Japan Luxury Lighting Fixtures Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Japan Industry Overview

- Market Overview

- Industry Supply Chain Analysis

- DROT

- Regulatory Framework Governing the Handling of NH₄HCO₃

- Competitive Landscape

- Yamagiwa

- Moooi

- Flos Japan K.K.

- NABA DENKI SANGYO CO LTD

- Odelic Co Ltd

- Domestic Manufacturers

- Analysis on Wholesaler/Trading Companies

- Ongoing Technological Advancements

- Luxury Lighting Fixtures Manufacturing Method Analysis

- Luxury Lighting Fixtures Manufacturing Cost Analysis

- Luxury Lighting Fixtures Transportation Method Analysis

- Luxury Lighting Fixtures Transportation Cost Analysis

- Price Benchmarking

- SWOT Analysis

- Key End User Analysis

- Risk Analysis

- Recent Key Developments Analysis

- Light Source Type Analysis

- Interior Design Analysis

- Application Analysis

- End user Analysis

- Root Cause Analysis (RCA) for Luxury Lighting Fixtures Market

- EXIM Analysis

- Industry Risk Assessment

- Japan Outlook and Projections

- Japan Overview

- Market Value (USD Million), Volume (Thousand Tons), Current and Future Projections, 2020-2030

- Increment $ Opportunity Assessment, 2020-2030

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2020-2030, By

- Light Source Type, Value (USD Million), Volume (Thousand Tons)

- LED Lamps

- HID Lamps

- Fluorescent Lamp

- Other

- Interior Design, Value (USD Million), Volume (Thousand Tons)

- Modern

- Traditional

- Transitional

- Application, Value (USD Million), Volume (Thousand Tons)

- Wire

- Radio

- End user, Value (USD Million), Volume (Thousand Tons)

- Commercial

- Industrial

- Residential

- Light Source Type, Value (USD Million), Volume (Thousand Tons)

- Japan Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Japan Luxury Lighting Fixtures Market Outlook:

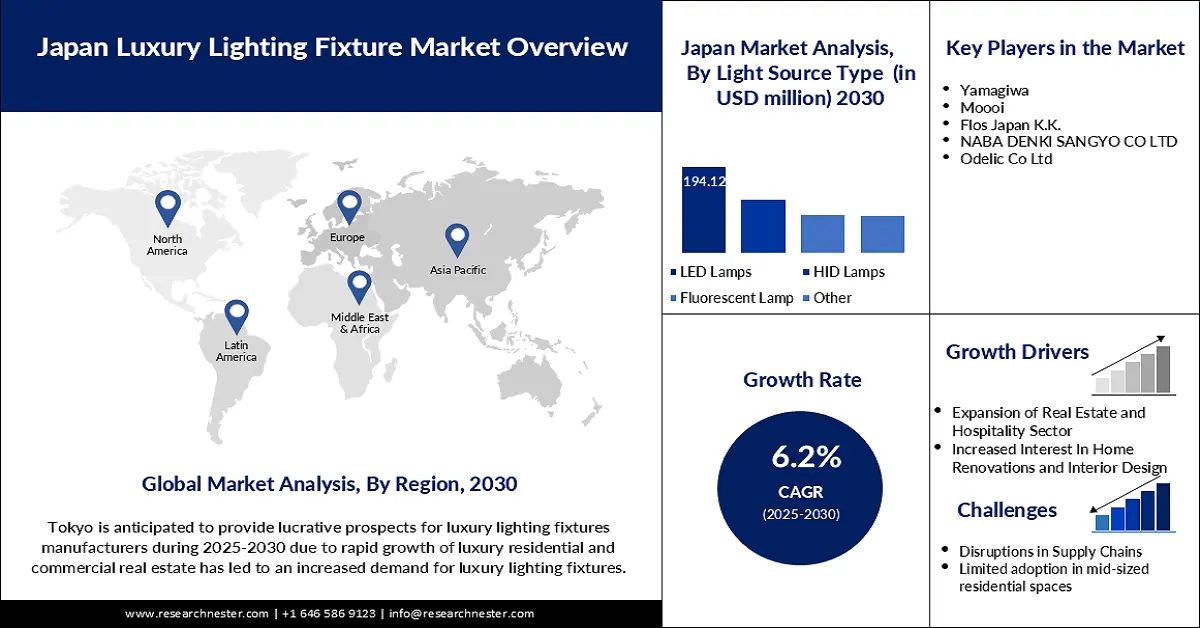

Japan Luxury Lighting Fixtures Market size was valued at USD 336.2 million in 2024 and is anticipated to surpass USD 485.3 million by the end of 2030, expanding at a CAGR of 6.2% during the forecast period, i.e., 2025-2030. In 2025, the industry size of Japan luxury lighting fixtures is evaluated at USD 358.9 million.

