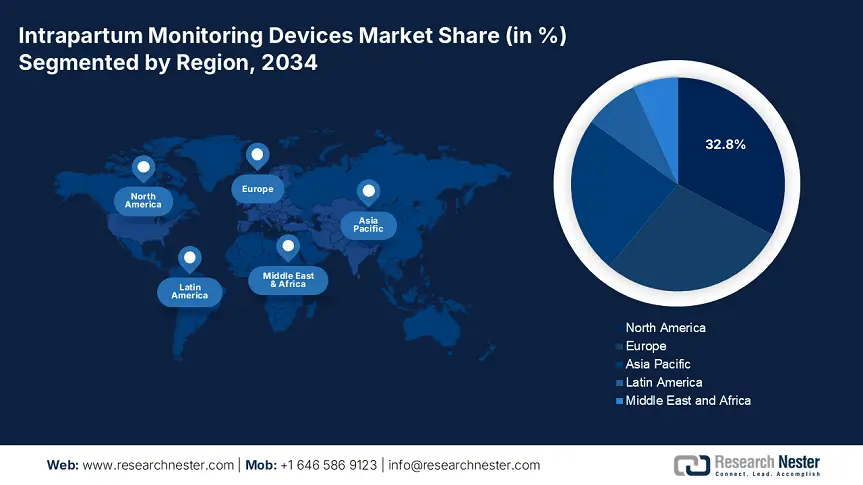

Intrapartum Monitoring Devices Market - Regional Analysis

North America Market Insights

North America intrapartum monitoring devices market leads the market, dominates the region, and is anticipated to hold a market share of 32.8% at a growth rate of 7.6% CAGR by 2034. The market is driven by high federal funding, increasing clinical mandates, and the accelerated adoption of AI-powered fetal monitoring technologies. For the U.S., Medicare and Medicaid together spent more than USD 2.3 billion in 2024 on maternal and intrapartum care technologies, with CMS reimbursement expansion supporting AI-based wireless telemetry systems under such CPT codes as 59050. Rising cesarean rates, a population of aging mothers, and policy reforms favoring remote monitoring are compelling public and private hospitals to invest in urban as well as underserved areas. North America is the most profitable and innovation-focused market for intrapartum monitoring device makers.

The intrapartum monitoring devices market in the U.S. is expanding rapidly with the rise in prioritization of maternal health under federal and state regulations. The CDC report depicts that nearly 3.8 million births are clinically eligible for intrapartum monitoring, and have high-risk pregnancy rates globally growing at a rate of 18.5% for over the past five years. The Centers for Medicare & Medicaid Services (CMS) provided more than USD 2.3 billion in combined spending under Medicare and Medicaid in 2024, demonstrating policy initiatives to increase fetal monitoring reimbursement under bundled maternity payment models. AI-based telemetry and non-invasive wireless systems are now up for partial reimbursement under CPT Code 59050 and associated DRGs. These developments, combined with federal quality reporting measures tied to device use, are driving intrapartum monitoring devices into hospital obstetric processes.

North America Government Investment & Policy (2021-2025)

|

Country |

Initiative / Policy |

Launch Year |

Funding / Budget Allocation |

|

U.S. |

CMS Maternity Care Bundled Payments Expansion |

2021 |

USD 1.7 billion allocated to digital labor monitoring |

|

NIH Perinatal Monitoring Research Grant Program |

2023 |

USD 580.5 million for fetal monitoring R&D |

|

|

Canada |

PHAC Perinatal Innovation Strategy |

2022 |

CAD 800.4 million for smart fetal monitoring adoption |

|

Ontario Digital Maternal Health Rollout |

2024 |

CAD 200.6 million for regional monitoring infrastructure |

Asia Pacific Market Insights

The APAC region is the fastest-growing intrapartum monitoring devices market region and is expected to capture the market share of 23.9% at a CAGR of 8.8% in 2034. The region is led by growing childbirth rates, increasing awareness towards fetal health, and massive government investment in digital infrastructure for maternal healthcare. Public expenditure on a large scale throughout the region provides a boost to the renovation of labor wards with non-invasive AI-based fetal monitoring systems. the shift towards value-based maternal care is driving adoption levels both in the public and private sector hospitals. In addition, the region enjoys local manufacturing centers within China, India, and South Korea, lowering the cost of devices and enhancing supply chain responsiveness.

China has the highest intrapartum monitoring devices market share and is expected to retain the market share of 8.9% by 2034. China's government expenditure on intrapartum monitoring devices grew by 15.4% over the last five years, with increased centralized procurement via the National Health Commission (NHC) and quicker regulatory approvals by the National Medical Products Administration (NMPA). During 2023, more than 1.9 million patients were monitored during labor with digitally integrated IMDs in tier-1 and tier-2 hospitals by government subsidies and hospital modernization policies. Perinatal safety under the maternal health program of China has shifted focus towards IMDs as a strategic investment area, with the scope of device deployment widened in urban and semi-urban public healthcare facilities.

Government Investment & Policy (2021-2025)

|

Country |

Initiative / Policy |

Launch Year |

Funding / Budget Allocation |

|

Australia |

National Women’s Health Strategy 2020-2030 - Phase II |

2021 |

AUD 52.4 million for maternal & intrapartum technologies |

|

Japan |

Smart Maternal Care Tech Subsidy Program (MHLW) |

2022 |

¥8.8 billion to support digital fetal monitors in hospitals |

|

India |

Ayushman Bharat Digital Mission (ABDM) - Maternal Integration |

2022 |

₹1,620.3 Crore earmarked for perinatal monitoring integration |

|

South Korea |

Maternal & Child Smart Healthcare Project |

2023 |

₩92.5 billion to deploy AI-based monitoring in public clinics |

|

Malaysia |

National Health Reform Strategy (Maternal Tech Component) |

2024 |

RM 110.4 million for maternal health digital infrastructure |

Europe Market Insights

The Europe intrapartum monitoring devices market is expected to grow steadily, with an estimated 2034 regional market share of 28.3% with a CAGR of 7.2% in 2034. The market is driven by policy initiatives in advanced maternal care, increased spending under EU healthcare reform platforms, and advanced use of AI-enabled continuous fetal monitoring systems. The nations, including the UK, Germany, and France, are driving investment in digital labor monitoring technologies, fueled by increasing rates of cesarean deliveries, an aging population of mothers, and government requirements for perinatal health safety. Increasing regulatory convergence under EMA and pan-European maternal health policy, underpinned by a patient-focused model of care and public-private partnerships.

Germany is Europe's largest intrapartum monitoring devices market and is expected to hold the market share of 8.3% in 2034. The German market is expected to hit €4.3 billion in expenditures by 2024, a growth of 12.3% from 2021. The Hospital Future Act highlighted maternal care digitization and offered €1.6 billion for perinatal monitoring technology. The German Medical Association has provided guidelines for electronic fetal monitoring in every hospital delivery room, increasing the need for AI-based monitors with real-time alert systems. Further, the statutory health insurance system in Germany also raised the reimbursement for wireless fetal telemetry under new DRG codes. These policies have led to greater penetration of smart IMDs in urban and mid-sized hospitals.