Intraocular Lens Market Outlook:

Intraocular Lens Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 9.3 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of intraocular lens is assessed at USD 5.4 billion.

The global market is structurally driven by the rising surgical volume for cataract and refractive procedures, largely underwritten by public health systems and national eye care programs. According to the World Health Organization data in August 2023, cataract remains the leading cause of blindness globally, and nearly 2.2 billion people have distance vision impairment. Moreover, the WHO and NIH data indicate that the cataract surgical overage is expanding steadily due to the aging demographics and improved access to ophthalmic services, mainly in the middle and high-income economies. As per the NIH March 2025 study, nearly 50 million people are expected to have cataracts in 2050, directly increasing the demand for the implanted lenses during the surgical intervention. Moreover, the reimbursement frameworks, such as Medicare, ensure coverage of cataract surgery with monofocal IOL implantation, ensuring predictable institutional demand across hospitals and ambulatory surgical centers.

Global Population with Vision Impairment

|

Condition |

Affected Population (Million People) |

|

Cataract |

94.0 |

|

Refractive error |

88.4 |

|

Age-related macular degeneration (AMD) |

8.0 |

|

Glaucoma |

7.7 |

|

Diabetic retinopathy |

3.9 |

|

Presbyopia |

826.0 |

Source: WHO August 2023

Moreover, the government-supported ophthalmology infrastructure and surgical capacity expansion is a central demand enabler. As per the NLM August 2023 study, cataract surgery is one of the most frequently performed surgical procedures among adults aged 65 years and older in the U.S., with more than 3.6 million procedures conducted annually. Similarly, the national blindness prevention programs in the Asia Pacific and parts of Latin America continue to prioritize cataract backlog reduction, translating into large volume market procurement by public hospitals. In Europe, population aging reinforces the long-term surgical demand. Besides these, publicly reported statistics indicate that the IOL market is driven by the non-discretionary on ophthalmic care, making it resilient to short term economic fluctuations while remaining closely aligned with national healthcare capacity and reimbursement policies.

Key Intraocular Lens Market Insights Summary:

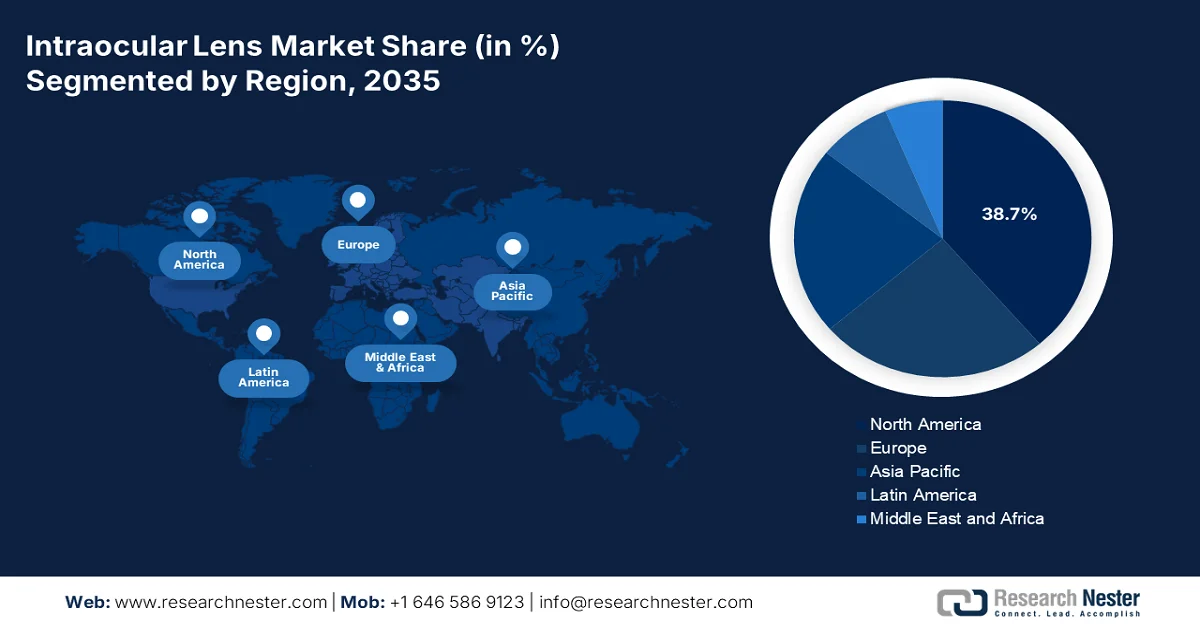

Regional Highlights:

- North America is anticipated to command a 38.7% revenue share by 2035 in the intraocular lens market propelled by high cataract surgical volumes, favorable reimbursement frameworks, and expanding adoption of premium intraocular lenses among the aging population

- Asia Pacific is forecast to expand at a CAGR of 7.8% during 2026–2035, stimulated by a vast aging patient base, rising cataract prevalence, expanding healthcare access, and strong government-supported surgical programs

Segment Insights:

- In the intraocular lens market, the Cataract Surgery application segment is projected to account for a dominant 90.4% share by 2035, driven by the global prevalence of cataracts and sustained high surgical volumes supported by government healthcare programs

- The Single Piece IOLs design segment is expected to maintain its leading position through 2035, fueled by simplified implantation, capsular stability, and widespread adoption in minimally invasive cataract procedures

Key Growth Trends:

- Government-funded cataract surgery programs

- Rising cataract backlog

Major Challenges:

- High R&D and regulatory costs

- Reimbursement and pricing pressure

Key Players: Johnson & Johnson Vision (U.S.), Alcon (Switzerland), Bausch + Lomb (U.S.), Carl Zeiss Meditec (Germany), Hoya Corporation (Japan), STAAR Surgical (U.S.), Rayner (UK), Ophtec (Netherlands), HumanOptics (Germany), Physiol (France), Santen Pharmaceutical (Japan), NIDEK (Japan), Lenstec (U.S.), EyeKon Medical (U.S.), Care Group (India), Aurolab (India), Medicontur (Hungary), Hanita Lenses (Israel), Eagle Optics (India), Appasamy Associates (India).

Global Intraocular Lens Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 9.3 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: India, South Korea, Australia, Spain, Italy

Last updated on : 11 February, 2026

Intraocular Lens Market - Growth Drivers and Challenges

Growth Drivers

- Government-funded cataract surgery programs: The public funding of cataract surgeries directly translates into sustained market demand. According to the NLM September 2025 report, the cataract surgical rate ranges from 36 million to 12,800 million. Moreover, in the emerging economies, the national programs are expanding surgical access. For example, India’s National Programme for Control of Blindness and Visual Impairment funds millions of cataract surgeries annually via public hospitals and NGOs, significantly surging the bulk IOL procurement. Additionally, the publicly funded cataract initiatives in countries such as Brazil, China, and Indonesia are surging the procedure volumes via subsidized surgeries, further stabilizing the baseline IOL demand. These programs also favor standardized, cost-effective IOL models, reinforcing large-volume procurement contracts with domestic and multinational manufacturers.

- Rising cataract backlog: Surgical backlogs remain a measurable demand driver in the intraocular lens market. As per the Royal College of Ophthalmologists January 2022 data, nearly 600,00 patients were waiting for ophthalmology procedures with cataracts representing a major share. Moreover, various government data have highlighted the cataract surgery delays across Asia and Africa during the COVID-19 prompting the post pandemic recovery funding. further the governments are now prioritizing high-volume procedures to clear backlogs. Besides, many health systems have introduced extended operating hours, high-throughput surgical camps, and fast-track cataract pathways to surge the case clearance. This backlog-driven surge is expected to sustain elevated IOL consumption over the medium term as deferred patients re-enter surgical pipelines.

- Rising healthcare expenditure on eye care: Increased public healthcare spending is strengthening the ophthalmic infrastructure and surgical capacity in the market. According to the OECD November 2025 data, the health expenditure across member countries averaged 9.3% of GDP with eye care embedded within the non-communicable disease and aging care budgets. In the U.S., the healthcare spending is reaching a significant trillion with outpatient and ambulatory surgical services growing faster than inpatient care, benefiting cataract procedures. This sustained budgetary expansion supports wider adoption of advanced surgical equipment and reimbursed IOL implantation, particularly in outpatient and ambulatory settings where cataract surgery volumes are growing most rapidly.

Challenges

- High R&D and regulatory costs: The path from concept to commercial intraocular lens market requires immense investment in research and clinical trials, followed by a stringent multi-year regulatory approval process. For example, the FDA process for a new premium IOL can cost a million and take years. Small innovators must secure significant venture funding to navigate this. Further, the Medicare physician fee schedule also shows an ongoing scarcity of reimbursement for new technology, adding financial uncertainty.

- Reimbursement and pricing pressure: The reimbursement for the premium intraocular lens market is often limited, pushing a high cost onto patients. Further, the U.S. cataract patients opt for premium lenses largely due to the out-of-pocket costs. The government payers set reimbursement for the cataract procedure itself, not the lens technology constraining pricing power. Top players overcome this via surgeon training programs that demonstrate the value proposition to patients, aiming to convert more standard procedures to premium upgrades despite reimbursement headwinds.

Intraocular Lens Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 9.3 billion |

|

Regional Scope |

|

Intraocular Lens Market Segmentation:

Application Segment Analysis

The cataract surgery is projected to hold the largest share value of 90.4% in the intraocular lens market by 2035. The segment is driven by the global prevalence of cataracts as the leading cause of blindness worldwide. Besides the rising procedure rates and improving surgical access in the aging population are the consistent high volume growth driver. Moreover, the demand is covered by the major healthcare programs. According to the NLM August 2023 study, nearly a4 252 532 cataract surgeries were performed under the Medicare FFS beneficiaries. This number is expected to increase steadily, reflecting the procedure’s vital role in restoring vision for the elderly. Moreover, the large-scale government-supported blindness preventive initiative is further boosting the cataract surgery volumes, thereby sustaining long-term demand for intraocular lenses globally.

Design Segment Analysis

The single piece IOLs are the leading sub-segment in the design favored for their simplified surgical implantation and stability within the capsular bag in the market. Their body integrates the optic and haptics from a single material, which reduces the efficiency, making them the preferred choice for the majority of standard cataract procedures, mainly with the rise of minimally invasive micro incision surgery. The data from the procedural analyses shows their widespread adoption. For instance, the U.S. government audit report indicates that the single-piece IOLs constituted the vast majority of lenses used in sampled cataract surgeries. Indicating their market dominance in recent years.

Material Segment Analysis

Within the material segment, the hydrophobic acrylic is leading in the intraocular lens market, driven for their excellent biocompatibility and low rate of posterior capsule opacification. This material's inherent properties resist cellular adhesion and reduce the need for secondary laser procedures, making it the standard for both basic and advanced premium lens designs. Its stability and optical clarity have solidified its position as the material of choice for manufacturers. The government data on medical device utilization confirms this trend. The NLM August 2023 study highlights that the hydrophobic acrylic materials are superior to the hydrophilic material based on the square edge profiles, posterior capsule opacification, IOL opacification, good quality of vision, etc. Thus, indicating the material demand in the market.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

Application |

|

|

End user |

|

|

Price Range |

|

|

Design |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intraocular Lens Market - Regional Analysis

North America Market Insights

North America is the largest and dominating and is poised to hold the regional revenue market share of 38.7% by 2035. The market is defined by high procedural volumes, technological adoption, and a complex reimbursement landscape. The primary driver is the rising aging population, ensuring a large, stable patient base for cataract surgery. Besides, the demand is segmented between standard monofocal lenses largely reimbursed by Medicare and provincial plans, and a growing premium intraocular lens sector driven by the patient out-of-pocket spending for advanced visual outcomes. A key trend is the sustained shift of surgery from hospital outpatient departments to ambulatory surgery centers, a transition supported by the CMS payment policies favoring cost-efficient settings. Further, the health plans cover the foundational cost of cataract removal, defining the market’s base, while innovation is fueled by the private pay upgrades.

The U.S. market is mainly driven by the government-funded cataract surgery volumes and demographic aging trends. According to the NLM June 2022 study, the number of U.S. people aged above 40 with vision impairment reached approximately 12 million, reinforcing a sustained surgical demand via hospital outpatient departments and ambulatory surgical centers. Besides, the NLM study in March 2023 indicates that the cost of complex cataract surgery reached USD 877.85, with standard intraocular lens implantation covered as a reimbursable component, ensuring the stable baseline procurement. Moreover, various FDA approvals of intraocular lens surges the demand and expand the market growth. On the other hand, the government healthcare spending benefit high volume ophthalmic procedures. Overall, these data show the market is actively expanding in the U.S.

Recent FDA Approvals of Intraocular Lenses

|

Company Name |

Product Name |

IOL Type |

Key Indication / Feature |

FDA Approval Date |

|

Carl Zeiss Meditec AG |

CT LUCIA® 621P Monofocal IOL |

Monofocal, aspheric, single-piece C-loop |

Designed to compensate for a wide range of spherical aberrations and optimize visual outcomes in cases of decentration or lens misalignment |

25 April 2023 |

|

Rayner |

RayOne EMV Toric IOL |

Toric intraocular lens |

Intended for patients with astigmatism; approved following completion of a pivotal IDE study |

13 October 2025 |

|

Lenstec, Inc. |

SBL-3 Multifocal Intraocular Lens |

Multifocal IOL |

Provides multifocal visual correction; approval supported by Summary of Safety and Effectiveness Data (SSED) |

22 July 2022 |

|

AcuFocus, Inc. |

IC-8 Apthera Intraocular Lens (IOL) |

Small-aperture IOL |

Designed to extend depth of focus; approval based on PMA review and SSED |

22 July 2022 |

Source: FDA, ZEISS Medical Technology, Rayner

The Canada intraocular lens market is driven by the publicly funded cataract surgery volumes under the provincial health insurance programs and a rapidly aging population. According to the Global News July 2022, nearly 2.5 million people in Canada live with cataract, and over 500,000 procedures were performed nationwide, all requiring intraocular lens implantation. Demographic pressure continues to build as Statistics Canada in September 2024 reports that the adults aged 65 years and older represented 7.6 million a proportion projected to rise steadily via the decade increasing the demand for ophthalmic surgical care. From a spending perspective, the healthcare expenditure is rising with provinces prioritizing the surgical backlogs, including ophthalmology. These trends position Canada as a volume-led and closely linked to provincial budget allocations and hospital-based procurement frameworks.

APAC Market Insights

Asia Pacific is the fastest-growing market and is expected to grow at a CAGR of 7.8% during the forecast period 2026 to 2035. The market is driven by the global growth engine defined by the massive patient population, increasing healthcare access, and a diverse landscape of affordability and technology adoption. The primary demand driver is the high and rising prevalence of cataracts, driven by the aging populations and high rates of diabetes in countries such as India. The developed markets such as Japan, Australia, and South Korea exhibit robust adoption of premium IOLs driven by high disposable income and advanced surgical infrastructure, while the high-volume price-sensitive markets are dominated by the low-cost monofocal IOLs often supported by the government procurement schemes. The region is also a major manufacturing hub, with local players like Aurolab in India producing high-quality, low-cost IOLs that influence pricing and accessibility across emerging economies.

The intraocular lens market in India is shaped by the large-scale government and multilaterally funded cataract surgery programs that have created sustained high-volume demand over multiple decades. Moreover, the data from the 2026 Center for Global Development reported that India was performing around 3.5 million cataract surgeries annually, with 15.35 million cumulative procedures completed over seven years under the cataract blindness control program, each requiring an intraocular lens. This intervention contributed to a 26% reduction in cataract blindness prevalence, demonstrating both scale and continuity of surgical uptake. Further, the cost efficiencies achieved via local manufacturing of high-quality artificial lenses, with procedure costs reported as low as USD 10 per surgery, established India as a price-sensitive volume-led IOL market. Ongoing public programs continue to prioritize cataract backlog reduction, reinforcing the bulk procurement via government hospital and NGO partners and positioning India as one of the world’s largest unit-demand markets for intraocular lenses.

The China market is driven by expanding government-funded cataract surgery capacity, rapid population aging, and sustained public healthcare investment. Moreover, the cataract remains the leading cause of visual impairment among older adults, with national prevention programs prioritizing surgical treatment within public hospitals. According to the People’s Republic of China's October 2024 report, people aged 65 and above were approximately 216.76 million in 2023, representing over 15.4% of the total population, materially expanding the addressable surgical base. From a system capacity perspective, the WHO report indicates that China performs several million cataract surgeries annually, supported by government-led blindness prevention initiatives and rural health access programs. These data are closely aligned with public hospital procurement and national ophthalmology service expansion policies.

Europe Market Insights

The Europe intraocular lens market is shaped by a universal healthcare foundation, an aging population, and stringent regulatory harmonization under the medical device regulation. The demand is driven by high cataract surgery volumes in the aged population. Besides, a key trend is the division of publicly funded standards, monofocal procedures, and a growing self-pay premium intraocular lens segment for advanced technology lenses. The implementation of MDR by the EMA has increased the clinical evidence requirements temporally affecting new product introductions and strengthening the long term market quality. Moreover, the government healthcare spending prioritizes cost-effective outcomes, with the reimbursement policies varying significantly by country, often limiting full coverage to basic lenses. Further, the advanced surgical infrastructure and a focus on value-based healthcare are boosting the European market.

The intraocular lens market in Germany is expanding significantly and is supported by the statutory health insurance coverage, high cataract surgery volumes, and an aging population. Moreover, the rising aging population is a demographic group driving the cataract incidence and surgical demand. Besides, the report from the IQWIG in July 2024 shows that hospital statistics indicate that more than 900,000 cataract surgeries are performed annually, making it one of the most common inpatient and outpatient procedures in the country, each requiring intraocular lens implantation. Further, the EIT Health in January 2025 report shows that the total healthcare expenditure exceeded 498 billion euro with statutory health insurance financing close to cataract-related procedures. These factors position Germany’s market as a volume-driven reimbursement secured and closely tied to hospital and ambulatory surgical center procurement within the GKV framework.

The UK intraocular lens market is driven by the national health service-funded cataract surgery volumes and an expanding elderly population. According to the 2026 SpaMedica data, cataract surgery is the most frequently performed surgical procedure, with over 400,000 implantations. Moreover, 30% of the people are aged above 65, and 40% of the people are in need of surgery, driving the demand for intraocular lenses. On the other hand, the ophthalmology waiting list is raising prompting targeted funding to expand the high-volume elective care, including cataract pathways. Besides the cost for the cataract surgery ranges from 1,995 to 3,150 euro. These publicly financed volumes and backlog-reduction initiatives position the UK IOL market as demand-stable, procurement-led, and closely aligned with NHS budget allocations and hospital throughput efficiency.

Cataract Surgery Pricing by Intraocular Lens Type

|

Clinic |

Consultation |

Cataract Monofocal Lens |

Cataract Multifocal Lens |

|

Optimax |

Free |

£2,995 |

£3,995 |

|

Ultralase |

Free |

£2,995 |

£3,995 |

|

Optegra |

Free |

£2,795 |

£3,895 |

|

Optical Express |

Free |

£1,995 |

£3,195 |

|

Centre For Sight |

£445 |

£3,330- £3,795 |

£4,330 – £4,750 |

Source: LESH August 2024

Key Intraocular Lens Market Players:

- Johnson & Johnson Vision (U.S.)