The Japan luxury lighting fixtures market is expected to rise at a steady rate during the forecast period due to the increasing demand for aesthetically and functionally better lighting solutions in residential and commercial applications. Due to changes in consumer taste towards luxury and bespoke lighting solutions, manufacturers are now developing new products to meet various design needs. The market is also backed by various incentives from the government to encourage sustainable efforts and innovation in technology, which contribute to the market’s future growth. For instance, Japan government’s Green Growth Strategy plans to cut emissions by 46.0% by 2030, which has boosted the shift towards energy efficient lighting solutions in luxury products.

The growth in Japan luxury lighting fixtures market has been driven by technological developments and the integration of smart lighting systems used in smart homes and urban infrastructure. In January 2024, Toshiba came up with a new series of LED street lights with intelligent sensors to enhance public safety and save energy. This development supports the government’s vision for intelligent cities and underlines the importance of high-end lighting in improving the quality of cities. The further development of eco-friendly and networked lighting systems contributes to market growth and underlines the leading role of Japan in the development of new lighting technologies.

Key Japan Luxury Lighting Fixtures Market Insights Summary:

Segment Insights:

- LED Lamps Segment in the japan luxury lighting fixtures market is projected to account for 40.0% share through 2030, reflecting its expanding role across premium residential and commercial applications, strengthened by rising adoption of intelligent and long-life lighting solutions supported by energy efficiency and cost advantages

- Modern Interior Design Segment is estimated to represent approximately 55.0% share through 2030, highlighting its dominance in luxury lighting demand as Japanese consumers increasingly prefer minimalist aesthetics and technologically advanced fixtures aligned with simplicity and reduced ornamentation

Key Growth Trends:

- Rapid urbanization and smart home integration

- Energy efficiency and sustainability initiatives

Major Challenges:

- Decline in new housing developments

- Supply chain disruptions and import dependency

Key Players: Moooi, Flos Japan K.K., NABA DENKI SANGYO CO LTD, Odelic Co Ltd

Global Japan Luxury Lighting Fixtures Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 336.2 million

- 2025 Market Size: USD 358.9 million

- Projected Market Size: USD 485.3 million by 2030

- Growth Forecasts: 6.2% CAGR (2025-2030)

Key Regional Dynamics:

- Largest Region: Tokyo

- Fastest Growing Region: Osaka

- Dominating Countries: Japan, Germany, Italy, France, United States

- Emerging Countries: China, South Korea, India, Singapore, United Arab Emirates

Last updated on : 29 August, 2025

Japan Luxury Lighting Fixtures Market - Growth Drivers and Challenges

Growth Drivers

-

Rapid urbanization and smart home integration: Japan urban population is still rising, which creates a need for high-quality and individually designed luxury lighting systems. This trend is further driven by the growing adoption of smart home systems, where consumers are interested in smart lighting that is both functional and decorative. In June 2023, ENDO Lighting launched Synca, a versatile lighting system for the home and office, to meet this need and propel the market. The increasing emphasis on user experience and integration only serves to increase demand, which in turn fuels creativity in the luxury lighting market.

-

Energy efficiency and sustainability initiatives: The move towards energy-efficient lighting has become a major force behind the luxury lighting fixtures market. Light emitting diodes are expected to garner significant growth by 2030 as Japan continues to strive to cut its energy use. In January 2024, Endo Lighting added new LED products to the product line, thus strengthening the concept of sustainable design. There are also government incentives for using energy-efficient technologies that enhance the use of luxury LED fixtures.

-

Growth in commercial real estate and hospitality: The growth in high-end commercial buildings, hotels, and upscale retail outlets in cities is creating the need for high-end lighting. In November 2024, the company released a new line of architectural luminaires for high-end commercial environments to beautify architecture. This trend is in harmony with the rapid growth of the hospitality and retail industries in Japan and the expansion of investments in luxury lighting products.

Challenges

-

Decline in new housing developments: The decline in the population of Japan is having an impact on the new construction of homes and the residential luxury lighting sector. As housing starts to slow down, manufacturers are left struggling to find ways of sustaining the growth they are experiencing. In 2023, only 9.8% of fixtures required in Japan were imported, which means that the country relied much on domestic production, which could be affected if the construction of new houses decreases.

-

Supply chain disruptions and import dependency: Japan luxury lighting fixtures market is still import-oriented, and China is the main supplier, which provides 71.0% of imports. Global supply chain risks and geopolitical risks are threats to the stability of the market. In 2023, imports reached USD 704 million, which raises concerns over the supply chain for materials and components and may hamper project delivery and raise costs.

