Global IO-Link Market Size, Forecast and Trend Highlights Over 2025-2037

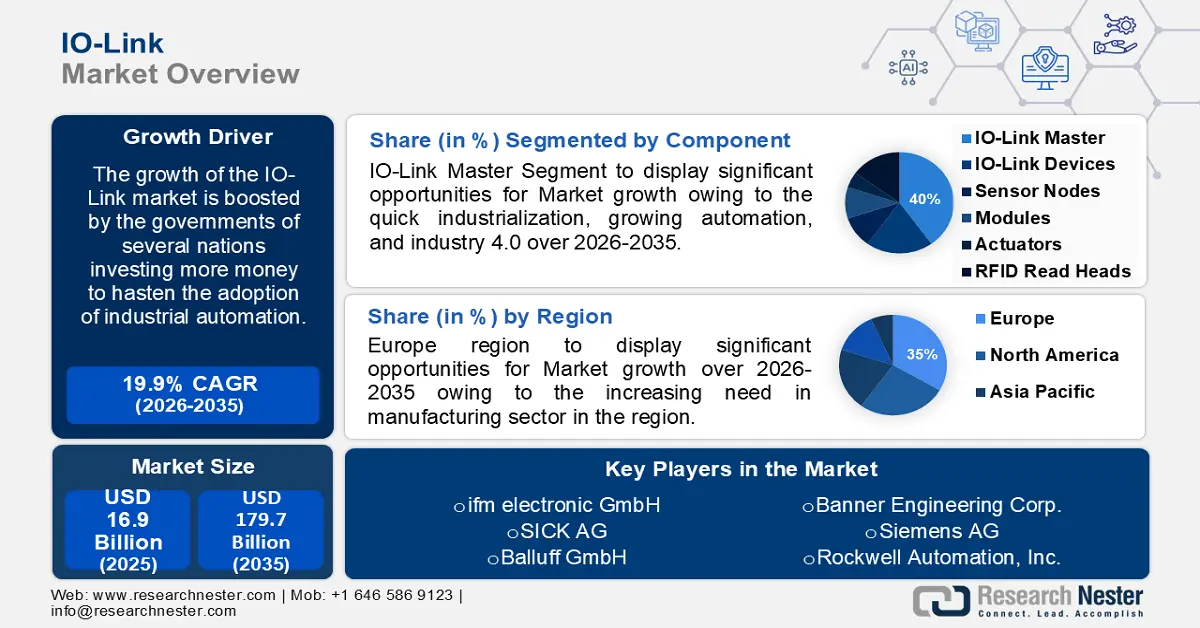

IO-Link Market size was valued at USD 16.9 billion in 2024 and is expected to secure a valuation of USD 179.7 billion in 2037, expanding at a CAGR of 19.9% during the forecast period, i.e., 2025-2037. In 2025, the industry size of IO-link will be evaluated at USD 19.3 billion.

The increased demand for smart manufacturing and Industry 4.0 is driving industries to utilize IO-link technology owing to its ability to deliver performance improvements and data transparency. Various companies are expanding their product lines with IO-Link capabilities to facilitate real-time data transactions and predictive maintenance operations in industrial environments. For instance, in May 2024, Balluff launched the Generation 2 condition monitoring sensor. The sensor operates through an IO-Link interface to provide improved smart condition monitoring capabilities with features for real-time diagnostics and predictive maintenance support. The industrial sector is integrating IO-Link communication protocols into devices to strengthen their importance in building Industry 4.0 infrastructure.

Industrial 4.0 is accelerating the adoption of IO-Link technology in process automation along with its discrete automation applications. The device-level intelligence and an open standard component of IO-Link allow simpler configuration, rapid device replacement, and better overall equipment effectiveness. This technology brings the most benefit to advanced manufacturing production lines that need immediate data acquisition from sensors and various actuators. Modern manufacturing facilities emphasize IO-Link as their basic communication protocol in their networks due to its capabilities in enhancing machine transparency while delivering efficient operations and data integration, which is contributing to their increasing sales.

