IPv6 Market Outlook:

IPv6 Market size was over USD 6.22 billion in 2025 and is anticipated to cross USD 89.79 billion by 2035, growing at more than 30.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IPv6 is estimated at USD 7.93 billion.

The reason behind the growth is impelled by the growing amount of mobile devices across the globe. This has led to an increase in demand for IPv6 since it supports new applications and also provides larger address space as compared to IPv4. In 2021, there were more than 10 billion active mobile devices worldwide, and by 2025, over 18 billion mobile devices are anticipated to be in use.

The growing technological advancements are believed to fuel the market growth. With new technological advancements, the network framework works are improving and are demanding fast Internet packages, which has increased the adoption of faster IPv6.

Key IPv6 Market Insights Summary:

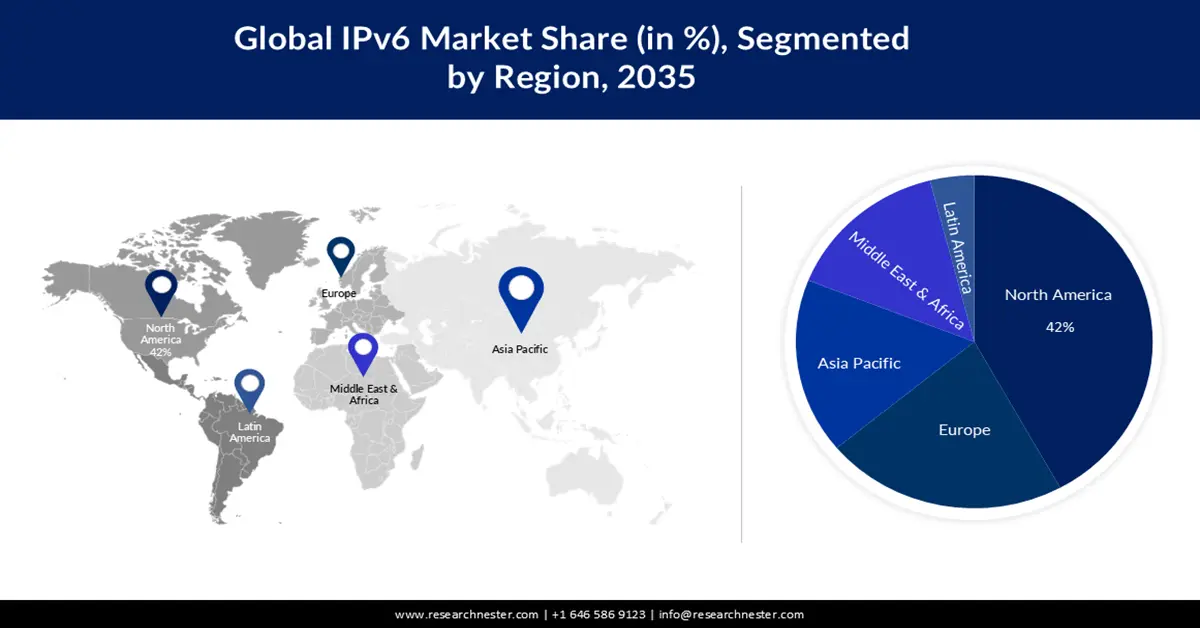

Regional Highlights:

- North America IPv6 market will dominate over 42% share by 2035, driven by the region’s leadership in IPv6 deployment and adoption.

Segment Insights:

- The large enterprises segment in the ipv6 market is forecasted to secure a 65% share by 2035, driven by the need for performance, security, and address scalability.

- The ftth services segment in the ipv6 market is projected to hold a notable revenue share from 2026-2035, driven by support for 5G, IoT, and high-speed, high-bandwidth services.

Key Growth Trends:

- Integration of Cloud Computing and Data Centers

- Government Initiatives and Regulations

Major Challenges:

- Integration of Cloud Computing and Data Centers

- Government Initiatives and Regulations

Key Players: NTT Communications Corporation, KDDI Corporation, SoftBank Corp, Reliance Jio Infocomm Ltd, Verizon, T-Mobile USA, Inc., AT&T Intellectual Property, Tata Teleservices Ltd., China Telecom Global Limited.

