Isopropyl Myristate Market Outlook:

Isopropyl Myristate Market size was over USD 85.1 million in 2025 and is anticipated to cross USD 180.35 million by 2035, growing at more than 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of isopropyl myristate is assessed at USD 91.07 million.

Isopropyl myristate’s increasing application in cosmetics is propelling the profit shares of leading companies. The swiftly expanding market for beauty and skincare products especially creams, lotions, and deodorants is set to fuel the consumption of isopropyl myristate. The increasing industrial activities in developing regions such as Latin America, Asia Pacific, and the Middle East & Africa are creating a lucrative environment for isopropyl myristate manufacturers. Isopropyl myristate is finding high application in biodegradable lubricants and greases. The growth in the mining, shipping, forestry, and water management activities to further set to amplify the consumption of isopropyl myristate.

Key Isopropyl Myristate Market Insights Summary:

Regional Highlights:

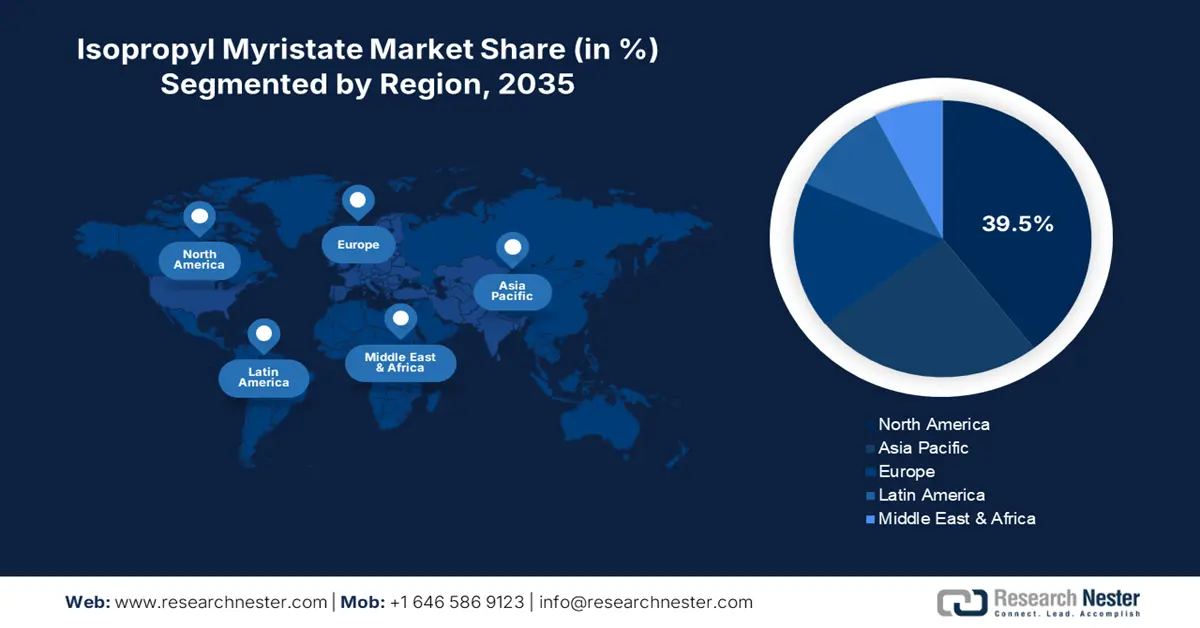

- North America dominates the Isopropyl Myristate Market with a 39.5% share, driven by continuous innovations in drug formulations and delivery systems, ensuring leadership in pharmaceutical advancements through 2026–2035.

- The Asia Pacific Isopropyl Myristate Market is projected for rapid growth through 2026–2035, driven by robust urban/industrial growth and favorable government policies.

Segment Insights:

- The Liquid segment is projected to achieve a 69.1% share by 2035, driven by its versatility and ease of formulation in various applications.

- The Pharmaceutical Formulations segment of the Isopropyl Myristate Market is projected to hold a 42.3% share by 2035, driven by isopropyl myristate’s role as a solvent and absorption enhancer in topical drugs.

