Isopropyl Palmitate Market Outlook:

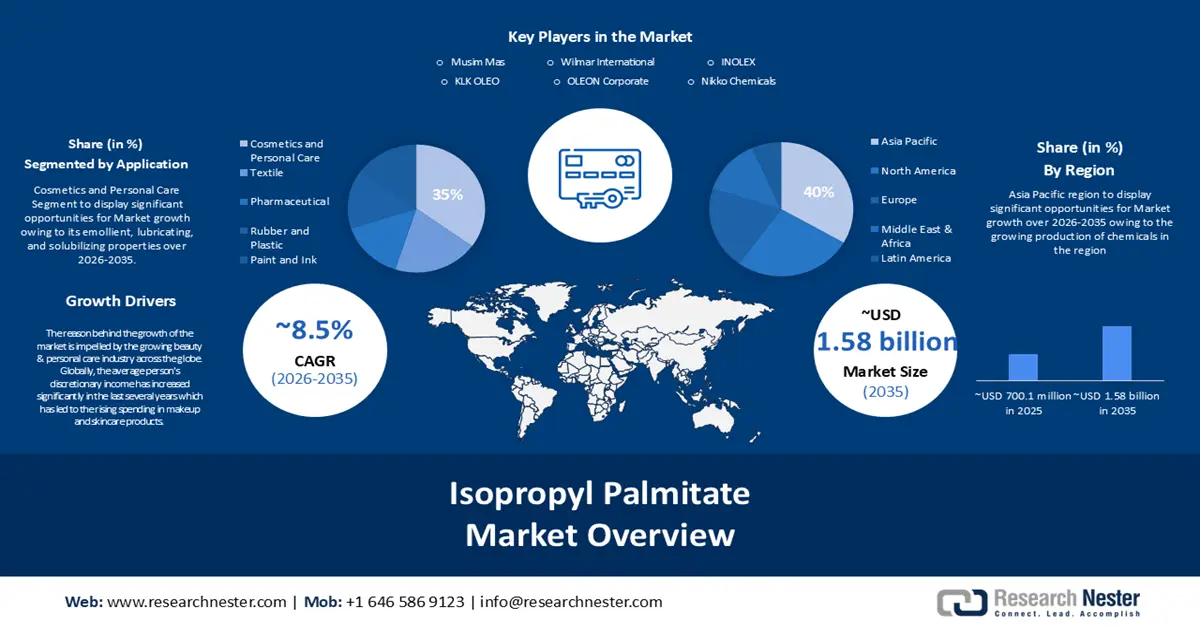

Isopropyl Palmitate Market size was valued at USD 700.1 million in 2025 and is set to exceed USD 1.58 billion by 2035, expanding at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of isopropyl palmitate is estimated at USD 753.66 million.

The reason behind the growth is impelled by the growing beauty & personal care industry across the globe. Globally, the average person's discretionary income has increased significantly in the last several years which has led to the rising spending in makeup and skincare products among women.

For instance, globally, the beauty and personal care industry is expected to expand by over 3% between 2024 and 2028, reaching a market size of around USD 735 billion by 2028.

The growing usage of antiperspirant sticks is believed to fuel the market growth. Antiperspirant sticks employ isopropyl palmitate as a physical stabilizer that fights odors, leaves a clean, fresh aroma behind, and diminishes perspiration.

Key Isopropyl Palmitate Market Insights Summary:

Regional Insights:

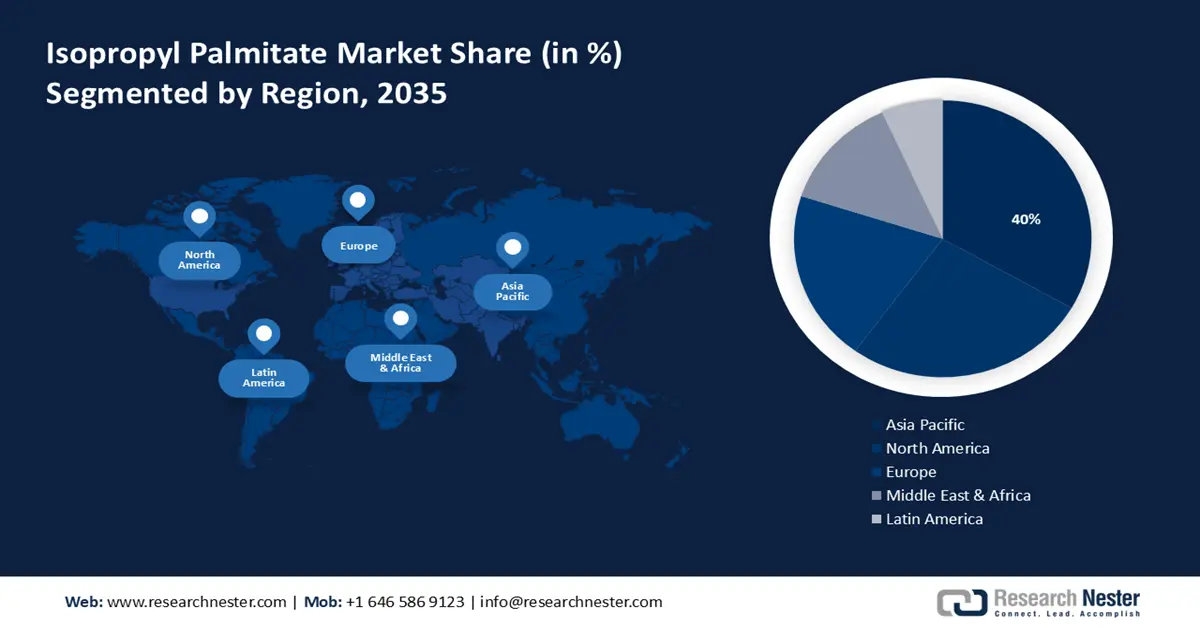

- By 2035, the Asia Pacific region is anticipated to command around 40% share of the isopropyl palmitate market, supported by India’s expanding chemical manufacturing base.

- The North America region is expected to remain the second-largest by 2035, propelled by growing personal disposable income.

Segment Insights:

- By 2035, the cosmetics & personal care segment in the isopropyl palmitate market is projected to exceed a 35% share, underpinned by its utilization in a range of moisturizers and hair care products.

- The greater than or equal to 95% segment is set to capture a notable share through 2035, bolstered by its role as a safe and effective action enhancer for transdermal drug delivery through the skin.

Key Growth Trends:

- Rising utilization in pharmaceuticals

- Growing Adoption in the textile industry

Major Challenges:

- Side effects of isopropyl palmitate

- Stringent regulatory requirements associated with the safety of the product

Key Players: Musim Mas, KLK OLEO, Wilmar International, Kao Corporation, OLEON Corporate, INOLEX, Guangzhou Zhonghai Chemical, Nikko Chemicals, Haiyan Fine Chemical Industry Co.

Global Isopropyl Palmitate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 700.1 million

- 2026 Market Size: USD 753.66 million

- Projected Market Size: USD 1.58 billion by 2035

- Growth Forecasts: 8.5%

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, South Korea, Indonesia, Mexico, United Arab Emirates

Last updated on : 28 November, 2025

Isopropyl Palmitate Market - Growth Drivers and Challenges

Growth Drivers

- Rising utilization in pharmaceuticals - Isopropyl palmitate is utilized as an excipient in topical medicinal formulations to offer assistance with the solvency and conveyance of active components.

- Growing Adoption in the textile industry - In the textile processing industry, isopropyl palmitate serves as a grease and wetting agent and is utilized in polymers, textile treatment items, and dyes.

- Increasing food and beverage sector - Often alluded to as isopropyl hexadecanoate, isopropyl palmitate is a premium nourishment and flavoring component with exceptional purity, and is used as a preservative and food additive in a assortment of food products to upgrade flavor and texture.

- Isopropyl palmitate as an adhesive - Cakes and tablets can too be compressed utilizing isopropyl palmitate as an adhesive and was employed as a model enhancer to study drug release characteristics in pressure-sensitive adhesives.

Challenges

- Side effects of isopropyl palmitate - Use of isopropyl palmitate should only be done sparingly as high or excessive concentrations can be harmful owing to the ingredient's potent thickening qualities that keep the skin from breathing properly, which may cause breakouts, and result in dry, and flaky skin.

