Isononanol Market Outlook:

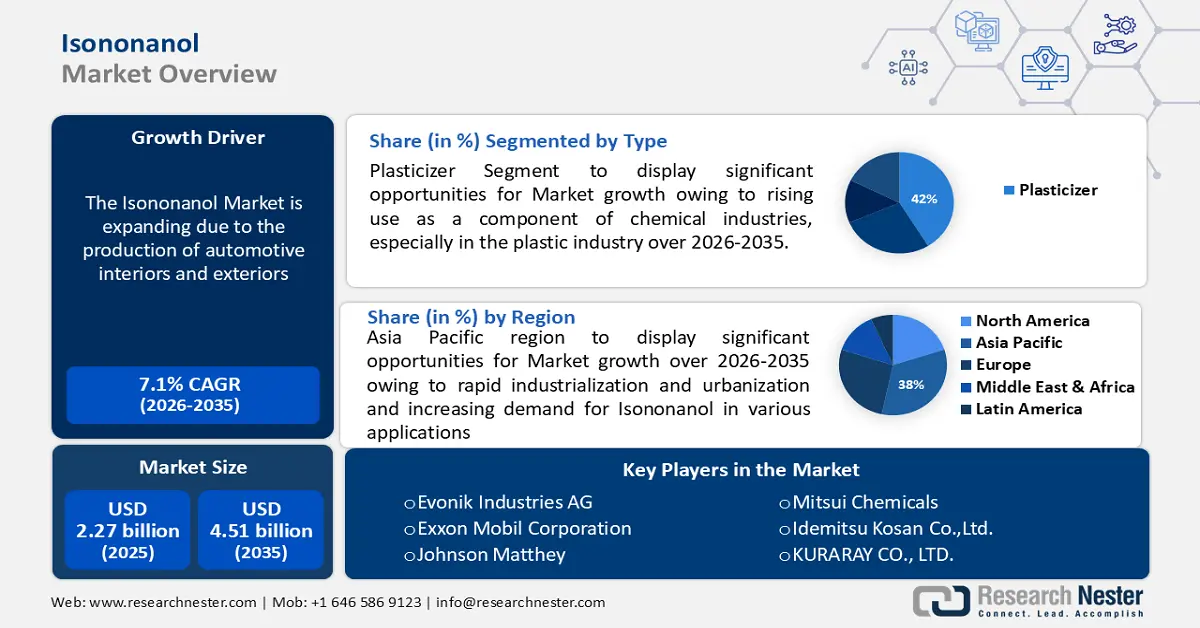

Isononanol Market size was over USD 2.27 billion in 2025 and is anticipated to cross USD 4.51 billion by 2035, witnessing more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of isononanol is assessed at USD 2.42 billion.

The global industry volume of plasticizers will reach nearly 10.88 million tonnes by 2022. In particular, plasticizers help to enhance the flexibility, durability, and resilience of plastics. The growing demand for plasticizers in various industries such as construction, automotive, and packaging is driving the demand for isononanol. It is a vital component in the manufacturing process of these plasticizers, making it an essential raw material for several industries.

Additionally, isononanol is utilized in the manufacturing of paints and coatings as a solvent or coalescing agent. With the expansion of the construction and automotive sectors globally, there is a growing need for paints and coatings, thereby fuelling the demand for isononanol.

Key Isononanol Market Insights Summary:

Regional Highlights:

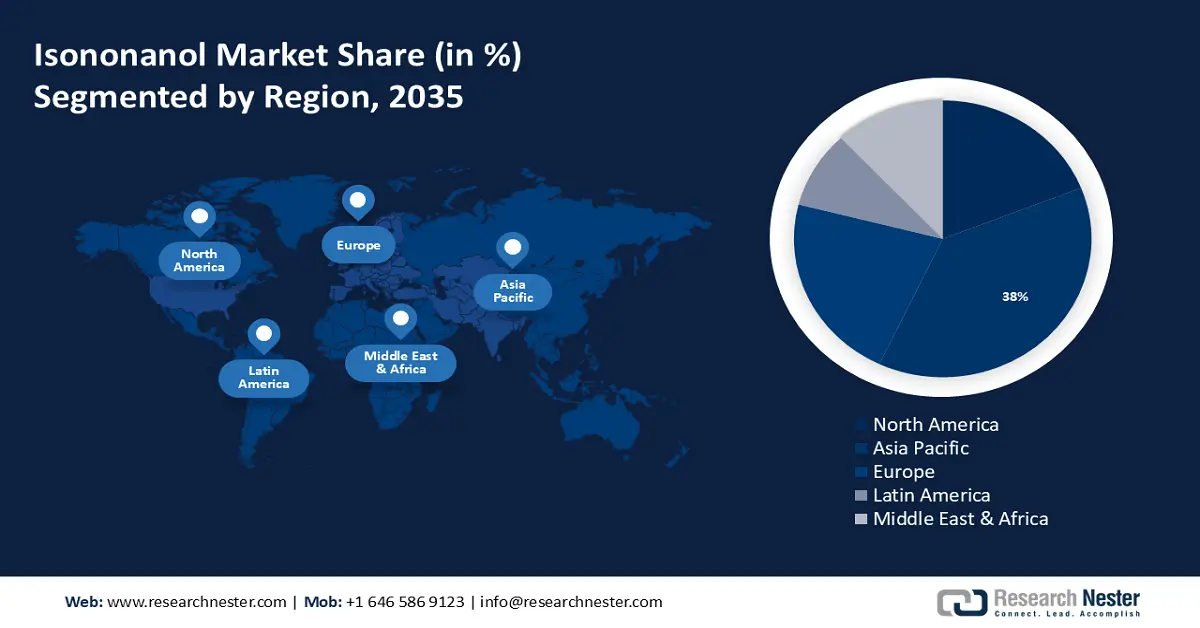

- Asia Pacific is projected to secure a 38% share of the isononanol market by 2035, underpinned by its accelerating industrialization, rising urban infrastructure development, and expanding automotive production across major economies in the region.

- Europe is anticipated to command a notable revenue share in 2035 as advancements in chemical processing technologies strengthen its isononanol adoption across a highly innovative automotive manufacturing landscape.

Segment Insights:

- The plasticizer segment is expected to hold a 42% share of the isononanol market by 2035, supported by escalating consumption of plasticized PVC across automotive and chemical industries.

- The building & construction segment is set to capture a substantial revenue share by 2035, reinforced by rising construction activity in developing nations and increasing reliance on isononanol-based materials in electrical cable applications.

Key Growth Trends:

- Growth in Automotive Production

- Technological Advancements

Major Challenges:

- Fluctuating Feedstock Prices

- Rising Competition from Substitute Products

Key Players: Evonik Industries AG, Exxon Mobil Corporation, Johnson Matthey, BASF SE, SINOPEC/ China Petrochemical Corporation, KH Neochem Co., Ltd., CPC Corporation, NAN YA PLASTICS CORPORATION, OXEA GmbH, Mitsui Chemicals.

Global Isononanol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.27 billion

- 2026 Market Size: USD 2.42 billion

- Projected Market Size: USD 4.51 billion by 2035

- Growth Forecasts: 7.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 28 November, 2025

Isononanol Market - Growth Drivers and Challenges

Growth Drivers

- Growth in Automotive Production- The automotive industry is a major consumer of isononanol, primarily in the production of automotive interiors and exteriors. As the Automotive sector continues to expand globally, especially, in emerging markets, the demand for isononanol is expected to witness steady growth. As analyzed by Research Nester analyst, particularly in APAC, the used automotive industry is expanding significantly on a global scale. Sales of 94–96 million automobiles were up 3-4% in 2023, and 5-6% growth is anticipated in 2024. This rise in production and sales is anticipated to support the isononanol market growth during the projection period.

- Technological Advancements- Ongoing research and development efforts are leading to technological advancements in the production process of isononanol, resulting in improved efficiency and cost-effectiveness. These advancements are likely to stimulate market growth by making isononanol more accessible to a wider range of industries.

- Surging Construction Activities- The construction industry’s growth, particularly in emerging economies, is a significant driver for the Isononanol market. isononanol is used in the production of construction materials such as PVC pipes, cables, thermoplastic pipes and flooring materials. As construction activities increase to meet infrastructure demands, the demand for isononanol is also expected to rise. Compared to the previous year, the construction sector entered 2023 with a 7% increase in nominal value added and a 6% increase in nominal gross production.

- Shift towards Sustainable Chemicals- With increasing environmental concerns, there is a growing preference for eco-friendly and sustainable chemicals. isononanol, being biodegradable and non-toxic, is gaining traction as a sustainable alternative in various applications, driving its isononanol market growth. It was observed by Research Nester’s analysts that sustainable products saw a 2.7x greater rate of growth than non-sustainable ones. 75% of eco-friendly products sell better online than in physical stores. Seventy-eight percent of consumers think sustainability matters.

Challenges

- Fluctuating Feedstock Prices- The prices of raw materials used in the production of isononanol, such as n-butylene and propylene, can be volatile due to factors like supply-demand dynamics, geopolitical tensions, and crude oil price fluctuations. Fluctuating feedstock prices pose a challenge for isononanol manufacturers in terms of production costs and profit margins. This fluctuation in prices may hamper the growth of isononanol market in the upcoming years.

- Rising Competition from Substitute Products- isononanol faces competition from substitute products such as phthalate-based plasticizers and alternative alcohols like isononyl alcohol.

- Downturns in key industries can decrease isononanol demand, causing overcapacity and pricing pressures.

Isononanol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 2.27 billion |

|

Forecast Year Market Size (2035) |

USD 4.51 billion |

|

Regional Scope |

|

Isononanol Market Segmentation:

Product Type Segment Analysis

The plasticizer segment is predicted to account for 42% share of the global isononanol market by 2035. The global volume of plasticizers reached almost 10.88 million metric tons in 2022. In 2030, the global industry volume of this compound is expected to increase to more than 14.32 million tonnes. The segment’s growth is attributed to its rising use as a component of chemical industries, especially in the plastic industry. The global plastic industry is stimulated to witness robust growth during the forecast period driven by increasing population, urbanization, and industrialization across the globe. This, in turn, is expected to fuel the demand for isononanol during the forecast period. Furthermore, the global plasticizers market is expected to flourish on account of PVC in the automotive industry. Plasticized PVC is used to promote good paint-ability and enhancing the appearance of the vehicle. This, in turn, is anticipated to boost the growth of the isononanol market, as its maximum consumption in the manufacturing of plasticizers.

End-Use Segment Analysis

Building & Construction segment in isononanol market is established to attain a significant revenue share during the forecast period. The growing construction industry across developing countries such as India, China, and South Korea is anticipated to boost the product demand in these applications. Also, the product’s excellent dielectric properties make it an ideal choice for manufacturing high-quality electric cables used in industries such as telecommunications, data transmissions, and power generation, making it an essential component for the construction industry.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

End-Use |

|

|

Grade |

|

|

Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Isononanol Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 38% by 2035, due to rapid industrialization and urbanization and increasing demand for isononanol in various applications in the region.The region is experiencing rapid industrialization and urbanization, driving demand for various products requiring isononanol, such as PVC pipes, cables, automotive parts, and construction materials. As countries in the region continue to develop infrastructure and urban areas, the demand for isononanol as a key intermediate is expected to increase significantly. The region is a hub for automotive manufacturing with countries like China, Japan, South Korea, and India leading in production volumes. Asia-Pacific's Light Vehicle (LV) production ended 2023 on a high note. Due to the strong pace of production in China and Japan, as well as Korea and India, this region's output increased by almost 10% year on year with a record volume of 51.8 million units. isononanol is extensively used in producing automotive interiors, exteriors, and components. As the demand for automobiles continues to rise due to increasing population and rising disposable incomes, the demand for isononanol in the region’s automotive industry is set to grow. Additionally, there is a growing awareness and emphasis on sustainability and environmental responsibility in the Asia Pacific region. isononanol, being biodegradable and non-toxic, is increasingly preferred as a sustainable alternative in various applications. The shift towards eco-friendly chemicals is expected to drive the adoption of isononanol in the region.

European Market Insights

The European isononanol market is expected to garner significant revenue share. The European automotive industry is a major consumer of isononanol for manufacturing automotive components, interiors, and exterior parts. As one of the largest automotive components, interiors, and exteriors parts. As one of the largest automotive markets globally, Europe’s demand for Isononanol is driven by the production of vehicles and the need for high-quality materials with excellent performance with excellent performance characteristics. Europe is known for its innovation and technological advancements in chemical manufacturing processes. Ongoing research and development efforts focus on improving the efficiency, sustainability, and cost-effectiveness of isononanol production. These advancements drive isononanol market growth by enhancing the competitiveness of European manufacturers and meeting the evolving needs of industries.

Isononanol Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Exxon Mobil Corporation

- Johnson Matthey

- BASF SE

- SINOPEC/ China Petrochemical Corporation

- KH Neochem Co., Ltd.

- CPC Corporation

- NAN YA PLASTICS CORPORATION

- OXEA GmbH

Recent Developments

- Dow and Johnson Matthey declared that LP OxoSM Technology has been chosen by Zibo Qixiang Tengda Chemical Company, Ltd., a Chinese company, to manufacture isononyl alcohol (INA) at its new production plant. Global business director for Industrial Solutions, a Dow company, stated that QXTD was the first in the industry to use process technology for more sustainable INA manufacturing. Compared to standard INA production techniques, this technology required a smaller manufacturing footprint and used less energy without sacrificing throughput or efficiency.

- Evonik introduced another cutting-edge plasticizer of the current generation with ELATUR® TM. The new specialty product is a member of the trimellitate group and possesses low migratory behavior, low volatility, and high-temperature resistance—a trio of highly sought-after qualities.

- Report ID: 5955

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Isononanol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.