IP Management Software Market Outlook:

IP Management Software Market size was over USD 12.05 billion in 2025 and is projected to reach USD 41.63 billion by 2035, witnessing around 13.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IP management software is assessed at USD 13.48 billion.

The increasing need for globalization of businesses to expand their company portfolio is driving significant growth in this sector. With the increase in international exports, the need to preserve IP assets while complying with region-specific jurisdictions has inflated. This further encourages organizations to adopt advanced technologies for managing their IP rights.

The intellectual property management software market has introduced an efficient way for businesses to track, protect, and enforce their IPRs while reducing thefts. The enhanced features can enable profitable management of international filings, renewals, and regulations, offering organizations hassle-free business operations even in external regions. For instance, in May 2024, Anaqua launched PATTSY WAVE Version 8 to offer expanded data validation throughout the global landscape. The streamlined IP management software comes with an enhanced user interface, offering precision and ease to corporations and law firms. The efficient execution of these tools is further inspiring businesses and companies to adopt and introduce more innovative solutions.

Key Intellectual Property (IP) Management Software Market Market Insights Summary:

Regional Highlights:

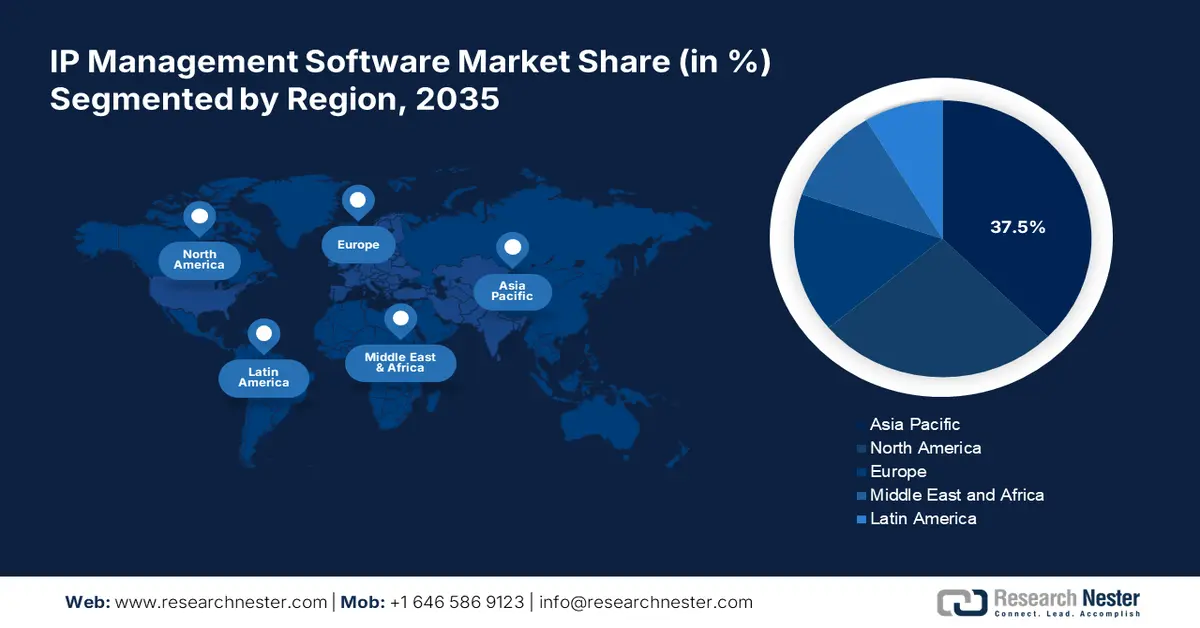

- Asia Pacific's 37.5% share in the IP Management Software Market is driven by innovations, R&D investment, and a surge in patent/trademark filings, solidifying its lead through 2035.

Segment Insights:

- The Cloud segment is expected to dominate market share by 2035, driven by cost-efficiency, flexibility, and remote accessibility of cloud tools.

