Integrated Workplace Management System Market Outlook:

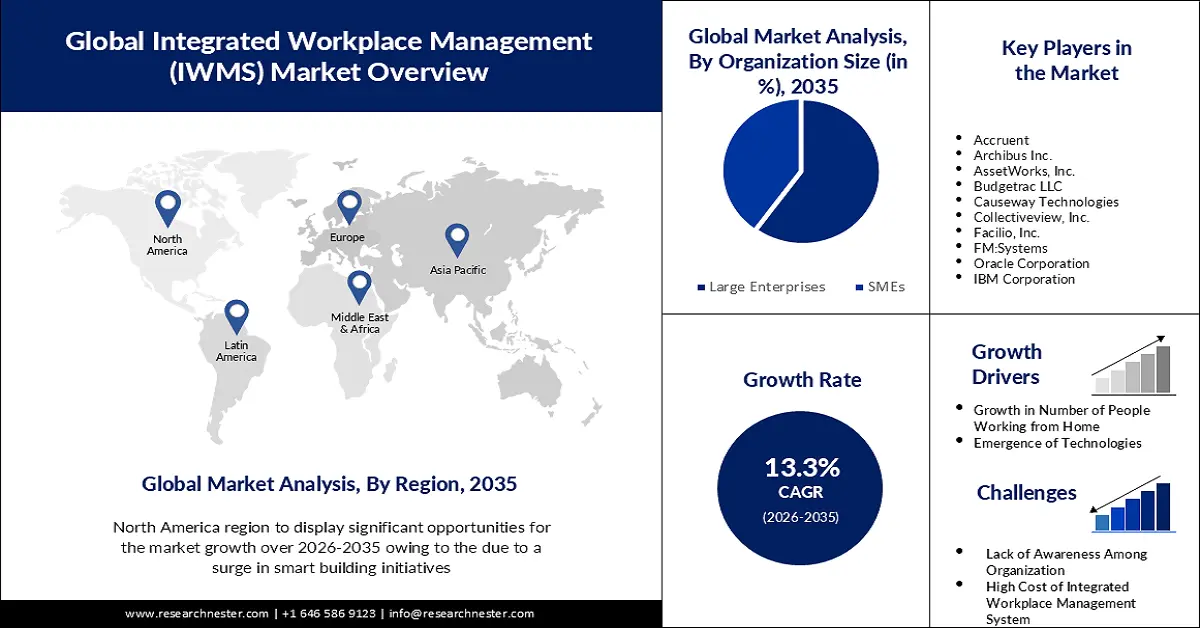

Integrated Workplace Management System Market size was over USD 5.37 billion in 2025 and is projected to reach USD 18.72 billion by 2035, growing at around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of integrated workplace management system is evaluated at USD 6.01 billion.

The major factor boosting the market is the growing consumption of energy by the commercial sector. An average small firm consumes between about 14000 and approximately 24000 kWh of energy annually. Hence, by using IWMS enterprise leaders may obtain a comprehensive picture of each building's energy use and they could proactively make changes that minimize expenses while minimizing the carbon footprint.

Furthermore, real estate agents demand a thorough analysis of each structure, including information on its square footage, occupancy, and costs. Corporate real estate managers additionally have to maintain complete records of all assets and property in order to comply with new IASB and FASB lease accounting rules. This includes the lease's conditions, beginning and ending dates, owner, and lessee. With the installation of IWMS software, real estate managers may keep every relevant information on a single digital platform, making it feasible for them to visualize each space and asset in their portfolio as well as respond to inquiries regarding lease accounting.