IO-Link Sector: Growth Drivers and Challenges

Growth Drivers

- Growing focus on enhancing asset efficiency: The rising emphasis on minimizing operational downtime and boosting asset operational performance is fueling the widespread implementation of IO-Link technology throughout various industrial sectors. The leading companies in industrial automation systems are persistently developing IO-Link solutions to enhance equipment dependability and optimize factory floor data transmission. For instance, in April 2023, Turck launched the TBEN-L-8IOLA, which represents an Ethernet block I/O module having eight Class A IO-link master ports. The module comes with 16 adjustable digital channels and provides 2A power capability through pin 2 to sustain actuators that need additional power. Such recent advancements indicate how IO-link is crucial for reducing downtime and maintenance expenses and supporting predictive diagnostic operations in industrial environments.

High-uptime sectors highly value IO-link's capability to automatically configure devices while providing an easy setup of devices. Smart factories benefit from new generation technology development as IO-link delivers significant device visibility while improving operational performance, establishing itself as an essential automatic component for modern industrial control programs. - Surging adoption of Industrial IoT: The rising adoption of IIoT across various industries is boosting the demand for IO-link devices, which enable interconnected device communication while encouraging data-based operational decision-making. Companies are developing advanced sensor technologies to provide enhanced real-time system monitoring and industrial device connectivity. For instance, in December 2023, Omron rolled out the E2E-IL series of proximity sensors, with integrated IO-Link communication features. Factory operations increasingly depend on devices with IO-Link capabilities due to the rising requirement for transparent data exchange and connectivity for operational excellence is contributing to the overall market growth.

Various sectors, such as automotive, food and beverage, and pharmaceuticals, are collaborating with IO-link technologies for improving operational efficiency and equipment reliability. IO-link is driving the development and advancements of smart manufacturing as well as IIoT applications due to expanding industrial requirements for intelligent connected systems.

Challenges

-

Data security concerns: IO-Link establishes continuous communication links between industrial sensors, actuators, and controllers to enhance industrial connectivity. The enhanced connectivity created by IO-Link generates new obstacles for defending sensitive data. The expansion of devices connected to networks creates rising security threats, including breaches of data, cyberattacks, and unauthorized system access opportunities. Sensitive or proprietary data handled by manufacturing operations is likely to resist IO-Link adoption until businesses implement comprehensive cybersecurity systems. The lack of secure end-to-end data transmission in the integration with IT systems is hindering the growth of the IO-link market.

IO-Link Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

19.9% |

|

Base Year Market Size (2024) |

USD 16.9 billion |

|

Forecast Year Market Size (2037) |

USD 179.7 billion |

|

Regional Scope |

|

IO-Link Segmentation

Component Segment Analysis

The IO-link master segment is predicted to hold the largest IO-link market share of about 40% during the stipulated timeframe. Implementation of IO-Link masters with edge computing capabilities is increasing due to industrial requirements for decentralized automation systems and real-time decision operations. The ongoing development of industrial automation systems involves companies that integrate edge computing with IO-Link to create more intelligent and responsive systems. For instance, in February 2024, Hilscher released their sensorEDGE and sensorEDGE FIELD IO-Link masters as devices that unify standard IO-Link sensor interfaces with edge computing functionalities. These devices enable direct interfacing with Ethernet-based IT systems while maintaining existing communication networks and controllers, making IT/OT integration possible without modification. Through local processing, these developments reduce bandwidth usage while achieving better accuracy in a shorter timeframe.

The extensive application range of IO-Link masters is demonstrating their value to multiple industrial domains. Industrial applications widely rely on IO-Link masters as these devices establish uninterrupted connections between control systems and field instrumentation across various manufacturing domains, including automotive operations and process automation. Industrial automation is expanding through the rising demand for IO-Link masters, resulting in improved connected systems technology.

