Interventional Pulmonology Market Outlook:

Interventional Pulmonology Market size was over USD 4.4 billion in 2025 and is estimated to reach USD 7.6 billion by the end of 2035, expanding at a CAGR of 5.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of interventional pulmonology is assessed at USD 4.6 billion.

The increased incidence of respiratory ailments is primarily fueling a surge in the interventional pulmonology market. Testifying to this demographic shift, the World Health Organization (WHO) revealed that, in November 2024, more than 3.5 million deaths were registered in 2021 around the world due to chronic obstructive pulmonary disease (COPD). It also marked that by the end of 2025, nearly 226,650 newly diagnosed lung cancer cases will be registered in the U.S, as per the American Cancer Society report published in 2025. Besides, the rising demand for minimally invasive surgeries (MIS) has led to the new invention of robotic bronchoscopies. This approach has enabled doctors to navigate with unparalleled precision and reach suspicious nodules, which is a challenging access.

The annual procedure volumes in interventional pulmonology highlight the significant global activity. According to the NLM report, released in May 2023, in the U.S., 500,000 bronchoscopies are performed. Further, the data from NLM report released in May 2024 states that the medical thoracoscopy is a vital diagnostic tool which has achieved an overall diagnostic accuracy rate of 95.7%. As minimally invasive methods are experiencing rapid technological advancements and are expected to witness a rise in adoption rates in both developed and developing nations.

Key Interventional Pulmonology Market Insights Summary:

Regional Insights:

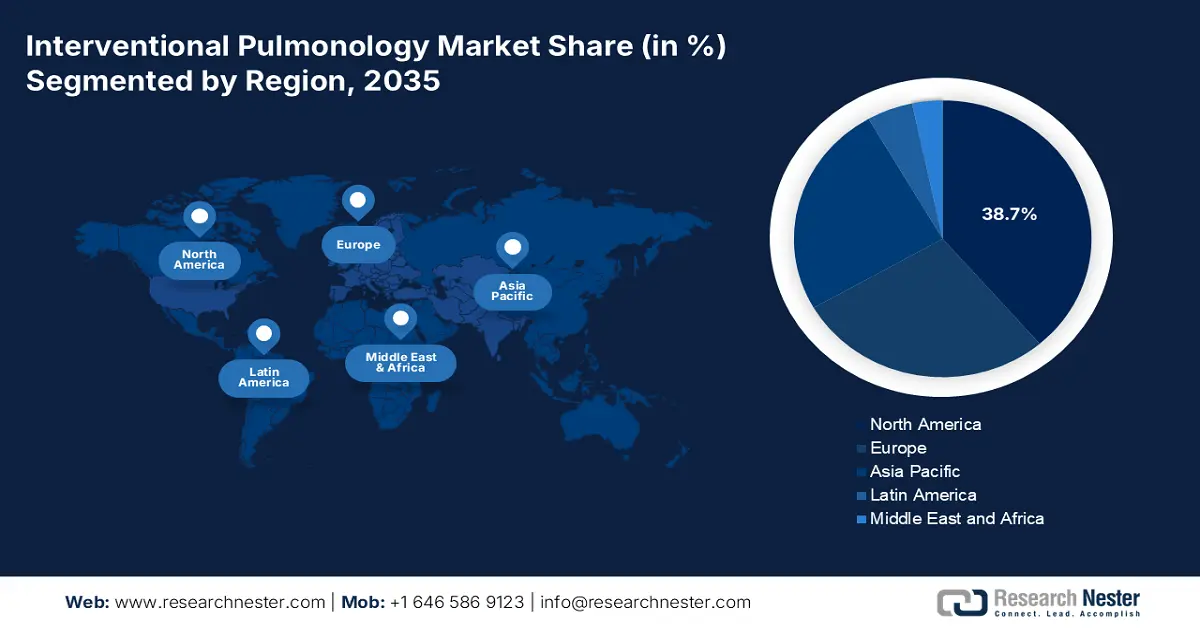

- By 2035, North America is projected to secure a 38.7% share in the interventional pulmonology market, sustained because of the rising burden of chronic respiratory conditions and growing adoption of minimally invasive pulmonary procedures.

- APAC is anticipated to strengthen its foothold in the sector by 2035 as a result of expanding lung-cancer screening programs, rising chronic respiratory diseases, and growing investment in advanced bronchoscopy and navigation technologies within the region.

