IP Camera Market Outlook:

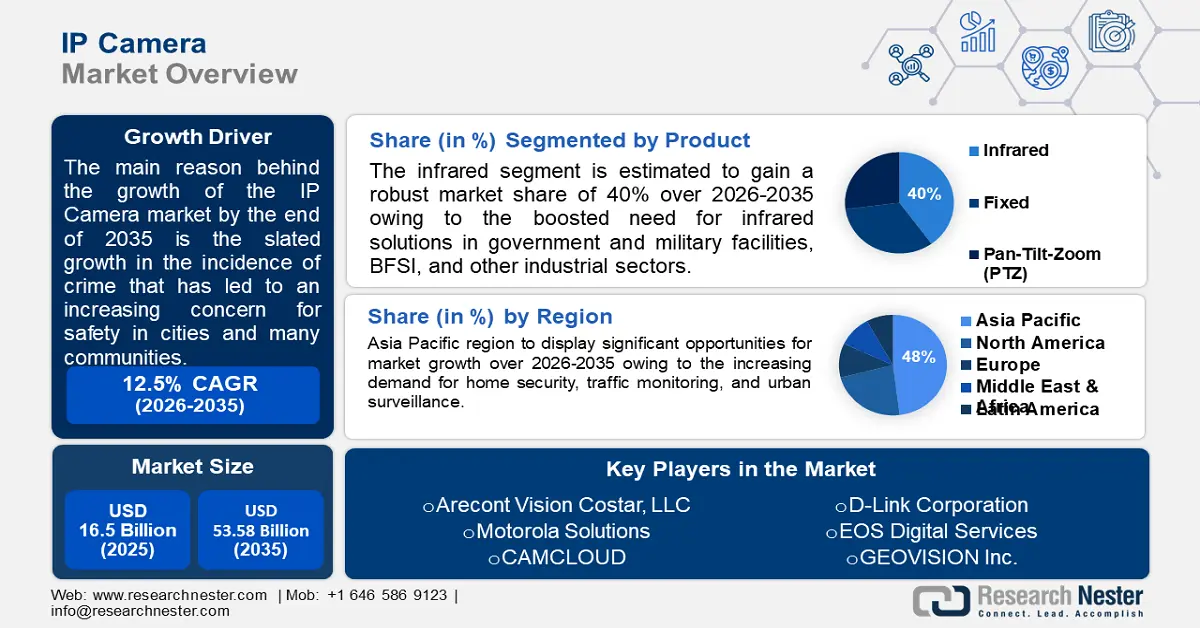

IP Camera Market size was over USD 16.5 billion in 2025 and is projected to reach USD 53.58 billion by 2035, growing at around 12.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IP camera is evaluated at USD 18.36 billion.

The market is booming because of the slated growth in the incidence of crime that has led to an increasing concern for safety in cities and many communities, which has created a surge in demand for safety measures, including IP cameras and other barriers as well, to ensure the safety and security of people in public spaces, residential areas, and businesses.

According to a report by the World Population Review in 2024, countries like Venezuela, Papua New Guinea, Afghanistan, Haiti, and South Africa have a crime index rate of more than 75%. In addition, the U.S. Department of State re-issued a “Level 4: Do Not Travel” travel advisory for Venezuela, driven by its high civil unrest and crimes.

Key IP Camera Market Insights Summary:

Regional Highlights:

