Joint Tester Market Outlook:

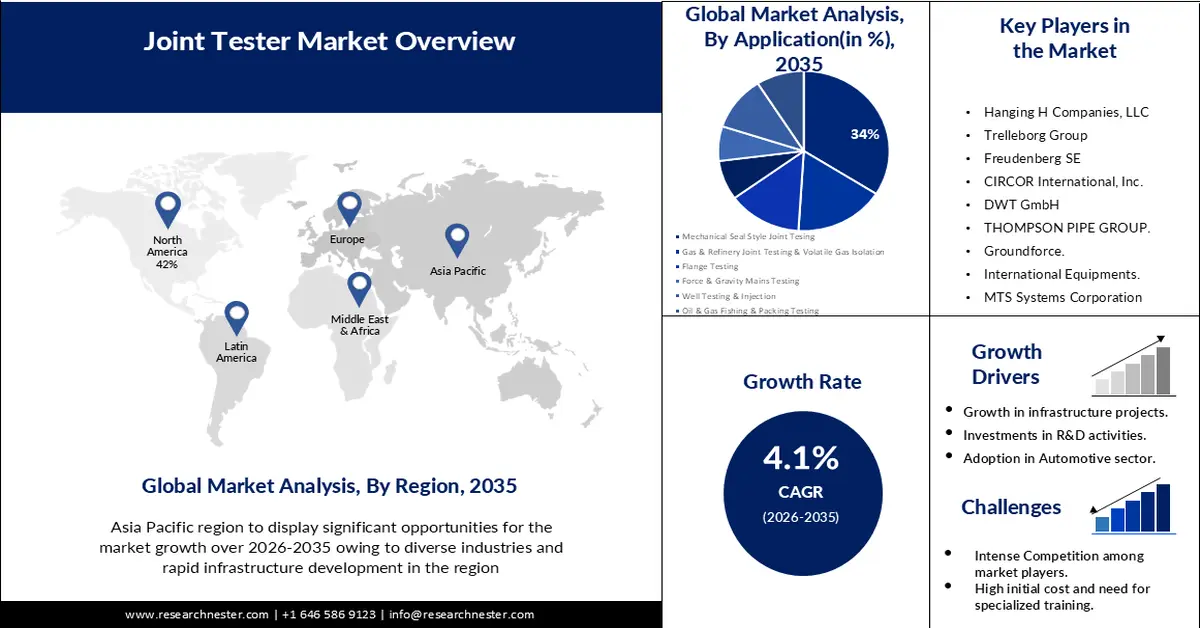

Joint Tester Market size was valued at USD 1.61 billion in 2025 and is set to exceed USD 2.41 billion by 2035, registering over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of joint tester is estimated at USD 1.67 billion.

The automotive industry’s expansion, driven by increasing vehicle production and stringent safety standards, contributes to the market growth. As per estimates, by 2022, there were 85.4 million vehicles produced around the world, a 5.7% increase over 2021.The integration of electronics architecture in automobiles has been steadily increasing, according to the automotive industry. Large-scale R&D and innovation activities for the testing of electronics components and compliance with regulatory requirements have been driven by OEMs and automotive suppliers in response to the growing demand for safety and comfort features. Furthermore, the incorporation of technological elements has resulted in an increase in the cars' overall weight. The laws governing emissions and fuel usage for cars will increase joint tester market demand.

Further, with the globalization of trade, the need for reliable joint testing solutions becomes paramount, fostering market expansion as businesses seek tools to ensure product integrity across borders. As analyzed by Research Nester analysts, Trade in goods increased by 1.9% in the first three months of 2023, amounting to about USD 100 billion, compared to the last quarter of 2022.

