Integrated Passive Devices Market Outlook:

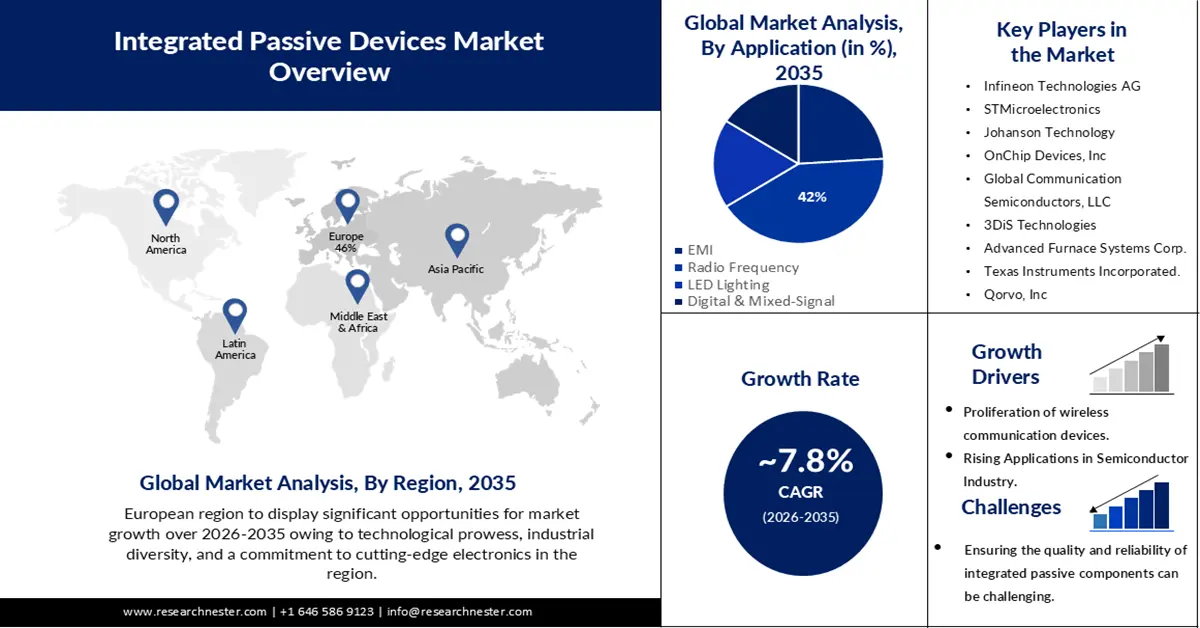

Integrated Passive Devices Market size was valued at USD 1.59 billion in 2025 and is set to exceed USD 3.37 billion by 2035, registering over 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of integrated passive devices is estimated at USD 1.7 billion.

The proliferation of wireless communication devices has increased demand for Integrated Passive Devices (IPDs). As per estimates, there were around 8 billion wireless subscriptions, by the end of 2021. These devices require various passive components like filters, baluns, and couplers, which can be integrated into a single chip using IPD technology. This integration reduces the space required and enhances the performance of the device. With the growing popularity of smartphones, tablets, smartwatches, and IoT devices, the demand for IPDs is expected to increase further. According to RNPL Analysts IoT connections increased by 18%, IoT analytics projects that that by 2023, there will be 16.7 billion active endpoints worldwide. The technology offers a cost-effective solution for miniaturization and high performance in electronic devices.

Also, the global rollout of 5G networks demands high-performance and compact components. Integrated passive devices (IPD) play a crucial role in 5G infrastructure by providing essential passive components for single filtering, impedance matching, and frequency tuning in RF front-end modules. Between the end of 2021 and the end of 2022, the number of 5G wireless connections worldwide climbed by 76%, to a maximum of 1.05 billion. As 5G adoption grows, so does the demand for IPDs.