Key Growth Trends:

- Digitalization of IP management

- Rising awareness about IP protection

Major Challenges:

- High initial cost

- Concern about data security

- Key Players: Anaqua Inc., Cardinal IP, Clarivate PLC, Dennemeyer, LexisNexis, PatSeer Technologies Pvt. Ltd, Patsnap Pte Ltd, Questel, WebTMS Limited, Wellspring Worldwide.

Global Intellectual Property (IP) Management Software Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.05 billion

- 2026 Market Size: USD 13.48 billion

- Projected Market Size: USD 41.63 billion by 2035

- Growth Forecasts: 13.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, UK

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

IP Management Software Market Growth Drivers and Challenges:

Growth Drivers

- Digitalization of IP management: The intellectual property management software market has the potential to unlock additional benefits from IPs. This attracts businesses to seek such advancement in managing their assets. The need for digitalization has paved a new way of fostering profit through licensing, sales, and partnerships. The new technologies can help to handle a large number of IP assets while maximizing their values. This has further propelled the demand for management software with innovative features. For instance, in December 2022, IamIP launched an AI-based smart monitoring tool that can penetrate into traditional systems to generate more precise search results for patents.

- Rising awareness about IP protection: The growing focus on monetizing company assets has enlarged the intellectual property (IP) management software market. Businesses are now heavily investing in adopting these tools to secure their intellectual rights while assuring compliance. According to a report published by WIPO in August 2024, worldwide patent filing grew by 2.7% in 2023, compared to the last year. Alongside, the applications for utility models and industrial designs also increased respectively by 3.9% and 2.8%. This clearly shows the increment in awareness about preserving IP assets. Moreover, the risk of theft and infringement has escalated the need for such encrypted platforms to track, protect, and enforce their IP rights.

Challenges

- High initial cost: The cost of implementing such software can be higher than the budget of many SMEs. This may further prevent these businesses from investing in the intellectual property management software market. The whole process of licensing, customization, integration, and training can also be expensive, increasing the economic burden on companies. Such financial barriers may hinder the optimum adoption of these IP management tools, limiting consumer access in various industries.

- Concern about data security: The progress in the intellectual property management software market may raise questions about data privacy. Integration of automation in IP handling comes with a concern about securing sensitive asset information of businesses. This can further create threats of cyberattacks, breaches, and unauthorized access, vandalizing consumer trust in service providers. In addition, this pushes software vendors to upgrade security features, which can be costly, restricting them from innovating.

IP Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.2% |

|

Base Year Market Size (2025) |

USD 12.05 billion |

|

Forecast Year Market Size (2035) |

USD 41.63 billion |

|

Regional Scope |

|

IP Management Software Market Segmentation:

Deployment Model (On-premises, Cloud)

In terms of the deployment model, cloud segment is likely to account for more than 68.1% intellectual property management software market share by the end of 2035. The remarkable growth is driven by the cost-efficiency and convenience of using cloud-based tools for IP management. These open platforms are preferred for their flexibility and scalability, compared to the traditional IT infrastructure. Many small to medium enterprises are now implementing such software to enable remote accessibility and collaboration between stakeholders and teams. In October 2023, MaxVal launched a modern IP management software, Symphony for law firms, enabling workflow automation, eliminating the need for expensive custom coding.

Component (Software, Service)

Based on components, the service segment is expected to capture a significant share of the intellectual property management software market by the end of 2035. The segment encompasses a variety of offerings such as consulting, training, licensing, and analytics. These services are often preferred due to the availability of customized options as per industrial or organizational needs. Companies are now investing to add these services to their products to capture a wide range of consumer base. For instance, in September 2024, Questel partnered with a SaaS-based platform, Patently to deliver enhanced patent data and services to a broader range of IP professionals. The strategic partnership will spread the reach of the company’s SEP data to Patently’s network of patent litigation and licensing, business development, and technology transfer.