Segment Insights:

- The bronchoscopes segment is estimated to command a 32.9% share by 2035 in the interventional pulmonology market, propelled by regulatory-aligned flexible models, Medicare-supported early cancer detection, and AI-enhanced diagnostic accuracy.

- Lung cancer is set to capture a 28.8% share by 2035, impelled by the critical need for early diagnosis, the expanding global patient pool, and technological gains such as improved EBUS-TBNA accuracy and investments in liquid biopsy development.

Key Growth Trends:

- Increasing patient pool and disease prevalence

- Tech-based innovation and its global validation

Major Challenges:

- Limited physician training and adoption

Key Players: Boston Scientific, Medtronic, Cook Medical, Pulmonx Corporation, Karl Storz, Richard Wolf GmbH, Ambu A/S, Teleflex Incorporated, Johnson & Johnson (Ethicon), Smiths Medical, ConMed Corporation, Merit Medical Systems, Becton Dickinson (BD), EndoChoice (now Olympus), Rocket Medical, Vathin Medical, Mindray Medical, Olympus Corporation, Fujifilm Holdings, Hoya Corporation (Pentax), Sony Medical, Hitachi Medical.

Global Interventional Pulmonology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.4 billion

- 2026 Market Size: USD 4.6 billion

- Projected Market Size: USD 7.6 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 18 August, 2025

Interventional Pulmonology Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing patient pool and disease prevalence: The Science Direct report based on the impact of environmental heat exposure on cardiovascular diseases, chronic respiratory diseases and diabetes mellitus, released in October 2025, states that nearly 545 million people experience chronic diseases prevalence globally and the rate is expected to grow 7.4% in the global population. This raise is linked to elderly populations, urban air pollution, and high smoking rates in developing economies.

-

Tech-based innovation and its global validation: The regulatory and financial support towards clinically validated technologies is an indication of accelerated progress in the interventional pulmonology market. The rising adoption of innovative techniques, including electromagnetic navigation bronchoscopy and EBUS, is vital in driving market growth. According to the NLM study, which was released in August 2023, the clinical applications of EBUS indicate a sensitivity rate of 85% and make it the most preferred method, as it is safer and less invasive for mediastinal staging of lung cancer.

-

Cost-effective interventions: Bronchoscopic interventions, such as endobronchial valve therapy, reveals a cost-effective option in comparison to lung volume reduction surgery. Additionally, the therapy enhances the exercise capacity, quality-adjusted life years and lung function. This method increases 0.25 quality-adjusted life years (QALYs) at an ICER of €7,657 per QALY gained, according to the November 2022 SMW report. The minimally invasive technique shortens hospital stays and helps the government to focus on budget-related efficiencies.

Rising Cases of Chronic Disease Prevalence

|

Country |

Percentage |

Year |

|

U.S. |

42% |

2024 |

|

India |

21% |

2022 |

|

Australia |

49.9% |

2022 |

|

China |

2.78% |

2023 |

Sources: CDC, NLM, ABS, Science Direct

Survey on Chronic Respiratory Disease in Uganda and India (2024)

|

Category |

Details |

Chronic Respiratory Disease Dataset 1 (India) |

Chronic Respiratory Disease Dataset 2 (Uganda) (COPD/PTLD) |

|

Study Recruitment |

Individuals approached |

403 |

75 |

|

Participant Characteristics |

CRD types |

Asthma: 193 (52%), COPD: 162 (44%), Other (ILD, CF): 16 (4%) |

COPD & PTLD |

|

Top Patient Factors for Referral |

MRC dyspnoea score |

137 (67%) |

— |

|

Shortness of breath |

127 (62%) |

— |

|

|

Reduced mobility from breathlessness |

108 (52%) |

Breathlessness affecting movement: 26 (87%) |

|

|

Decreasing activity levels |

100 (49%) |

20 (67%) |

|

|

Low exercise tolerance |

86 (41%) |

21 (70%) |

|

|

Poor self-management |

73 (35%) |

— |

|

|

Increasing shortness of breath |

— |

25 (83%) |

Source: NLM

Challenges

-

Limited physician training and adoption: Even with the availability of advanced devices, gaps in the knowledge and training of the specialists limits the uptake. This shortage minimizes the advantage of the adoption of complex procedures such as endobronchial ultrasound. Brazil has launched a government-endorsed program to provide training for specialists to increase the adoption rate in public hospitals. Further, without proper training and skill development in the pulmonology sector, market penetration remains slow and limited, and also government is not ready to invest in such costly technologies to increase the deployment.

