Interleukin Inhibitors Market Outlook:

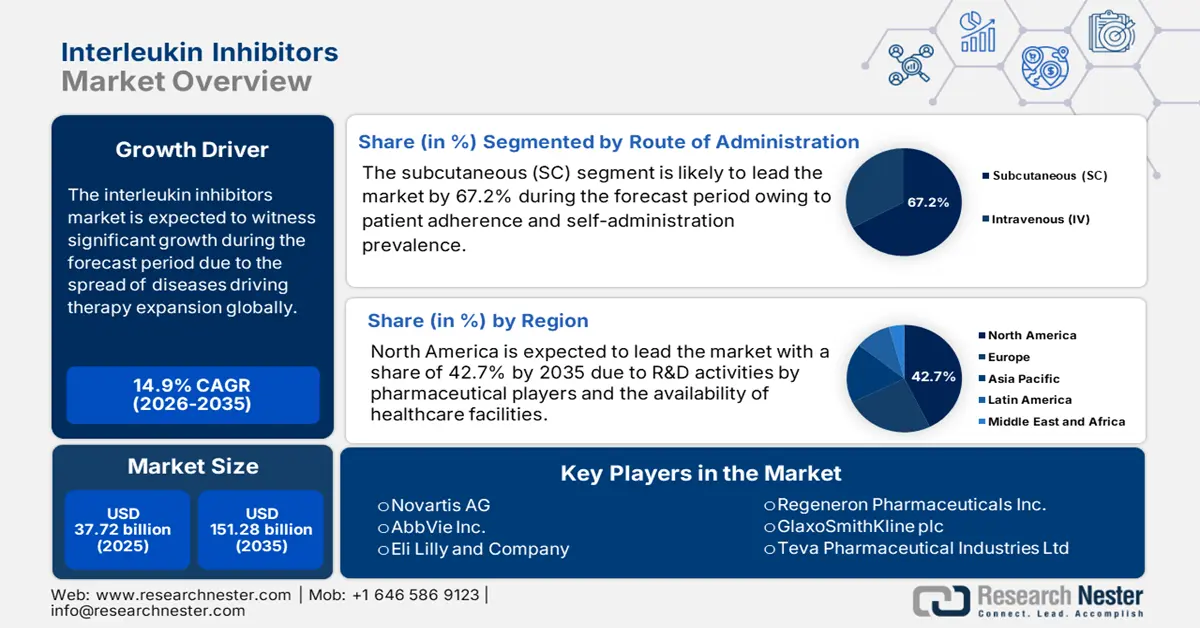

Interleukin Inhibitors Market size was valued at USD 37.72 billion in 2025 and is set to exceed USD 151.28 billion by 2035, expanding at over 14.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of interleukin inhibitors is estimated at USD 42.78 billion.

Interleukin inhibitors play a pivotal role in ensuring systematic immune defense against pathogens. They are produced in response to external pathogens and encourage signaling in a wide range of cells such as B and T monocytes, lymphocytes, macrophages, endothelial cells, and neutrophils. For instance, in June 2022, the U.S. FDA approved AbbVie’s SKYRIZI as the first and only precise interleukin-23 (IL-23) inhibitor for handling adults with moderately to severely active Crohn's disease. The inhibitor demonstrated a significant endoscopic response of more than 50% from the baseline simple endoscopic score, thus efficient for the market development.

An effective surge in the cause of inflammatory diseases, wherein patients experience musculoskeletal symptoms along with psoriasis-associated skin inflammation, is a driving factor for the upliftment of the interleukin inhibitors market. In this regard, the November 2023 ISPOR report carried out a comparative analysis of the payer’s pricing of bimekizumab and other licensed inhibitors. A 16 to 24-week cost-per-responder (CPR) model was implemented to analyze the approved biologic and targeted systemic disease-modifying anti-rheumatic drugs for diseases. The outcome was measured based on PsARC, ACR50, PASI90, and PASI100 response rates.