Our in-depth analysis of the global IP management software market includes the following segments:

|

Deployment Model |

|

|

Component |

|

|

Type |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IP Management Software Market Regional Analysis:

North America Market Analysis

North America is estimated to generate remarkable revenue in the intellectual property management software market by the end of 2035. The growth of this region is driven by the presence and efforts of the global IP solution providers. Leaders including Anaqua, LexisNexis, and Wellspring Worldwide are expanding the industry reach of this region overseas. Software companies are establishing a profitable marketplace to create opportunities for other domestic leaders. For instance, in February 2021, Anaqua acquired Quantify IP to offer organizations and law firms portfolio cost budgeting and tools to enhance IP strategies. The acquisition further leveraged the flagships including Global IP Estimator and Portfolio Estimator to integrate them with its IP managing software.

The U.S. IP management software market is a hub of innovators, serving global clients with advanced solutions. The domestic leaders are magnifying their investments to accelerate their progress in the global landscape. For instance, in February 2023, Wellspring Acquired IP Pragmatics to widespread its offerings to 900 companies, research institutions, and government agencies worldwide. The acquisition is a part of the company’s strategy to expand and consolidate its position across North America, Europe, and Asia.

Canada is also elevating its IT offerings to achieve great success in the intellectual property management software market. Growing awareness about the importance of preserving IP assets has propelled the demand for advanced solutions. The country’s strong technological and regulatory ecosystem is also contributing to driving innovation in this sector. Investments in R&D for industries including technology, biotechnology, and manufacturing accelerate the speed of IP generation and subsequently enlarge the IP market.

APAC Market Statistics

Asia Pacific industry is estimated to account for largest revenue share of 37.5% by 2035,It is expected to witness lucrative growth due to technological developments and innovations. The advancements have leveraged the amount of investment in R&D for various industries. This has further led to a greater number of IP generation in developing countries such as China, Japan, India, and South Korea. A higher volume of patents, trademarks, and copyrights are being issued, which propels the demand for efficient IP management tools. Many global leaders are now taking the opportunity to expand their business to serve such an enlarging demand. For instance, in January 2024, Anaqua partnered with AnyGen to introduce AI solutions for the IP industry in this region.

India is estimated to garner greater investment opportunities for the intellectual property management software market, following its aim of complete digitalization. Many domestic companies and government research teams are individually contributing to bringing innovations in this sector. For instance, in May 2024, LexOrbis partnered with Researchwire to introduce robust IP solutions for consumers. The collaboration aims to utilize RW’s bespoke tools and methodologies to enhance its IP services, solidifying its global presence.

Being one of the highest patent application holders, China is fostering a profitable scope for the participants in the intellectual property management software market. The majority of the domestic leaders and startups are showing interest in investing in IP solutions. This is further attracting foreign investors for participation. The government is also taking the initiative to boost international businesses by commencing supportive policies and forums. For instance, in October 2024, the CNIPA and IPONZ announced to launch PPH pilot program for two years. This will further allow for fast patent examination for different countries and regions.

Key IP Management Software Market Players:

- Anaqua Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cardinal IP

- Clarivate PLC

- Dennemeyer

- LexisNexis

- PatSeer Technologies Pvt. Ltd

- Patsnap Pte Ltd

- Questel

- WebTMS Limited

- Wellspring Worldwide

- ipQuants

- Synopsys, Inc.

The current tech leaders are showing interest in developing new technologies for boosting the performance of IP tools. This further inspires other companies to invest more in innovation and development. For instance, in June 2024, Clarivate launched the IP Collaboration Hub to reduce risks and time consumption during filing and prosecution. The new solution integrates with IPMS to provide a connective portal for local agents and instructors, automating communication between all individuals. Such developments are further encouraging other competitors to introduce more innovative solutions for this sector. Such key players include:

Recent Developments

- In June 2024, Anaqua launched its new IP management platform AQX 11 to help corporations and law firms gain a fair valuation of their IP assets. The AI-powered platform is capable of offering automated decision-making and efficiency for IP attorneys to excel in the competitive landscape.

- In March 2024, ipQuants partnered with Questel to incorporate advanced workflow automation and AI to offer efficiency, accuracy, and strategic insight into IP management. The alliance aims to unprecedented tools and analytics for IP professionals worldwide, driving innovation in the field.

- Report ID: 6724

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intellectual Property (IP) Management Software Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.