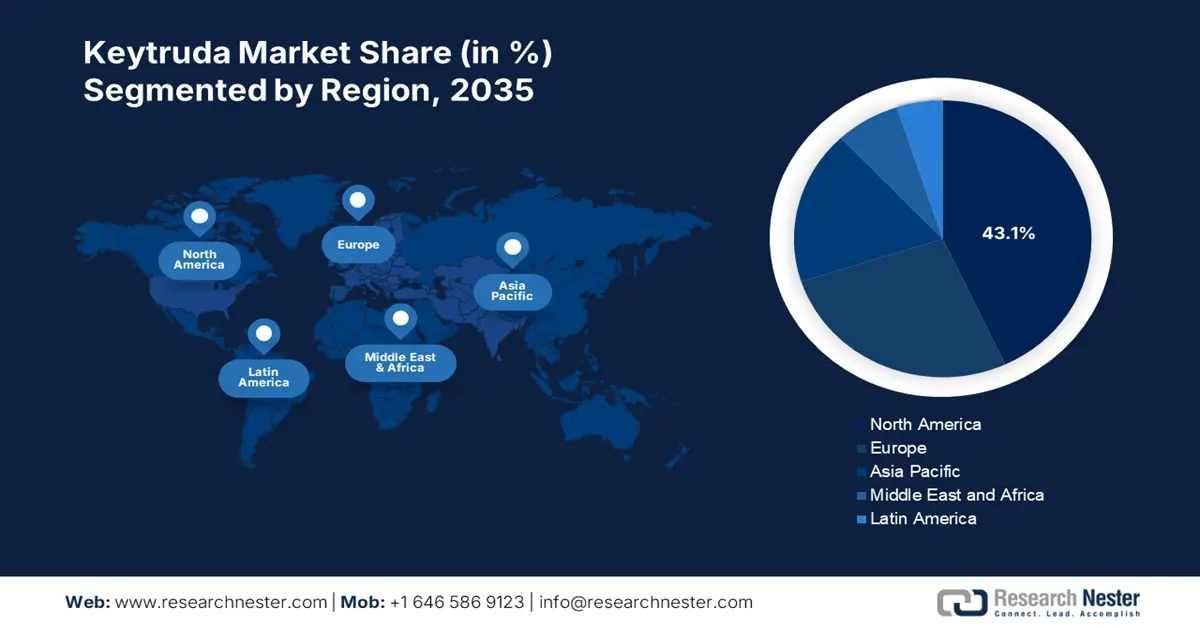

- North America commands a 43.1% share in the Keytruda Market, fueled by high healthcare spend and advanced infrastructures, ensuring strong growth prospects through 2035.

- Asia Pacific's Keytruda market is projected for lucrative growth by 2035, fueled by favorable healthcare policies and higher healthcare spending.

Segment Insights:

- The Hospital Pharmacies segment is projected to capture over 65.4% market share by 2035, fueled by their critical role in managing complex cancer treatments.

- The Lung Cancer segment is poised for substantial growth in the Keytruda Market from 2026-2035, driven by the high incidence of lung cancer and unmet needs for advanced treatment options.

Key Growth Trends:

- Investments in research and development

- Combination therapies

Major Challenges:

- Adverse effects of medication

- High treatment costs

- Key Players: Bristol-Myers Squibb Company, AstraZeneca PLC, Roche Holding AG, Pfizer Inc., Sanofi S.A., and more.

Global Keytruda Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.05 billion

- 2026 Market Size: USD 28.78 billion

- Projected Market Size: USD 53.71 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.1% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, Japan, India, Brazil, Russia

Last updated on : 13 August, 2025

Keytruda Market Growth Drivers and Challenges:

Growth Drivers

- Investments in research and development: A key growth driver for the Keytruda market is growing R&D activities, as they unlock opportunities for the discovery of new treatment combinations to enhance its therapeutic profile. Furthermore, R&D will allow us to conduct comprehensive clinical trials that not only prove the efficacy of Keytruda across various cancer types but also discover new biomarkers for use in patient selection. For instance, in July 2022, AstraZeneca announced a significant investment of USD 1.27 billion in acquiring biotechnology company TeneoTwo Inc. This move was made to expand its range of treatments for blood cancers, demonstrating its unwavering commitment to improving cancer treatments.

- Combination therapies: The catalyst growth drivers for the Keytruda market are the effects of multiple therapeutic agents as they ensure overall efficacy in the treatment of cancer. The incorporation of Keytruda with chemotherapy or targeted therapies allows clinicians to achieve a better patient outcome, which also encompasses higher response rates and extended survival. For instance, in May 2024, CytomX Therapeutics collaborated with Merck to evaluate CX-801 with KEYTRUDA (pembrolizumab) in patients with advanced metastatic solid tumors. This collaboration aims to evaluate the safety, tolerability, and preliminary efficacy of CX-801 in combination with KEYTRUDA in patients with advanced metastatic solid tumors.

Challenges

- Adverse effects of medication: In the Keytruda market, a significant challenge is the use of the drug since the immune-related adverse effects may considerably affect patient compliance and treatment outcomes. Such side effects can be so severe, with intense inflammation and autoimmune reactions, that the treatment has to be discontinued or requires additional interventions to contain them. This could thus complicate the management of the patients. Furthermore, adverse effects would have a bearing on the quality of life of patients and prevent the widespread use of Keytruda, as healthcare providers would need to consider weighing the risks against the benefits of treatment.

- High treatment costs: A major challenge in the Keytruda market is the high cost of treatment which hampers market penetration of Keytruda, for patients in lower income brackets and areas where healthcare resources are sparse. This sets a financial barrier to disparities in access to treatments, with most patients unable to afford the product or pay more for out-of-pocket expenses, causing delays or foregone treatment. For instance, in October 2021, according to the National Cancer Institute, with USD 16.22 billion in out-of-pocket expenses and USD 4.87 billion in patient time costs, the total national patient economic burden related to cancer care in 2019 was USD 21.09 billion.