Cost-per-responder (CPR) Inhibitors Analysis

|

Inhibitors |

Bio-naive Patients |

Bio-experienced Patients |

|

Bimekizumab |

|

|

|

Ustekinumab |

PsARC- £10,917 (USD 13,806.7) |

PsARC- £11,067 (USD 13,996.8) |

|

Risankizumab |

ACR50- £39,913 (USD 50,479.5) |

Same as bio-naive |

|

Secukinumab |

PASI100- £32,033 (USD 40,515.1) |

N.A. |

|

Ixekizumab |

N.A. |

PASI100- £39,706 (USD 50,214.0) |

Source: ISPOR November 2023

Key Interleukin Inhibitors Market Insights Summary:

Regional Highlights:

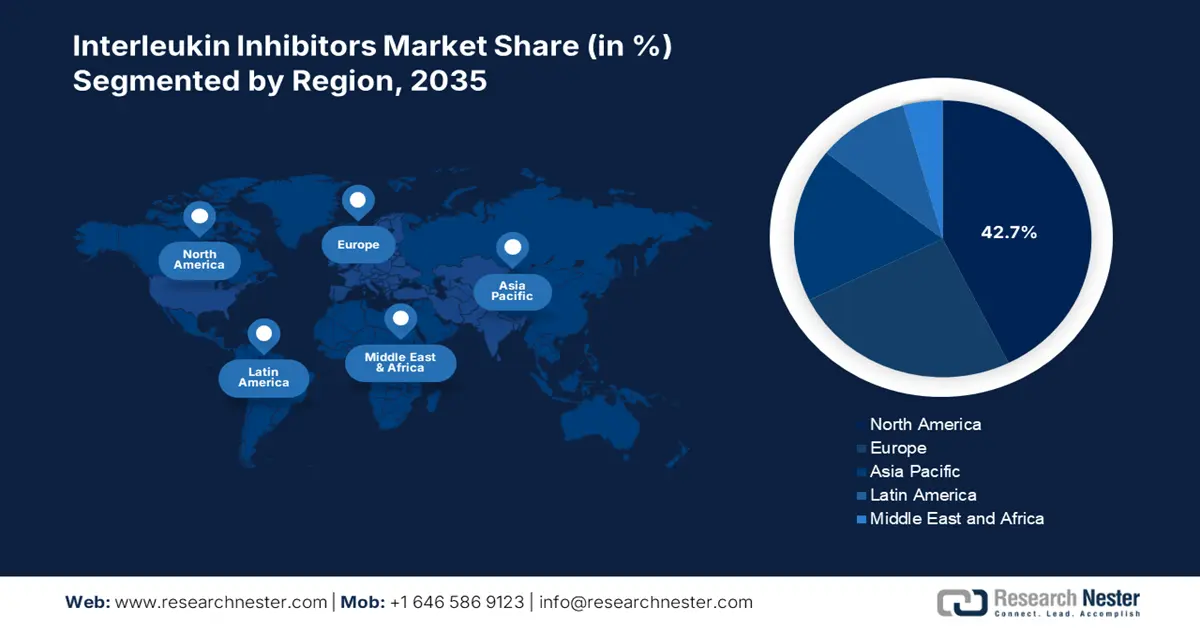

- North America holds a 42.7% share in the Interleukin Inhibitors Market, driven by provision of healthcare facilities, medical expenditures, and increased R&D, sustaining leadership through 2026–2035.

- The APAC interleukin inhibitors market expects the fastest growth by 2035, attributed to increased awareness of health-based diseases and surge in clinical studies.

Segment Insights:

- The Subcutaneous (SC) segment is anticipated to achieve 67.2% market share by 2035, driven by increasing patient awareness and innovations in formulations.

- The Psoriasis segment is projected to hold 42.4% market share by 2035, driven by the effectiveness of IL-17 and IL-23 inhibitors.

Key Growth Trends:

- Prevalence of chronic diseases

- Innovation in drug delivery

Major Challenges:

- Increased side-effects

- High treatment expenses

- Key Players: Novartis AG, AbbVie Inc., Eli Lilly and Company, Regeneron Pharmaceuticals Inc..

Global Interleukin Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.72 billion

- 2026 Market Size: USD 42.78 billion

- Projected Market Size: USD 151.28 billion by 2035

- Growth Forecasts: 14.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 13 August, 2025

Interleukin Inhibitors Market Growth Drivers and Challenges:

Growth Drivers

-

Prevalence of chronic diseases: According to the December 2024 WHO report, nearly 18 million non-communicable deaths take place, especially before 70 years of age. In addition, these diseases are quite prevalent in low- and middle-income nations, wherein three-quarters, that is 32 million deaths occur. Therefore, to keep a check, a clinical trial data conducted by NLM in December 2025 stated that the use of interleukin (IL)-23 inhibitors constituted over 70% improvement for patients with psoriasis and 50% for patients with inflammatory bowel disorder, thus a positive impact for the interleukin inhibitors market.

- Innovation in drug delivery: In April 2023, Daewoong Pharmaceutical retained Novateur's product development and business development team to gain support for its agreement with Vitalli Bio regarding the launch of DWP213388. The purpose was to achieve an investment of USD 10 million for upfront commitments and the deal was worth USD 477 million. Besides, in January 2025, AstraZeneca invested USD 570 million in developing a global hub and clinical delivery in Canada. Thereby, with such contributions towards drug delivery, the interleukin inhibitors market is expected to flourish.

Challenges

-

Increased side-effects: The adoption of interleukin inhibitors has been medically proven to be effective in combating diseases. However, there are a few side effects such as nausea, headache, vomiting, bloating, diarrhea, and low blood pressure. In addition, certain rare side effects including breathing trouble, muscle pain, loss of weight, abnormal liver function, watery eyes, chest pain, and abnormal heartbeat adversely impact the expansion of the interleukin inhibitors market globally. Therefore, consultation with healthcare professionals is necessary to be aware of the appropriate dosage and intake.

- High treatment expenses: The manufacturing of biologic drugs comprises increased investment, especially in the research and development as well as complex production processes. Hence, both these aspects make inhibitors-based drugs extremely expensive for patients from developing nations. Despite their potential advantages in limiting the progression of diseases, the huge cost factor is a serious concern for patients with low-to-moderate income, which in turn is a restraint for the interleukin inhibitors market.

Interleukin Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.9% |

|

Base Year Market Size (2025) |

USD 37.72 billion |

|

Forecast Year Market Size (2035) |

USD 151.28 billion |

|

Regional Scope |

|

Interleukin Inhibitors Market Segmentation:

Route of Administration (Subcutaneous (SC), Intravenous (IV))

Subcutaneous (SC) segment is anticipated to capture interleukin inhibitors market share of over 67.2% by 2035. Factors such as increasing awareness of patients and innovation in formulations are driving the segment's growth. In September 2024, Roche stated the approval of OCREVUS ZUNOVO by the U.S. FDA for the healing of primary progressive multiple sclerosis (PPMS) and relapsing multiple sclerosis (RMS). It is a healthcare professional (HCP)-based subcutaneous injection permitted for both these forms of multiple sclerosis, thus a prolific and effective upliftment for the segment.

Application (Rheumatoid Arthritis, Psoriasis, Inflammatory Bowel Disease (IBD), Asthma)

In interleukin inhibitors market, psoriasis segment is poised to dominate revenue share of around 42.4% by the end of 2035. As per the 2025 Global Psoriasis Atlas Organization report, almost 60 million of the world population suffer from psoriasis. Additionally, the prevalence of the diseases is less than 1% among the young population, and the adult population constitutes 0.1% in East Asia and 2.5% in Western Europe. However, to combat the occurrence, IL-17 and IL-23 inhibitors are suitable, as stated in a study conducted by NLM in April 2024. The survival curve for both inhibitors was 95%, thus making them suitable to aid psoriasis globally.

Our in-depth analysis of the global interleukin inhibitors market includes the following segments:

|

Route of Administration |

|

|

Application |

|

|

Type |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Interleukin Inhibitors Market Regional Analysis:

North America Market Analysis

North America interleukin inhibitor market is anticipated to account for revenue share of more than 42.7% by the end of 2035. Factors such as the provision of healthcare facilities, medical expenditures, and increased research and development are driving the market upliftment. As per the Penn Medicine Organization August 2023 report, the establishment of the Colton Center for Autoimmunity allows researchers to ensure in-depth analysis of mechanisms about underlying autoimmune diseases. This approach directly addresses the misguided activity at the heart of autoimmune conditions, thus positively impacting the interleukin inhibitors market.

The U.S. interleukin inhibitors market is gaining traction due to the evolution of innovative therapies along with a strong presence of regulatory bodies. As per the January 2023 U.S. FDA report, 37 latest drugs were approved in 2022 for infectious diseases, neurological conditions, endocrine, heart, and kidney defects, and different types of cancer. Additionally, 54% of novel drug approvals catered to rare diseases including hepatorenal syndrome, unresectable uveal melanoma, obstructive hypertrophic cardiomyopathy, generalized pustular psoriasis, and acid sphingomyelinase deficiency. All these aspects are suitable for boosting the market in the country.

The interleukin inhibitors market in Canada is witnessing significant growth owing to contributions by key players in association with government and administrative organizations. For instance, in April 2021, Novartis Pharmaceuticals Canada Inc. declared the Health Canada approval of Ilaris, an interleukin-1 beta inhibitor, for aiding adult-onset Still’s disease (AOSD). This disease is a rare form of inflammatory arthritis that is considered a complicated disease with an inconstant appearance and possibly life-threatening complications. Therefore, the launch of inhibitors as therapy solutions for complex diseases is expected to amplify the market growth.

APAC Market Statistics

The interleukin inhibitors market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline. The region is subjected to an increase in awareness of health-based diseases based on which there has been a surge in clinical studies for drug recommendations. Besides, inflammatory bowel disease is very common in the region due to which there has been development of monoclonal antibodies. As per a study conducted by Biomedicine & Pharmacotherapy in January 2023, patients suffering from Crohn’s disease (CD) and ulcerative colitis (UC) can be treated with integrin blockers, and its first application was the anti-α4 integrin antibody natalizumab, which can block both α4β7 and α4β1.

The interleukin inhibitors market in India is expecting substantial growth since there has been development of antibody drugs by researchers. According to the January 2021 Frontiers Organization report, a clinical study was conducted on 6,765 patients regarding the IL-17 inhibitor implementation, out of which few comprised patients from India under the Asia group. It was evaluated that the PASI 75 response for the inhibitor was 95%, denoting the safety and efficacy of the inhibitor applied among patients. Besides, continuous focus on research and development resulted in the development of the latest agents, IL-17A and IL-17F, that require further clinical trials for approval, thus poised to drive the market in the country.

The interleukin inhibitors market in China is gaining exposure owing to the commonness of arthritis disorders affecting a majority of the population. According to the March 2024 Frontier’s Organization report, a study was conducted in the country regarding the utilization of canakinumab for the treatment of systemic juvenile idiopathic arthritis. A total of 11 patients were enrolled, out of which 91.0% were aided with tocilizumab. However, with the canakinumab implementation, 45.5% displayed positive responses, 45.5% showed neutral responses, and 9.0% displayed negative responses. Therefore, canakinumab is a tolerable and effective treatment for China population, which in turn constitutes a positive impact on the interleukin inhibitors market.

Key Interleukin Inhibitors Market Players:

- Novartis AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AbbVie Inc.

- Eli Lilly and Company

- Regeneron Pharmaceuticals Inc.

- Johnson & Johnson Services, Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Bausch Health Companies Inc.

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd

- Biogen Inc.

- Vanda Pharmaceuticals Inc.

Companies dominating the interleukin inhibitor market are gaining rapid exposure due to making enhancements in their product portfolios and cultivating therapeutic effectiveness through planned collaborations to acquire emergent opportunities in autoimmune disease management and ensure market growth. In September 2024, Eli Lilly and Company reported the U.S. FDA approval of EBGLYSS, a targeted IL-13 inhibitor, suitable for the ailment of adults and children of over 12 years of age with a weight of at least 88 pounds (40 kg) with moderate-to-severe atopic dermatitis (eczema) that is not well controlled despite treatment with topical prescription therapies.

Here's the list of some key players:

Recent Developments

- In February 2025, Vanda Pharmaceuticals Inc. and AnaptysBio, Inc. announced their exclusive agreement for the development and commercialization of imsidolimab (IL-36R antagonist mAb), which accomplished two registration-enabling global Phase 3 trials, GEMINI-1 and GEMINI-2, assessing the protection and efficiency of imsidolimab in patients with generalized pustular psoriasis (GPP).

- In July 2021, Biogen Inc. and InnoCare Pharma Limited stated their collaborative and licensed agreement for orelabrutinib, an oral small molecule Bruton’s tyrosine kinase inhibitor (BTKi) for the possible treatment of multiple sclerosis (MS).

- Report ID: 7246

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Interleukin Inhibitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.