Key Integrated Workplace Management System Market Insights Summary:

Regional Highlights:

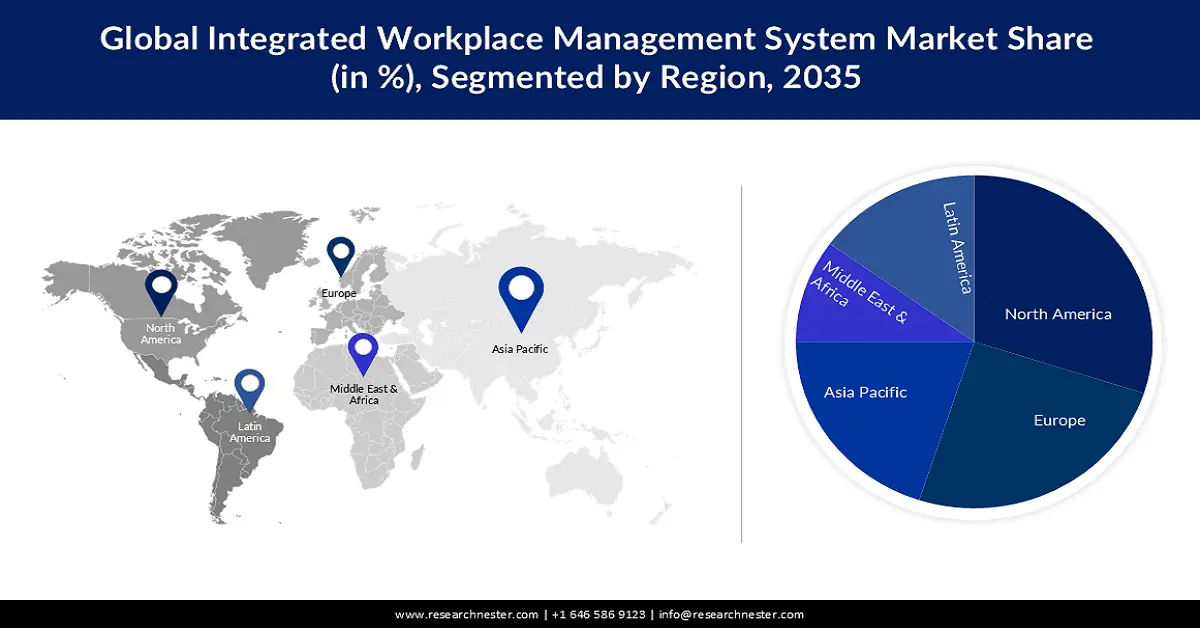

- The North America integrated workplace management system market is projected to capture a 30% share by 2035, driven by increasing adoption of advanced workplace management solutions.

Segment Insights:

- The manufacturing segment in the integrated workplace management system market is forecasted to experience significant growth over 2026-2035, driven by the need for asset tracking and analytics in manufacturing facilities.

- The large enterprises segment in the integrated workplace management system market is expected to maintain the highest market share over 2026-2035, driven by the rising number of large enterprises and their investment in data analytics.

Key Growth Trends:

- Growing Prevalence of People Working from Home

- Emergence of New Technologies

Major Challenges:

- High Cost of Integrated Workplace Management System

- Lack of Skilled Workforce

Key Players: Accruent, Archibus Inc., AssetWorks, Inc., Budgetrac LLC, Causeway Technologies, Collectiveview, Inc., Facilio, Inc., FM:Systems, Oracle Corporation, IBM Corporation.

Global Integrated Workplace Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.37 billion

- 2026 Market Size: USD 6.01 billion

- Projected Market Size: USD 18.72 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Integrated Workplace Management System Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Prevalence of People Working from Home Approximately 81% of the population in the globe preferred working from home in 2022. Moreover, by 2030, about 254 million people would be working remotely in the world. Hence, there has been growing advancement made by the organization in their system in order to benefit remote working employees. Selecting a place to work is the top consideration when coming to a remote operation. The majority of contemporary IWMS solutions give remote workers access to a mobile app so they may book a room in advance of a meeting or reserve a desk. Additionally, these apps enable staff to arrange for food, A/V support, guest wifi, and more.

- Emergence of New Technologies Technologies including loT, advanced analytics, cutting-edge new sensors, mobility, SaaS, and new development environments are making organizational integration increasingly in demand. As a result, the market is estimated to be influenced.