Type Segment Analysis

The OI-link wireless segment is estimated to hold the revenue IO-link market share of about 55% through 2037. The segmental growth is attributed to the formal recognition of IO-Link Wireless as an international standard. This enables the implementation of IO-link wireless systems into current automation systems to bolster their adoption. The standardized wireless communication protocol allows for easy interoperability between devices and improves system flexibility, making it effective for use in automotive, manufacturing, and logistics sectors. The companies are implementing wireless platforms to reduce costs, coupled with improved system scalability is driving increased demand for IO-link wireless solutions, making them essential for Industry 4.0 applications.

The industrial automation sector demands IO-link wireless solutions due to increasing trends toward remote monitoring and connectivity in industrial automation. Industry operations benefit from wireless data collection methods as they enable cost-efficient analysis of information from equipment located at distant sites. The wireless connectivity of IO-Link is making it highly useful for spaces that cannot endure wired components. Real-time data transmission capabilities through wireless channels are a significant driver for IO-link wireless adoption, which benefits multiple industrial sectors.

Our in-depth analysis of the global IO-Link market includes the following segments:

|

Type |

|

|

Component

|

|

|

Application |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IO-Link Industry - Regional Scope

Europe Market Insights

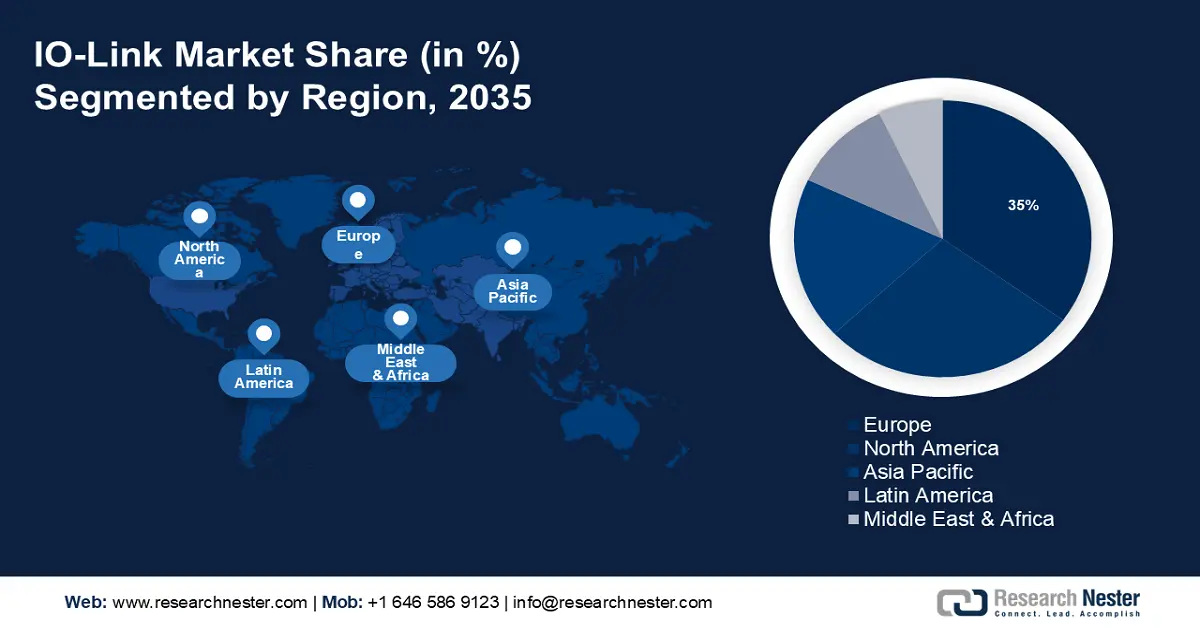

The IO-link market in Europe is expected to account for the largest revenue share of about 35% during the forecast period, owing to the robust manufacturing sector. The manufacturing industries are leveraging Industry 4.0 principles, resulting in simultaneous growth in efficient and interoperable automation solutions. IO-Link technology is essential for enabling shorter machine downtimes, so industries including automotive, food & beverage, and chemicals find it highly desirable for their operations across the region.