Skin flare-ups could be brought on by isopropyl palmitate if it is used excessively, and might result in blackheads, and whiteheads, and may result in skin irritation with extended, also cause skin to become red, swollen, and is also considered hazardous to aquatic life and may have long-term negative consequences on the ecosystem. Moreover, isopropyl, butyl, phenyl, benzyl, and isopropyl palmitate have been outright banned in the EU owing to their comedogenic action, which can result in acne. - Stringent regulatory requirements associated with the safety of the product

- Fluctuations in raw material prices such as palm oil can impact the overall cost of production and the profitability

Isopropyl Palmitate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 700.1 million |

|

Forecast Year Market Size (2035) |

USD 1.58 billion |

|

Regional Scope |

|

Isopropyl Palmitate Market Segmentation:

Application Segment Analysis

In isopropyl palmitate market, cosmetics & personal care segment is likely to hold more than 35% share by 2035. In order to improve product performance, isopropyl palmitate is utilized in a range of moisturizers and hair care products. It is useful in cosmetics since it is an ester made of isopropyl alcohol and palmitic acid.

As an essential component of moisturizers, creams, emulsions, and body oils, isopropyl palmitate softens, soothes, and enhances the overall texture of the skin, making it one of the most significant uses of the ingredient in cosmetics. Isopropyl palmitate also functions as a lubricant in creams and lotions, enhancing their spreadability and encouraging uniform product distribution of ingredients that are important for the shelf life of the product.

In addition, isopropyl palmitate is used in styling products, hair care serums, and conditioners to help manage and condition hair, smooth cuticles, detangle hair, lessen frizz, and improve the overall look and feel of hair.

Type Segment Analysis

The greater than or equal to 95% segment in the isopropyl palmitate market is set to garner a notable share shortly. One category is "Greater than or Equal to 95%," which describes products containing isopropyl palmitate with a purity level of 95% or more which are essentially colorless and odorless and can be used for cosmetic purposes, and can also be safe and effective action enhancers for transdermal drug delivery through the skin.

Our in-depth analysis of the global isopropyl palmitate market includes the following segments:

|

Type |

|

|

Source |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Isopropyl Palmitate Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 40% by 2035. India has one of the biggest chemical industries in the world and has the potential to become one of the top locations in the world for chemical manufacturing. India's chemical sector is developing; it ranks sixth in the world for chemical imports and eleventh for chemical exports globally.

For instance, India's chemical and petrochemical (CPC) sector is currently valued at over USD 175 billion, placing it in a prominent position on the global market. Besides this, one of the primary manufacturing sectors in China is the chemical industry, which is still larger than that of any other country. Moreover, the global income generated by the chemical industry wa foreseen to be around USD 5 trillion in 2022.

In addition, China boasts the largest textile sector globally, both in terms of total output and exports, which accounts for almost half of the world's production of apparel and textiles. For instance, China manufactured over 2 billion meters of apparel fabric in 2023. This may lead to a higher demand for isopropyl palmitate in the region.

North American Market Insights

The North America isopropyl palmitate market is assessed to be the second largest, during the forecast timeframe led by the growing personal disposable income. As a result, more and more consumers are spending higher levels of disposable income on cosmetics and beauty products in the region, leading to a higher demand for isopropyl palmitate.

For instance, The United States' disposable personal income rose by more than 0.2% in December 2023 compared to the same month the previous year.

Isopropyl Palmitate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Musim Mas

- KLK OLEO

- Wilmar International

- OLEON Corporate

- INOLEX

- Guangzhou Zhonghai Chemical

- Nikko Chemicals

- Haiyan Fine Chemical Industry Co

Recent Developments

- BASF announced the launch of a range of new catalysts to increase the efficiency of isopropyl alcohol (IPA) production and has undergone testing and has been certified to create IPA. Furthermore, the company also announced the introduction of O4-204, a new catalyst for n-butane-based maleic anhydride production to emphasize dedication to offering effective and lasting solutions, and to assist clients in becoming more successful.

- Nikko Chemicals introduced Nikkol Lecinol MFL with high levels of lysophosphatidic acid, to strengthen the skin's barrier function, and also to shield the skin from environmental stresses including air pollution.

- Report ID: 5794

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Isopropyl Palmitate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.