- Provide Security to the Organization Every business focuses on security, whether that be the security of data or the workplace itself. Hence, the implementation of IWMS software is on the surge. Moreover, since data is stored across multiple places, each of those places needs to be carefully secured. Hence, the ability to access facility data over a single secure database is one of an IWMS's greatest advantages, as well as one of its most significant security aspects. Also, the facilities manager is able to quickly assess the rate of occupancy of each workstation and the location of each asset owing to an IWMS. With this understanding, the facilities manager may identify potential security or safety problems, such as fire hazards or places that aren't secure though should be, and take the appropriate action.

Challenges

-

Lack of Awareness Among Organization - Although there is an increasing demand for integrated workplace management systems, the market's expansion is being hampered by a scarcity of experienced labor. Additionally, IWMS is experiencing a scarcity of skilled personnel as a result of a lack of understanding of cutting-edge technologies. Given the numerous sites and geographical distribution of the large IWMS projects, implementation is difficult. IWMS efforts have the responsibility of monitoring and resolving issues caused by different cultures, languages, specific laws, and regional business standards. Organizations have had trouble determining how regulatory objectives and company objectives fit due to a lack of experience at the management and senior levels. This also keeps companies from realizing the value of hiring qualified facilities managers.

- High Cost of Integrated Workplace Management System

- Lack of Skilled Workforce

Integrated Workplace Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 5.37 billion |

|

Forecast Year Market Size (2035) |

USD 18.72 billion |

|

Regional Scope |

|

Integrated Workplace Management System Market Segmentation:

Organization Size Segment Analysis

The large enterprises segment in the integrated workplace management system market is slated to generate the highest revenue by 2035. This growth of the segment is influenced by the rising larger enterprises and growing awareness among them. In 2021, there are expected to be about 351,519 large companies with 250 or more employees worldwide, compared to approximately 337,522 in 2020. Moreover, these large enterprises have significant investments in data analytics which further opens a scope for them to implement advanced technology in order to improve organizations’ productivity and efficiency. Hence, this further dominated the adoption of IWMS in the large enterprises.

End User Industry Segment Analysis

The manufacturing segment in the integrated workplace management system market is projected to have significant growth over the forecast period. This is owing to the need for tracking, and managing assets & analytics on facility utilization, density, vacancy rates, and chargebacks.

Our in-depth analysis of the global market includes the following segments:

|

Offering |

|

|

Deployment Type |

|

|

Organization Size |

|

|

End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Integrated Workplace Management System Market Regional Analysis:

North American Market Insights

The North America integrated workplace management system market is poised to have the highest growth by the end of 2035. For every technology, North America has always been a leading-edge and competitive region. The region still has one of the greatest acceptance rates for technical advancement. Additionally, the United States currently holds the greatest market share for integrated workplace management systems due to a spike in smart building efforts in this nation.

European Market Insights

The integrated workplace management system was first used in Europe. Specifically, in the region's manufacturing and automobile industries, predictive maintenance has grown into an essential component of contemporary corporate operations. The integrated workplace management system market is growing in Europe, where it continues to attract significant funding and interest from European companies.

Integrated Workplace Management System Market Players:

- Accruent

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Archibus Inc.

- AssetWorks, Inc.

- Budgetrac LLC

- Causeway Technologies

- Collectiveview, Inc.

- Facilio, Inc.

- FM:Systems

- Oracle Corporation

- IBM Corporation

Recent Developments

- Accruent, the industry's top provider of solutions to integrate the built environment, has partnered with Viewport, a prominent global provider of AI-powered software for the process sector, which includes the chemical, oil & gas, and utility industries. The Netherlands-based company Viewport is recognized for integrating software with other platforms where asset-related data is kept in order to produce a unified view of all technical data. By working together, organizations are thought to be better able to face their biggest asset information management difficulties, resulting in continual growth and improvement.

- The leading provider of connected asset management and services, Yotta, which is now a part of Causeway Technologies, was expected to implement Alloy so that English Heritage could more effectively manage its tree assets, which include 160 hectares of woodland and individual trees with significant historical and botanical value.

- Report ID: 5054

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Integrated Workplace Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.