Key Growth Trends:

- Health and wellness products including essential oils fueling isopropyl myristate consumption

- Isopropyl myristate’s growing use in animal medicines

Major Challenges:

- Sustainability trend lowering isopropyl myristate sales

- Adverse effects and recalls

- Key Players: Cepsa, Eastman, BASF SE, and Berg + Schmidt GmbH & Co. KG.

Global Isopropyl Myristate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 85.1 million

- 2026 Market Size: USD 91.07 million

- Projected Market Size: USD 180.35 million by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 13 August, 2025

Isopropyl Myristate Market Growth Drivers and Challenges:

Growth Drivers

- Health and wellness products including essential oils fueling isopropyl myristate consumption: The health and wellness market is emerging as a high-growth marketplace for isopropyl myristate manufacturers. The rising popularity of skincare and wellness is fueling the demand for active and effective essential oils and subsequently the consumption of isopropyl myristate. For instance, the Observatory of Economic Complexity (OEC) reveals that the total trade of essential oils was calculated at USD 5.57 billion in 2023. The export (USD 743 million) and import (USD 1.12 billion) activities of essential oils are highly concentrated in the U.S. Furthermore, the size of the natural extract market is estimated at USD 13.9 billion in 2025. The booming production and commercialization of essential and natural oils are poised to uplift the application of isopropyl myristate.

- Isopropyl myristate’s growing use in animal medicines: Isopropyl myristate is increasingly being used in pet products such as flea and tick-killing solutions. The pet adoption trend is exhibiting a significant boom across the world, which is directly influencing veterinary healthcare product sales. For instance, the American Society for the Prevention of Cruelty to Animals (ASPCA) states that nearly 4.0 million shelter animals are adopted every year. This highlights the increasing demand for their health and wellness products.

Challenges

- Sustainability trend lowering isopropyl myristate sales: Increasing focus on sustainability and organic trends are poised to act as a barrier to isopropyl myristate sales growth. The rising popularity of organic chemicals is estimated to have a negative influence on the production and consumption of chemicals produced from non-renewable feedstocks. Furthermore, environmental concerns and carbon emissions during the production process challenge the isopropyl myristate market growth to some extent.

- Adverse effects and recalls: The negative effects of isopropyl myristate limit their use in certain applications such as cosmetics and skincare. The excess exposure to eye, skin, and indigestion leads to adverse after-effects hampering the goodwill of the company and major recall of products. The recalls majorly hamper the profits of leading companies leading to budgetary challenges.

Isopropyl Myristate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 85.1 million |

|

Forecast Year Market Size (2035) |

USD 180.35 million |

|

Regional Scope |

|

Isopropyl Myristate Market Segmentation:

Application (Skincare Products, Haircare Products, Cosmetics, Pharmaceutical Formulations, Industrial Applications)

Pharmaceutical formulations segment is poised to hold more than 42.3% isopropyl myristate market share by 2035. Isopropyl myristate’s wide application as a solvent and absorption enhancer in topical drugs is contributing to its sales growth. The continuous innovations in the transdermal drug delivery systems are driving the consumption of isopropyl myristate. The increasing spending on research and development is further backing the demand for isopropyl myristate. For instance, the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) study discloses that biopharmaceutical R&D spending is expected to increase from USD 202.0 billion in 2024 to USD 213.0 billion by 2026. Such positive investment moves are set to create lucrative opportunities for isopropyl myristate companies in the pharmaceutical sector.

Form (Solid, Liquid)

By the end of 2035, liquid segment is expected to capture around 69.1% isopropyl myristate market share. The versatility and ease of formulation capability are driving the demand for liquid isopropyl myristate. The cosmetics sector is primarily augmenting the sales of liquid form isopropyl myristate. Skincare creams, lotions, perfumes, deodorants, and haircare solutions make high use of liquid isopropyl myristate owing to its excellent solvent and emulsifying properties. The growth in the sales of these products is set to propel the consumption of liquid isopropyl myristate in the coming years. The liquid isopropyl myristate manufacturers are estimated to earn high profits in the emerging economies owing to rapid expansion activities of end use industries.