Interventional Pulmonology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 4.4 billion |

|

Forecast Year Market Size (2035) |

USD 7.6 billion |

|

Regional Scope |

|

Interventional Pulmonology Market Segmentation:

Product Segment Analysis

With a 32.9% revenue share, the bronchoscopes segment is expected to dominate the interventional pulmonology market over the assessed period. This subtype, particularly the flexible models, is highly preferred for lung cancer screening due to their compliance with stringent regulatory mandates. This is also established by a report from the U.S. Preventive Services Task Force in 2023. Thus, Medicare coverage for early detection of these malignancies is benefiting the segment with a strong financial backing and adoption rate, as per the CMS. The surge in this category is further bolstered by AI integration in scopes, as the diagnostic failure can lead to adverse health-related issues by 15% and this is addressed by AI, as it can speed up the diagnostic time and accuracy, stated in Science Direct article released in April 2025.

Application Segment Analysis

Lung cancer is poised to account for the largest share of 28.8% in the interventional pulmonology market throughout the discussed timeframe. The importance of early diagnosis and the worldwide enlarging patient pool are the primary drivers behind its predominant captivity in this sector. The same can be exemplified by the EBUS-TBNA accuracy rate by 14.6% due to its superior lymph node staging accuracy, as unveiled by the NLM article in May 2021. The segment is further propelled by USD 4.6 million in funding for advancements on the liquid biopsy test as a minimally invasive alternative for these procedures, sanctioned by the ULCE Health in October 2023.

End user Segment Analysis

Hospitals are estimated to lead the end user segment in the interventional pulmonology market, while capturing a 45.7% revenue share by the end of 2034. This forefront position is consolidated by the comprehensive infrastructure of these facilities that can support all types of complex pulmonary procedures. Additionally, the 24/7 critical care capabilities and availability of specialized pulmonologists make hospitals the most preferred point of care for afflicted patients. This also testified to these organizations having a central role in performing advanced diagnostic and therapeutic IP procedures, including bronchoscopies, pleural interventions, and airway stent placements, particularly for high-acuity patients.

Our in-depth analysis of the global interventional pulmonology market includes the following segments:

|

Segments |

Subsegments |

|

Product |

|

|

Application |

|

|

Procedure |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Interventional Pulmonology Market - Regional Analysis

North America Market Insights

North America is poised to retain its leadership in the global interventional pulmonology market by holding the highest share of 38.7% during the analyzed timeline. The region is driven by the rising incidence of chronic respiratory diseases such as COPD, lung cancer, and severe asthma, and by the rising adoption of minimally invasive procedures. The NLM article released in December 2023 depicts that nearly 600 million cases of COPD are expected by 2050, compared with the past five years' COPD cases. On the other hand, the interventional pulmonology market is experiencing a rapid shift with advancements in technology, and has improved the accuracy of peripheral bronchoscopy by approximately 60% to 85%, as per the chest article released in 2025. This transformation highlights the demand for advanced pulmonary care.

The U.S. dominance over the regional interventional pulmonology market is primarily gained from high procedure volumes, fast technology adoption, and payer-enabled reimbursement pathways. Besides, the rapid adoption of AI bronchoscopy systems testifies to the technologically progressive atmosphere cultivated across the country, where the FDA has granted Breakthrough Device Designation for the NIO by Invenio Imaging, which is a lung cancer reveal image analysis to help physicians evaluate bronchoscopic lung forceps biopsies. The device has been used for more than 10,000 procedures in bronchoscopy, neurosurgery, and endoscopy.

Hospital Distribution by Annual Bronchoscopy Procedure Volume in the U.S.

|

Procedure Range |

% of Hospitals Performing |

|

< 500 procedures/year |

80% |

|

500–1,499 procedures/year |

16% |

|

1,500–2,500 procedures/year |

2% |

|

> 2,500 procedures/year |

1% |

Source: NLM

APAC Market Insights

The interventional pulmonology market is witnessing a rapid shift and is led by the increase in lung cancer programs, rising chronic respiratory diseases, and the fast adoption of minimally invasive therapeutic and diagnostic tools. China is leading the interventional pulmonology market due to its rising patient base, improvement in hospital infrastructure. Trends such as the integration of CT-derived navigation, EBUS-TBNA expansion for mediastinal staging, and increasing capital investment in bronchoscopy suites boost the APAC market. Further, as per the Non-Profit Organization, Asian Pacific Association for Bronchology and Interventional Pulmonology in 2025 report, the lung cancer screening programs rose to 51.2% due to people having high rates of smoking habits. Policy support is largely determining the market penetration by 2035.