Key Joint Tester Market Insights Summary:

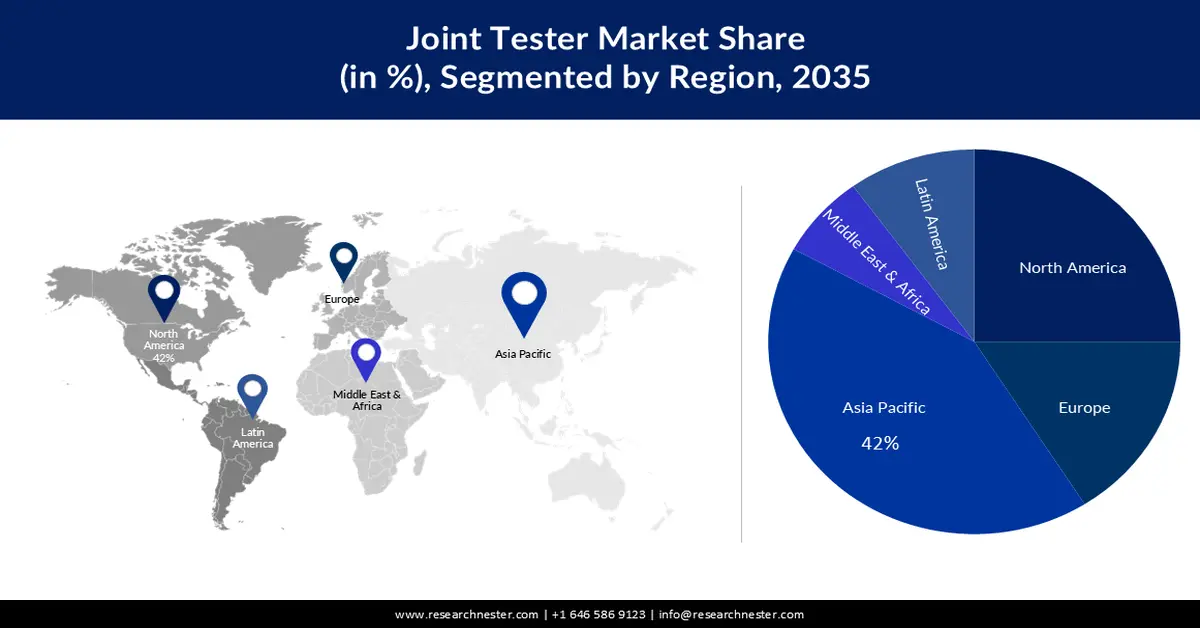

Regional Highlights:

- Asia Pacific is projected to hold the largest revenue share of 42% by 2035, driven by rapid industrialization, infrastructure development, and demand from automotive, aerospace, construction, and electronics sectors.

- North America is expected to capture a significant share by 2035, fueled by demand from automotive, aerospace, and construction industries and adherence to stringent quality standards.

Segment Insights:

- By 2035, the mechanical seal-style joint tester segment is projected to hold a 34% revenue share, driven by rising demand for precision and advanced testing in automotive, aerospace, oil & gas, and manufacturing sectors.

- The split style joint tester segment is expected to capture the majority revenue share, supported by its versatility and adaptability across diverse joint types and industrial applications.

Key Growth Trends:

- Growing Oil and Gas Exploration

- Increased Demand for Quality Assurance

Major Challenges:

- Regulatory Complaince

- Encouraging the adoption of automation in joint testing remains a challenge

Key Players: Hanging H Companies, LLC, Trelleborg Group, Freudenberg SE, CIRCOR International, Inc, DWT GmbH, THOMPSON PIPE GROUP., Groundforce., International Equipments., MTS Systems Corporation, Yokogawa Electric Corporation.

Global Joint Tester Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 1.67 billion

- Projected Market Size: USD 2.41 billion by 2035

- Growth Forecasts: 4.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 26 November, 2025

Joint Tester Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Oil and Gas Exploration- The joint tester market experiences a surge in demand due to the expanding oilfield services and gas exploration activities, necessitating precise testing for the durability and safety of joints in critical equipment.

-

Increased Demand for Quality Assurance- The market is poised for growth as industries prioritize quality control in manufacturing processes, driving the demand for advanced joint testing solutions.

-

Rising Infrastructure Development -Growing infrastructure projects worldwide fuel the need for robust joint testing, providing a significant boost to the market. For instance, as of May 2022, China had about USD 5 trillion worth of infrastructure projects in development or in operation, valued at over USD 25 million. The next two nations on the list, with infrastructure projects valued at around USD 2 trillion, were the United States and India.

-

Technological Advancements- Ongoing innovations in joint testing technologies enhance efficiency, accuracy, and ease of use, stimulating market growth and attracting businesses seeking cutting-edge solutions.