Our in-depth analysis of the global isopropyl myristate market includes the following segments:

|

Form |

|

|

Purity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Isopropyl Myristate Market Regional Analysis:

North America Market Forecast

North America isopropyl myristate market is anticipated to hold revenue share of more than 39.5% by 2035. The pharma giants are dominating the isopropyl myristate sales in the region. Continuous innovations in drug formulations and delivery systems are creating a positive environment for isopropyl myristate producers. The U.S. and Canada are expected to witness a double-digit isopropyl myristate sales growth in the coming years. The presence of large-scale industries is also augmenting the applications of isopropyl myristate in both countries.

The U.S.’s strong chemical manufacturers base is backing the isopropyl myristate trade activities across the country. Increasing health and wellness trends are augmenting the sales of medicines and oils. This move is acting as a game changer for isopropyl myristate manufacturers as they are able to secure high profits in this segment.

Canada’s expanding beauty and skincare market is foreseen to increase the sales of isopropyl myristate market in the coming years. For instance, the report by TFO Canada estimated that the beauty and personal market was calculated at USD 7.6 billion in 2023 and is expected to increase at a steady CAGR through 2028. The continuous rise in the demand for cosmetics, skincare, and haircare products is poised to propel the consumption of isopropyl myristate in the coming years.

Asia Pacific Market Statistics

The Asia Pacific isopropyl myristate market is set to increase at the fastest pace between 2025 to 2035. The robust growth in urban and industrial activities is directly influencing the isopropyl myristate sales. The rising foreign investments and favorable government policies are seen to augment the consumption of isopropyl myristate in the region. China and India owing to the swift expansion of industries are likely to double the revenues of isopropyl myristate companies in the coming years. The J-beauty and K-beauty trends are fueling the use of isopropyl myristate in cosmetics and personal care products in Japan and South Korea.

China’s industrial growth is expected to open lucrative doors for isopropyl myristate market. The use of isopropyl myristate in lubricants and grease is set to double its demand in the coming years. The country’s 14th five-year plan, supportive industrial policies, and Made-in-China strategies are expected to boost the revenues of isopropyl myristate producers in the coming years. The government through a press release in June 2024 revealed that the total value added in industrial companies above the designated size surpassed by 5.6% YoY growth.

The strong presence of a chemical manufacturer base in India is likely to increase the isopropyl myristate trade activities. The health and wellness trends are driving innovations in pharmaceutical production, leading to high consumption of isopropyl myristate. For instance, the India Brand Equity Foundation (IBEF) study elaborates that the country’s pharma sector is set to surpass USD 450.0 billion by 2047. Furthermore, the large market for beauty and personal care products is further propelling the demand for isopropyl myristate in the country.

Key Isopropyl Myristate Market Players:

- Cepsa

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eastman

- BASF SE

- Berg + Schmidt GmbH & Co. KG

- Croda International Plc

- IOI Oleochemicals

- Jarchem Industries Inc.

- KLK OLEO

- Kokyu Alcohol Kogyo Co., Ltd.

- Mosselman S.A.

- Oleon GmbH

- Sumika Semiconductor Materials Texas Inc.

- Honeywell International Inc.

- NanJing DongDe Chemicals

- Shaanxi Top Pharm Chemical

Leading companies are employing several organic and inorganic marketing strategies to earn high profits and maximize their revenue shares. New product launches, technological innovations, strategic collaborations & partnerships, mergers & acquisitions, and regional expansions are some of the tactics employed by industry giants. The key players are entering into strategic collaborations with end users such as cosmetics and pharma manufacturers to boost their sales and revenues. By entering into untapped markets, isopropyl myristate market are able to expand their production capacities and earn high profits.

Some of the key players include in isopropyl myristate market:

Recent Developments

- In September 2024, Eastman announced the introduction of a new electronic-grade solvent to deliver superior quality. The company expanded its EastaPure solvents portfolio by adding high-purity isopropyl alcohol to meet semiconductor purity and reliability standards.

- In June 2024, Cepsa announced the construction of the first chemical plant in Spain to produce the base for hydroalcoholic gels made from isopropyl alcohol. The new plant aims to have a production capacity of 80,000 tons of isopropyl alcohol.

- Report ID: 7262

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Isopropyl Myristate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.