Keytruda Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 27.05 billion |

|

Forecast Year Market Size (2035) |

USD 53.71 billion |

|

Regional Scope |

|

Keytruda Market Segmentation:

Distribution Channel (Hospital Pharmacies, Specialty Pharmacies)

Based on the distribution channel, the hospital pharmacies segment is projected to capture keytruda market share of over 65.4% by 2035. They also play a critical role in managing complex cancer treatment regimens and ensuring the safe administration of immunotherapies. These pharmacies are provided with special staff and facilities for the storage, preparation, and dispensing requirements of keytruda. In addition, the hospitalization rates of patients have been witnessing a significant surge. For instance, in year 2021, according to the Journal for Immunotherapy of Cancer, within two years of the start of immunotherapy, 7,587 (53%) patients were admitted to 16,053 hospitals. In a hospital setting, integration not only improves patient care but also propels the growth of Keytruda as a treatment of choice in oncology.

Cancer Type (Melanoma, Lung cancer, Hodgkin lymphoma, Stomach cancer, Urothelial carcinoma)

The lung cancer segment is anticipated to dominate the keytruda market by 2035, attributable primarily due to the high incidence of the disease and the strong unmet medical need for better treatment options. The increasing prevalence of lung cancer cases in the U.S., propels the need for producing innovative therapies. In addition, in February 2024, the WHO statistics stated, that lung cancer was the most commonly occurring cancer worldwide with 2.5 million new cases accounting for 12.4% of the total new cases. Survival among NSCLC patients with the highest levels of PD-L1 expression makes keytruda an imperative therapeutic for patients.

Our in-depth analysis of the global market includes the following segments:

|

Cancer Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Keytruda Market Regional Analysis:

North America Market Statistics

North America in keytruda market is anticipated to capture around 43.1% revenue share by the end of 2035, due to high healthcare spend and advanced infrastructures. In addition, the demand for efficacious cancer therapies has been increasing, which helps Keytruda be in a good position in the market within the region. Moreover, the presence of key players in the market shapes the innovation and advanced medications using keytruda.

The U.S. Keytruda market is unfolding remarkable growth opportunities attributable to the rising developments using Keytruda as an effective source of medication. For instance, in September 2021, by acquiring Acceleron Pharma in a USD 11.5 billion transaction, Merck & Co. carried on with its strategic expansion. A medication to treat pulmonary arterial hypertension, a rare lung condition, was being actively developed by Acceleron Pharma. Merck & Co. is committed to strengthening its position in the pharmaceutical industry, as evidenced by its parallel commitment to the development of keytruda for non-small cell lung cancer.

The keytruda market in Canada is witnessing significant growth due to regulatory support and strong principles laid by them. For instance, in September 2024, it was announced that according to Health Canada's approval, KEYTRUDA was used as a monotherapy. Furthermore, adult and pediatric patients with unresectable or metastatic microsatellite instability-high (MSI-H) or mismatch repair deficient (dMMR) solid tumors have progressed after this treatment. Thus, the improvement in treating cancer is evident in the country.

Asia Pacific Market Analysis

The keytruda market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline i.e. 2025-2035. Adoption of immunotherapy medications is also aided by favorable healthcare policies and higher healthcare spending in the region. This market is therefore anticipated to expand quickly, reflecting the continuous need for cancer treatments that are safer and more efficient.

The keytruda market in India is expecting substantial growth owing to the faster access to new treatments which is made possible by expedited regulatory approvals, which benefits the market. For instance, in 2023, it was announced that the government fully exempted pembrolizumab (keytruda), a Merck cancer drug, from basic customs duty. Furthermore, research and technological developments are fostering the creation of novel therapies, and patient access to these treatments is being improved by advantageous reimbursement policies.

The keytruda market in China is gaining traction due to initiatives and support from local governments. For instance, in January 2025, the National Medical Products Administration (NMPA) of China approved PADCEVTM (enfortumab vedotin) in combination with KEYTRUDA (pembrolizumab). The combination of treatments is expected to give patients with la/mUC a new therapeutic option and a substitute for platinum-containing chemotherapy, which has been the norm for almost 40 years.

Key Keytruda Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AbbVie Inc.

- Merck & Co. Inc.

- Bristol-Myers Squibb Company

- AstraZeneca PLC

- Roche Holding AG

- Pfizer Inc.

- Sanofi S.A.

- Johnson & Johnson

- Eli Lilly and Company

The presence of companies in the keytruda market is fostered due to collaborative strategies between companies to expand their portfolios and expertise in delivering efficacy in treatments using keytruda. For instance, in October 2022, by the terms of its current collaboration and license agreement, Merck exercised its option to jointly develop and commercialize personalized cancer vaccine (PCV) mRNA-4157/V940 with Oderna, Inc. In a current Phase 2 clinical trial, Moderna is evaluating mRNA-4157/V940 as an adjuvant treatment for patients with high-risk melanoma in conjunction with Merck's anti-PD-1 therapy, KEYTRUDA. Here's the list of some key players:

Recent Developments

- In May 2024, Novartis announced the acquisition of Mariana Oncology, a biotech company that specializes in creating radioligand therapies (RLTs) for the treatment of cancer. The company anticipated that the acquisition would add significant research capabilities and improve Novartis' current RLT pipeline.

- In March 2022, Gufic Biosciences Limited announced that it signed a research and collaboration agreement with M/s. Selvax Pty Ltd. This agreement was made to expedite the commercialization of Selvax's cancer immunotherapy treatment.

- Report ID: 6975

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Keytruda Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.