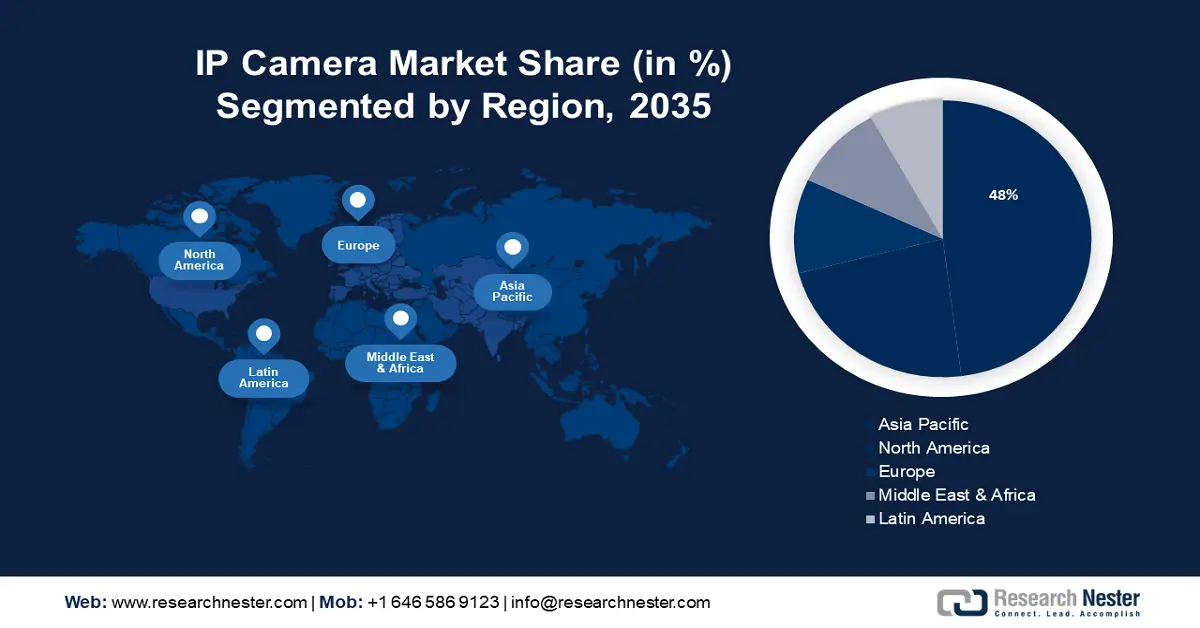

- The Asia Pacific IP camera market will account for 48% share by 2035, driven by the surge in the increasing use of modern security technologies for various purposes.

Segment Insights:

- The consolidated segment in the ip camera market is expected to achieve robust growth till 2035, driven by its centralized power server architecture for system configuration and content storage.

- The infrared segment in the ip camera market is forecasted to exhibit tremendous growth till 2035, fueled by the boosted need for infrared solutions in government, military, BFSI, and other industrial sectors.

Key Growth Trends:

- Increasing usage of home surveillance

- Rising IoT technologies

Major Challenges:

- Lack of awareness

- Cyber-attacks & personal data privacy concerns

Key Players: Hikvision, Arecont Vision Costar, LLC , Motorola Solutions, CAMCLOUD, D-Link Corporation, EOS Digital Services, GEOVISION Inc., Hangzhou Hikvision Digital Technology Co. Ltd., Honeywell International Inc.

Global IP Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.5 billion

- 2026 Market Size: USD 18.36 billion

- Projected Market Size: USD 53.58 billion by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

IP Camera Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing usage of home surveillance - As the population increases in metropolitan areas, the home security systems market has also become a popular choice in the commercial and residential sectors. They are also expected to be able to monitor remotely using their computers, tablets, smartphones, and other smart devices, as well as several crimes such as home burglaries. Research Nester researched burglary statistics in 2024 and witnessed that about 66% of burglaries affect residential properties.

-

Rising IoT technologies - Homeowner adoption of IoT technologies is contributing to market growth, as users are increasingly selecting smart IP cameras over more traditional mountable Wi-Fi cameras to increase the security of their properties. Businesses in this sector are expected to gain from this in their revenue share.

The demand for thermal imaging systems has increased significantly as a result of the introduction and growing use of IoT in video monitoring. Research Nester estimated in 2023 that IoT connections had increased from 18% in 2022 to more than 14 billion active IoT endpoints. - High adoption of AI technologies - Since AI algorithms can evaluate video footage in real- time; IP cameras can accurately detect and classify objects, faces, and events. According to a report by the International Monetary Fund in 2024, more than 40% of global employment is projected to be exposed to AI.

Furthermore, deep learning algorithms can help to further enhance the accuracy and dependability of video analytics, enabling IP cameras to offer smart observations and digitalize security procedures.

Challenges

-

Lack of awareness - There is limited use of IP cameras in developing regions because many businesses are unaware of their potential applications. As they are unsure of the possible returns, business owners are reluctant to invest in new technology. In many developing nations, there is a dearth of knowledge regarding the advantages of IP cameras for both government and residential applications, which further limits market expansion.