Japan Luxury Lighting Fixtures Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2030 |

|

CAGR |

6.2% |

|

Base Year Market Size (2024) |

USD 336.2 million |

|

Forecast Year Market Size (2030) |

USD 485.3 million |

|

Country Scope |

Japan (Tokyo, Yokohama, Osaka, Nagoya, Sapporo, Fukuoka, Kawasaki, Kobe, Kyoto and Saitama) |

Japan Luxury Lighting Fixtures Market Segmentation:

Light Source Type Segment Analysis

The LED lamps segment is expected to capture 40.0% of the Japan luxury lighting fixtures market share during the predicted period due to energy efficiency and costs. In February 2024, Nichia released a new line of high-efficiency LED chips for horticultural lighting, which is a new application for LED technology. The application of LED light in residential, commercial and industrial areas enhances the market dominance of LEDs in the long run. As the life expectancy of LED products increases and as they become smarter, this segment is anticipated to remain strong and dynamic.

Interior Design Segment Analysis

Modern interior design is estimated to account for approximately 55.0% of the Japan luxury lighting fixtures market through 2030, due to changing consumer trends in lighting that favor simplicity and less ornamentation. In April 2024, Citizen introduced new LED downlights for commercial applications with improved features that respond to contemporary designs. Sophisticated design and use of high technology make modern luxury lighting fixtures the ideal solution for modern interiors. Thus, the further development of the Japanese architectural landscape will be led by the modern lighting segment.

Our in-depth analysis of the Japan luxury lighting fixtures market includes the following segments:

|

Segment |

Subsegments |

|

Light Source Type |

|

|

Interior Design |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Japan Luxury Lighting Fixtures Market - Regional Analysis

Tokyo Market Insights

Tokyo is still the leading market for luxury lighting fixtures in Japan due to the increased number of commercial buildings, luxurious hotels, and upscale residential homes in the city. In January 2024, Toshiba launched smart LED streetlights in Tokyo, which supports the strategy of smart cities. Ongoing commitment to state-of-the-art design and technology means that the city has a growing and expanding market for luxury lighting products. Furthermore, Tokyo city has adopted the use of smart technology in residential and public areas turning into a potential investment prospect in luxury lighting solutions.

Osaka Market Insights

The luxury lighting fixtures market in Osaka is expected to rise at a stable pace due to a rising number of hotels and retail outlets. In March 2024, Sharp launched solar-powered LED outdoor lights which were to be used in public areas in the city, which shows the city’s commitment to sustainable design. Osaka's development is further enhanced by continuous urban development projects and increased use of efficient lighting systems. As Osaka gears up for Expo 2025, the need for high-end lighting is expected to increase in the city and strengthen the company’s market standing.

Key Japan Luxury Lighting Fixtures Market Players:

- Yamagiwa

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Moooi

- Flos Japan K.K.

- NABA DENKI SANGYO CO LTD

- Odelic Co Ltd

The competition in Japan luxury lighting fixtures market is intense, and key players are constantly adding new products and incorporating new technologies to gain a competitive edge. The key players in the market are Moooi, Flos Japan K.K., NABA DENKI SANGYO CO LTD, and Odelic Co Ltd. These companies focus on innovation, quality and design to provide solutions to the growing needs of luxury lighting for homes and businesses. In March 2024, Odelic unveiled more than 1,000 models, thus strengthening its position as a market leader in terms of product offerings and international presence. This strategic move is consistent with the current market dynamics that have been characterized by the expansion of product offerings in a bid to meet the diverse needs of the consumers, thus improving the market position of Odelic and boosting the growth of the luxury lighting segment.

Here are some leading companies in the Japan luxury lighting fixtures market:

Recent Developments

- In January 2024, Panasonic launched a new line of smart LED lighting solutions designed for residential and commercial use. These products aim to enhance energy efficiency and user convenience through advanced IoT integration, aligning with the growing trend towards smart home technologies while addressing consumer needs for sustainability.

- In January 2024, Yamagiwa announced its participation in the Maison&Objet exhibition in Paris. This event will showcase new products, including "SUI & SYOKU" and "TWIGLIGHT," crafted by Japanese artisans. The aim is to highlight traditional craftsmanship while expanding their global presence in the luxury lighting market. This move is expected to enhance brand visibility and attract international clients.

- In April 2023, Yamagiwa successfully showcased a range of innovative lighting designs at the Milano Design Week. This event emphasized their commitment to blending modern aesthetics with traditional techniques. It marked a significant step in establishing their brand internationally, drawing attention from designers and industry leaders alike.

- Report ID: 6916

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.