IoT Data Management Market Outlook:

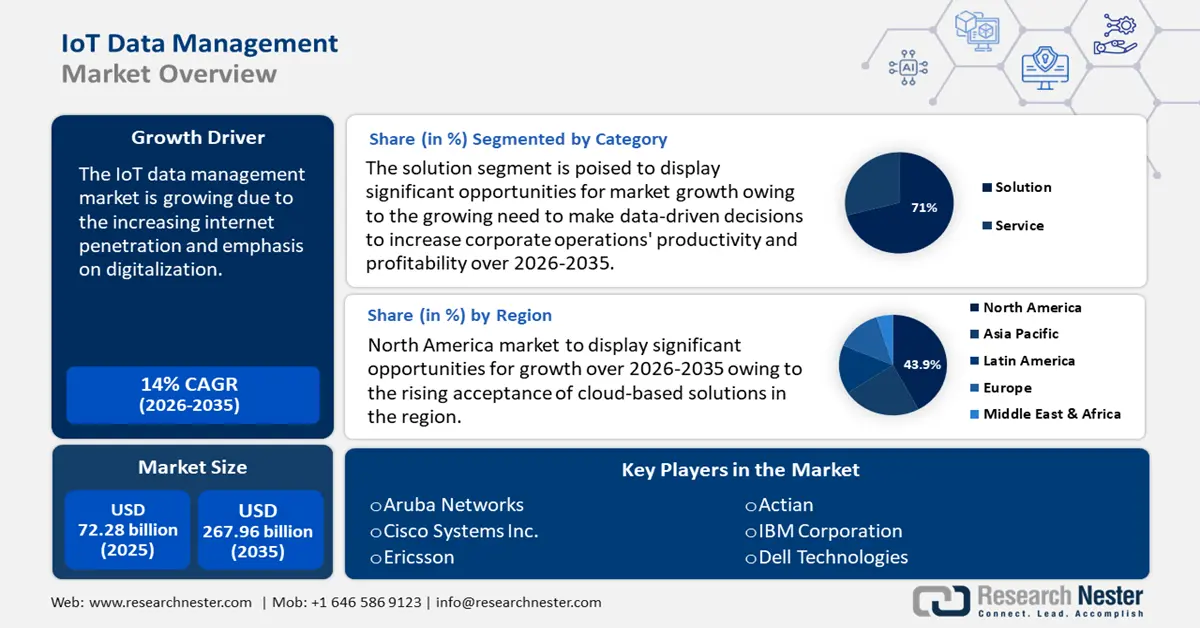

IoT Data Management Market size was valued at USD 72.28 billion in 2025 and is likely to cross USD 267.96 billion by 2035, expanding at more than 14% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IoT data management is assessed at USD 81.39 billion.

The IoT data management market is propelling due to increasing internet penetration and growing emphasis on digitalization. International Telecommunication Union (ITU) stated that 5.5 billion people, or 68% of the global population used the Internet in 2024.

As more industrial IoT devices are connected, the volume of data generated continues to increase. By guaranteeing resource optimization and reducing downtime, managers can use the data produced by these devices to boost production. The possibility of using the gathered data in novel ways has increased due to real-time data analytics. Several IoT data management solutions and service providers have recently set out to introduce data-driven products, services, and solutions for industrial end users.

Key IoT Data Management Market Insights Summary:

Regional Highlights:

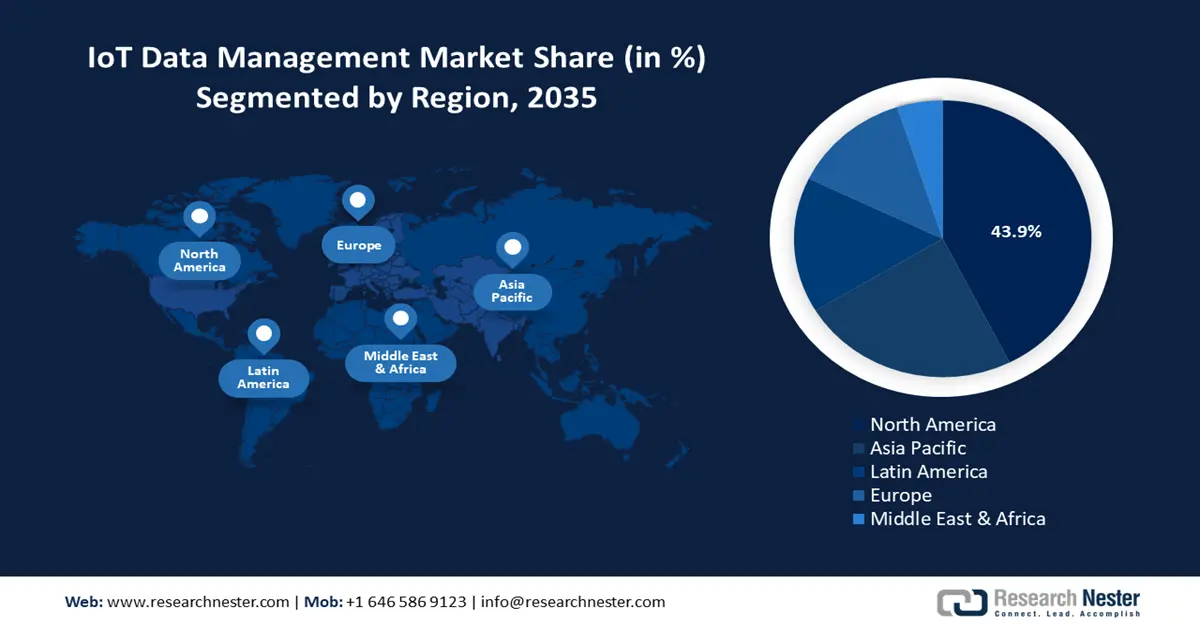

- North America dominates the IoT Data Management Market with a 43.9% share, fueled by rising cloud adoption and government support for smart infrastructure, driving growth through 2026–2035.

- Asia Pacific's IoT Data Management Market is poised for huge growth through 2026–2035, fueled by the expansion of digital ecosystems and government-backed IoT initiatives.

Segment Insights:

- The Large Enterprises segment of the IoT Data Management Market is set for substantial growth through 2035, attributed to major companies’ increasing adoption of IoT device management for massive client datasets.

- The Solution segment is projected to hold over 71% share by 2035, fueled by the growing need for IoT device management solutions across key sectors.

Key Growth Trends:

- Growing demand for smart homes

- Growing focus on the modernization of data warehouse

Major Challenges:

- Data security & privacy concerns

- Scalability & data quality issues

- Key Players: Aruba Networks, Cisco Systems Inc., Ericsson, Actian, IBM Corporation, Hewlett Packard Enterprise, Dell Technologies, Oracle Corporation, SAP SE, Microsoft Corporation.

Global IoT Data Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 72.28 billion

- 2026 Market Size: USD 81.39 billion

- Projected Market Size: USD 267.96 billion by 2035

- Growth Forecasts: 14% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

IoT Data Management Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for smart homes: The IoT data management market is expanding due to the growing demand for smart homes, as customers seek more technologically assisted domestic convenience. For instance, there is at least one smart speaker in more than 130 million homes. Over the following five years, the number will increase to 335 million. Moreover, in 2023, global spending on IoT items will amount to USD 1.1 trillion. IoT technology improves ease, efficiency, and energy management in the home by connecting these gadgets and allowing them to communicate. The rate of social informatization has been steadily accelerated by the growing development of information and control technologies, which have also encouraged the informatization of people's communication, employment, and way of life.

- Growing focus on the modernization of data warehouse: Data-intensive processes are hampered by traditional data warehouses' inability to effectively manage constantly growing data quantities. They hinder the integration of new data sources and analytics capabilities because of their inflexible structures, high maintenance costs, restricted scalability, and data silos, which make it challenging to adjust to shifting business needs. These factors have pressurized businesses to invest in modernizing data warehouses, driving IoT data management market growth. Several companies are at the forefront of data warehouse modernization, such as Snowflake, Amazon Redshift, Google BigQuery, and IBM.

- Increased technological developments: The growing adoption of edge computing has enabled real-time data processing and reduced latency. Moreover, advancements in artificial intelligence (AI) and machine learning (ML) have improved data analytics, while blockchain ensures secure and transparent data transactions. Cloud-based platforms, such as AWS IoT and Google Cloud IoT Core, have improved scalability and flexibility. Also, the augment of 5G networks has escalated data transfer rates and enhanced data management platforms. Approximately 320 5G networks have been launched globally as part of the ongoing rollout. By the end of 2024, 5G coverage is predicted to reach 55% of the world's population.

Challenges

-

Data security & privacy concerns: The risk of cyberattacks and illegal access to private information increases with the number of connected gadgets. Strong security mechanisms and efficient encryption protocols are needed to address these security issues. Furthermore, to guarantee the safe and responsible administration of IoT devices and the data they produce, adherence to data protection laws and standards becomes essential.

- Scalability & data quality issues: To handle more data, the data management system must grow as the number of connected devices rises. Moreover, ensuring high-quality control procedures, like accuracy checks, is crucial for all information gathered from sensors on these internet-connected devices at various points around an organization's grounds.

IoT Data Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 72.28 billion |

|

Forecast Year Market Size (2035) |

USD 267.96 billion |

|

Regional Scope |

|

IoT Data Management Market Segmentation:

Category (Solution, Services)

Solution segment is projected to hold IoT data management market share of over 71% by the end of 2035. The segment growth can be attributed to the growing need for IoT device management solutions across the automotive, healthcare, and manufacturing sectors. The IoT in manufacturing is expected to reach USD 200.3 billion by 2030 with a compound rate of 13.9%. Moreover, the National Institutes of Health reported that more than any other industry, health accounted for 40% of IoT-related technology in 2020, representing a USD 117 billion IoT data management market. IoT solution adoption is aided by the growing need to make data-driven decisions to increase corporate operations' productivity and profitability. Furthermore, IoT improves convenience and comfort in several ways, from smart homes that modify settings according to customer preferences to smart retail establishments that provide tailored recommendations.