Global IPv6 Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.22 billion

- 2026 Market Size: USD 7.93 billion

- Projected Market Size: USD 89.79 billion by 2035

- Growth Forecasts: 30.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Japan

Last updated on : 8 September, 2025

IPv6 Market Growth Drivers and Challenges:

Growth Drivers

- Integration of Cloud Computing and Data Centers- IPv6 is the latest Internet protocol that has brought significant changes and new features to Cloud computing and has also provided means to better develop new techniques from which modern data centers can profit. More than 60% of organizations moved their workloads to the cloud alone in 2020.

- Government Initiatives and Regulations- Some governments and regulatory bodies are actively encouraging or mandating IPv6 adoption to ensure the continued growth of the internet and to address concerns related to IPv4 address exhaustion. Furthermore, many businesses and service providers have started implementing IPv6 with a view to better supporting these government agencies owing to national IT strategies and governmental mandates around the world.

Challenges

- Cost of Implementation- Transitioning to IPv6 can be costly, especially for large enterprises and service providers with extensive network infrastructures. This cost includes equipment upgrades, software updates, staff training, and potential temporary dual-stack support expenses.

- Compatibility Issues

- Dual Stack Transition Complexity

IPv6 Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

30.6% |

|

Base Year Market Size (2025) |

USD 6.22 billion |

|

Forecast Year Market Size (2035) |

USD 89.79 billion |

|

Regional Scope |

|

IPv6 Market Segmentation:

End-User Segment Analysis

The large enterprises segment in the IPv6 is set to garner a robust share of 65% shortly. IPv6 is being integrated into large enterprises as it is efficient and provides for improved performance, and increased security features including (IPsec) Internet Protocol Security integration, and also has capabilities that are missing from IPv4. Besides this, it also helps large enterprises in scaling their networks more effectively and avoids potential address shortage issues.

Product Type Segment Analysis

IPv6 market from the FTTH services segment is estimated to gain a notable revenue share in the coming years. FTTH services can be provided using IPv6 protocol since it provides superior speed, more bandwidth, greater dependability, and higher quality of service and also supports the development of cutting-edge technologies including 5G and the Internet of Things (IoT) is crucial.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IPv6 Market Regional Analysis:

North American Market Insights

The IPv6 market in North America industry is poised to dominate majority revenue share of 42% by 2035, impelled by the growing adoption of IPv6. North America has been a leader in IPv6 adoption, with several large ISPs, government agencies, and enterprises actively deploying IPv6. The region has made significant progress in transitioning to IPv6 to address the impending exhaustion of IPv4 addresses.

The U.S. government has been proactive in driving IPv6 adoption, mandating that all federal agencies enable IPv6 on their public-facing websites and services. This initiative has encouraged many private sector organizations to follow suit. According to a survey of major content providers conducted in 2023, the US had an adoption rate of IPv6 of over 45%, and Canada had a rate of roughly 32%.

European Market Insights

The European IPv6 market is estimated to garner significant market share by the end of 2035. IPv6 adoption in Europe varies by country. Some countries, such as Belgium and Germany, have made substantial progress, while others are still in the early stages of deployment. The European Commission has been actively promoting IPv6 adoption across the European Union. The Commission encourages member states to take steps towards IPv6 readiness to support the growth of digital services and IoT applications.

IPv6 Market Players:

- NTT Communications Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KDDI CORPORATION

- SoftBank Corp

- Reliance Jio Infocomm Ltd.

- Verizon

- T‑Mobile USA, Inc.

- AT&T Intellectual Property

- Tata Teleservices Ltd.

- China Telecom Global Limited

Recent Developments

- Asahi Net Co., Ltd. declared in a news discharge about the extension of the IPv6 association administration "v6 Interface" gave in the VNE business.

- India positioned No. 1 in IPv6 with almost 60% reception, trailed by Belgium (58%). Because of Dependence Jio's greenfield network that holds 91.8% of the IPv6 supporter base, catching second situation to T-Portable (92.3%).

- Report ID: 2037

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IPv6 Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.