Iron Deficiency Anemia Therapy Market Outlook:

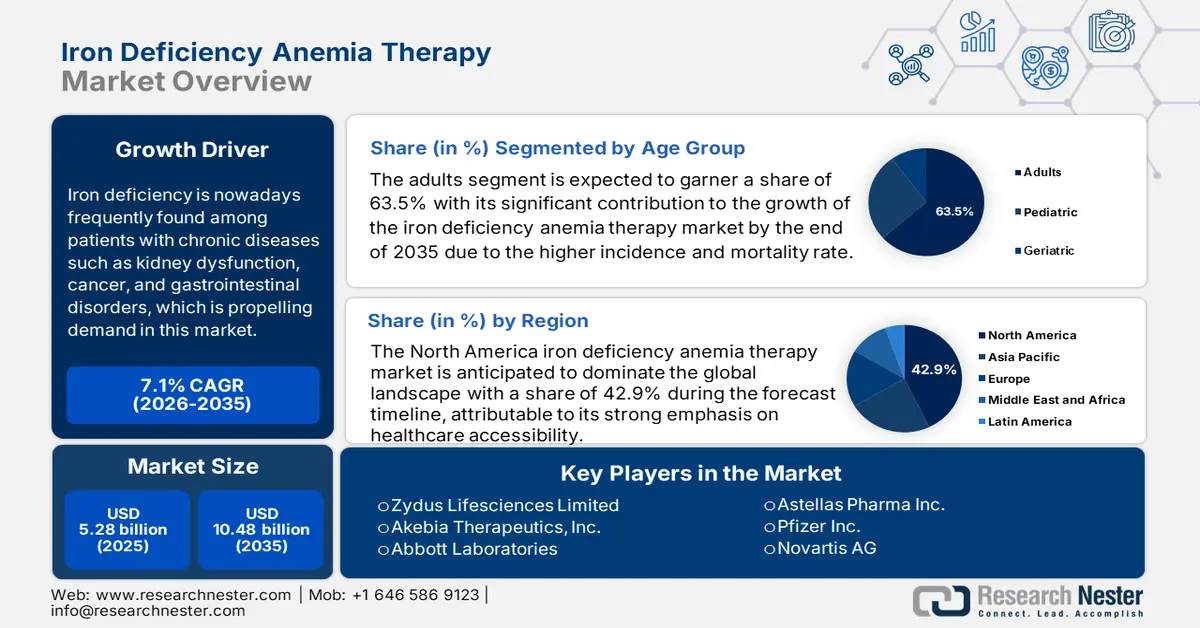

Iron Deficiency Anemia Therapy Market size was over USD 5.28 billion in 2025 and is poised to exceed USD 10.48 billion by 2035, growing at over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of iron deficiency anemia therapy is estimated at USD 5.62 billion.

Iron deficiency is nowadays frequently found among patients with chronic diseases such as kidney dysfunction, cancer, and gastrointestinal disorders, which is propelling demand in the iron deficiency anemia therapy market. As the prevalence of these conditions rises, more cases of associated anemia are being diagnosed, making it a serious public health concern worldwide. According to a 2023 NLM report, this is the most common form of microcytic hypochromic anemia, which implied over 66.0% of the global burden in 2021. Another IHME journal, publishing 2021 statistics revealed that globally around 825.0 million women and 444.0 million men were affected with dietary iron deficiency.

Furthermore, the significant widespread in women and adolescents is pushing global health organizations to improve the availability and accessibility of the iron deficiency anemia therapy market. In addition, the rising economic burden of therapeutics is encouraging companies to introduce more generic and affordable options to serve a larger portion of the consumer base. For instance, a study on the cost-effectiveness of available solutions was published in the 8th edition of the American Society of Hematology in November 2024. It evaluated the payer’s pricing efficiency of oral and intravenous courses in women with heavy menstrual bleeding. The study identified iron dextran injection to be the most cost-effective strategy with an incremental cost-effectiveness ratio (ICER) of USD 1,300/quality-adjusted life year (QALY).