Challenges

-

Regulatory Complaince-Adhering to evolving industry standards and compliance requirements pose a persistent challenge, demanding constant updates and adjustments for joint tester.

-

Joint testers face challenges in seamlessly integrating with diverse testing environments and tools, hampering efficiency and collaboration.

-

Encouraging the adoption of automation in joint testing remains a challenge.

Joint Tester Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 1.61 billion |

|

Forecast Year Market Size (2035) |

USD 2.41 billion |

|

Regional Scope |

|

Joint Tester Market Segmentation:

Application Segment Analysis

The mechanical seal-style joint tester market is poised to hold 34% of the revenue share during the forecast period. The segment’s growth can be attributed to the increasing demand for precision and efficiency in testing seals, especially in critical applications like automotive, aerospace, oil a gas, and manufacturing. Further, technological advancements in mechanical seal testing methodologies contribute to the growth of this segment. Advanced joint tester offers enhanced capabilities to accurately assess the quality and effectiveness of mechanical seals, addressing the stringent quality standards set by various industries.

TypeSegment Analysis

Split style joint tester market is expected to garner majority revenue share due to its versatile application across various industries and ease of use. Split style joint tester offers the flexibility to test a wide range of joints in different materials and structures. These testers can accommodate various joint sizes and shapes, making them highly adaptable for different testing requirements, contributing significantly to their market dominance.

Our in-depth analysis of the global joint tester market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Joint Tester Market - Regional Analysis

APAC Market Insights

The Asia Pacific industry is anticipated to account for largest revenue share of 42% by 2035, owing to diverse industries and rapid infrastructure development. With countries like China, India, Japan, and South Korea at its helm, the market experiences substantial growth attributed to burgeoning industrialization and stringent quality assurance demands. In this dynamic region, industries such as automotive, aerospace, construction, and electronics are significant contributors to the demand for joint testing testing equipment. The automotive sector, in particular, propels market growth due to its quest for precision and reliability in vehicle components. Moreover, the construction industry’s need for robust testing tools to ensure structural integrity, especially in earthquake-prone areas, adds impetus to the market. As observed by Research Nester analysts, the region’s construction industry gathered a total revenue of USD 6 billion in 2021. Additionally, the collaborative efforts between local manufacturers and global players facilitate the adoption of cutting- edge testing technologies, fostering the market’s expansion across the Asia Pacific.

North American Market Insights

North American joint tester market is expected to garner significant revenue share. The region’s growth is driven by robust demand from sectors like automotive, aerospace, construction, and manufacturing. In the automotive industry, where precision and safety are paramount, the need for advanced joint testing equipment remains high to ensure the quality and reliability of vehicle components. Similarly, the aerospace sector relies on sophisticated testing tools to maintain the integrity of aircraft structures and components, aligning with the region’s emphasis on safety and compliance. The construction industry, particularly in earthquake- prone areas, fuels demand or joint testing devices to ensure the durability Ans safety of structures. Additionally, the region’s adherence to rigorous quality standards and a culture of technological advancement continually drives the growth of the Joint Tester market in North America.

Joint Tester Market Players:

- Petersen Products Co

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hanging H Companies, LLC

- Trelleborg Group

- Freudenberg SE

- CIRCOR International, Inc.

- DWT GmbH

- THOMPSON PIPE GROUP.

- Groundforce.

- International Equipments.

- MTS Systems Corporation

Recent Developments

- The MTS Systems Corporation, a prominent worldwide provider of position sensors and high-performance test systems, has announced the global launch of MTS ExceedTM Testing Systems, a new product line tailored to the expanding material testing market for manufacturing and quality assurance applications.

- The all-new 3400 and 6800 Series universal testing systems with cutting-edge safety and operational features are now available in single and dual column variants, with capacities ranging from 500 N to 50 kN, according to Instron, Norwood, Mass. The 3400 and 6800 Series are the successors to the 3300 and 5900 Series systems. They have many new features and enhanced requirements that make mechanical testing easier, safer, and more intelligent than it has ever been. These consist of Auto Positioning, Built-In Safety Coaching, Operator Protect, Smart-Close Air Kit, and Collision Mitigation.

- Report ID: 5502

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Joint Tester Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.