The governments are investing in digital transformation initiatives to enhance industrial market positions. The adoption of technologies such as IO-Link is increasing due to initiatives such as the German Industry 4.0 Initiative and European Digital Innovation Hubs, which focus on promoting automation, connectivity, and smart manufacturing. Europe market is experiencing rapid expansion in the IO-link field owing to requirements for smarter factories, improved cybersecurity, as well as Industrial IoT implementation.

The IO-link sales in the U.K. are all set to register a healthy growth in the forthcoming years, owing to the requirements for productivity improvement, reduced operational costs, and market competitiveness. There is an increasing demand for IO-Link technology in the market, as automation solutions implement real-time data processing and machine-to-machine communication procedures. IO-Link establishes smooth communication between sensors, actuators, and control systems, driving manufacturers to adopt efficient automation processes, resulting in market expansion and cost savings.

The increasing demand for predictive maintenance tools for automotive, aerospace, and energy operations is contributing to the overall market growth. The monitoring capabilities and diagnostics functions of IO-Link are preventing machine breakdowns and minimizing unexpected equipment stoppages. In addition, the industries are aimed at lowering maintenance expenses while extending operational duration, further fostering the market growth.

North America Market Insights

The North America IO-link market is expected to hold second second-largest revenue share of about 28% during the forecast period. The industrial evolution and the Industrial IoT are rapidly increasing across the region. The rise of IO-link is essential for modern industries as they require improved operational efficiency and cost reduction, along with digital technology integration. The technology's sensor and actuator to control system communications fit perfectly into modern requirements of data analytics and machine learning techniques. Real-time monitoring requirements and rising automation trends are driving manufacturers to adopt IO-Link technology.

Government support through funding initiatives is promoting the widespread use of IO-link technology through advancements in manufacturing innovation. The U.S. Department of Energy is supporting industrial growth across multiple business sectors through initiatives that provide grants and subsidies for smart sensors and automation adoption.

The U.S. IO-link sales are exhibiting steady growth during the forecast period. There is a rising focus on sustainability and energy efficiency across different industrial sectors in the country. Organizations are using technology tools to detect energy usage while minimizing waste and maximizing their resource management capabilities. The IO-link provides real-time data from sensors and actuators, which supports permanent process energy consumption supervision. This data collection method enables energy cost reductions and regulatory compliance, as well as sustainable practices, boosting the IO-link market expansion.

Robotics and automation technologies are experiencing rapid growth in the market, fueling the automotive, electronics production, and supply chain operations. The key function of IO-Link in robotic systems consists of delivering improved interoperability as well as increased flexibility to advance robotic technologies. Companies that choose automated solutions to boost precision levels and efficiency skills require reliable and scalable connectivity, which is provided through IO-link as their operations expand.

Companies Dominating the IO-Link Landscape

- Ifm electronic GmbH

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SICK AG

- Balluff GmbH

- Banner Engineering Corp.

- Siemens AG

- Rockwell Automation, Inc.

- Festo SE & Co. KG

- Datalogic S.p.A

- Hans Turck GmbH & Co. KG

- Pepperl + Fuchs

The competitive landscape of the IO-Link market is characterized by the presence of several key players offering a wide range of solutions to enhance industrial automation and connectivity. Major companies are leading the market with their advanced IO-Link masters, sensors, and connectivity devices. These companies are focused on product innovations, strategic partnerships, and acquisitions to expand their product portfolios. Additionally, emerging players are contributing to the market's growth and intensifying competition by introducing wireless IO-Link solutions and integrating IIoT capabilities.

Here are some key players operating in the global market:

Recent Developments

- In November 2024, CoreTigo and SICK announced a strategic partnership to advance IO-Link Wireless technology in industrial automation. This collaboration aims to provide seamless integration, simplified deployment, and enhanced flexibility, enabling innovative machine designs and efficient retrofits.

- In April 2023, Emerson and CoreTigo showcased their collaborative efforts at Hannover Messe, unveiling wireless automation solutions designed to enhance connectivity and flexibility in industrial environments. This partnership underscores the growing trend of wireless solutions in driving Industry 4.0 innovations.

- Report ID: 5988

- Published Date: May 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IO-Link Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert