Intranet as a Service Market Outlook:

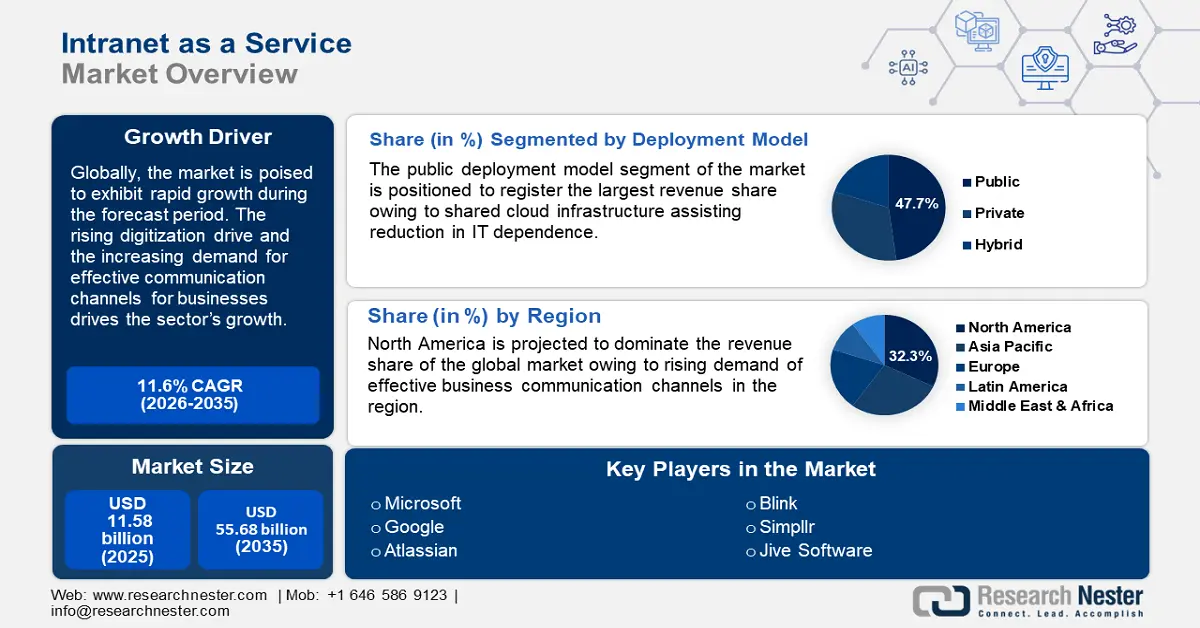

Intranet as a Service Market size was over USD 18.58 billion in 2025 and is projected to reach USD 55.68 billion by 2035, witnessing around 11.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of intranet as a service is evaluated at USD 20.52 billion.

A major market driver is the rising adoption of intranet as a service by organizations seeking to leverage cost-effective platforms. The increasing demand provides lucrative opportunities for key market players to position advanced business-to-business (B2B) solutions to optimize workflows. A key market shift was ushered in by the COVID-19 pandemic that boosted the prevalence of hybrid and remote work. For instance, in October 2024, the U.S. Bureau of Labor Statistics reported findings from the American Community Survey (ACS) that remote work drastically increased across all major industries owing to COVID-19 restrictions and while the removal of all social distancing policies has reduced the percentage of remote workers, the number is still higher than in 2019. Companies require scalable solutions that can provide access anywhere for a rising number of remote workforce, and IaaS services are key solutions to solving the predicament.

The intranet as a service market growth is driven by technological advancements and positioning IaaS services as vital components to digital transformation strategies worldwide. The advent of powerful generative AI tools is beneficial for the sector’s growth by enhancing user experience. Furthermore, the rise of social media has fueled new-age jobs such as content creation, which leverage IaaS services to leverage generative AI tools such as ChatGPT plus or Microsoft CoPilot for large companies to automate routine tasks. For instance, in November 2023, BP p.l.c. announced that it will be expanding the use of generative AI to boost its global employee experience through the use of Copilot for Microsoft 365.

The infrastructure as a service sector’s lucrative opportunities are evident from the increasing revenue share of top industry players such as Microsoft. For instance, Microsoft reported revenue worth USD 211 billion and over USD 88 billion in operating income in the fiscal year 2023, which augurs well for the industry stakeholders in the IaaS sector. Furthermore, IaaS services have become indispensable in modern digital workplaces, and with a rising push for digitization globally, the market is positioned to maintain a profitable expansion by the end of the forecast period.

Key Intranet as a Service Market Insights Summary:

Regional Highlights:

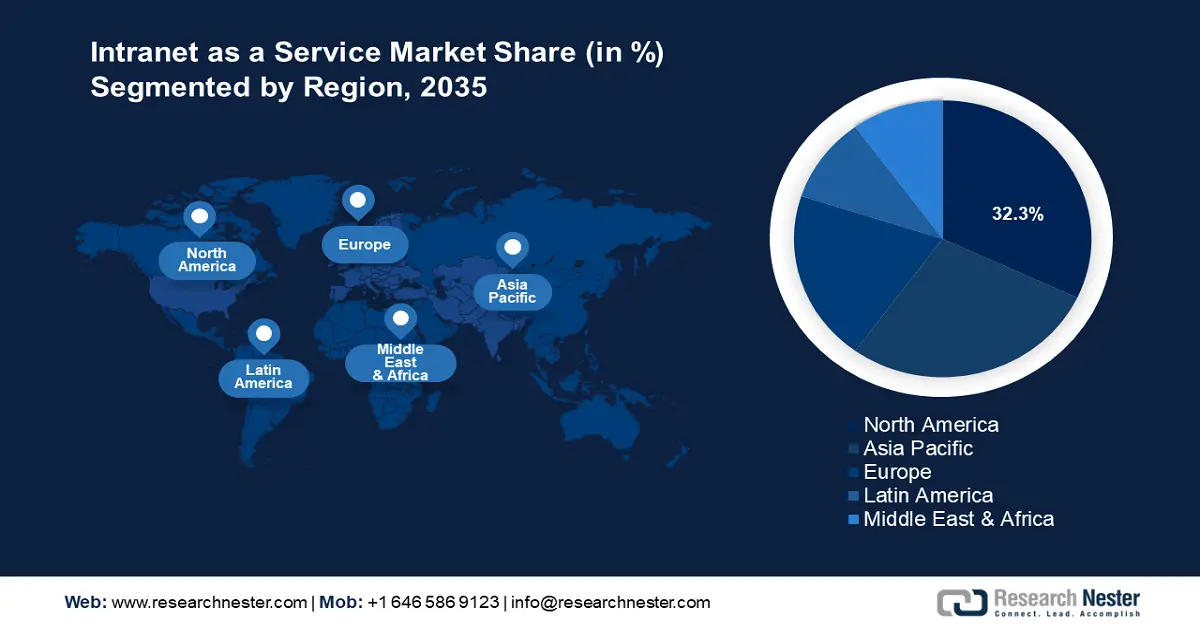

- North America’s 32.3% share in the intranet as a service market is propelled by advanced IT infrastructure, driving growth through 2026–2035.

- APAC’s intranet as a service market is anticipated to see rapid growth by 2035, driven by rapid IT infrastructure expansion and emerging economies driving digitalization and AI-powered intranet adoption.

Segment Insights:

- The Public Deployment Model segment is projected to hold more than a 47.7% share by 2035, driven by its cost-effectiveness, scalability, and demand for remote intranet access.

Key Growth Trends:

- Cross-industry adoption driven by ESG goals

- Rising adoption of low-code/no-code intranet solutions

Major Challenges:

- Concerns about data security breaches

- Challenges of breaking down siloed content

- Key Players: Microsoft, Blink, Google, Simpplr, Staffbase, Unily, Jostle, Workvivo Limited, Meta, Jive Software, Atlassian.

Global Intranet as a Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.58 billion

- 2026 Market Size: USD 20.52 billion

- Projected Market Size: USD 55.68 billion by 2035

- Growth Forecasts: 11.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Intranet as a Service Market Growth Drivers and Challenges:

Growth Driver

- Cross-industry adoption driven by ESG goals: The stringent environmental, social, and governance (ESG) initiatives are driving the adoption of IaaS solutions. Businesses are utilizing internet tools to measure sustainability metrics and IaaS solutions enable companies to stand out by integrating ESG reporting and employee participation modules. Furthermore, an intranet can provide a platform for companies by avoiding greenwashing, and provide credible information on sustainability practices.

Additionally, the intranet as a service sector will benefit from the rising adoption of intranet platforms by businesses owing to strict ESG regulations. For instance, in 2021, the Securities and Exchanges Board (SEBI) of India introduced the Business Responsibility and Sustainable Reporting (BRSR) framework to the top 1000 companies by market capitalization that is mandatory from the fiscal year 2023 and in 2023, SEBI introduced the BRSR core applying to the top 150 listed companies in India by market capitalization from FY2024. These trends of tightening ESG guidelines create sustained demand for IaaS solutions for businesses. - Rising adoption of low-code/no-code intranet solutions: A key driver of the intranet as a service market is the rise of low-code-no-code development leading to increasing adoption of customizable intranets that require minimal IT involvement. Customizable low-code/no-code intranet platforms allow operational teams to create tailored workflows boosting adoption in small-scale operations that operate with lean IT teams.

Businesses are leveraging the low-code/no-code solutions to reduce development cycles and boost faster time to market. For instance, in November 2024, FPT announced a three-year partnership agreement with OutSystems, and through this collaboration, FPT is poised to become OutSystems' reseller and delivery partner for the IaaS South Korea market and offer clients accelerated time-to-market along with cost-efficient software solutions. - Growing expansion and adoption in SMEs: The intranet as a service (IaaS) market is poised to expand owing to the rising adoption of intranet solutions by small and medium enterprises (SMEs) to level the playing field with larger competitors. Affordable subscription models allow SMEs to leverage intranet solutions and mitigate infrastructure costs. This creates positive market competition by bolstering SMEs which reduces market monopoly benefitting the end user. For instance, in January 2022, Acrowire released a new intranet platform that is specifically built for law firms and is completely customizable to the firm, providing targeted information relevant to each user. The increased digitization drives and the release of customizable intranet platforms that SMEs can leverage in various sectors are positioned to create sustained revenue streams for IaaS solutions providers.

Challenges

- Concerns about data security breaches: The rising reliance on cloud-based platforms creates the risk of data breaches and unauthorized access. The enterprises that manage large amounts of sensitive information, in the healthcare and banking sectors, face heightened security concerns.

- Challenges of breaking down siloed content: The effective breakdown of siloed content can be a challenge for the sector. Additionally, integration with legacy systems can pose a challenge for IaaS providers affecting the sector’s growth. Furthermore, providers may struggle to create flexible solutions that can cater to organizational needs without incurring excessive costs.

Intranet as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.6% |

|

Base Year Market Size (2025) |

USD 18.58 billion |

|

Forecast Year Market Size (2035) |

USD 55.68 billion |

|

Regional Scope |

|

Intranet as a Service Market Segmentation:

Deployment Model (Public, Private, Hybrid)

The public segment is set to hold more than 47.7% intranet as a service market share by 2035. A major driver of the segment’s growth is the cost-effectiveness and scalability offered. The public deployment model leverages shared cloud infrastructure allowing organizations to reduce IT investments. Furthermore, public cloud providers benefit from economies of scale that allow them to offer services at competitive prices and are expected to find rising opportunities due to increasing demand for remote access to intranet services.

In March 2024, Granicus signed a Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS) to offer engagement and experience solutions to the public sector hosted on AWS. The collaboration is poised to enable Granicus to capture billions of monthly digital transactions and drive personalized citizen experiences, indicating to industry shareholders the lucrative opportunities in the public deployment model segment of the IaaS sector.

The private deployment model of the Internet as a service market is positioned to offer profitable opportunities to key market players during the forecast period. The segment’s expansion is attributed to rising awareness of data security and stringent calls to impose data security regulations. Sectors such as healthcare, defense, finance, etc., are adopting private intranet platforms, either on-premise or managed by a third-party vendor to ensure that data access adheres to regulatory standards.

While the implementation time can be higher, private deployment models are preferred choices for large organizations with considerable IT budgets. For instance, in October 2024, Deloitte and Liferay partnered to provide digital experiences and redefine the evolving customer needs by integrating conceptualization and development on Liferay’s Digital Experience Platform (DXP). Successful collaborations as such bode well for the continued growth of the segment.

Organization Size (Large Enterprises, SME)

By organization size, the large enterprise segment of the intranet as a service (IaaS) market is poised to provide profitable opportunities by the end of the forecast period. Large organizations require scalable solutions to streamline internal collaboration and IaaS providers are poised to find opportunities with large enterprises expanding to emerging economies. Large corporations operate in multiple markets with branches across multiple geographical locations necessitating centralized platforms that facilitate operational consistency. IaaS providers are poised to find opportunities with large enterprises expanding to emerging economies, driving requirements for IaaS solutions.

For instance, in May 2024, Amazon Web Services (AWS) and Orange Middle East & Africa announced a collaboration to help customers build applications using AWS services installed within Orange’s network. Additionally, the segment benefits from the ability to allocate substantial budgets for tailored solutions to ensure alignment with an organization’s goals.

Our in-depth analysis of the global IaaS market includes the following segments:

|

Deployment Model |

|

|

Organization Site |

|

|

Type |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intranet as a Service Market Regional Analysis:

North America Market Forecast

By the end of 2035, North America intranet as a service market is set to capture around 32.3% revenue share and is poised to provide the most profitable opportunities in the sector by the end of the forecast period. A key driver of the sector in the region is the advanced IT infrastructure driving adoption. Additionally, the regional market had an edge owing to the early adoption of cloud-based infrastructure and the presence of industry leaders.

Furthermore, the rising focus on boosting employee productivity has positioned IaaS providers to provide intranet solutions as an essential part of the modern digitally integrated workplace. In August 2023, Cassels Brock & Blackwell LLP implemented Infodash as their intranet solution to serve the transaction and advisory needs of Canada’s business sector. With the scope of application expanding in various industries due to digitalization drives, the sector is projected to maintain its growth.

The U.S. IaaS market holds a dominant revenue share in North America. The country’s push toward digital workplace transformation is boosting the sector’s growth. Key industries such as IT, media, and finance are relying on robust intranet platforms to manage decentralized platforms. Furthermore, healthcare organizations are adopting IaaS solutions to comply with stringent regulations such as HIPAA. Additionally, the rise of artificial intelligence (AI) and machine learning (ML) in intranet solutions is helping companies transform user experiences. With the expansion of new IaaS solutions providers to the U.S. market, the sector is poised to remain competitive during the forecast period.

Canada is poised to expand its revenue share in the North America intranet as a service market by the end of the forecast period. Stringent data protection laws such as the Personal Information Protection and Electronic Documents Act (PIPEDA). Key market players who provide bilingual intranet platforms in English and French are poised to expand their revenue share. Furthermore, the rising digitalization drive in Canada creates burgeoning opportunities for the corporate sector to embrace IaaS solutions.

IaaS solutions providers are expanding their market presence in Canada to leverage the burgeoning opportunities. For instance, in October 2024, Softdocs announced continued expansion into Canada in partnership with the University College of the North (UCN) where the latter will utilize Softdocs’ full suite of products, including electronic forms in EdCloud, eSignatures, workflow, document management, and print customization.

APAC Market Forecast

The APAC intranet as a service market is poised to register the fastest growth during the forecast period. China, India, Japan, South Korea, and Australia are major domestic markets in APAC. The rapid expansion of IT infrastructure in China and emerging economies in Southeast Asia drives provides steady opportunities.

In January 2024, workflow automation technologies developer, Kore.AI announced a USD 150 million strategic growth investment to drive AI-powered customer and employee experiences for global brands. The funding is indicative of the growth potential of the IaaS sector.

China holds a dominant market share in the IaaS sector owing to service providers offering localized solutions that align with strict data sovereignty laws. Region-specific intranet providers that offer secure and compliant systems are positioned to expand their revenue share by leveraging the opportunities offered in the market in China. For instance, in November 2024, China Unicom Guangdong launched the U Mobile Intranet solution, which allows mobile users to remotely access their home and enterprise intranets. Additionally, the digital economy boom and rapid integration of AI have led to rising demand for intranets that facilitate real-time data analytics.

The India intranet as a service market is projected to expand its revenue share during the forecast period. Nationwide initiatives such as Digital India are driving the market while the country has a robust position as a global IT hub necessitating IaaS solutions. Furthermore, the widespread use of mobile-first platforms assists the sector’s growth as many companies aim to engage their workforce through user-friendly intranets. India’s market feature is cost-efficiency with SMEs adopting scalable solutions, and IaaS solutions providers are poised to leverage the opportunities by providing affordable intranet platforms. In February 2024, Galaytix India extended its generative AI data platform to automate corporate credit lending for global banks. The trends bode well for IaaS solutions providers to expand to sectors such as banking and healthcare further in India and abroad.

Key Intranet as a Service Market Players:

- Microsoft

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Blink

- Simpplr

- Staffbase

- Unily

- Jostle

- Workvivo Limited

- Meta

- Jive Software

- Atlassian

The intranet as a service market is poised to expand during the forecast period. Key market players are investing to boost scalability and improve user experience. Additionally, investments in AI-driven personalization are positioned to create tailored experiences while integration with third-party applications to improve workflows is poised to benefit IaaS solutions providers.

Here are some key players in the market:

Recent Developments

- In August 2024, Vultr announced the launch of its industry cloud solution that delivers industry-vertical, cutting-edge cloud computing solutions. Vultr’s industry cloud solution will offer solutions for specific industry needs and regulatory requirements across healthcare, manufacturing, telecommunications, retail, media, and finance sectors.

- In July 2024, NetApp announced the introduction of new capabilities designed for strategic cloud workloads including GenAI and VMware. These advancements to NetApp data and storage service are positioned to reduce the risks and resources for customers to manage strategic workloads across complex multicloud environments.

- Report ID: 6845

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intranet as a Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.