India shows a rapid growth of interventional pulmonology as private hospitals in developed areas are rapidly adopting EBUS and navigational tools, whereas the public sector lags in expansion. Government health funding has increased over the last decade, and national cancer control programs are strengthening diagnostic pathways. The Amrita Hospitals report 2025 states that the hospital has performed 1500 rigid bronchoscopic therapeutic procedures and 4000 diagnostic bronchoscopic procedures to date. Further, advancements such as Bronchoscopic Thermal Vapour Ablation, which is an endoscopic lung volume reduction (ELVR) treatment, surge the adoption rate in the country for improved respiratory mechanics.

Import data of spirometers, ventilators, CPAP/BiPAP machines, pulse oximeters, and bronchoscopes

|

Country |

Product Description |

Trade Value (1000USD) |

Quantity |

Year |

|

China |

Medical ventilators; CPAP; BiPap; Oxygen concentrators |

275,799.86 |

2,712,290 |

2022 |

|

India |

Medical ventilators; CPAP; BiPap; Oxygen concentrators |

199,262.41 |

|

2022 |

|

Japan |

Medical ventilators; CPAP; BiPap; Oxygen concentrators |

352,346.95 |

3,488,360 |

2022 |

|

Singapore |

Medical ventilators; CPAP; BiPap; Oxygen concentrators |

274,054.59 |

2,855,500 |

2022 |

Source: WITS

Europe Market Insights

Europe is predicted to augment its position as the second-largest shareholder in the global interventional pulmonology market consistently by the end of 2035. The region is driven by the rising aging populations, lung-cancer screening uptake, and greater investment in minimally invasive diagnostics and therapies. Additionally, the region-wide reimbursement reforms are ensuring maximum adoption in this sector by providing adequate financial backing. In Europe, nearly 226,500 death cases are registed due to lung cancer, as per the Eurostat report in July 2024. This indicates the demand for procedural distribution across the region and innovations in robotic platforms in pulmonology sector.

Germany dominates the Europe interventional pulmonology market and is driven by the robust outpatient procedural capacity, dense hospital network, and early adoption of advanced bronchoscopy platforms. Prevalence of high lung cancer among older population, combined with organized screening expansions and strong referral pathways to sustain diagnostic volumes. Further, local manufacturing of the devices and clinical partnerships with hospitals surge the cost efficiencies. The NLM article released in June 2023 states that lung cancer cases have increased 68.5% to 93.8%, and reduced mortality rate of 15%. This is due to the rising pulmonology sector innovations.

Key Interventional Pulmonology Market Players:

- Boston Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic

- Cook Medical

- Pulmonx Corporation

- Karl Storz

- Richard Wolf GmbH

- Ambu A/S

- Teleflex Incorporated

- Johnson & Johnson (Ethicon)

- Smiths Medical

- ConMed Corporation

- Merit Medical Systems

- Becton Dickinson (BD)

- EndoChoice (now Olympus)

- Rocket Medical

- Vathin Medical

- Mindray Medical

- Olympus Corporation

- Fujifilm Holdings

- Hoya Corporation (Pentax)

- Sony Medical

- Hitachi Medical

The commercial dynamics of the interventional pulmonology market are influenced by strategic moves of Olympus, Boston Scientific, and Medtronic. Such leaders are increasingly integrating AI to leverage product capabilities that can solidify their forefront position in this sector for the upcoming years. On the other hand, Cook Medical and Ambu are more focused on the cultivation of a disposable pipeline that can establish a stronger alignment with infection risk-related requirements. Furthermore, pioneers in emerging landscapes, such as Vathin and Mindray, are gaining ground in this category with their innovations in cost-effective alternatives.

Such key players are:

Recent Developments

- In May 2024, Fujifilm revolutionized pulmonary diagnostics with its real-time 3D lung mapping, Synapse 3D AI Navigation Platform, for tumor localization. The device is used to analyze images and assist with interpretation, reporting and planning in pulmonology, neurology and cardiology sectors.

- In November 2023, Medtronic plc announced the FDA approval of the Symplicity Spyral renal denervation (RDN) system, which is used to treat hypertension for physicians and patients who need to manage their blood pressure.

- Report ID: 7989

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Interventional Pulmonology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.