-

Cyber-attacks & personal data privacy concerns - Data transfers, mostly through digital IP video surveillance cameras, raise concerns about possible cyberattacks and end-user data information leakage. Concerns regarding IP camera security were also raised by competing countries' cyber agency attacks on other countries. Consequently, during the forecast period, rising instances of data theft and leakage will hinder the revenue share.

IP Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 16.5 billion |

|

Forecast Year Market Size (2035) |

USD 53.58 billion |

|

Regional Scope |

|

IP Camera Market Segmentation:

Product Segment Analysis

Infrared segment in the IP camera market is poised to grow substantially till 2035. The segment's tremendous growth rate can be augmented by the boosted need for infrared solutions in government and military facilities, BFSI, and other industrial sectors. According to a report by the International Institute for Strategic Studies in 2024, spending from 2023 surpassed 9% in global defense in 2024.

Furthermore, the improved security and safety of business, residential, or public facilities in low-light and visibility situations by employing this type of video traffic and surveillance unit used to precisely monitor at night has led to an increase in the adoption rate of this type of camera.

Connection Segment Analysis

Consolidated segment is estimated to capture IP camera market share of around 75% by the end of 2035 since it runs on a centralized power server that saves all configuration information for the system's cameras, DVRs, and NVRs in addition to all content for access and analysis at a later time. This would also fuel demand for the enterprise server in the forecasted year.

As per Research Nester estimates in 2022 there was an increase in the demand for IoT devices by 40% from 2016 to 2021. Additionally, the distributed segment is also predicted to have a projected gain over the forecast year attributed to more video surveillance systems being installed in buildings. With distributed solutions, the cost of purchasing additional video recorders is reduced because built-in storage capabilities enable data to be saved on online content storage devices like hard flash drives, SD cards, disc drives, and network-attached storage (NAS).

End User Segment Analysis

Residential segment in the IP camera market is expected to witness exponential growth rate through 2035, propelled by the increase in urban population as they demand improved security and protection. According to the World Bank, in 2023, more than 50% of people globally live in urban areas, and it is estimated that by 2045, this data will cross 6 billion.

IP cameras now offer several qualities, such as night vision capabilities, motion detection, HD video quality, two-way audio, and many more, which proves them to be a powerful tool for improving home security.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Connection |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IP Camera Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 48% by 2035. The landscape's substantial growth in the region is expected to be credited to the surge in the increasing use of modern security technologies for a range of purposes, including home security, traffic monitoring, and urban surveillance. This would increase the home security systems sector in this region. According to Research Nester analysts in 2023, global cybersecurity vulnerabilities increased from 21,518 in 2021 to more than 23,964 in 2022. Moreover, the market demand in the field is expected to benefit from higher government, corporate, and academic investments in R&D and innovation aimed at creating technologies related to administration.

In Japan, there is an increase of about 29.8% in the reported crimes, which is a total of about 12,372 major crimes, including murder, rape, robbery, trafficking, and many more. This would lead to tremendous growth in the IP camera landscape in Japan.

China demands more surveillance cameras as they have dense social surveillance networks all over the country, which is about 9.6 million Km2 for a population of about 1.4 billion.

North American Market Insights

The North American region will also encounter a huge influence on the IP camera market demand during the forecast period, led by the increase in population, which demands security surveillance, which boosts the market revenue share of IP camera sector. According to a report by the Census in 2023, the U.S. gained about 1.6 million people in 2022.

There was an increase in cyberattacks in 2023, due to which 343 million more victims arose in the U.S. In addition, this increase was about 72% from 2021 to 2023.

In Canada, the annual crime rate witnessed a growth rate of 5% from 2021 to 2022, which demands more IP cameras in this country.

IP Camera Market Players:

- Sony Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hikvision

- Arecont Vision Costar, LLC

- Motorola Solutions

- CAMCLOUD

- D-Link Corporation

- EOS Digital Services

- GEOVISION Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Honeywell International Inc.

IP Camera market size expansion is predicted that the top five companies would occupy about 21%. Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this sector and are estimated to be the major key players in this landscape.

Recent Developments

- Sony Corporation- The CMOS Image Sensor for Security Cameras is the first IP camera product that Sony Corporation has introduced. Surveillance cameras can now take and send original, high-quality images to the operator's device thanks to this sensor.

- Hikvision- With the introduction of its new ITS camera, Hikvision can monitor and enhance traffic flow and road safety. This product is primarily used on highways and in frequently crowded urban areas.

- Report ID: 6240

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IP Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.