- Alcon (Switzerland)

- Bausch + Lomb (U.S.)

- Carl Zeiss Meditec (Germany)

- Hoya Corporation (Japan)

- STAAR Surgical (U.S.)

- Rayner (UK)

- Ophtec (Netherlands)

- HumanOptics (Germany)

- Physiol (France)

- Santen Pharmaceutical (Japan)

- NIDEK (Japan)

- Lenstec (U.S.)

- EyeKon Medical (U.S.)

- Care Group (India)

- Aurolab (India)

- Medicontur (Hungary)

- Hanita Lenses (Israel)

- Eagle Optics (India)

- Appasamy Associates (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Vision in the market has advanced beyond materials science into a comprehensive digital ecosystem. Its strategic initiative focuses on integrating the IOL calculation and surgical planning with advanced diagnostics via platforms such as TECNIS Synergy and Veritas workstation.

- Alcon’s dominance in the intraocular lens market is reinforced by its large-scale R&D investment and premium portfolio strategy. A key advancement is the aggressive commercialization of wavefront-guided light-adjustable lenses that correct presbyopia and astigmatism without diffractive rings. The company has increased its sales growth by 5% and generated USD 2.1 billion in cash from operations.

- Baush + Lomb has strengthened its position in the market via strategic acquisitions and a focus on surgeon education. A significant advancement was the acquisition of AcuFocus and its IC-8 Apthera IOL, which uses a small aperture design to extend depth of focus. The company has generated a revenue of USD 1.280 billion in Q4 2024.

- Carl Zeiss Meditec uses its unparalleled strength in diagnostics to advance in the market. Its key initiative is the creation of a closed loop circle of wisdom seamlessly connecting its high precision biometers and surgical microscopes with its portfolio of AT LISA trifocal and toric IOLs.

- Hoya Corporation’s strategy in the market indicates technological differentiation in optical design and material science. The core advancement is its development of the Vivinex and iSert series, utilizing unique aspheric and frosted edge designs to minimize dysphotopsia.

Here is a list of key players operating in the global market:

The global intraocular lens market is a highly competitive arena dominated by a few multinational giants which uses its extensive R&D, comprehensive product portfolios, and strong surgeon relationships to maintain leadership. The key strategic initiatives across the sector include active investment in advanced technology, such as premium presbyopia correcting and toric lenses, strategic acquisitions to expand geographic and technological footprints, and direct-to-consumer marketing to drive the adoption of premium products. For example, in April 2024, Appasamy Associates Pvt. Ltd. announced that Warburg Pincus, a leading global growth investor, had acquired a stake in the Company. Further, this is the largest investment in the India healthcare sector by the firm. Meanwhile, the mid-tier and regional players from Europe, Japan, and India are increasingly competing via cost-effective alternatives, innovative designs, and by securing strong positions in public healthcare procurement programs.

Corporate Landscape of the Intraocular Lens Market:

Recent Developments

- In October 2025, BVI, a global leader in ophthalmic device innovation, announced that the U.S. Food and Drug Administration (FDA) has approved its FINEVISION HP trifocal intraocular lens (IOL).

- In June 2025, Rayner, a global manufacturer of products for cataract surgery based in Worthing, UK, announced that its RayOne Galaxy and RayOne Galaxy Toric intraocular lenses are now available in Brazil.

- In June 2025, Johnson & Johnson, a global leader in eye health, announced that it is expanding its portfolio of presbyopia-correcting intraocular lenses with the roll-out of TECNIS Odyssey IOL in Europe, the Middle East, and Canada.

- Report ID: 4856

- Published Date: Feb 11, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intraocular Lens Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.