Comparative analysis of first-line treatments

|

Treatment |

Type |

Cost per Patient |

QALYs |

|

Iron Dextran |

Intravenous |

USD 89,000 |

14.5 |

|

Iron Sucrose |

Intravenous |

USD 92,000 |

14.5 |

|

Ferrous Sulfate |

Oral |

USD 87,000 |

13.3 |

Source: ASH 2024 Study

Key Iron Deficiency Anemia Therapy Market Insights Summary:

Regional Highlights:

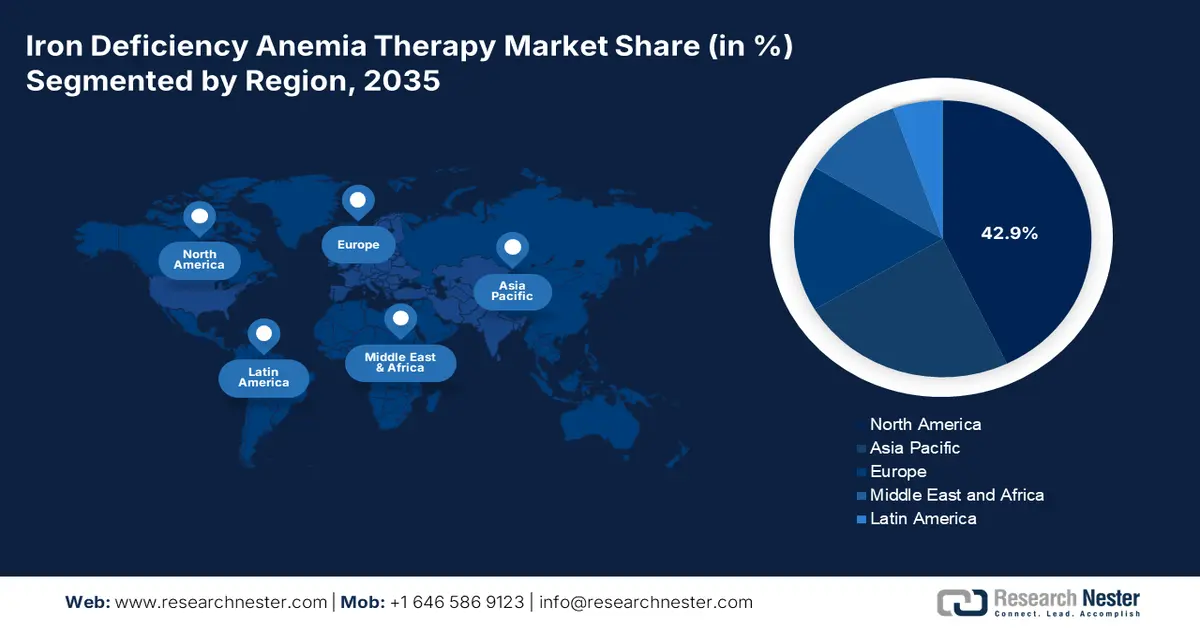

- North America dominates the Iron Deficiency Anemia Therapy Market with a 42.9% share, propelled by strong healthcare accessibility, wide distribution channels, and presence of generics pioneers, supporting growth through 2035.

- Asia Pacific's Iron Deficiency Anemia Therapy Market is set for the fastest growth by 2035, attributed to rising anemia cases and foreign investments improving medical infrastructure.

Segment Insights:

- The Adults segment is projected to hold over 63.5% market share by 2035, driven by the high incidence of IDA among adults with chronic conditions.

- The Oral Iron segment is expected to experience notable growth from 2026-2035, fueled by convenient administration, generic availability, and recent FDA approvals.

Key Growth Trends:

- Rising promotional activities and awareness programs

- Expansion of specialized medicine pipelines

Major Challenges:

- Rising concerns about adverse reactions

- Lack of appropriate diagnostic and investment culture

- Key Players: Akebia Therapeutics, Inc., Sanofi, Zydus Lifesciences Limited, GSK plc, Abbott Laboratories.

Global Iron Deficiency Anemia Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.28 billion

- 2026 Market Size: USD 5.62 billion

- Projected Market Size: USD 10.48 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Iron Deficiency Anemia Therapy Market Growth Drivers and Challenges:

Growth Drivers

-

Rising promotional activities and awareness programs: The heightened risk of developing severe casualties due to advanced cases is boosting the iron deficiency anemia therapy market. With the growing vulnerable population of pregnant women, children, and chronic disease individuals, a surge in efficient and fast-acting remedies is increasing. Various public and private initiatives are also contributing to this cohort by educating people about the symptoms, causes, and complications of this condition, captivating a wider audience. For instance, in February 2024, Emcure Pharmaceuticals commenced a women’s healthcare-focused campaign, Unmask Anemia, to spread awareness about iron deficiency erythrocytopenia in India.

-

Expansion of specialized medicine pipelines: The efficacy of personalized therapies has significantly modernized the iron deficiency anemia therapy market. As the pharmaceutical trend shifts toward specificity, companies are increasingly engaging in extensive R&D to cultivate individualized supplements with smaller intakes and tailored functionalities. In addition, funding from regional authorities is acting as a financial cushion, serving the purpose. For instance, in May 2024, a USD 5.6 million federal grant was sanctioned to support research activities in Michigan Medicine, addressing abnormal menstrual bleeding and anemia. This fund was intended to improve the quality and capabilities of screening and treatment.

Challenges

-

Rising concerns about adverse reactions: The unavoidable side-effects of the products from the iron deficiency anemia therapy market are a major setback in maximum consumption. The occurrence of constipation, nausea, and stomach irritation often undermines the necessity and effectiveness of the medications. This further leads to poor adherence and reduced positive aspects, discouraging consumers from purchasing and taking these drugs. In addition, the concerns about developing serious gastrointestinal issues due to regular consumption may disrupt the approval process and brand reputation, hindering continuous business flow.

-

Lack of appropriate diagnostic and investment culture: Despite ongoing innovations in the iron deficiency anemia therapy market, the high cost of advanced administrations prevents optimum adoption. The limited access to adequate detection methods often leads to delayed intervention, which may fail the existing products in efficacy. Moreover, the shortage of sufficient financial support and trained professionals in rural areas implies worsened cases, which are almost impossible to cure. Such mixed responses from both investors and consumers may dilute the interest of pharma developers, restricting growth.

Iron Deficiency Anemia Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 5.28 billion |

|

Forecast Year Market Size (2035) |

USD 10.48 billion |

|

Regional Scope |

|

Iron Deficiency Anemia Therapy Market Segmentation:

Age Group (Adults, Pediatric, Geriatric)

The adults segment is estimated to capture iron deficiency anemia therapy market share of over 63.5% by 2035. The higher incidence and mortality rate of this condition among this age group is the major propelling factor. According to 2024 NLM data, 90.0% of dialysis recipients with 3rd stage CKD develop erythrocytopenia. Another 2020 NLM study revealed that adults aged >60 years are more prone to 1-5 CKD stages. This is prominent evidence of severity in adult individuals with chronic diseases such as chronic kidney disease (CKD) and heart failure due to the occurrence of IDA. Thus, this community is captivating the primary focus of health organizations and drug developers, signifying this segment’s crucial role in this sector’s growth.

Product Type (Oral Iron, Intravenous (IV) Iron)

Based on product type, the oral iron segment is predicted to show notable growth in the iron deficiency anemia therapy market during the assessed period. Recent advancements and discoveries in this category have revamped its leadership in this sector. In addition, its generic availability and convenient administration make it preferable for all demographics of patients. This also helps simplify the process of regulatory allowance and production, inspiring pioneers to invest more in this segment. For instance, in February 2023, GSK received approval from the FDA for its oral hypoxia-inducible factor prolyl hydroxylase inhibitor, Jesduvroq (daprodustat) to treat anemia in CKD residents undergoing dialysis. The new alternative of intravenous modules broadened the range of affordable options.

Our in-depth analysis of the global iron deficiency anemia therapy market includes the following segments:

|

Age Group |

|

|

Product Type |

|

|

Therapy Areas |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Iron Deficiency Anemia Therapy Market Regional Analysis:

North America Market Analysis

North America iron deficiency anemia therapy market is anticipated to capture revenue share of over 42.9% by 2035. The region’s proprietorship is backed by its strong emphasis on healthcare accessibility and wide distribution channels. The adequate infrastructure allows local professionals to offer every sufferer an accurate diagnosis and prompt response. In addition, the presence of global generics pioneers has accumulated a wide range of supplements, enabling consumers with affordable selections. According to a report from the Association of Accessible Medicines (AAM), the generic and biosimilar drugs industry saved around USD 445.0 billion for habitants and healthcare systems in the U.S. in 2023.

The extensive insurance coverage and proactive government initiatives are boosting the U.S. iron deficiency anemia therapy market. Additionally, the biologics excellence of this country is also escalating the frequency of clinical discoveries in this field, widening its reach. Furthermore, the combined effort from both public and private authorities to spread awareness about the preventions and curatives of IDA has propelled participation from local producers. For instance, in July 2021, Sandoz commenced immediate commercialization of its solely developed intravenous iron, Ferumoxytol Injection in this country. This strategic expansion was intended to occupy a steady position in the global IV iron industry, worth more than USD 1.0 billion.

Canada is propagating the iron deficiency anemia therapy market with its increased involvement in biopharmaceutical R&D. The government-issued favorable policies and grants are continuously fueling this landscape by enabling a strong local drug discovery network. Moreover, the enlarging scope for biologics and biosimilars is subsequently fostering a promising future for global leaders, encouraging them to enlist this country in their marketing strategy. For instance, in August 2024, Kye Pharmaceuticals gained market authorization from Canada regulatory ACCRUFeR (ferric maltol). This prescription-only oral medicine is capable of reducing ID and IDA widespread in adults across the nation.

APAC Market Statistics

The iron deficiency anemia therapy market in Asia Pacific is predicted to showcase the fastest growth over the assessed period. The rising cases of anemia in this region, particularly in low- and middle-income countries, are evidence of the presence of a larger marketplace. According to the IHME database, South Asia was reported to have a 35.7% prevalence of erythrocytopenia in 2021. Foreign investments to improve the medical infrastructure in these countries are also ensuring the exponential growth of this regional territory. For instance, in November 2022, The Foundation for the National Institutes of Health allocated USD 6.0 million to escalate R&D in IV iron methods. This fund was dedicated to post-pregnancy IDA in seven low- and middle-income nations including Bangladesh, India, and Pakistan.

India is augmenting the regional iron deficiency anemia therapy market with an inflating demand for affordable and accessible regimens. The absence of established infrastructure and the rising patient population are conjugately garnering lucrative opportunities for investment in this category. In addition, the collaborative effort from government and private organizations such as Anaemia Mukt Bharat (AMB) strategy (launched in 2018) to spread awareness throughout the country. For instance, in May 2022, Emcure Pharmaceuticals launched the EmWocal campaign in association with the Federation of Obstetrics and Gynaecologists of India (FOGSI).

China is also paving its way towards global leadership in the iron deficiency anemia therapy market with higher prevalence and strong manufacturing capabilities. It is steadily leveraging its speed of drug development in various medical categories by conducting meticulous clinical and preclinical studies. Such a progressive and adaptive atmosphere of this country is further attracting both domestic and international pioneers to participate. For instance, in November 2022, CSL Vifor opted for Fresenius Kabi Co. Ltd. to manufacture and market its intravenous iron therapy, Ferinject, after getting approval from the National Medical Products Administration (NMPA) in China.

Key Iron Deficiency Anemia Therapy Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AbbVie Inc.

- AdvaCare Pharma

- Akebia Therapeutics, Inc.

- Bayer AG

- Covis Pharma GmbH

- CSL Limited

- F. Hoffmann-La Roche Ltd.

- GSK plc

- Johnson & Johnson

- Novartis AG

- PHARMACOSMOS A/S

- Pfizer Inc.

- Sanofi

- SK Capital Partners

- Zydus Lifesciences Limited

- Pharmacosmos Group

- Vifor Inc.

The competitive dynamics of the iron deficiency anemia therapy market are continuously evolving through the integration of biotechnology and biologics. The contribution of the global biopharma industry to the diversification of the product portfolio of this category has significantly leveraged the speed of adoption. Global leaders are setting their targets to supply the unmet needs of emerging marketplaces such as India, China, and Canada to globalize their offerings. For instance, in March 2022, Zydus Lifesciences gained allowance for its new drug application (NDA) from the Drug Controller General of India to commercialize Oxemia (Desidustat). This oral, small-molecule hypoxia-inducible factor-prolyl hydroxylase (HIF-PH) inhibitor is designated to address CKD-related anemia. Such key players include:

Recent Developments

- In August 2024, Pharmacosmos Group acquired G1 Therapeutics for a transaction of USD 405.0 million to solidify its commercial portfolio of innovative treatments for iron deficiency anemia. The acquisition comprised of 68% premium to G1’s closing share price and a 133% premium to G1’s prior 30-day volume-weighted average price.

- In March 2024, Vifor International received marketing authorization in Canada for its ferric carboxymaltose injection, FERINJECT. This intravenous therapy is indicated to treat iron deficiency anemia (IDA) in adult and pediatric patients 1 year of age and older in the absence of response from oral iron preparations.

- Report ID: 7177

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.