Organization Size (Large Enterprises, Small & Medium Enterprises)

The large enterprises segment in IoT data management market is poised to gain a substantial share in the forecast period. The segment is expanding due to major companies’ growing use of IoT device management to effectively manage their massive client datasets, equipment, and business operation data. Major businesses increasingly invest in intelligent and connected technologies to manage and optimize various industrial processes through a consolidated platform. Large companies can acquire creative insights that promote growth by combining customized hardware and software enabled by IoT with advanced data analytics. For instance, the retail business uses IoT to examine consumer purchasing patterns across various demographics, and the healthcare industry uses IoT to closely monitor patient recovery trends.

Our in-depth analysis of the IoT data management market includes the following segments:

|

Category |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IoT Data Management Market Regional Analysis:

North America Market Statistics

North America IoT data management market is poised to account for revenue share of more than 43.9% by the end of 2035. Rapid technological advancement, the rising acceptance of cloud-based solutions, and the growing need for better data analytics and connectivity are the main factors propelling the IoT data management market's expansion. To increase operational effectiveness and consumer experience, major industries like manufacturing, healthcare, and smart cities are making significant investments in IoT technologies. Furthermore, government programs encouraging smart infrastructure and the development of 5G networks are driving the industry in the region. According to the Ericsson Mobility Report, 5G accounts for 59% of smartphone subscriptions in North America, with 37% of Canadian and 53% of US users reporting satisfaction with their 5G service.

The focus on cybersecurity to safeguard IoT devices in the U.S. influences industry trends and increases investments in safe platforms. Additionally, partnerships between new and established businesses encourage creativity and the creation of specialized IoT solutions suited to certain industrial requirements. In Canada, IoT innovation has been made possible by the government's dedication to creating smart cities and bolstering digital infrastructure. Through initiatives such as the Smart Cities Challenge, municipalities are encouraged to adopt IoT technologies that enhance urban living, such as waste reduction initiatives and traffic control systems. This national push for digital transformation fuels the demand for IoT solutions and also fosters an atmosphere that is advantageous for Canadian businesses providing IoT development services.

APAC Market Analysis

Asia Pacific will encounter huge growth in the IoT data management market during the forecast period. The need for connected ecosystems is expanding due to the industry's increasing shift from traditional to digital ecosystems, which is driving up demand for IoT-based solutions and data management. In addition to the growing need for connected devices, several technological developments have made the implementation of IoT solutions more practical and affordable, which has contributed to the expansion of IoT in the Asia Pacific.

Furthermore, two government-sponsored programs and policies that have already significantly contributed to the growth of China's IoT sector are Internet Plus and Made in China 2025. The local government is promoting and assisting businesses in integrating IoT technologies into their operations and goods through several programs. This assistance consists of creating IoT-focused industrial parks, encouraging industry-research collaboration, and offering subsidies for IoT initiatives. Furthermore, due to their significant investment in IoT research and development, Chinese IT behemoths like Huawei Technologies play a critical role in China's IoT data management market.

India's growing urbanization has increased the demand for creative ways to better manage energy, transportation, utilities, and urban infrastructure. The IT industry is crucial to providing the necessary networking infrastructure for Internet of Things devices. Because of improvements in networking technologies, such as 5G and low-power wide-area networks (LPWAN), which enable reliable and seamless communication between Internet of Things devices, the IoT data management market for IoT is anticipated to expand.

Key IoT Data Management Market Players:

- Aruba Networks

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cisco Systems Inc.

- Ericsson

- Actian

- IBM Corporation

- Hewlett Packard Enterprise

- Dell Technologies

- Oracle Corporation

- SAP SE

- Microsoft Corporation

The IoT data management market will continue to grow as a result of major players in the industry making significant investments in R&D to broaden their product lines. Important market developments include new product launches, mergers and acquisitions, increased investments, contractual agreements, and cooperation with other organizations. Market participants are also engaging in a range of strategic actions to broaden their global footprint.

Recent Developments

- In September 2024, Ericsson announced the release of two innovative routers, the Ericsson Cradlepoint R980 and S400, which are designed to provide enterprises with seamless, secure, and scalable connectivity for AI, computer vision, data analysis, and other advanced applications in IoT environments and vehicle networks.

- In April 2024, Hewlett Packard Enterprise introduced Wi-Fi 7 access points (APs), which offer up to 30% greater wireless traffic capacity than competitors' offerings. The new APs also enhance network security and location-based services, enabling connection for demanding enterprise AI, Internet of Things (IoT), location, and security applications.

- Report ID: 6874

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IoT Data Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.